presentation title - Prudent Champion, LLC

advertisement

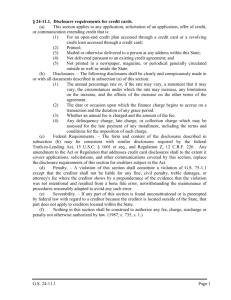

Plan Fee Disclosures Due August 30th – Action Required Robert A. Lavenberg, CPA,JD,LL.M BDO USA LLP ® ® Mark D. Mensack, AIFA ,FDE Independent Fiduciary Consultant Proposed Definition of Fiduciary Rule - Who’s a Fiduciary? - Named Fiduciary (specifically named or appointed) - Functional Fiduciary (due to job functions performed) “Day-toDay” Decisionmakers Functional Fiduciaries “HighLevel” Decisionmakers Plan Fee Disclosures Due August 30th – Action Required Page 2 Fiduciary Responsibilities Act Solely In Interest of Participants & Beneficiaries Identify Parties In Interest Make Policy Decisions Monitor Service Providers Act Under ERISA Standards of Conduct (as a “Prudent” Fiduciary) Ensure Plan Pays Only Reasonable Fees Plan Fee Disclosures Due August 30th – Action Required Page 3 Fiduciary Responsibilities: Ensure Plan Pays Only Reasonable Fees Understand How Fees Are Paid (Paid by Sponsor, the Plan, Both or by Other Means?) Continually Monitor Fees & Expenses Obtain Explanation of Direct & Indirect Fees from Service Providers Plan Fee Disclosures Due August 30th – Action Required Page 4 Not Meeting Fiduciary Responsibilities? Personal Criminal Liability (Including imprisonment) Personal DOL Civil Liability for 20% to 50% of Monies Recovered Personal Liability under ERISA §409 Civil Liability of Sponsor (2008 LaRue Decision) Plan Fee Disclosures Due August 30th – Action Required Page 5 Improved Transparency through 3-Pronged Fee Disclosure Regulations Service Provider Fee Disclosures Form 5500 Schedule C Service Provider Fee Disclosures to Fiduciaries 408(b)2 Plan Fee Disclosures Due August 30th – Action Required Page 6 Fee Disclosures to Participants – 404(a)5 Regulatory Update: Implementation of Fee Disclosures 404(a)(5) First Annual Disclosures (Effective August 30, 2012) Form 5500 Schedule C Disclosures (Effective 2009) Regulations 408(b)(2) Disclosures (Effective July 1, 2012) Plan Fee Disclosures Due August 30th – Action Required Page 7 First Quarterly Disclosures to Participants Effective November 14, 2012 408(b)(2) Disclosure Rules All services to be provided under the agreement • A Covered Service Provider must disclose: The compensation or fees to be received for each service The manner of receipt of compensation or fees Information about conflicts of interest There is integration of these items with the disclosures on Form 5500, Schedule C. Plan Fee Disclosures Due August 30th – Action Required Page 8 Who is a Covered Service Provider? Receives $1,000 or more in DIRECT and/or INDIRECT* compensation: • Fiduciary • Serving investment contract, product or entity that holds assets, in which plan has direct equity investment • Directly serving as advisor, manager or administrator Receives $1,000 or more in INDIRECT compensation: • Accounting • Auditing • Legal • Investment consulting • Custodial • Actuarial • Appraisal *“…several billion dollars of revenue-sharing fees are being hidden annually from plan sponsors and plan participants…” Jay Sanders, The CPA Journal, NYSSCPA, 2005 Plan Fee Disclosures Due August 30th – Action Required Page 9 Consequences of non-compliance? Covered Service Provider become disqualified person All transactions between the Plan and a disqualified person are prohibited! Plan Fee Disclosures Due August 30th – Action Required Page 10 Prohibited transactions must be reported on Form 5500 and as schedule to financial statements Questions as to why the fiduciary is allowing the plan to pay fees to a disqualified person 404(a)(5) Disclosure of Fees & Expenses to Participants Plan Sponsors must use data provided by CSP under 408(b)(2 )to prepare a participant disclosure under 404(a)(5) which includes: - Plan-related information • • • General plan information Administrative expense info Individual expense info - Investment-related information • • • Performance data in an “apples to apples” comparison format Benchmarking info Fee & expense info Quarterly statements must disclose specific fees & expenses deducted from individual accounts Plan Fee Disclosures Due August 30th – Action Required Page 11 404(a)(5): Quarterly & Annual Disclosures to Participants Quarterly Disclose investment expenses per $1,000 of investment Quarterly Report of expenses allocated