Emerging Challenges and Opportunities for the

EMERGING CHALLENGES AND

OPPORTUNITIES FOR THE

GEOSCIENCE WORKFORCE

Keynote Presented at the Geoscience and the 21st Century Workforce Workshop

Sponsored by the National Science Foundation

Penn State University, June 2013

Roger H. Bezdek, Ph.D., President

Management Information Services, Inc.

Washington, D.C., rbezdek@misi-net.com

THIS PRESENTATION

• Discuss job market for geoscience workforce

• Assess future supply of geoscience workers

• Analyze supply & demand for geoscience jobs

• Evaluate demographic trends

• Identify challenges for maintaining adequate workforce

• Analyze drivers of future job requirements

• Identify new & emerging geoscience occupations

• Discuss options for alleviating future workforce shortages

• Identify challenges & opportunities

• Identify areas of required research

2

“SHORTAGE” OF GEOSCIENCE WORKERS?

• “Consensus” in the literature seems to be that there is a shortage of geoscientists. For example, some recent findings:

-“Society needs more geoscientists than there are presently students”

--

“Near-term demand for geoscientists that exceeds the available supply”

-“Supply falls short of current and projected demand”

-“Supply shortage of geoscience graduates”

• Is there a current & impending shortage of geoscientists?

• This is an important question

3

IS THERE A GLUT OF U.S. STEM WORKERS?

• Geoscientists are a subset of STEM professions -- science, technology, engineering, & math

• Is there a shortage of STEM workers?

• Everyone seems to think so

• However, studies question this; for ex.,

EPI & Boston Consulting Group

Economic Policy Institute (EPI) concludes:

-U.S. has more than a sufficient supply of workers available to work in STEM occupations

-For every 2 students that U.S. colleges graduate with STEM degrees, only 1 is hired into a STEM job

-Wages have remained flat, with real wages hovering around their late 1990s levels.

• So, what is going on here? Need H1-B visas?

What does this imply for the NSF STEM Talent Expansion Program?

4

SALARIES ARE INDICATIVE

• If there is a “shortage” of geoscience workers, then salaries should be increasing. Is this true? Yes!

Mean Annual Salaries of Geoscience Occupations

Source: U.S. Bureau of Labor Statistics

Geoscience salaries continue to increase significantly over period when average U.S. salaries are flat 5

PETROLEUM GEOLOGIST SALARIES

Average Petroleum Geologist Salary

$210

$190

$170

$150

$130

$110

$90

$70

$50

2004 2005 2006 2007 2008 2009 2010 2011 2012

Entry Level 10-15 Yrs 20 Yrs +

Source: AAPG Annual Salary Survey

Petroleum geologists salaries have increased ~ 75% over past decade!

6

FUTURE DEMAND > SUPPLY

Oil & Gas Industry Geoscientist Supply and Demand

Source: American Geological Institute

7

GEOSCIENCE JOB GROWTH

Geoscience occupations forecast to be among the most rapidly growing

Forecast Job Growth, Selected Occupations, 2010 - 2020

10%

0%

-10%

-20%

40%

30%

20%

Source: U.S. Bureau of Labor Statistics

Geoscience jobs expected to increase 21% by 2020 – 3X average job growth

8

FUTURE WAVE OF RETIREMENTS

Age Distribution of Geoscientists in the Oil and Gas Industry

½ of total O&G workforce eligible to retire

~ 10 years

Source: American Geological Institute

Oil & gas industries have been downsizing & shedding employees for

2 decades, & now face a large impending wave of retirements 9

FEDERAL RETIREMENT TSUNAMI

Age Distribution of Geoscientists in the U.S. Government

Source: American Geological Institute and U.S. Office of Personnel Management

Most Federal geoscientists eligible to retire < 10 years

10

MANY SPECIALTIES AT RISK

Percentage of Federal Workforce > 50 Years Old

80%

75%

70%

65%

60%

55%

50%

Mining Eng.

