2011 Public Hearing Presentation

advertisement

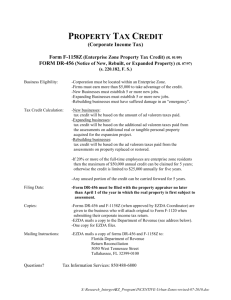

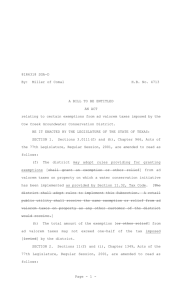

Rules For Budget Hearing • The hearing is a forum to permit the public to be informed of the details of the spending plans of the Hinds County School District and is not a press conference. • The Media is invited to cover the meeting as it would any other public meeting. • Please take this opportunity to sign the comment list if you wish to make comments or ask questions. • Comments and questions will be restricted to budget related issues. • Speakers will be limited to three (3) minutes for making comments or asking questions 1 This presentation and support handouts are intended to provide summary financial and general statistical data about the various funds of the Hinds County Public School District. These funds are supported by Mississippi Adequate Education Program (MAEP) funds, local Ad Valorem tax collections, federal grant funds and funds generated locally within the school district. Public Hearing on Proposed Budget Fiscal Year 2015-2016 June 11, 2015 Hinds County School District 3 Hinds County School District Board of Trustees Name Position District Term Caroline Jacobs Secretary Dist. 1 2011-2016 Dist. 2 2011-2016 Robbie Anderson Linda Laws President Dist. 3 2013-2018 Bill Elkins Vice President Dist. 4 2014-2019 Dist. 5 Superintendent 2014-2019 Carolyn Samuel Delesicia Martin, Ed. D. 4 Vision Statement The Hinds County School District envisions its schools as learning environments that… PROVIDE the safest possible learning environment; TEACH so that every student masters the fundamentals; CHALLENGE students to reach their potential; ENSURE a broad range of experiences for students; BUILD a strong partnership between school, home & community; PREPARE students to live productive lives as informed, responsible citizens. 5 Impact of Hinds County School District The success of Hinds County School District … Serves approximately 47,450 citizens; Fosters higher property values; Directly employs approximately 770 people - Largest employer in rural county & 15th largest employer in Hinds County; Pays on average $2.5 M in monthly payroll; $1.8 M to vendors Provides education for Bolton, Edwards, Raymond, Terry, Byram, Utica and surrounding communities; 6 Fiscal Year Budget • Section 37-61-9, Mississippi Code Annotated (1972), requires the school district, to prepare a budget of anticipated revenues and expenditures on or before August 15th for the coming fiscal year. • The district’s educational plan expressed in dollars and used to measure and monitor revenues and expenditures. • Annual budgets are essential for sound financial management. • The budget may change or may be amended as the instructional needs of our students change. • All information provided during this presentation is based on source information available at this time. 7 Simplified Budget Development Process • Determine Board’s budget guiding principles • Use strategic plan to guide identification of budget priorities • Include other stakeholders in budgeting process • Identify inclusion/deduction recommendations • Determine Board & Superintendent’s action regarding recommendations • Present final proposed budget to Public • Board adopts budget 8 Guiding Principles • Identify budget priorities for instruction, support activities, etc. • Maintain parity among all schools • Actively pursue cost cutting measures and identify budget reducing options • Build in appropriate budget safeguards • Be Conservative and Realistic! 