Core Concepts - Karachi Tax Bar Association

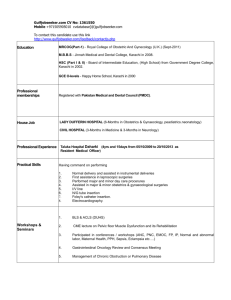

advertisement

Income Tax Bar Association Karachi WORKSHOP ON SALES TAX Pearl Continental Hotel, Karachi 21 – 22 July 2005 CONTENTS Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Core Concepts Registration Determination of tax Book keeping, records and returns Penalties and additional tax Audit Adjudication appeals and ADRC Provincial sales tax on services Rules Case study Questions & answers session Income Tax Bar Association Karachi CORE CONCEPTS By Workshop on Sales Tax Pearl Continental 21-22 July 2005 SYED MOHAMMAD SHABBAR ZAIDI Partner A. F. Ferguson & Co. CORE CONCEPTS Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Scope of tax Liability of sales tax Taxable activity Registered person Taxable supplies Zero rating Exemption Taxable goods Goods Supply Time of supply Value of supply Tax fraud Tax period CORE CONCEPTS Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Scope of tax Income Tax Bar Association Karachi REGISTRATION By Workshop on Sales Tax Pearl Continental 21-22 July 2005 ASIF ALI KHAN Senior Manager Taseer Hadi Khalid & Co. REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Compulsory Registration De-registration Black listing and suspension of registration Change in registration particulars Transfer of registration Revision of registration certificate Penalties REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Registered person A person who is registered or is liable to be registered under the Sales Tax Act 1990 Requirement of registration Basic conditions – Person should be engaged in making taxable supplies in Pakistan (including zero rating supplies) – Taxable supplies should be in the course or furtherance of any taxable activity carried on – Person should not already be registered REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered Manufacturer having annual turnover from taxable supplies, in any tax period during last twelve months, exceeding Rs. 5,000,000 Retailer having value of supplies exceeding Rs. 5,000,000 in any period during the last twelve months Importer Wholesaler (including Dealer) Distributor Person required to be registered for any duty or tax collected or paid under sales tax mode, under any Federal or Provincial law REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Manufacturer General criteria: – A person who engages, whether exclusively or not, in the production or manufacture of goods, irrespective that the raw material of which the goods are produced or manufactured are owned by him REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Manufacturer - cont’d Specific inclusion: – A person who by any process or operation: Assembles; Mixes; Cuts; Dilutes; Bottles; Packages; Repackages; or prepare goods by any other manner REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Manufacturer - cont’d Specific inclusion: – Any person who disposes of his assets in any fiduciary capacity including: An assignee or trustee in bankruptcy Liquidator Executor Curator Manufacturer Producer Any other person REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Registration Persons required to be registered – cont’d Manufacturer - cont’d Specific inclusion: – Any person, firm or company which owns, holds, claims or uses any patents, proprietary or other rights to goods being manufactured, whether in his or its name, or on his or its behalf, as the case may be, whether or not such person, firm or company sells, distributes, consigns, or otherwise disposes of such goods Pearl Continental 21-22 July 2005 Exceptional case of manufacturer-cumexporter for refunds REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Retailer – A person supplying goods to general public for the purpose of consumption Importer – A person who lawfully imports goods in Pakistan Wholesaler (including Dealer) Any person who – who carries on the business of buying and selling goods by wholesale or of supplying or distributing goods, directly or indirectly, by wholesale for cash / deferred payment or for commission or other valuable consideration REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Wholesaler (including Dealer) – cont’d Any person who – stores such goods belonging to others as an agent for the purpose of sale – supplying taxable goods to a person whose income is not liable to tax under the Income Tax Ordinance, 2001but has deducted tax under section 153 of the Ordinance – in addition to making retail supplies is engaged in wholesale business REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Distributor – A person appointed for a specified area by: manufacturer; importer; or any other person to purchase goods from him for further supply – A person who in addition to being a distributor is also engaged in supply of goods as a wholesaler or a retailer REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Under Federal