Armenia: Structure of Remittances

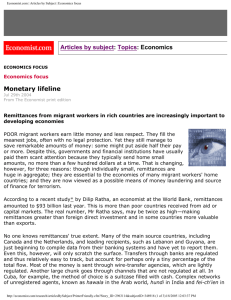

advertisement

Impact of Remittances on Economic Growth: Empirical Experience of Armenia Lily Karapetyan Senior Specialist Ministry of Finance of RA Cholpon-Ata, Kyrgyz Republic September 10-11, 2012 Content 1. 2. 3. 4. Review Positive Impact Negative Impact Conclusions 1. Review Net Remittances in CIS Countries as GDP Percentage 2010 Tajikistan Moldova Kyrgyz Republic Armenia 9.0 Georgia 6.5 Ukraine 4.0 Mongolia 1.7 Azerbaijan 0.9 Belarus 0.9 Russia -0.9 Kazakhstan -1.8 -5.0 0.0 5.0 Source: World Bank, WDI 10.0 24.8 21.9 20.4 15.0 20.0 25.0 30.0 Armenia: Structure of Remittances (inflow, outflow, net remittances) 1,800,000 1,600,000 1,400,000 1,200,000 1,000,000 800,000 600,000 400,000 200,000 2004 2005 2006 Inflow 2007 Outflow 2008 2009 Net inflow 2010 2011 Characteristics of Remittances Remittances versus foreign direct investments are more sustainable both in CIS countries and in Armenia. The bulk of remittances are transfers from Russia, which continue growing. Russia accounted for 90% of transfers in 2011 versus 72% in 2004. The second place is occupied by transfers from the USA, with falling tendency (14.5% in 2004, 3.7 – in 2011). The empirical analysis evidences that the RA remittances are dependent on the level of consumer prices in Russia (with factor =0.9), GDP of Russia (0.5), and world oil prices (0.2). Armenia: Net Inflow Structure of Remittances by Countries share in total.% Remitances structure by countries of origin 100.0 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 2004 2005 2006 2007 2008 USA Other years Russia 2009 2010 2011 Volatility of Remittances in CIS Countries 1.80 1.60 1.40 1.20 1.00 0.80 0.60 0.40 0.20 0.00 Standard deviation FDI REM 2. Positive Impact Sources of GDP Growth in Armenia 120.0 100.0 80.0 60.0 40.0 20.0 0.0 20.0 10.5 10.5 13.9 13.2 13.7 10.0 6.9 2.2 5.0 2003 8.3 2004 Industry Net indirect taxes 7.1 2005 7.9 2006 Agriculture Remittances 7.3 2007 -14.1 7.2 7.5 2008 2009 Construction GDP, real growth 4.7 0.0 -10.0 9.1 2010 Services 11.2 2011 -20.0 Aggregate Demand Aggregate demand Additional consumption. In Armenia case the multiplier of expenditures is estimated at about 1.5; Additional investments; Remittances promote increase of consumption and investments. Regression analysis based on the least square method demonstrated that consumption is more sensitive to impact than investments are. Data of household survey confirmed the hypothesis; Contributed to purchase of durable goods; Regression analysis based on the least square method demonstrates, that remittances contribute to growth of consumption and investments. However, the impact on consumption is more essential than on investments. This is confirmed also by the household survey results. Consumption Remittances Investments Export Import Remittances Spending Priorities (as percentage of the total remittances) Total Direction Current EducationReal remittanc consump estate, es, $ tion land 75 6.4 0.2 Agricultu Renovati Business Savings ral on machiner y 0.1 1.2 0.9 0.4 76.9 5.1 0.7 2.4 2 1.4 0.2 1.7 9.5 Urban 76.7 8.9 1.6 0 2.4 2.2 1 2.2 5 Rural 72.9 7.4 1.6 6.1 2.8 1.5 0.3 1.6 5.9 До 500 Urban Rural 5001000 50007000 1015000 Consume Other r goods 2.8 13 Urban 60.3 15.1 0.9 0 8.2 6.5 1.4 5.2 2.4 Rural 49.9 11.5 0 10.7 12.9 3.6 7.1 4.3 0 Urban 44.3 7.1 17.1 0 4.3 0 11.4 15.7 0 Rural 40.0 20.0 0 0 20.0 0 0 20.0 0 25.0 0 25 0 0 25 0 0 25 40.0 0 0 0 30.0 0 0 0 30.0 15000- Urban Rural Aggregate Supply, Production Factors Aggregate supply and production factors High rates of construction growth High rates of services’ growth Accumulation of human capital through positive impact on education and health sectors. Empirical analysis demonstrates that positive impact of remittances on health sector versus education is higher. Accumulation of physical capital. Construction Remittances Services Employment Human capital Other Directions Development of financial system Development of commercial links and capital investments Negative Impact on Economic Growth Moral hazard: households receiving remittances tend not to work. Regression analysis shows that growth of remittances reduces employment in Armenia; Reduction of workforce: because the growth of remittances is mostly due to migration in previous years, which is the evidence of workforce reduction, particularly - of high-quality workforce; Occurrence of Dutch disease: remittances contribute to occurrence of Dutch disease: increase of the real effective exchange rate reduces competitiveness and export; There are investments, but they are not productive: according to the Survey in Armenia only 12% of households are engaged in business. The main part of remittances at the peak of economic growth was focused on housing development; Risk of creating a trap for economic policy. CIS: Remittances and Employment (source: WB) Remitences and employment in CIS,2010 Employment 30.0 25.0 MDA TJK 20.0 KGZ 15.0 10.0 ARM GEO 5.0 30 35 40 45 MNG UKR BLR 0.0 50 -5.0 Remittances AZE KAZ 55 RUS 60 65 70 Conclusions Cause – and – Effect Relationship Verification of cause-and-effect relationship reliability Are remittances the source of economic growth or vice-versa – does poor economic situation contribute to migration, which leads to growth of remittances? Verification results In Armenia remittances contribute to economic growth (Granger causality test) and the cycle of remittances’ activity coincides with GDP cycle. Activity Cycles, GDP, and Remittances Downtrend cycles (HP filter) .15 .10 .05 .00 .08 -.05 .04 -.10 .00 -.15 -.04 -.08 -.12 1996 1998 2000 2002 Residual 2004 2006 Actual 2008 2010 Fitted Econometric Analysis Results In the short run remittances have positive impact on economic growth in Armenia In the long run the impact is negative The model (Pooled OLS ) used in 6 countries of CIS has also provided results similar to Armenian, with some difference in factors. Thank you for attention!