9 Enrollment (ADA vs ADM) Historic by School School Name Grade FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 Byram Middle 6-8 959 1032 1080 1038 987 942 941 961 Carver Middle (RFA excluded)* 6-8 201 210 212 225 215 224 207 194 Gary Road Elementary k-2 878 875 897 938 868 897 863 879 Gary Road Intermediate 3-5 903 950 971 979 940 936 915 888 Utica k-8 k-8 547 502 476 447 436 392 388 387 Terry High 9-12 1002 1073 1157 1235 1254 1261 1231 1204 Raymond High (RFA included)* 9-12 534 502 530 552 539 532 544 528 Raymond Elementary k-5 424 414 443 446 445 422 429 420 Bolton Edwards k-8 k-8 634 585 561 564 565 531 539 516 Average Daily Attendance (ADA) 6082.28 6144.11 6326.75 6423.41 6250.14 6137.44 6056.59 5977.67 LESS SPED INCLUSION (MAEP) 6051.17 6099.79 6285.09 6416.96 6172.80 6066.26 5988.57 5910.76 Average Daily Membership (ADM) 6610.00 6710.00 6577.00 6412.00 6302.00 6189.00 STUDENTS FUNDED MORE (LESS) MAEP (324.91) (293.04) (404.20) (345.74) (313.43) (278.24) 10 FY14 954 188 902 882 361 1193 540 425 485 5930.23 5860.68 6218.00 (357.32) FY15 946 182 902 884 334 1186 627 426 481 5984.10 5915.02 6278.00 (362.98) Enrollment (ADA vs ADM) Historic District 11 Budget Highlights Personnel Annual Step and Scale increases for all certified staff (+$1,355,000) - $464,000 MAEP Annual Step increases for support staff (+1.52%/$273,000)) Annual Step increases for Administrative Staff (+$180,000) Retiree savings related to lower replacement salaries (-$210,720) 14 Budget Highlights Operations 14TH Year of Contracted Transportation Services Contract; (2.5%) Service agreements of provision of substitute teachers, food service staff (+2.5%) Cleaning staff will remain at prior year rates (+2.5%) Increase in Property, General and Liability Insurance (-20%) 15 Budget Highlights Instructional Maintain our current academic and instructional programming AmeriCorps Tutors (10) –GRE, GRI, BEMS, RES ($60,000) Replacement and New Band Instruments ($80,000) Audio Visual Equipment for new Career and Technical Center Program ($30,000) 16 Proposed Budget Highlights Capital Projects (estimate $7,000,000) Phase 1 Tracks – RHS & THS Phase 2 Softball/Soccer Field House – RHS Softball/Baseball/ Soccer Field House – THS Visitor Public Toilets & Concession – RHS Visitor Public Toilets & Concession – THS Bleacher Replacements Phase 3 Upgrade of practice football fields at Utica, Bolton Edwards, and Byram Phase 4 Construct new playgrounds Modify classroom at CMS/RFA to Biology Lab Space Installation of emergency generators 17 Proposed Budget Highlights Technology Replacement/Upgrade of Computer Hardware – (+$150,000) Project Computer Access (Phase 3) – (+$178,000) Intercom system for Hinds Career Technical Center(+40,000) Smart Board purchases ($100,000) Debt Service Debt Service payments ($6,263,451) 18 Allocations To Schools Funds are allocated to schools based on a per student and /or per teacher basis. Principal is responsible for managing their individual school budget (site based management). Funds may be transferred between certain accounts to accommodate needs. 19 Allocations To Schools Description PROFESSIONAL/EDUCATION SERVICE CURRICULUM IMPROVEMENT SERVICE RESOURCE OFFICERS/OT PROFESSIO TECHNICAL SERVICES DATA PROCESSING SERVICES SECURITY WATER & SEWER ELECTRICITY NATURAL GAS TELEPHONE LAWN SERVICES WASTE DISPOSAL REPAIR & MAINTENANCE SERVICES TECHNOLOGY REPAIRS RENTAL OF EQUIPMENT OTHER PURCH PROPERTY SERVICES 20 $ per Student $ 9.71 $ 12.03 $ 31.00 $ 27.76 $ 15.42 $ 0.93 $ 13.88 $ 185.07 $ 24.68 $ 30.85 $ 38.56 $ 18.74 $ 254.47 $ 77.11 $ 46.27 $ 6.17 Description INSURANCE FREIGHT AND SHIPPING PRINTING & BINDING TRAVEL & PER DIEM TRAVEL MILEAGE REIMBURSEMENT TRAVEL LODGING AND MEALS TRAVEL AIRPLANE AUTOMOBILE ETC TRAVEL STUDENTS GENERAL SUPPLIES OFFICE SUPPLIES INSTRUCTIONAL SUPPLIES JANITORIAL SUPPLIES SOFTWARE PAPER (SUPPLIES) TEXTBOOKS BOOKS & PERIODICALS OTHER FURNITURE & EQP < $5,000 $ per Student $ 2.31 $ 7.71 $ 6.17 $ 5.40 $ 5.40 $ 9.25 $ 3.08 $ 3.08 $ 69.40 $ 5.40 $ 11.57 $ 15.42 $ 21.59 $ 9.25 $ 154.23 $ 20.05 $ 61.69 21 Budget Projection Summary Combined budget of all funds 1 Fund Balance at July 1, 2015 15,416,188 Re ve nue s 71,330,972 Expe nditure s 71,330,972 Excess (deficiency) of revenues over expenditures Total Othe r Financing 2 Fund Balance Use d Fund Balance at June 30, 2016 Notes: 1. Fund Balance at July 1, 2015 is an estimate until FY 2015 General Ledger is closed. 2. 22 - Fund Balance Used is a projection based on expected revenues and expenditures. 