Excise Act 2005 FED is collectible under sales tax mode on: – advertisements on closed-circuit TV and cable TV network – facilities for inland travel by air or railway – carriage of goods by air – shipping agents authorised to transact business on behalf of others – telecommunication services in respect of telephone, telegraph, telex and alike REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Under Federal Excise Act 2005 – cont’d – Person providing services liable to FED are now required to be registered under FED Act only. Earlier, such persons were required to be registered under Sales Tax Act – Person already registered under Sales Tax Act for provision of excisable services in Sales Tax mode are not required to be registered under FED Act – Persons registered under Sales Tax Act, which now provides services liable to FED are also not required to be registered under FED Act REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Persons required to be registered – cont’d Under Provincial Ordinance – Person providing services of: advertisements on TV / Radio Courier Hotels / Clubs – Person providing services as Custom agents Ship chandlers Stevedores REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Registration Procedure Required Person If not Complete Registration application (FORM ST-1) & Stock Declaration (Annexure) Central Registration Office Local Registration Office Pearl Continental 21-22 July 2005 Issuance of Registration Certificate (Annexure B) Completion of verification If Complete REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Procedure – cont’d Jurisdiction Company Area of registered office Other person Area of business activity Other person having single manufacturing unit, where business premises and unit are in different areas Area of manufacturing unit REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Registration Procedure – cont’d Modes for filing of registration application If before LRO – Through Registered AD mail – Through Courier If directly before CRO – Through Email at staxregistration@cbr.gov.pk – Forms should be signed & scanned Timings for registration Once liable, should be registered before making taxable supplies CRO to register within 7 days of filing of application or reject within 15 days of filing REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Compulsory Registration Conditions Liable person fails to apply for registration Inquiry by LRO / other office, authorized by CBR, proves that the person is required to be registered Procedure Inquiry for requirement of registration Submission of written report to LRO issuance of notice by LRO and opportunity of personal hearing if notice is replied by the person contesting his liability to be registered Decision by the LRO & if registration required transmission of the case to CRO if no reply to notice, LRO forwards cases to CRO for compulsory registration REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Compulsory Registration – cont’d Obligations Compulsorily registered person to comply with all the provisions of the Act Failure may lead to access / examination of record, documents etc. as provided in section 25 and consequently assessment of sales tax payable under section 11 of the Act Wrong compulsory registration Due to inadvertance, error or misconstruction Recommendation for de-registration by LRO Cancellation of registration by CRO Person shall not be liable to pay any tax, default surcharge or penalty, subject to section 3B REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 De-registration Conditions – discontinuance of business – supplies becomes exempt from tax – taxable turnover during last 12 months falls below the threshold limits – failure to file return for 6 consecutive months – tax obligations not to be affected REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 De-registration – cont’d Procedure – if application filed – Application to LRO on ST-3 form – Completion of audit or inquiry and directions for discharge of liability through final return by LRO – LRO specifies the date of de-registration not later than 3 months of the application or dues clearance, whichever is earlier – Cancellation of registration by CRO on recommendation of LRO Procedure – failure to file returns – LRO issues written notice and grants opportunity of hearing – LRO recommends CRO if no liability is outstanding REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Black-listing & Suspension of Registration Conditions Issuance of fake invoices Evasion of Tax Tax fraud Only Collector is empowered to take action Procedure Confirmation of facts by the Collector Opportunity to clarify position Order in writing to blacklist or suspend registration to affected person, CRO and STARR 90 days time for completion of inquiry if records produced 90 days time for show cause on completion of inquiry REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Change