The Austrian Theory of Capital and Interest

advertisement

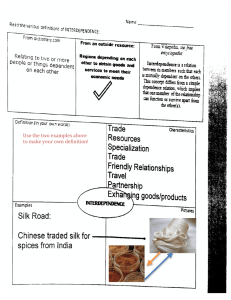

The Austrian Theory of Capital and Interest Peter Lewin: University of Texas at Dallas plewin@utdallas.edu My Web page This file online The Capital Idea The Capital Based View of the Firm A Story in Two Parts Part One – The Theory of Capital Part Two – The Theory of Interest Part One – Overview: The Theory of Capital Capital Theory and the Austrian School of Economics It’s the Austrians’ “claim to fame.” Menger (1871) Böhm-Bawerk (1880 – 1921) Wieser Mises Hayek (1930’s, 1941) Rothbard Lachmann Kirzner Current applications Garrison Horwitz Lewin …. (macro) (macro-family) (management) Wider Connections Without which it is difficult to understand Capital Theory Adam Smith (1776) David Ricardo (1817) Karl Marx Neo Ricardians – Post Keynesians (Nicolas Kaldor Joan Robinson Pierro Sraffa – Keynesian Marxists) Neo Classicals Carl Menger Joseph Schumpeter John Hicks Adam Smith The annual produce of the land and labor of any nation can be increased in its value by no other means, but by increasing either the number of its productive laborers, or the productive powers of those laborers who had before been employed. The number of productive laborers, it is evident, can never be much increased, but in consequence of an increase of capital, or of the funds destined for maintaining them. The productive powers of the same number of laborers cannot be increased, but in consequence either of some addition and improvement to those machines and instruments which facilitate and abridge labor; or of a more proper division and distribution of employment. In either case the additional capital is almost always required. It is by means of an additional capital only that the undertaker of any work can either provide his workmen with better machinery, or make a more proper distribution of employment among them (Smith 1982: 343, italics added). David Ricardo Carl Menger Neo Classicals Karl Marx Neo Ricardians Post Keynesians Joseph Schumpeter John Hicks According to Smith Saving is necessary for the achievement of economic growth. The earning of profit is consequent, not simply upon the accumulation of capital, but, significantly, also upon the fruits of the division of labor – in modern terms capital accumulation, technical progress and economic organization are tied together. The availability of capital is necessary (though apparently not sufficient) for the adoption of new and more productive methods of production. There is a type of diminishing returns – this is clearly not in the form of a declining rate of return to investment in a given mode of production, but rather refers to the eventual possible exhaustion of investment opportunities for extending the division of labor, that is, for the discovery and introduction of new and improved production methods. David Ricardo Different world, different concerns Malthus and the pressures of population – land is fixed, wages are fixed, so rent keeps rising and profit keeps falling until the stationary state is reached. David Ricardo “Laws” of distribution between K, N and L “factors” of production – profit, wages and rent. To calculate the rate of profit you need to measure capital the labor theory of value. Industrialization and the heterogeneity of capital All capital is circulating? The Ricardian practice of assuming equilibrium. Capital flows ensure a uniform rate of profit. Carl Menger Neo Classicals Karl Marx NeoRicardians Post Keynesians John Hicks Joseph Schumpeter Ricardo’s Legacy Quantification – A shift towards a more mechanical way of looking at things Cost of production valuation – A reflection of the materialist fallacy, partially banished by the marginalist revolution. Labor value was replaced by equilibrium value (general equilibrium). Carl Menger Owes much to Adam Smith and nothing to Ricardo. – There is a time structure to the production process. Goods of lower and higher order. The earlier one intervenes in nature’s processes the more productive one can be. “[B]y making progress in the employment of goods of higher orders for the satisfaction of their needs, economizing men can most assuredly increase the consumption goods available to them accordingly - but only on condition that they lengthen the periods of time over which their activity is to extend in the same degree that they progress to goods of higher order.” (Menger 1981: 153 italics added). Production is the result of human planning - there can be errors - the market tends to correct such errors, but there is no continual equilibrium - there is continual groping of the structure of production toward the changing structure of consumption. Underlining Menger’s Insights Adopting Menger’s perspective one cannot lose sight of the variety of goods and services and individual activities and choices. There is no suggestion of a uniform rate of profit at any point in time. Yet there is an inescapable order within the variety provided by our understanding of the purposes of individuals. “The process of transforming goods of higher order into goods of lower order, ... must always be planned and conducted, with some economic purpose in view, by an economizing individual” (Menger 1981: 159-60). Capital and the conscious organization of production are inextricably linked. Eugene von Böhm-Bawerk The most visible and well known Austrian economist – the “master” of Austrian Capital Theory – 3 volumes over many years, engaging many eminent scholars B-B’s vision is the same as Menger’s – a series of concentric circles – wisely chosen “roundabout” methods of production are more “productive” – they yield a greater volume of consumption goods. Roundabout Production is Advantageous “There are two concomitants of the adoption of the capitalist methods of production, ... One is advantageous, the other disadvantageous. …. With an equal expenditure of the two originary productive forces, labor and valuable forces of nature, it is possible by well chosen roundabout capitalist methods to produce more or better goods than would have been possible by the direct noncapitalist method. It is a truism well corroborated by empirical evidence.” (Böhm-Bawerk 1959: Book II, 82-3). “...[O]ne thing that can be stated with a reasonable degree of certainty is the proposition ... that as a general rule a wisely selected extension of the roundabout way of production does result in an increase in the magnitude of the product. It can be confidently maintained that there is no area of production which could not materially increase its product over the result obtained by its present method (Böhm-Bawerk.” 