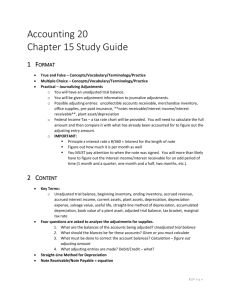

Measuring Business Income: The Adjusting Process

advertisement

Measuring Business Income: The Adjusting Process Objective 1 Distinguish accrual accounting from cash-basis accounting. The Two Bases of Accounting: Accrual-basis: Transactions are recorded when revenues are earned or expenses are incurred. Cash-basis: Transactions are recorded when cash is paid or cash is received. Accrual Versus Cash Example In January 2002, Prensa Insurance sells a three-year health insurance policy to a business client. The contract specifies that the client had to pay $150,000 in advance. Yearly expenses amount to $20,000. What is the income or loss? Accrual Versus Cash Example Accrual-Basis Accounting (000 omitted) 2002 Revenues $50 Expenses 20 Net income (loss) $30 2003 2004 $50 20 $30 $50 20 $30 Accrual Versus Cash Example Cash-Basis Accounting (000 omitted) 2002 Cash inflows $150 Cash outflows 20 Net income (loss) $130 2003 2004 $ 0 20 ($20) $ 0 20 ($20) Accounting Period Managers adopt an artificial period of time to evaluate performance. Interim Period Statements Monthly Quarterly Semi-annually Objective 2 Apply the revenue and matching principles. Revenue Principle When is revenue recognized? When it is deemed earned. Recognition of revenue and cash receipts do not necessarily occur at the same time. The Matching Principle What is the matching principle? It is the basis for recording expenses. Expenses are the costs of assets and the increase in liabilities incurred in the earning of revenues. Expenses are recognized when the benefit from the expense is received. Matching Expenses with Revenues Example Parker Floor sells a wood floor for $15,000 on the last day of May. The wood was purchased from the manufacturer for $8,000 in March of the same year. The floor is installed in June. When is income recognized? Matching Expenses with Revenues Example May Revenues Cost of goods sold Net income $15,000 8,000 $ 7,000 The Time Period Concept It requires that accounting information be reported at regular intervals. Interacts with the revenue principle and the matching principle Requires that income be measured accurately each period Objective 3 Make adjusting entries. Adjusting Entries Assign revenue to the period earned. Assign expenses to the period incurred. Bring related asset and liability accounts into correct balance. Two Types Of Adjusting Entries Prepaids or Deferrals Accruals Five Categories Of Adjusting Entries Prepaid expenses Accrued revenues Depreciation Accrued expenses Unearned revenues Types of Adjusting Entries Deferrals Accruals 1. Prepaid Expenses. Expenses paid in cash and recorded as assets before they are used or consumed. 3. Accrued Revenues. Revenues earned but not yet received in cash or recorded. 2. Unearned Revenues. Revenues received in cash and recorded as liabilities before they are earned. 4. Accrued Expenses. Expenses incurred but not yet paid in cash or recorded. LO 4 Identify the major types of adjusting entries. Adjusting Entries for Deferrals Deferrals are either: Prepaid expenses OR Unearned revenues. LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Prepaid Expenses” Payment of cash, that is recorded as an asset because service or benefit will be received in the future. BEFORE Cash Expense Payment Recorded Prepayments often occur in insurance rent supplies maintenance on equipment advertising fixed assets (depreciation) LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Prepaid Expenses” Prepaid Expenses Costs that expire either with the passage of time or through use. Adjusting entries (1) to record the expenses that apply to the current accounting period, and (2) to show the unexpired costs in the asset accounts. LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Prepaid Expenses” Illustration 3-4 Adjusting entries for prepaid expenses Increases (debits) an expense account and Decreases (credits) an asset account. LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Prepaid Expenses” Example (Insurance): On Jan. 1st, Phoenix Consulting paid $12,000 for 12 months of insurance coverage. Show the journal entry to record the payment on Jan. 1st. Prepaid Insurance 12,000 Jan. 1 Cash Prepaid Insurance Debit 12,000 Cash Credit Debit 12,000 Credit 12,000 LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Prepaid Expenses” Example (Insurance): On Jan. 1st, Phoenix Consulting paid $12,000 for 12 months of insurance coverage. Show the adjusting journal entry required at Jan. 31st. Jan. 31 Insurance Expense 1,000 Prepaid Insurance 1,000 Prepaid Insurance Insurance Expense Debit Debit 12,000 Credit 1,000 Credit 1,000 11,000 LO 5 Prepare adjusting entries for deferrals. Prepaid Insurance Example On January 2, 2005, Parker Floor paid $24,000 for a two-year health insurance policy. Prepaid Insurance 24,000 Cash 24,000 Prepaid Insurance Example What is the journal entry on December 31, 2005? Dec. 31, 2005 Insurance Expense 12,000 Prepaid Insurance 12,000 To record insurance expense Prepaid Insurance Example What was the determining factor in matching this expense? Time Accruals What is an accrual? It is the recognition of an expense or revenue that has arisen but has not yet been recorded. Expenses or revenues are recorded before the cash settlement. Accrued Expenses Example Employees at Mary Business Services are paid every Friday. Weekly salaries total $30,000. The business is closed on Saturday and Sunday. The employees were last paid on April 26, which was a Friday. They will be paid on May 3. Accrued Expenses Example April May 1 2 3 26 27 28 29 30 Accrued Expenses Example What is the adjusting entry on April 30? They worked April 29 and 30. $30,000 ÷ 5 = $6,000 per day $6,000 × 2 days = $12,000 April 30, 2002 Salaries Expense 12,000 Accrued Salaries Expenses To accrue salary expense 12,000 Accrued Revenues Example During the month of April, Mary Business Services rendered services to customers totaling $15,000. At the end of April, the customers have not as yet been billed. Accrued Revenues Example What is the April 30 adjusting entry? April 30, 2005 Accrued service Receivable 15,000 Service Revenue 15,000 To accrue service revenue Accrued Revenues Example What is the determining factor in recognizing this service revenue? Performance Unearned or Deferred Revenue Example In January 2005, Prensa Insurance received $150,000 from a business client to provide health insurance coverage for three years. January 2, 2005 Cash 150,000 Unearned Revenue 150,000 Received revenue in advance Unearned or Deferred Revenue Example What is the journal entry on December 31, 2005? Unearned revenue 50,000 Revenue 50,000 To record revenue collected in advance Correct liability $100,000 Total accounted for $150,000 Correct revenue $50,000 Notice Adjusting entries always have... – one income statement account and... – one balance sheet account. Adjusting entries never involve cash. Objective 4 Prepare an adjusted trial balance. Adjusted Trial Balance The adjusting process starts with the unadjusted trial balance. Adjusting entries are made at the end of the accounting period and then an adjusted trial balance is prepared. The adjusted trial balance serves as the basis for the preparation of the financial statements. Contra Accounts A contra account has a companion account. Accumulated depreciation is a contra account to plant assets. A contra account’s normal balance is opposite that of the companion account. Wood Enterprise Example Partial Balance Sheet December 31, 2005 Plant assets: Machinery Less: Accumulated depreciation Total $30,000 10,000 $20,000 Contra account Book value Adjusting Entries for “Depreciation ” Buildings, equipment, and vehicles (long-lived assets) are recorded as assets, rather than an expense, in the year acquired. Companies report a portion of the cost of a long-lived asset as an expense (depreciation) during each period of the asset’s useful life LO 5 Prepare adjusting entries for deferrals. (Matching Principle). Adjusting Entries for “Depreciation” Example (Depreciation): On Jan. 1st, Phoenix Consulting paid $24,000 for equipment that has an estimated useful life of 20 years. Show the journal entry to record the purchase of the equipment on Jan. 1st. 24,000 Equipment Cash Jan. 1 Equipment Debit 24,000 Cash Credit Debit 24,000 Credit 24,000 LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Depreciation” Example (Depreciation): On Jan. 1st, Phoenix Consulting paid $24,000 for equipment that has an estimated useful life of 20 years. Show the adjusting journal entry required at Jan. 31st. ($24,000 / 20 yrs. / 12 months = $100) Jan. 31 Depreciation Expense Accumulated Depreciation Depreciation Expense Debit 100 100 Accumulated Depreciation Credit Debit 100 Credit 100 LO 5 Prepare adjusting entries for deferrals. Adjusting Entries for “Depreciation” Depreciation (Statement Presentation) Accumulated Depreciation is a contra asset account. Appears just after the account it offsets (Equipment) on the balance sheet. Balance Sheet Jan. 31 Assets Equipment Accumulated Depreciation Net Equipment LO 5 24,000 (100) 23,900 Prepare adjusting entries for deferrals. Depreciation Example On January 2, Wood Enterprise purchased a truck for $30,000 cash. The truck is expected to last for 3 years. Depreciation Example The cost of the truck must be matched with the accounting periods in which it was used to earn income. What is the journal entry for the year ended December 31, 2005? Depreciation Example Dec. 31, 2005 Depreciation Expense 10,000 Accumulated Depreciation 10,000 To record depreciation on truck Objective 5 Prepare the financial statements from the adjusted trial balance. Financial Statements Financial statements have two parts: 1 The first part includes the following: – name of the entity – title of the statement – date or period covered 2 The second part is the body of the statement. Financial Statements Example Prensa Insurance Income Statement Year Ended December 31, 2005 Revenue from insurance services $50,000 Less: Salaries expense 14,275 Supplies expense 250 Rent expense 3,600 Utilities expense 625 Interest expense 600 Depreciation 650 Net income $30,000 Financial Statements Example Prensa Insurance Statement of Owner’s Equity Year Ended December 31, 2005 Prensa Insurance Equity, January 1, 2002 Add: Net income Prensa Insurance Equity, December 31, 2002 $100,000 30,000 $130,000 Financial Statements Example Prensa Insurance Balance Sheet Year Ended December 31, 2002 Assets: Cash Accounts receivable Supplies inventory Prepaid rent Office equipment Less: Accumulated depreciation Total assets $189,150 5,000 100 1,000 5,000 250 $200,000 Financial Statements Example Liabilities and Equities: Utilities payable Interest payable Accounts payable (supplies) Salaries payable Bank loan Total liabilities Owner’s equity Total liabilities and owner’s equity $ 150 600 250 4,100 64,900 $ 70,000 130,000 $200,000 Trial Balance Trial Balance – Each account is analyzed to determine whether it is complete and up-to-date. Phoenix Consulting - Jan. 31st (before adjusting entries) Acct. No. 100 105 110 120 130 200 210 220 300 400 Account Cash Accounts receivable Prepaid insurance Equipment Investments Accounts payable Unearned revenue Note payable Austin, capital Sales Debit $ Credit 50,000 35,000 12,000 24,000 300,000 $ $ 421,000 20,000 24,000 200,000 40,000 137,000 $ 421,000 LO 4 Identify the major types of adjusting entries. End