in Registration particulars Conditions Change in name or address Change in other particulars Verification for change of business category Procedure Notification of change on From ST-2 to LRO/CRO within 14 days of such change Submission of Form ST-1 additionally for change in address Submission of From ST-3 addtionally for change in ownership Issuance of revised registration certificate by CRO REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Transfer of registration Conditions Discretionary powers of CRO Shifting of business activity Any other valid reason given by the registered person Procedure Issuance of intimation letter by CRO at own motion or on application by the person Intimation letter to be issued to registered person and the concerned Collectorates Transfer of records and responsibilities REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Revision of registration certificate Conditions Conversion of multiple registration into single registration Procedure Application on ST-1 for single registration to CRO Ascertainment of of tax liabilities by CRO from concerned Collectorates / LTU / RTO Issuance of revised registration certificate by CRO and merger of previous registration number REGISTRATION Income Tax Bar Association Karachi Workshop on Sales Tax Penalties Pearl Continental 21-22 July 2005 Failure to make an application for registration Rs.10,000 or 5% of the tax involved whichever is higher If not applied within 60 days of the start of business activity Imprisonment for a term which may extend to 3 years or with fine which may extend to equivalent to amount of tax involved, or both. Failure to notify changes in particulars of registration Rs.5,000 Income Tax Bar Association Karachi DETERMINATION OF TAX LIABILITY By Workshop on Sales Tax Pearl Continental 21-22 July 2005 RASHID MALIK DETERMINATION OF TAX LIABILITY Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 How is the tax liability determined Meaning of output tax Meaning of input tax Input tax not available Cash transactions Tax paid on stock before registration Debit notes and credit notes Refund of sales tax DETERMINATION OF TAX LIABILITY Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 How is the tax liability determined Income Tax Bar Association Karachi BOOK KEEPING, RECORDS AND RETURNS By Workshop on Sales Tax Pearl Continental 21-22 July 2005 MEHMOOD A. RAZZAK Partner Mehmood Idress Masood & Co. BOOK KEEPING, RECORDS & RETURNS Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Records of supplies and purchases Retention of records Tax invoice Returns and types of returns Returns on certain occasions Tax period Due date BOOK KEEPING, RECORDS & RETURNS Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Records of supplies and purchases Income Tax Bar Association Karachi PENALTIES & ADDITIONAL TAX By Workshop on Sales Tax Pearl Continental 21-22 July 2005 MOHAMMAD ALI Consultant Qaiser Mufti Associates PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Penalties Additional tax PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Workshop on Sales Tax Penalties Pearl Continental 21-22 July 2005 Non furnishing a return within the due date Non issuance an invoice when required Un-authorized issuance an invoice in which an amount of tax is specified Failure to notify material nature changes in the particulars of registration Failure to deposit the amount of tax due or any part thereof in the time or manner laid down under the Act Repetition of erroneous calculation in the return during a year whereby amount of tax less than the actual tax due is paid PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Workshop on Sales Tax Penalties Pearl Continental 21-22 July 2005 Failure to make application for registration Failure to maintain records as required Non compliance with the provisions of section 25 Failure to furnish the information required under sub-section (5) of section 26 Whosoever commits, causes to commit or attempts to commit the tax fraud Violation of embargo placed on removal of goods Obstruction of the authorized officer in the performance of his official duties PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Penalties Workshop on Sales Tax Pearl Continental 21-22 July 2005 Non compliance of section 73 of the Act Failure to fulfill any of the conditions, limitations or restrictions prescribed Contravention of the provisions of this Act for which no penalty has, specifically, been provided Where any officer of Sales Tax authorized to act under this Act, acts or omits or attempts to act or omit in a manner causing loss to the sales tax revenue or otherwise abets or connives in any such act PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Additional Tax If a registered person does not pay the tax due or any part thereof, whether wilfully or otherwise, in time or in the manner specified under this Act, rules or notifications issued