1959: 84-85). But a Sacrifice is Involved “The disadvantage which attends the capitalist method of production consists in a sacrifice of time. Capitalist roundaboutness is productive but time-consuming. It yields better consumption goods, but not until a later time.” (BöhmBawerk 1959: 82). “All consumption goods which man produces come into existence through the cooperation of human powers with the forces of nature, which are in part of economic character, in part free natural powers. Man can produce the consumption goods he desires through those elemental productive powers. He does so either directly, or indirectly through the agency of intermediate products which are called capital goods. The indirect method entails a sacrifice of time but gains the advantage of an increase in the quantity of the product. Successive prolongations of the roundabout method of production yield further quantitative increases though in diminishing proportions.” (Böhm-Bawerk 1959: 88). Structure or Quantity? Menger or Ricardo? He believes in structure: “A nation’s capital is the sum of heterogeneous concrete capital goods. To aggregate them one needs a common denominator. This common denominator cannot be found in the number of capital goods … nor their length or width or volume or weight or any other physical unit of measurement …. The only measuring rod that does not lead to contradictions … is the value [of these capital goods]” (Hennings 1997: 132, his translation of Böhm-Bawerk 1959 [1921] III 105). He provides a formal quantitative treatment: “It is more important, as well as correct, to consider the average time interval occurring between each expenditure of originary productive forces and the final completion of the ultimate consumption good. A production method evinces a higher or lower degree of capitalist character, according to whether, on the average, there is a longer or shorter period of waiting for the remuneration of the expenditure of the originary productive forces, labor and uses of land.” (Böhm-Bawerk 1959: 86). Calculated the APP as follows. Quantity (Stock) or Structure? Quantitative Ricardian Cost of production Marxist, Neo Ricardian Joan Robinson Luigi Pasinetti (the Italians) Compositive Mengerian Schumpeterian General Equilibrium Paul Samuelson, Robert Solow, Paul Romer, Robert Barro, Robert Lucas Modern Growth Theory. Modern Austrian Mises, Hayek, Lachmann, Rothbard, Kirzner A Bunch of Capital Controversies The APP is vulnerable to all kinds of attacks. – Point input point output or flow input point output but not flow input flow output. How to value the inputs (neglect of land)? Is interest paid? J. B. Clark (later repeated, with variations by F. H. Knight against Hayek). Attacked the APP. – Time is irrelevant - T is either 0 or ∞ B-B’s formalization allowed for the extension of the Ricardian approach into the modern “production function” – Q=F(K, L, N) K has the form it needs - used at both the firm and economy level. Diverts attention away from questions concerning real world capital formation decisions. Cambridge US v. Cambridge UK (K is bogus – therefore profits are unjustified) – Both are Neo-Ricardians? – The UK Ricardians attacked the wrong thing (Lachmann’s critique). But what is it really about? What is really at stake? The nature of the economics process – hence desirable economic policy The best way to do economics – the scope of economics From Hayek to Lachmann and Beyond. Hayek is of the “compositive” school Hayek at the LSE – contra Keynes – needed a more complete theory of Capital – The Pure Theory of Capital – 1941 – “Our main concern will be to discuss in general terms what type of equipment it will be most profitable to create under various conditions, and how the equipment existing at any moment will be used, rather than explain the factors which determined the value of a given stock of production equipment and the income that will be derived from it.” (1941: 3) – “The problems that are raised by any attempt to analyze the dynamics of production are mainly problems connected with the interrelationships between the different parts of the elaborate structure of productive equipment which man has built to serve his needs. But all the essential differences between these parts were obscured by the general endeavor to subsume them under one comprehensive definition of the stock of capital. The fact that this stock of capital is not an amorphous mass but possesses a definite structure, that it is organized in a definite way, and that its composition of essentially different items is much more important than its aggregate ‘quantity,’ was systematically disregarded.” (1941: 6). Lachmann extends the “compositive” vision Hayek never managed to produce a treatment of Capital that satisfied him Investment that raises the demand for Capital (1937) is the inspiration for Lachmann’s work on Capital 1956 – Capital and Its Structure – the final chapter? Lachmann - Aspects of the Capital Structure Capital is Heterogeneous – capital vs. capital goods. Capital goods are part of the Capital Structure. A “structure” is an order. The capital structure is partly designed and partly the result of adaptation – “spontaneous order.” – The design part is about firms (and households) – The spontaneous part is about the market process The capital structure is characterized by complementarity and specificity. – Decision-makers form capital combinations with complementary resources – some are dynamically more specific than others – Change cause substitutions to be made - capital gains and capital losses – coherence vs. flexibility B-B’s insight is valid - the capital structure becomes increasingly more complex over time. Is it relevant? – the scope of economics Structure v. Stock – quantity v. quality – composition v. size the scope of economics. The black box of the firm vs. the economic organization. Hayek Richardson, Penrose and recent work on firm boundaries and strategies (linking up with Coase and Williamson). – When does aggregation (quantity) obscure structure? When incommensurate items are aggregated. Modularity may be the way to go. – Organization matters for production. A wider (and more fruitful?) perspective. Part Two -The Theory of Interest B-B explains why the existence of interest is a matter of time preference TP is a necessary and sufficient condition for the earning of interest PTPT theory of interest. Productivity cannot explain the earning of interest. But the PTPT is vulnerable – What does TP mean? – There are multiple interest rates – Samuelson’s rice model. How should we speak? What viewpoint is more relevant to the real world in which interest is paid in money? Implications of PTPT Interest is not profit!! Profit is the result of uncertainty (Knight, Mises, Hayek, Rothbard). Resource owners earn rent (Rothbard, Fetter) wages (human capital), rent (land and physical capital) - all resources are part of “capital” - also relevant to the economics of organization. The level of interest rates has very little to do with economic growth and productivity. Directs our attention to the market for loanable funds.