Document

advertisement

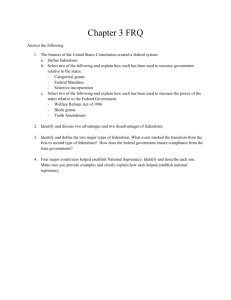

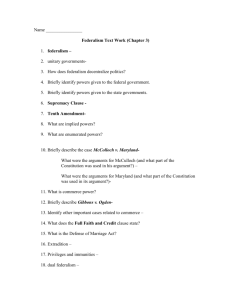

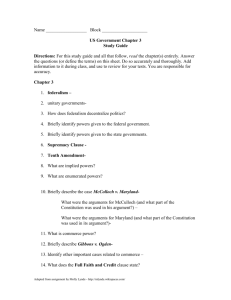

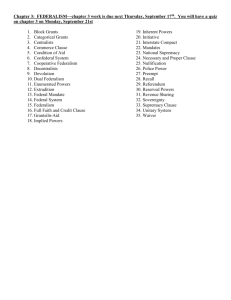

Federalism Federalism Is the process by which two or more governments share powers over the same geographic area. The Tenth Amendment “The powers not delegated to the U.S. by the Constitution…are reserved to the states respectively, or to the people.” Reserved Powers Clause FEDERALIST No. 28 Alexander Hamilton believed that people could shift their support between state and federal levels of government as needed to keep the two in balance. “If their rights are invaded by either, they can make use of the other as the instrument of redress.” CONSTITUTIONAL VAGUENESS The Constitution does not spell out the powers states have. States were thought to be responsible for poverty, public safety, health, and education. Because of the constitutional vagueness, the COURTS have largely defined the division of authority between the federal government and the states. Formal Constitutional Framework • The national government has only those powers delegated to it by the Constitution. • The national government is supreme. • The state governments have residual powers; meaning those neither assigned to the national government nor denied to the states. • Some powers are specifically denied to both the national government and the state governments. Powers Denied to the States • Making treaties with foreign governments. • Authorizing private persons to prey on the • • • • • shipping and commerce of other nations. Coining money, issuing bills of credit, or making anything but gold and silver coin legal tender in payment of debts. Taxing imports or exports. Taxing foreign ships. Keeping troops or ships in time of peace. Engaging in war. Interstate Relations • Full faith and credit • Privileges and immunities • Extradition • Interstate compacts Federalism through History DUAL FEDERALISM 1787 to late 1930’s A 19th century concept of government recognizing a duality of power between the national and state governments, each having a distinct sphere of authority and jurisdiction. McCulloch v. Maryland (1819) In 1819 McCulloch v. Maryland, Chief Justice John Marshall considered whether Congress had the power to incorporate a Bank. He wrote: Since the Constitution had given Congress the power to “make all Laws which shall be necessary and proper for carrying into execution of the forgoing Power, the Bank of the United States was constitutional.” The Supremacy Clause The other issue: whether the state of Maryland could tax a branch of the Bank of the United States. Since the Constitution and federal laws were supreme under the Supremacy Clause of Article VI, they took precedence over the laws of the states. “A state cannot tax those subjects to which its sovereign powers do not extend..the power to tax involves the power to destroy.” Gibbons v. Ogden (1824) First case to involve the Constitution’s interstate commerce clause. Chief Justice Marshall construed Gibbon’s federal license to nullify Ogden’s state one. Thus, he broadly defined the national government’s power to regulate commerce, consequently restricting the power of the states. The Civil War One major historical event settled the issue of national supremacy versus states’ rights. The Civil War made it clear that the national government is supreme—its sovereignty derives directly from the people and thus, states cannot secede. Federalism through History COOPERATIVE FEDERALISM 1930’s to 1970’s The interpretation is characterized by a sharing of governmental powers for the purpose of joint problem solving. Emergence of a National Economy Federal-state distinctions much harder now. Insurance companies sold policies to customers both inside and outside a given state. There were different laws regulating identical policies that happened to be purchased from the same company by persons in different states. This didn’t make a lot of sense. The New Deal The New Deal set forth a program that was dictated at the national level but carried out at the state level. The new legislation included massive job programs that provided work for unemployed Americans. Other programs, like Aid to Families with Dependent Children (AFDC) and Social Security, offered assistance to people who could not work. Thus, the states and federal government became to be seen as partners. Nixon President Richard Nixon also advanced the New Deal and Great Society: • established the Supplemental Security Income program • expanded the food stamp program • created the Environmental Protection Agency (EPA) in 1970 to enforce laws such as the Clean Air Act (1963). Federalism through History CREATIVE FEDERALISM 1970’s & 80’s A form of cooperative federalism extending federal grants-in-aid beyond general governments to special districts and private organizations. The Great Society The legacy of Roosevelt’s New Deal continued with President Lyndon Johnson’s “War