thereunder or claims a tax credit, refund or makes an adjustment which is not admissible to him, or incorrectly applies the rate of zero per cent to supplies made by him, he shall, in addition to the tax due, pay default surcharge. PENALTIES & ADDITIONAL TAX Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Additional Tax For the first six months of default = @ 1.5% per month of the amount of tax due or the amount of refund erroneously made From 7th months onwards = @ 1.5% per month of the amount of tax due or the amount of refund erroneously made In case default is on account of tax fraud= @ 2% per month of the amount of tax evaded or the amount of refund fraudulently claimed, till such time the entire liability including the amount of default discharge is paid Income Tax Bar Association Karachi AUDIT, RULES & SPECIAL PROCEDURES By Workshop on Sales Tax Pearl Continental 21-22 July 2005 ADNAN AHMAD MUFTI Partner Shekha & Mufti, Chartered Accountants AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Audit Suspended todate except by DRRA Modes of Audit of Sales Tax Records Routine Audit Investigative Audit Audit by Special Auditors Sales Tax Rules 2005 Blacklisting & Suspension of Registration Credit and Debit Note Apportionment of Input Tax Sales Tax Special Procedures Rules 2005 Minimum value addition by importers Minimum value addition by retailers Sales Tax on Electric Power & Gas Issuance of Tax Invoices against Advance Payment Receipt AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 MODES OF AUDIT AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Routine Audit At any time, but once a year, a registered person may be asked to produce both manual or computerised record lying in his possession or possession of his agent Audit Observation to be replied in Fifteen (15) Days Audit report, carrying quantification of charges or taxes, issued 100% Penalty waived if unpaid principal tax alongwith default surcharge is paid before receipt of notice of audit 75% penalty waived if unpaid principal tax alongwith default surcharge is paid at any time before issuance of show cause notice AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Routine Audit Monitoring, Control and Procedure Audits selected through Computer Programming Collector / Additional Collector may also select audits manually based on CBR’s directives A particular audit team cannot audit the same registered person more than once in 2 years Audit Notice to be given to taxpayer 15 days before the scheduled date of audit Audit to be completed within 3 to 4 days unless extended by Assistant Collector in writing AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Routine Audit Monitoring, Control and Procedure Audit reports prepared by auditors to be approved by Deputy / Assistant Collector and finally by Additional Collector within 14 days of commencement of audit Audit report to be sent to taxpayer within 4 weeks All correspondence, notices and orders sent to the registered persons to bear the seal and signature with contact details of the officer issuing it. Auditors bound to affix their signatures and official seal on records checked during audits Audit Completion Certificate as per STGO AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Investigative Audit goods and stocks records, data, documents and correspondence accounts and statements utility bills and bank statements information regarding nature and sources of funds or assets with which the business is financed any other records or documents Workshop on Sales Tax Pearl Continental 21-22 July 2005 The Collector or the authorized officer by CBR can inspect: The aforesaid data can also be taken into custody by the relevant officer All government departments, local bodies, autonomous bodies, corporations bound to supply requisite assistance to such officer in connection with the investigation AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Audit by Special Auditors Audit by Chartered Accountants of Cost & Management Accountants Audit to be conducted as per Terms of Reference Special Auditor may conduct audit of records already examined by Department Audit of Retailer could involve surveillance, video filming Retailer can opt for Special Audit AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Sales Tax Rules 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Blacklisting & Suspension of Registration Collector may blacklist registration of registration person if he has evidence that the supplier has issued false invoices, or evaded tax or has committed tax fraud Workshop on Sales Tax This troubles both the supplier and the buyer CBR Web Site carries names of blacklisted persons and respective Collectorate What to be done to avoid hassle ? Pearl Continental 21-22 July 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Credit and Debit Note and Destruction of Goods Rules Eventualities prescribed in Section 9 to be catered