Geodesy Petrol. Eng Geology

Source: American Geological Institute and U.S. Office of Personnel Management

Geophysics Oceanography

In some fields retirement risk may be acute

11

ATTRITION, GROWTH, & REPLACEMENT

• What is overall outlook for geoscience jobs in the U.S.?

• At present ~ 265K U.S. geoscience jobs

• Geoscience grads continuing on to geoscience careers:

Bachelor’s, 30%; Master’s, 43%; Doctorate, 66%

• Over next decade in U.S.:

-~ 130K geoscientists expected to retire

-72K geoscience job growth by 2021 (BLS)

-45K total new graduates -- BS/BA, MS, Ph.D.

• Thus, potential net deficit of > 150,000 geoscientists

• Actually, net deficit likely to be even lager due to new sources of geoscience job growth

12

SHORTAGES WILL BE WORSE IF

NON-U.S. WORKERS UNAVAILABLE

Potential Shortage of Oil & Gas Industry Geoscientists

35,000

30,000

25,000

20,000

Why do we think that

U.S. can continue indefinitely to poach world’s supply of geoscientists?

15,000

10,000

5,000

0

2015 2020 2025 2030

Source: American Geological Institute and Management Information Services, Inc.

However, potential shortage likely to be even more severe due to new sources of geoscience job growth

13

GEOSCIENCE WORKFORCE SHORTAGE

• Thus, there is no current or impending “glut” of geoscience professionals

• In fact, just the opposite is true :

-Recent salary data indicate robust job market

-Forecasts indicate that demand will > supply

-Workforce deficit could exceed 150K – & this may be a conservative estimate

• The EPI study looked at all STEM occupations, and surplus labor was concentrated in computer programming & some IT fields

• It did NOT indicate a surplus of geoscience professionals

• The EPI study has important implications for future geoscience workforce, which we will discuss shortly

14

FUTURE SUPPLY OF GEOSCIENCE WORKERS

• Enrollments -- flat

• Graduation rates -- flat

• Career choices after graduation

-most geoscience grads do not remain in field

• Inflow from other specialties

• Foreign workers -- H-1B visas

• Increased participation of women in geoscience

• Increased participation of minorities in geoscience

15

GEOSCIENCE STUDENTS NOT INCREASING

U.S. Geoscience Enrollments

Source: American Geological Institute

Geoscience undergrad enrollments plateaued past 2 decades; geoscience grad enrollments plateaued past 4 decades

16

GEOSCIENCE GRADUATES NOT INCREASING

U.S. Geoscience Degrees Conferred

# of geosciences degrees awarded flat for past 3 decades

17

WOMEN UNDERREPRESENTED

Percentage of Women in Environmental Science and Geoscience Occupations

Source: American Geological Institute and U.S. Bureau of labor Statistics

18

STUDENT POPULATION WILL BE MINORITIES

U.S. Population, 18 and Younger

60%

50%

40%

30%

20%

10%

0%

2010 2025

Hispanic Black Combined

2050

Source: U.S. Census Bureau

“Minorities” – especially Hispanics -- will comprise majority of U.S. students

This will have profound impact on future U.S. workforce

19

FEW HISPANICS IN GEOSCIENCES

Hispanic Percent of Federal Geoscience Workforce

Compared to Hispanic Percent of Students

40%

30%

20%

10%

0%

Environmental Environmental

Eng.

Sci.

Mining & Geo

Eng.

Oceanography Hispanic %

Students 2025

Hispanic %

Students 2050

Source: U.S. Office of Personnel Management

Hispanics not underrepresented in Geoscience; they are hardly present at all

20

U.S. GEOSCIENCE EMPLOYMENT

Oil & Gas (48%)

Government (17%)

Academia (16%)

Mining (10%)

Environmental

8%

--- Other (1%)

Source: U.S. Bureau of Labor Statistics and National Science Foundation

Geosciences employment overwhelmingly dominated by energy industry and related sectors

21

FUTURE OF GEOSCIENCE JOBS

• Historically, fortunes of geoscientists have been tied to the boom and bust cycles of the natural resource industries – oil, gas, & mining.