15,416,188 MAEP ALLOCATION (LAST 12 YEARS) FY16 26,863,742 FY15 25,099,766 24,344,030 3,361,101 FY13 24,218,472 3,002,215 24,503,022 FY11 24,850,808 2,783,414 2,816,191 FY10 29,415,776 FY09 28,234,166 FY08 FY05 FY04 23 2,060,707 921,762 26,492,067 FY07 FY06 }+$1,763,976 2,983,833 FY14 FY12 2,388,059 23,582,001 19,815,006 18,980,531 18,772,036 Under funded amount FY09 to FY 2016 =$20,317,282.00 Revenue Projection By Source Revenue Source Local Sources Intermediate Sources State Sources Federal Sources Sixteenth Section Total Revenues $ Budgeted Amount 34,489,704 29,756,103 6,239,380 845,785 Budget % 48.35% 0.00% 41.72% 8.75% 1.19% 71,330,972 100% Budgeted Revenue by Percentage 1.19% 8.75% 48.35% Local Sources Intermediate Sources 41.72% State Sources Federal Sources Sixteenth Section 24 0.00% Expenditures By Function Budgeted Expenditure 32,118,193 22,889,290 2,909,938 125,100 7,025,000 6,263,451 Expense Function Instruction Programs Support Services Non-Instructional Services Sixteenth Section Land Management Facility Acquisition and Construction Debt Services Total Expenditures $ 0.18% 4.08% 9.85% 71,330,972 8.78% 45.03% 32.09% 25 Budgeted % 45.03% 32.09% 4.08% 0.18% 9.85% 8.78% 100.00% Expenditures By Function Expense Function Support Services - Student Support Services - Instructional Support Services -General Administration Support Services - School Administration Support Services - Business Services Support Services - Operations & Maintenance Services Support Services - Transportation Services Support Services - Central Services Total Expenditures 18.83% Budgeted Expenditure 2,408,581 2,817,672 1,385,400 3,055,013 805,563 5,877,970 4,310,053 2,229,684 $ 9.74% 22,889,290 10.52% 12.31% 6.05% 25.68% 3.52% 13.35% 26 Budgeted % 10.52% 12.31% 6.05% 13.35% 3.52% 25.68% 18.83% 9.74% 100.00% Expenditures By Object Expenditure by Object Code Budgeted Expenditure Object Code Expenditure Personal Services - Salaries 29,370,133 Personal Services - Employee Benefits 10,363,439 Purchased Professional & Technical Services 3,152,797 Purchased Property Services 4,542,023 Other Purchased Services 829,645 Supplies 5,504,546 Property 5,274,023 All Other Objects 7,054,098 Total Expenditures 71,330,972 7.98% 100.00% 10.67% 44.44% 8.33% 1.26% 6.87% 4.77% 15.68% 27 Budgeted % 46.31% 16.74% 4.42% 6.37% 1.16% 7.72% 7.39% 9.89% Debt Service Due FY 2015 28 Ad Valorem Local Revenue Request 29 HIND COUNTY SCHOOL DISTRICT FY 2016 MILL COMPUTATION (Based on 2014 AV from Tax Assessor) Operations New Program G.O.B Total Dollars To Be Raised: Include estimated Home Stead reimbursement Exclude Ad Valorem Tax Reduction Total Assessed Value (AV): Less: Amount Special Homestead Value: Net Assessed Value: Est. Collection Rate: Final Net Assessed Value: Total $ To Be Raised Plus: Homestead CR ($ Lossed) Less: HomesteadCosts Reimbursement Plus: Collection 19,327,083 417,351,809 24,010,607 393,341,202 95% 373,674,142 19,327,083-- 245,920 - . 417,351,809 24,010,607 393,341,202 95% 373,674,142 245,920-- Net $ To Be Raised Divided By Net Assessed Value Mills Mills (Adj for 3 Months Delay) 19,327,083 373,674,142 51.7218 51.7218 245,920 373,674,142 0.6581 0.6581 48.1803 51.7218 3.5415 0.6581 0.6581 4.1996 4,828,120 L.T.N Totals 417,351,809 24,010,607 393,341,202 95% 373,674,142 4,828,120-- 1,017,331 417,351,809 24,010,607 393,341,202 95% 373,674,142 1,017,331-- 25,418,454 417,351,809 24,010,607 393,341,202 95% 373,674,142 25,418,454-- 4,828,120 373,674,142 12.9207 12.9207 1,017,331 373,674,142 2.7225 2.7225 25,418,454 373,674,142 68.0230 68.0230 Millage Applications: Prior Request for FY 2015: New Request for FY 2016: Amount of Change: Net Change for Operations: Net Change for Debt Service: Prior Requested Total Millage FY 2015 New Requested Total Millage FY 2016 Net Increase Over Previous Year 1 Mil generates--------------------------------> 14.3792 12.9207 (1.4585) 2.5510 2.7225 0.1715 (1.2870) 65.11 68.02 2.91 $ 373,674 $ - $ 373,674 $ 373,674 31 Ad Valorem Tax Millage 32 Example Calculation How much Ad Valorem Tax would a single family home valued at $100,000 generate in the Hinds County School District, at the school taxes of 68.02 mills? Facts: Formula: $100,000 = true value 10% = Class II ratio .06802 = millage rate of 68.02 mills “true value” X “ratio” = “assessed value” “assessed value” X “millage rate” = “tax bill” Application of Formula to $100,000 X 10% = $10,000 Facts: $10,000 X .06802 = $680.02 Thus, in this example, the ad valorem tax bill is $680.02. 