through these rules Workshop on Sales Tax Time limit allowed is 180 days. Can be extended for another 180 days No need to issue credit note if the buyer is an unregistered person Goods unfit for consumption need to be destroyed Pearl Continental 21-22 July 2005 The time limit of 180 days not applicable where supplier has paid entire tax on advances AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Apportionment of Input Tax Why apportionment ? What is “Residual Input” ? Workshop on Sales Tax The concept of “Provisional Adjustment” ! Final adjustment to be made at the end of each financial year Pearl Continental 21-22 July 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Sales Tax Special Procedure Rules 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Payment of Sales Tax by Commercial Importers on Value Addition Registration status no more a relief ! Applicable @ 10% to registered persons who Workshop on Sales Tax import goods for subsequent supply to other person Import for self use outside the ambit of tax under the special procedure Deemed Supply at the Time of Import Pearl Continental 21-22 July 2005 If importer had sold his products at a higher value addition in any tax period during last year, he shall pay tax at such high rate AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Payment of Retail Tax on Value Addition Minimum value addition @ 10% Incidence of tax shifted to purchase instead of sales Workshop on Sales Tax Certain Retail Sectors given benefit of low percentage of value addition Audit once a year Retailer declaring 6% increase in his purchases from that of last year exempted from audit Pearl Continental 21-22 July 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Payment of Sales Tax on Electric Power & Natural Gas In case of registered consumers, the utility bill issued by distribution company shall be treated as a tax invoice Workshop on Sales Tax Registered consumers entitled to claim input tax against aforesaid invoices in the tax period in which the bill is paid provided the bill contains registration number and address of the business premises declared to the Collector of such consumer Pearl Continental 21-22 July 2005 AUDIT, RULES & SPECIAL PROCEDURES Income Tax Bar Association Karachi Issuance of Tax Invoices against Advance Payment Receipt “Advance Payment Receipt” means the receipt issued by the registered person at the time of receipt of advance Workshop on Sales Tax No tax payable at the time of issuance of tax invoice Input Tax admissible on the basis of Receipt Prescribed Format of Receipt not in agreement Pearl Continental 21-22 July 2005 with section 2(44), Rule 110 and STGO Income Tax Bar Association Karachi AJUDICATION, APPEALS & ADRC By Workshop on Sales Tax Pearl Continental 21-22 July 2005 NAVEEM MERCHANT ADJUDICATION, APPEALS & ADRC Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Adjudication Appeals Alternate Dispute Resolution ADJUDICATION, APPEALS & ADRC Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Adjudication Income Tax Bar Association Karachi PROVINCIAL SALES TAX ON SERVICES By Workshop on Sales Tax Pearl Continental 21-22 July 2005 MAJID KHANDWALA Partner Ford Rhodes Sidat Hyder & Co. PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Services tax under the Ordinance Excisable services taxed under the Act Issues relating to services tax PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Services tax under the Ordinance Enforced through Provincial Sales Tax Ordinances,2000 with effect from July 1, 2000 Workshop on Sales Tax Islamabad Capital Territory (Tax On Services) Ordinance, 2001 with effect from August 18, 2001 All the provisions of the Sales Tax Act, 1990 made applicable Sales tax rate 15% Pearl Continental 21-22 July 2005 PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Services covered with effect from July 1, 2005 Workshop on Sales Tax Pearl Continental 21-22 July 2005 Hotels Clubs Caterers Advertisement on TV and Radio excluding – those sponsored by Government agency for Health and Education – those sponsored by Population Welfare Division re Sathi educational promotion campaign funded by USAID and – those public service messages telecast on TV by WWF and UNICEF Customs agents Ship Chandlers Stevedores Courier Services PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Service withdrawn with effect from July 1, 2005 Workshop on Sales Tax Pearl Continental 21-22 July 2005 Marriage Halls and lawns Beauty Parlours, Beauty Clinics and Slimming Clinics Laundries and Drycleaners FEDERAL EXCISE DUTY IN SALES TAX MODE Income Tax Bar Association Karachi Other services subject to Federal Excise Duty under Federal Excise Act, 2005 to be levied and collected as if it were a Sales Tax under the Sales Tax Act, 1990 SRO 648(1)/2005 dated July 1, 2005 specifies the following services – Workshop on Sales Tax Pearl Continental 21-22 July 2005 Advertisement on closed circuit