• Thus, future of geoscience jobs depends on future of energy industries

• What does the world’s energy future look like?

• The future energy mix will likely look much like the current one : Oil, natural gas, & coal continue to dominate

“The key to past performance has not been the expansion of resources in the ground but rather the sustained application of new technologies by skilled professionals . Technology will be even more important to sustaining industry growth in the future. So, too, will be the availability of skilled professionals to apply that technology.” American Petroleum Institute

22

FOSSIL FUELS HERE TO STAY

In 2050, fossil fuels will still provide ~

80% of the world’s (much larger) energy supply

2050 World Energy Mix

2012 World Energy Mix

Other Energy

(14%)

Other Energy

(20%?)

Fossil Fuels

(86%)

Fossil Fuels

(80%?)

What does this imply for geoscience workforce?

23

FUTURE WORLD ENERGY SUPPLY

Forecast World Energy Consumption

(Mtoe: Million Tons Oil Equivalent)

Source: International Energy Agency 24

FOSSIL FUEL DEMAND

AND PRICES INCREASING

Forecast U.S. Fossil Fuel Prices

$35

$30

$25

$20

$15

$10

$5

$0

2013 2018 2023 2028 2033 2038

Oil Natural Gas Coal

Source: U.S. Energy Information Administration

In real terms, oil prices increase 37%, natural gas prices increase 56%, and coal prices increase 20%, and these may be conservative estimates 25

WORLD LIQUID FUELS PRODUCTION: HISTORY

World Liquid Fuel Production Increased up to

Mid 2004 & Then Hit Fluctuating Plateau

Source: U.S. Energy Information Administration

World “conventional” oil production will likely never exceed ~ 70 MMbbl/day

26

WORLD OIL PRICES

World in a race between declining conventional oil production & increasing unconventional oil production

The era of “easy” oil is past; future oil will be increasingly difficult, expensive, “dirty,” and increasingly “technology-challenged”

27

COAL: PRIMARY WORLD ENERGY SOURCE

OF THE PAST, PRESENT, AND FUTURE

• Coal was the world’s dominant energy source in the 19 th century

• Coal was the world’s major energy source in the 20 th century :

-More energy was obtained from coal than from oil

-Thus, contrary to common perception, 20 th the “coal century,” not the “oil century”

• Coal is the world’s most rapidly growing century was really energy source in the 21 th century :

-Coal use grew twice as fast as any other energy source over past decade

-Coal’s dominance is forecast to continually increase

• Coal necessary to meet world’s rising energy demand

28

COAL WILL PROVIDE CONTINUALLY

INCREASING SHARE OF WORLD ENERGY

Coal Share of Total World Energy Consumption: 2000 - 2035

30%

28%

26%

24%

22%

20%

2000 2007 2015 2020 2030 2035

Source: International Energy Agency, 2010.

Coal’s share of total world energy consumption forecast to increase by > 1/4: From < 23% in 2000 to > 29% in 2035.

29

FRAC GAS INCREASING RAPIDLY

Hydraulic fracturing (fracing) has revolutionized natural gas production

30

25

SHALE GAS REQUIRED TO OFFSET LOST

PRODUCTION OF CONVENTIONAL GAS

History Projections

Alaska

20

Shale gas

Coalbed methane

15

Non-associated

Onshore

10

5

Non-associated

Offshore

Gas associated with oil

Net imports

-

1990 1995

Source: EIA

2000 2005 2010 2015 2020 2025 2030

“EIA is increasingly relying on huge production increases from shale gas to meet its U.S. natural gas forecast.”