33 Tax Bill Implications by True Value True Value of Class II Property at 10% Tax Ratio Millage Rate 65.00 65.11 65.50 66.00 66.50 67.00 67.50 68.00 68.02 $50,000 $100,000 $150,000 $200,000 $250,000 $300,000 $350,000 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2,275 2,279 2,293 2,310 2,328 2,345 2,363 2,380 2,381 Annual Increase $ 87 $ 102 49 325 326 328 330 333 335 338 340 340 $ $ $ $ $ $ $ $ $ 15 $ 650 651 655 660 665 670 675 680 680 $ $ $ $ $ $ $ $ $ 29 $ 975 977 983 990 998 1,005 1,013 1,020 1,020 $ $ $ $ $ $ $ $ $ 44 $ 1,300 1,302 1,310 1,320 1,330 1,340 1,350 1,360 1,360 58 $ 1,625 1,628 1,638 1,650 1,663 1,675 1,688 1,700 1,701 $ $ $ $ $ $ $ $ $ 73 $ 1,950 1,953 1,965 1,980 1,995 2,010 2,025 2,040 2,041 Notice of Tax Increase NOTICE OF PROPOSED AD VALOREM TAX EFFORT HINDS COUNTY SCHOOL DISTRICT • Advertisement of Notice of Tax Increase is required by Mississippi Code Section 27-39207 • Advertisement as run indicates that the district’s proposed request may cause an increase in the ad valorem millage rate. 35 The Hinds County School District will hold a public hearing on its proposed school district budget for fiscal year 2016 on Thursday, June 11, 2015 at 5:00 p.m. at the Hinds County School District Career Technical Center, 14020 Highway 18 Raymond, Mississippi. At this meeting, a proposed ad valorem tax effort will be considered. The Hinds County School District is now operating with projected total budget revenue of $66,631,282. Of that amount, 37.6 percent or $25,048,850 of such revenue is obtained through ad valorem taxes. For next fiscal year, the proposed budget has total projected revenue of $67,633,236. Of that amount, 38.6 percent or $26,050,804 is proposed to be financed through a total ad valorem tax levy. For the next fiscal year, the proposed increase in ad valorem tax effort by Hinds County School District may result in an increase in the ad valorem tax millage rate. Ad valorem taxes are paid on homes, automobile tags, business fixtures and equipment, and rental real property. Any citizen of Hinds County School District is invited to attend this public hearing on the proposed ad valorem tax effort, and will be allowed to speak for a reasonable amount of time and offer tangible evidence before any vote is taken. Proposed Ad Valorem Tax Request The District requests a specific dollar amount of support and does not set millage. The information about millage is provided only as clarification of the district’s estimated affect on taxes. The ad valorem tax effort discussed and advertised is the District’s estimate based on available information. Forces outside the District come together to determine what the final millage rate will be. The final millage rate will be higher or lower based on final assessed valuation and homestead exemption. 36 Proposed Ad Valorem Tax Request Request that the Hinds County Board of Supervisors levy a millage rate that will generate total proposed ad valorem tax revenues of $25,418,454. Represents $1,088,345 increase over last year due to lack of MAEP full funding and partially offset by anticipated new property growth. Authority to request additional funds is granted in MS Law 37-57-104(3) and is not subject to 4% or 7 % tax increase limitations. Proposal is based on the 2014 Assessed Valuations. 37 Next steps in budget process Modifications or corrections related to the public hearing will be reviewed and incorporated into Budget. Conduct individual budget review meetings with Principals. Board will approve final budget at June 18, 2015 special board meeting. Resolution will be sent to the Hinds County Board of Supervisors requesting final request amount. 38 Questions or Comments? 39