on Poverty” three decades later. •Food Stamps •Medicare •Medicaid Federalism through History NEW FEDERALISM 1980’s & 90’s Proposal to return social and economic programs from the federal government to the states. DEVOLUTION PERMISSIVE FEDERALISM The state’s share of power rests upon the permission and permissiveness of the national government. Welfare Reform Laboratories of Democracy FISCAL FEDERALISM The shared responsibility between the national, state (and local) governments for taxing and spending policies. FEDERAL INCOME TAX LOCAL PROPERTY TAX STATE SALES TAX Unfunded Mandates •Brown v. Board of Education of Topeka, Kansas •Americans with Disabilities Act of 1990 •Motor Voter Act of 1993 •Americans with Disabilities Act required businesses and state governments to provide the disabled with equal access to services, buildings, and transportation systems. Purposes of Federal Grants To supply state and local governments with revenue Purposes of Federal Grants To supply state and local governments with revenue To establish minimum national standards Purposes of Federal Grants To supply state and local governments with revenue To establish minimum national standards To equalize resources among the states, on the “Robin Hood Principle” of taking, through federal taxes, money from people with high incomes and spending it, through grants, in states where the poor live Purposes of Federal Grants To supply state and local governments with revenue To establish minimum national standards To attack national problems yet minimize the growth of federal agencies To equalize resources among the states, on the “Robin Hood Principle” of taking, through federal taxes, money from people with high incomes and spending it, through grants, in states where the poor live Purposes of Federal Grants To improve the operation and levels of services of states and local governments Purposes of Federal Grants To improve the operation and levels of services of states and local governments To encourage the achievement of social objectives such as nondiscrimination Purposes of Federal Grants To improve the operation and levels of services of states and local governments To stimulate experimentation and new approaches To encourage the achievement of social objectives such as nondiscrimination Purposes of Federal Grants To improve the operation and levels of services of states and local governments To stimulate experimentation and new approaches To encourage the achievement of social objectives such as To attack major problems nondiscrimination but minimize the growth of federal agencies Federal Aid Highway Act of 1956 – building highways and construction. The national government financed 90% of the cost. 1974 Emergency Highway Energy Conservation Act – States had to agree to limit highways speeds to 55 mph if they wanted to receive funding for highway repair. A 1984 highway law withholds funds from states that do not enact minimum drinking age of 21 and mandatory sentences for drunk drivers. Types of Grants Categorical Grants Project Grants Block Grants Revenue Sharing Types of Grants Categorical Grants Elementary & Secondary Education Act – Provided money for reading, special education and support programs for public school. Types of Grants Project Grants Federal Aid Highway Act of 1956 – building highways and construction. The national government financed 90% of the cost. Types of Grants Since 1974 Community Development Block Grant Program provided a flexible source of annual grant funds for local governments nationwide. These projects must either - Block Grants (1) benefit low- and moderate-income persons; (2) prevent or eliminate slums or blight; or (3) meet other urgent community development needs. Types of Grants State and Local Assistance Act of 1972 initially delivered $4 billion per year in matching funds to states and municipalities. The program, which distributed some $83 billion dollars before it was killed by Ronald Reagan in 1986, proved enormously popular. Revenue Sharing FEDERAL REGULATIONS Direct Orders Regulations which must be complied with under threat of criminal or civil sanctions. FEDERAL REGULATIONS Direct Orders Regulations which must be complied with under threat of criminal or civil sanctions. Cross-Cutting Requirements Federal grants which are extended to all activities supported by federal funds regardless of their source. If one act is violated, all funds are withheld until compliance of the law is achieved. MORE FEDERAL REGULATIONS Cross-Over Sanctions These sanctions permit the federal government to use federal funds in one program to influence state and local policy in another. MORE FEDERAL REGULATIONS Cross-Over Sanctions These sanctions permit the federal government to use federal funds in one program to influence state and local policy in another. Partial-Preemption Programs given to state to administer. If they do not meet the nationally determined conditions or standards, the national government will assume the responsibility.