2035

31

GAS WELL PRODUCTIVITY DECLINING RAPIDLY

Number of U.S. Natural Gas Wells vs. Average

Productivity Of Each Well, 1990 - 2010

32

IT IS ALL ABOUT DECLINE RATES

• Shale gas wells have very high annual production decline rates:

-Conventional gas wells decline 25% - 40% in 1st year

-SG wells decline at much higher rates, ~ 85%.

• Initial productivity can be very high

• However, steep decline rates mean that relying on SG will exacerbate

“exploration treadmill” problem

• # of SG wells that must be drilled to maintain production will continue to increase.

“Estimated ultimate recovery from shale gas wells has been overstated by operators, and shale gas plays are marginally commercial at best in the current low gas price environment.

”

33

TREADMILL: DRILLING MORE

TO STAY CONSTANT

Annual Successful U.S. NG Wells v. U.S. NG Production

Drilling tripled, but production increased only ~ 20%

34

SHALE GAS GHG IMPACTS EXCEED COAL

GHG Emissions (grams carbon per million joules of energy)

Source: Cornell University.

Fuel switching from coal to natural gas could INCREASE GHGs

35

BOTTOM LINE: CARBON

MANAGEMENT IS IMPERATIVE

• No shortage of carbon-based fuels – world awash in hydrocarbons:

Heavy oil, oil sands, shale oil, frac gas, methane hydrates, coal, etc.

• Given: Fossil energy will continue to dominate

• May 2013: CO

2

> 400 ppm

• Trend is that GHGs will continue to increase

• THUS:

-IF world is serious about controlling greenhouse gas (GHG) emissions

-THEN carbon capture, utilization, & sequestration (CCUS) on massive scale becomes critical

36

CARBON CAPTURE AND SEQUESTRATION

Capture the carbon produced and safely and permanently sequester it

Worldwide, carbon capture & sequestration (CCS) will require trillions $ of investments, generate millions of jobs, & have profound impacts on the geoscience workforce

37

CO

2

FROM SOURCE USED FOR EOR

38

CURRENT U.S. CO

2

EOR ACTIVITY

U.S. has > 40 years of experience in EOR, and it’s oil industry is the world leader in CO

2

EOR

39

EXAMPLE: TEXAS ADVANCED POWER PLANT

INTEGRATING CO

2

EOR & CO

2

STORAGE

This is a first-of-its-kind commercial clean coal power plant that uses the CO

2 generated for EOR

40

HOW CO

2

CAPTURE/TRANSPORT/

STORAGE COULD EVOLVE

Source: ARI for NRDC, 2010.

CO

2

EOR opportunity in Texas is so large that it could absorb CO

2 from all planned coal power plants…and much more

41

CCUS ESSENTIAL

• Carbon capture, utilization, & sequestration

(CCUS) increasingly imperative, e.g.:

-Carbon capture in power plants, factories, refineries, etc.

-Carbon sequestration in aquifers

-Carbon utilization in enhanced oil recovery (EOR)

-Carbon utilization as a feedstock

• Studies have estimated economic & job impacts of CCUS initiatives & found them to be huge: Annually, ~ $200 billion, > 1 million jobs

• Found that even modest CCUS initiatives will greatly increase demand for geoscience workers

• Future CCUS initiatives will be more than modest

• This is good news for geoscience workers

• But presents daunting challenges for workforce development in industry and academia

Carbon mgt./CCUS may be world’s major energy, environmental, and technology challenge of the 21 st century

42

VAST NEW SOURCES OF GEOSCIENCE JOBS

• Growth in U.S. CCUS & related “green” sectors will lead to vast new employment opportunities – many related to geoscience

• Jobs will be created across a new spectrum of work activities , skill requirements, responsibilities, & salary levels

• Many of these jobs do not currently exist & do not have occupational titles defined in federal & st. govt. classifications

• Many of the new jobs require different set of skills than current jobs

• Education & training requirements must be assessed so that these rapidly growing sectors have enough qualified workers

• Eventually, federal government will classify the occupations & add them to the employment classification system

• Until then, geoscience jobs analysis & forecasting is conducted using the current set of U.S. Labor Dept. occupational titles

43

LARGE NUMBERS OF JOBS CREATED

IN MANY INDUSTRIES

Jobs Created in 2030 by CO

2

(Selected Industries)

EOR

Source: Management Information Services, Inc.

