Aff Answers - Open Evidence Archive

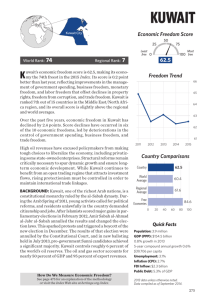

advertisement