TV Advertisement on cable TV network Inland Travel by air Travel by train in air-conditioned Sleeper and Parlour Class and First Class Sleeper (12.5%) Inland Carriage of good by air Shipping Agents Telecommunication Services (new additions) – Payphone cards and prepaid calling cards – Wireless Local Loop Exempt telecommunication services – Billings by internet service providers – International leased line charges payable by registered software exporting firms and licensed data and internet service providers – Pager service PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 The Sales Tax Special Procedures Rules, 2005 Chapter IX - Special Procedure for Persons Providing or Rendering Taxable Services Contains General Provisions Contains Specific Provisions as follows - Part One – Custom House Agents and Ship Chandlers Part Two – Courier Services Part Three – Advertisements on Television and Radio PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi General Provisions –Significant aspects Workshop on Sales Tax Pearl Continental 21-22 July 2005 In the case of Hotels, Stevedores and Courier services – gross amount charged is subject to tax. In the case of Clubs, taxable service does not include consideration received for membership fees, refundable deposits or security. Tax point in case of services provided over a period of time is upon completion of service or receipt of money, whichever is earlier. Where an extended credit facility is provided, invoices may be raised at the end of each month. Input tax on purchases and imports and utilities like gas, electricity and telephone (excluding mobile telephone?) may be adjusted. Input adjustment is permissible on paid (and not on payable) basis. Apportionment Rules apply Provisions of Section 59 apply in case of new registrants. A single registration may be obtained in the jurisdiction of the Sales Tax Collectorate where he is assessed for income tax purposes. PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Special Provisions – Part One Customs Agents Workshop on Sales Tax Taxable service does not include consideration received on account of transportation charges, demurrage, wharfage, duties and taxes, toll taxes, municipal charges, port charges, handling charges, packing charges, labour payment and other reimbursable expenses. Minimum benchmark level for value of taxable service per document is as follows - S. No. Document Minimum value (Rs.) Pearl Continental 21-22 July 2005 01 GD or Goods Declaration for home consumption or intobond filed 2000 02 Ex-bond GD or Goods Declaration filed 1,000 03 Pakistan Goods declaration for export filed 1,000 04 Rebate claims filed 0.25% of the amount of rebate claim 05 GD or Goods Declaration filed at airport (AFU) including baggage declaration. 500 06 Transit or transshipment permit 500 PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Workshop on Sales Tax Ship Chandlers Pearl Continental 21-22 July 2005 Audit once a year if tax deposited less than minimum benchmark level per document No routine audit if tax deposited in accordance with minimum benchmark level per document Audit once in three years if tax deposited twice or more than the minimum benchmark level per document Means a licensed person under the Customs Ship Chandlers (Licensing) Rules, 1980 Who transacts business relating to supply of provisions and stores on any conveyance proceeding to any foreign port, airport or station Taxable service does not include consideration received on other accounts such as transportation charges, toll taxes, municipal charges, port charges, handling charges, packing charges, labour charges PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Special Provisions – Part Two Courier Services Workshop on Sales Tax Taxable Services is any service provided by a courier company in relation to delivery of documents, goods or articles No sales tax on office mail where the consignee and consignor are the same person Refund may be claimed in respect of courier services related to export of goods where a goods declaration has been filed, treating such services as zero rated ? Special Provisions – Part Three Advertisements on Television and Radio Pearl Continental 21-22 July 2005 Input tax on advertisements routed through advertising agency permissible Invoice format specified to allow insertion of name of advertising agency as well as the advertiser. PROVINCIAL SALES TAX ON SERVICES Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Errors and Anomalies Income Tax Bar Association Karachi CASE STUDY By Workshop on Sales Tax Pearl Continental 21-22 July 2005 MUHAMMAD HANIF SHEIKH CASE STUDY Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Sales tax on scrap and fixed assets Sales tax on advances Discounts Liability of sales tax Insurance CASE STUDY Income Tax Bar Association Karachi Workshop on Sales Tax Pearl Continental 21-22 July 2005 Sales tax on scrap and fixed assets