44

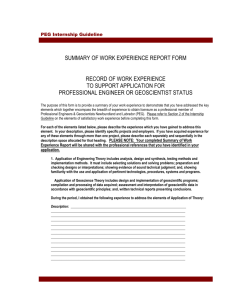

CCUS CREATES MANY GEOSCIENCE-RELATED JOBS

New & Emerging Jobs, Salaries, and

Educational Requirements in the CCUS Field

Occupational Title

Average

Salary Minimum Education

Director of CCUS project development

Plant technical specialist - safety instrument testing & repair

Safety investigator - cause analyst

Plant supervising technical operator

Plant safety engineer

Air quality control engineer

Field technician

Sequestration research manager

Emissions accounting & reporting consultant

GHG emissions report verifier

CCUS sampling technician

Energy trading specialist

CCUS power generation engineer

CCUS technician

Emissions reduction credit marketer & market analyst

Emissions reduction credit portfolio manager

Emissions reduction project developer specialist

Commercial energy field auditor

Air pollution specialist

Air resource engineer

CCUS policy analyst

Air quality specialist & enforcement officer

Air emissions permitting engineer

CCUS engineer/scientist intern

$148,700

$69,400

$97,300

$56,100

$98,800

$99,700

$25,800

$80,100

$69,400

$60,200

$38,300

$69,000

$111,800

$46,800

$79,600

$50,800

$68,500

$26,000

$69,400

$79,200

$44,900

$67,100

$70,600

$6,800

Bachelor's (Business)

Bachelor's (various)

Bachelor's (various)

Bachelor's (Engineer)

Bachelor's (various)

Bachelor's (CE)

HSD/GED

Master's (Science)

Bachelor's (various)

Bachelor's (Science)

HSD/GED

Bachelor's (various)

Bachelor's (ME)

Associate's

Bachelor's (Business)

Bachelor's (Business)

Bachelor's (various)

Associate's

Bachelor's (Science)

Bachelor's (Engineer)

Bachelor's (Science)

Bachelor's (Science)

Bachelor's (Science)

HSD/GED

Source: Management Information Services, Inc.

45

GREEN SECTOR-RELATED GEOSCIENCE JOBS

New & Emerging “Green” Geoscience-related Jobs,

Salaries, and Educational Requirements

Occupational Title

Water purification systems service technician

Environmental engineering manager

GHG emissions permitting consultant

Water resource consultant

Water resource engineer

Environmental research manager

GIS specialist

Engineering geologist

Environmental sampling technician

Climatologist

Restoration planner

Carbon sequestration plant installation, operations, eng. & mgt.

Carbon emission specialist

Emissions reduction project manager

Conservation of resources commissioner

Water resources policy specialist & advocate

Climate change & energy policy specialist & advocate

Environmental compliance specialist

Geothermal operations engineer

Hydrologist-Hydrogeologist

Source: Management Information Services, Inc.

Average

Salary

$41,400

$74,200

$68,800

$81,500

$69,600

$78,100

$51,000

$69,800

$38,800

$69,000

$79,200

$75,200

$69,300

$85,700

$94,400

$45,500

$46,800

$50,200

$66,100

$67,900

Minimum Education

HSD/GED

Bachelor's (Science)

Bachelor's (Science)

Bachelor's (Science)

Bachelor's (Science)

Master's (Science)

Bachelor's (Geography)

Bachelor's (Engineer)

HSD/GED

Bachelor's (Science)

Master's (Science)

Bachelor's (Engineer)

Bachelor's (various)

Bachelor's (various)

Master's (various)

Bachelor's (Science)

Master's (Various)

Bachelor's (Science)

Bachelor's (Engineer)

Bachelor's (Science)

46

HOW DO WE ADDRESS FUTURE SHORTAGE

OF GEOSCIENCE WORKERS?

