Federalism

advertisement

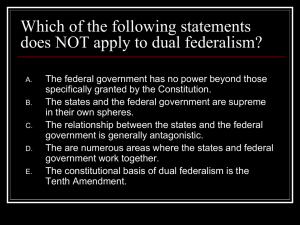

Federalism National Government vs. State Governments Federalism and the Constitution • Federalism as a Madisonian device • A way to limit federal authority (see Federalist 10 and 51) • The division of powers between two sovereign governments • It helps to address the diverse nature of our country (allows for local control) • State governments were well established and people trusted them Explanation for federalism • “…it clearly appears, that the same advantage which a republic has over a democracy, in controlling the effects of faction, is enjoyed by a large over a small republic-is enjoyed by the Union over the States composing it…The influence of factious leaders may kindle a flame within their particular States, but will be unable to spread a general conflagration through the other States.” Madison Federalist #10 Constitutional Basis of federalism • A strong national government – Article I, Section 8 grants government many broad powers, – but government also given powers to create all laws “necessary and proper” (elastic clause) – Article VI establishes the supremacy of the Constitution • Powers prohibited to the states – States denied from doing things that conflict with national government such enter treaties, coin money, keep troops or navies, make war levy import, export taxes – States left with the local powers of governing the welfare, health, safety and morals of its people • National government limited – Article I, Section 9 establishes powers denied to federal government – 10th Amendment grants states powers not granted by the Constitution to the national government (who wins if a conflict between the elastic clause and 10th Amendment • Article IV requires states to work together – Full faith and credit clause Layer Cake vs. Marble Cake Federalism People Federal gov’t States Developing Federalism—Early National Period McCulloch v. Maryland (1819) • Congress charters the Bank of the United States to provide loans for investment and infrastructure, control currency • Depression leads to distrust and the bank becomes a scapegoat so Maryland passes a tax on the Baltimore branch of the bank • At issue was whether Congress could establish a bank and whether the states could tax said bank • Chief Justice John Marshall ruled that while a national bank is not specifically stated in the Constitution, the necessary and proper clause gives the government the power to establish the bank; also “the power to tax is the power to destroy” and the states can’t tax a branch of the federal government thus lending validity to the supremacy clause Early National Period con’t Gibbons v. Ogden (1824) • This dispute arose because Ogden held a New York monopoly license to transport goods between New York and New Jersey while Gibbons held a federal contract to do the same • John Marshall ruled that granting a monopoly over interstate commerce violated the Constitution • This case most importantly gave the government the broad authority to regulate interstate commerce, an important tool used by the government during the New Deal and Civil Rights eras The Civil War era • After Marshall, Andrew Jackson worked to build a more conservative court, which granted the states more control over local issues • Nullification Crises- in 1798 Madison argued that the states have a right to refuse to obey laws when they feel the federal government has exceeded its authority; in 1832, South Carolina, using Madison’s words threatened to secede when they felt the government had passed a high federal tariff, secession was avoided, but the question still remains, can the states ignore federal laws they feel violate their sovereignty? Civil War cont’d • In the Dred Scott case Chief Justice Taney ruled that Congress does not have the power to outlaw slavery in the territories and the Missouri Compromise was unconstitutional • Post Civil War • 14th Amendment – The due process clause of the 14th Amendment makes the Bill of Rights applicable to the states, a power not felt until the 1900s • 16th Amendment – The income tax becomes an important tool for the New Deal and Fiscal Federalism or grants-in-aid The New Deal era • The states can’t cope with the demands of the Great Depression, thus Roosevelt is elected on the promise of a New Deal for the people (which also called for a more active government) • Initially the Supreme Court struck down the New Deal because it granted Congress to much discretion over interstate commerce in the “sick chicken case” New Deal and the commerce clause • In response, Roosevelt introduced his plan to change the Court from 9 to 15 and wouldn’t need an amendment to do it; luckily 5 of his opponents retire and are