Rafael T. Boza Presentation, Nov. 8 2011

advertisement

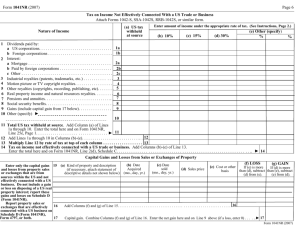

Peru New President and New Mining Legislation: What does it mean for foreign investors? by Rafael T. Boza Ollanta Humala Tasso • President since July 28, 2011 until July 28, 2016. • Leader of the Peruvian National Party. • Leftist, nationalist; close friend with Hugo, Evo, Luiz Inacío, and Cristina, and follower of Fidel. • Brother of the jailed “Etno Cacerista” lider ▫ Radical movement embracing indigenous racial superiority. • Intellectual author of attempted coup in 2005. • Interested in achieving “Great Transformation.” • Seeks market economy with social inclusion. Extractive Sectors in Peru • Mining: ▫ Occupies about 42 billion acres (13% of Peru’s terr.). ▫ Accounted for: US$21 billion in Peru’s exports in 2010 (61% of total). Up from US$17 billion in 2007. Worldwide: 7% of gold, 13% of silver, 8% of copper. ▫ Employs approx. 169,000 people. • Oil & Gas: ▫ Production of about $70,000,000 barrels in 2010. ▫ Booming with more gas reserves discovered. • New legislation applies to both sectors. Payments Prior to 9/28/2011 • ROYALTIES: Regulated by Law 28258 of 2004. ▫ Calculated on gross sales of concentrate or equivalent. ▫ If yearly sales (in US$ millions) are: below 60 1% ($45mm pays $450,000) between 60 to 120 2% ($112mm pays $2,240,000) over 120 3% ($196mm pays $5,880,000) ▫ Can be used as a cost and deducted from taxes. • INCOME TAXES, VAT. • SOCIAL CONTRIBUTION ▫ Voluntary payments remain. Situation After to 9/28/2011 • LAW 29788 - ROYALTIES ▫ Modifies Law 28528 re Royalties. • Main Provisions: ▫ On QUARTERLY OPERATIVE PROFIT (QOP) QOP=Sales Proceeds-(Sales costs + Operative cost) Sales price considered mkt. at arms length Limitations on deductions of costs and allocations ▫ Company will pay highest of: QOP x the EFFECTIVE RATE; or, 1% of Q Sales Proceeds. Situation After to 9/28/2011 • LAW 29788 – ROYALTIES (cont.) ▫ The EFFECTIVE RATE to be applied is calculated based on “simple” a formula: See formula ▫ The Co. needs to calculate the marginal %, determined by calculating QUARTERLY OPERATIVE MARGIN (QOM) QOM=QOP/Sales Proceeds 15 applicable %s for QOP, from 1% to 12% (may be more) • Very complex and not clearly regulated yet. Situation After to 9/28/2011 (Cont.) • LAW 29789 – SPECIAL MINING TAX. ▫ Taxes the QOP. Same way of calculating as for Royalties. ▫ EFFECTIVE RATE calculated over the QOM. See formula • Can be deducted from Income Tax as expense. • Same way of calculating as for Royalties. • Regulations to guide its applicability not clear. ▫ Will need to work with SUNAT. Situation After to 9/28/2011 (Cont.) • LAW 29790 – SPECIAL MINING GRAVAMEN. ▫ Payment for extraction & exploitation of nonrenewable resources. a/k/a second slice at Co.’s cake. ▫ Notice Tax v. Gravamen = SAME!* ▫ Applicable to Co.’s with Legal Stability Agreement Creative way to get around the LSAs. ▫ To calculate the payment: Co. deducts its Royalties, whether under 28528 or K. The applicable % goes from 4% to 13% ▫ Can be deducted from Income Tax as expense. Other Developments • LAW 29785 - PREVIOUS CONSULTATION LAW. ▫ Based on ILO Convention 169. Ratified by Peru in 1994. Law adopted in September 2011 – 17 yrs. later ▫ Indigenous peoples will be consulted PRIOR to adopting any legislative or administrative measure that affects them! Concessions (M/O&G) will need to be consulted. ▫ Risks: Corruption; representation; delays; worsening of social conflict; violence. Conclusion: • So, what does all this means for foreign investors? NOT SO GOOD NEWS! • More costs, taxes, bureaucracy, risks of corruption and FCPA liability, delays due to consultation, and more risk of social unrest. • Is Peru killing the goose that laid the golden egg? Thank you! Rafael T. Boza Senior Associate ADAIR & MYERS P.L.L.C. 3120 Southwest Freeway, Suite 320 Houston, TX 77098 Telephone: (713) 522-2270 Facsimile: (713) 522-3322 TAX Payment demanded by State w/o any retribution or service GRAVAMEN* Any economic burden imposed by State with or w/o retribution CONTRIBUTION Payment to State for infrastructure, improvements or other activities that benefit the contributor FEE Payment for State’s services The Law refers to a GRAVAMEN which is the same as a TAX. It is NOT a contribution because there is no improvement done by the State for benefit of Co. It is not a fee because Co. is not paying for any State’s service. * In Common Law the “Gravamen” means part of a criminal complaint. See BLACK’S LAW DICTIONARY 721 (8th ed. 2004). Here we are using the meaning of the Spanish word “Gravamen” in its Civil Law context which means burden or duty weighing on someone who has to do something for, or consent to, someone else’s benefit. See GUILLERMO CABANELLAS, DICCIONARIO DE DERECHO USUAL, Vol. II, 271 (7th ed. 1972).