• On-the-job training?

• Retooling of existing personnel?

• Crash education and training programs?

• Delayed retirements?

• Lure people out of retirement?

• Increased reliance on foreign workers?

• Energy/CCUS demands are worldwide & foreigners may not be available – other nations may be poaching our people.

• It takes 5 - 10 years, or more, to produce highly trained geoscientists required, so we have to begin more than a decade in advance

• How do companies, universities, & governments, plan for this?

• Have to forecast workforce requirements more than a decade into future & then have universities come up to speed. Is this possible?

Likely solution is a combination of options to fill the void until geoscience graduation numbers increase to meet demand

47

REDIRECT STEM STUDENTS TO GEOSCIENCE?

• EPI study:

-Supply of STEM-educated students remains strong

-In computer & information science & in engineering, U.S. colleges graduate 50% more students than are hired into those fields each year

-Of the computer science graduates not entering IT workforce, 32% say it is because IT jobs are unavailable;

53% say they found better jobs outside of IT

-Supply of STEM graduates larger than demand for them in industry

• If true, redirect STEM/IT/CS students to geoscience : They have the basic skills required & should be good fit

48

CONCLUSIONS: OPPORTUNITIES

• Current job market for geoscientists is robust

-High salaries

-Tight job market: Demand > supply

• Future job market for geoscientists excellent :

Demand likely to continue to exceed supply

• Energy industries will continue to grow & create numerous geoscience jobs

• Carbon mgt./CCUS & related environmental programs provide sources of immense job growth for geoscientists during 21 st century -- jobs immune from infamous “Boom & Bust” cycle

• Very good news for current & future geoscientists

• Especially good news in era when many college grads are saddled with huge educational loans & cannot find jobs (or are working as baristas)

• Good career advice: Tell your children, students, etc. to become geoscientists

Be realistic about future geosciences jobs: Many more mining engineers working for Shenhua and geologists working for

Chevron than “sustainability experts” working for Greenpeace

49

CONCLUSIONS: CHALLENGES

• Good news for students & workers may be bad news for employers & schools

• High rates of geoscientist attrition in near future

• Large % of impending retirees are in middle & upper mgt. positions that require many years of experience

• Energy industries : Workforce shortage causes project delays, cost overruns, & cancellations

•

Governments : How can public sector compete for future geoscience workers?

• Academia : How to make case for large increase in geoscience resources when budgets are tight & shrinking?

• High rates of geoscientist attrition in near future

• World priorities : Carbon mgt./CCUS/climate goals not achievable without adequate geoscience workforce

– no one is addressing this

• Where are required, qualified future geoscience workers to come from?

Next year? 5 years from now? 10 years from now?

• How to increase minorities’ enrollment in geosciences

50

REQUIRED RESEARCH

• Forecast alternate demand and supply scenarios or geoscience workforce

• Methods for alleviating shortage of geoscience workers

– short term & long term solutions needed

• Geoscience least diverse of all STEM fields – why?

• How can minorities be attracted to the geoscience professions?

• Assess why most geoscience graduates do not enter the profession and identify remedies

• Assess ed. & training requirements & salaries for new, emerging geoscience occupations & develop appropriate classifications

• Analyze impacts of growth of carbon mgt./CCUS on geoscience workforce

• Geoscientists required to address problems only beginning to emerge ; e.g. CCUS monitoring, verification, insurance, liability, transactions costs, litigation, etc.

• Determine if geoscience workforce constraints may limit world’s climate change mitigation efforts & assess implications – questions no one is even asking

51