replaced by pro-New Dealers; Court rules in favor of Congress in West Coast Hotel v. Parrish (1937) thus “the switch in time that saved nine” • Afterwards, the Court defers to Congress on regulating interstate commerce and takes a broad interpretation of the clause such as in the Ollie’s BBQ case of 1964 Fiscal Federalism-spending, taxing and producing grants in the federal system • Categorical grants-money given to states for a specific purpose, but there are conditions • Interstate Highway Act-governments pay 80% of cost of highway construction, but must be built to government specifications • States must establish a highway beautification program or lose 10% of its funding • Or Cross over sanctions • Funds withheld for highway construction unless the drinking ages of the states are raised (South Dakota v. Dole) • Block grants-money given to states, but less strings attached – Giving money to states to decrease emissions – Money given to the states for welfare, but the states come up with the system that helps them best The National Government’s Contributions to State and Local Government Expenditures Trends in National Government Grants to States and Localities The Issue: Health Costs! Devolution-a growing distrust of government and increased trust in states coupled with a GOP takeover has led to an increased backing off of the federal government • Reagan takes 42 categorical grants and turns them into block grants with few strings attached • Clinton passes the Personal Responsibility and Work Opportunity Act in 1995 • No Child Left Behind Act and Education Accountability Act passed in 2000 Key cases • US v. Lopez (1995) – In 1990, Congress passes Gun Free School Zone Act making it a federal offense to bring a firearm on a school campus because they reasoned crime has been exacerbated by the interstate movement of guns, drugs, and gangs and there is an increasing amount of guns found at school’s – Under the interstate commerce clause Congress felt they had the power to pass laws to ensure the “integrity and safety of the nation’s schools” • The Court ruled against Congress and interstate commerce clause for 1st time in 60 years – Congress was using a “worst case scenario” in passing the law – Court believed that Congress has gone far enough with the interstate commerce clause Key Cases • US v. Morrison (2000) – A female student at Virginia Tech sued 2 football players for raping her which was made a federal crime under the Violence Against Women Act of 1994 – Congress reasoned that gender-motivated crimes affects interstate commerce because if such crimes go unpunished then women will not participate in any commerce activity – In a 5-4 decision, William Rehnquist agreed that Congress was again misapplying the interstate commerce clause – The Court referenced the Lopez case and argued that at least in the Gun Free Zone Act Congress had data to make their decision, no such data existed for the passage of this law – Chief Justice Rehnquist wrote that [i]f the allegations here are true, no civilized system of justice could fail to provide [Brzonkala] a remedy for the conduct of...Morrison. But under our federal system that remedy must be provided by the Commonwealth of Virginia, and not by the United States." Devolution • • • • Advantages Local control Experimentation Local governments able to adapt to local needs leading to greater efficiency Traditional interpretation of the states’ power to regulate health, welfare and safety Disadvantages • Regional disunity • Fiscal responsibility of Congress • Oversight • “Irresponsibility” of states • Need to accomplish national goals with federal dollars Medellin v. Texas • Jose Medellin and his gang rape and murder a 14 and 16 year old girl • Medellin confesses 5 days later and is sentenced to death • Mexico sues US in World Court because Medellin a mexican national was not given the right of assistance from the Mexicacn consulate per Vienna Convention • Court ruled that US was wrong, but asked that his and others cases be reopened • Our laws say that a criminal defendant must raise challenges at trial or on appeal Medellin con’t • President Bush then intervenes by issuing a memo declaring the courts should give Medellin a new hearing after Supreme Court takes up Medellin’s habeas petition • Can the president tell states what to do? • Does US law become secondary to World Court? The Decision • Medellin relied on the supremacy clause…treaties included • The Supreme Court, however, ruled that the US doesn’t have to treat World Court judgments as binding domestic law • The President’s powers are limited to executing, not creating therefore Bush’s memo is not binding on states • Only Congress can enact legislation transforming domestic law