to & incurred directly by participant November 14th First disclosure due Plan Fee Disclosures Due August 30th – Action Required Page 12 Annual Plan-related information August 30th First disclosure due 404(a)(5) Quarterly & Annual Disclosures Annual Investment-related info (comparative format) Why Does It Matter to the Participant? Investment Returns Contributions Current Plan Balance Assets Needed to Retire Fees 1% in excess fees over the average American’s working lifetime, reduces a participant’s nest egg at retirement by 28% DOL, EBSA Website Plan Fee Disclosures Due August 30th – Action Required Page 13 Intent of New Rules Plan Participant Service Provider 404(a)(5) 408(b)(2) Plan Sponsor Plan Fee Disclosures Due August 30th – Action Required Page 14 Intent of New Rules • Force Plan Sponsors to be engaged in the fiduciary process • Force service providers to disclose fees & compensation • Expose indirect 401k costs • Engage participants in order to apply downward pressure on 401k costs “Over the ten-year period 2012-2021, the Department estimates that the present value of the benefits provided by the final rule will be approximately $14.9 billion…”* *http://www.dol.gov/ebsa/pdf/frparticipantfeerule.pdf Plan Fee Disclosures Due August 30th – Action Required Page 15 ERISA 404(a)(5): A Game Changer?* • Section 404(a)(5) of ERISA…requires that every one of 72 million plan participants are told something that they never knew…how much they pay each quarter for their 401(k) plan.* • …this amount is not some complex formula or even a percentage but is dollars and cents that can be compared to their mortgage, rent, car payments or what they spend on vacation. • Consider if only one in ten people who discover what they actually pay become concerned and do what comes naturally… Many of these concerned people will camp out at their plan administrator’s door, demanding to know why they are paying so much! *Dalbar Report, February 2012 *71% of 72 million participants believed they paid no fees - AARP, 2011 Plan Fee Disclosures Due August 30th – Action Required Page 16 Reality of New Rules Plan Sponsor 408(b)(2) Rock Plan Fee Disclosures Due August 30th – Action Required Page 17 404(a)(5) Hard Place Take Action - Step One The Prohibited Transaction Exemption In order to understand your responsibilities under Rule 408(b)(2) the first step is to understand the Prohibited Transaction Exemption. ERISA § 406(a)(1)(c) prohibits plan assets to be used to pay ANY party in interest for ANYTHING! Violation of this statute is a prohibited transaction! ERISA §408(b)(1) provides a prohibited transaction exemption only if three criteria are met: 1. The services must be necessary for the operation of the plan; 2. The services must be furnished under a contract or arrangement which is reasonable and; 3. No more than reasonable compensation is paid for the service. Plan Fee Disclosures Due August 30th – Action Required Page 18 July 1st – What should’ve happened? • Covered Service Provider (CSP) delivered a written disclosure which included: - CSP’s Fiduciary Status - Listing of services rendered by CSP - Compensation or fees for each service - Description of the arrangement between the CSP and whoever is paying the CSP • This information SHOULD be sufficient for the plan sponsor to prepare the 404(a)(5) participant disclosure by Aug 30th What could’ve happened? • CSP failed to provide any disclosures • CSP provided incomplete disclosures • Additional information is needed to determine if the contract or arrangement is reasonable and/or conflict free. *For simplicity these scenarios are “Problem Disclosures” Take Action - Step Two • In the event of a problem disclosure situation: - Plan Sponsor MUST demand necessary information in a comprehensible format • If CSP fails to provide this info within 90 days of the request: - Plan Sponsor MUST report CSP to DOL within 30 days, AND simultaneously begin the process to replace the CSP as expeditiously as possible* • Failure to terminate a non-compliant CSP would be a fiduciary breach under ERISA 404(a)* *29 CFR 2550.408b-2(c)(1)(ix)(G); 77 FR 5647-48 (2-3-12) Take Action - MUST? “The Department does not believe that responsible plan fiduciaries should be entitled to relief provided by the class exemption absent a reasonable belief that disclosures required to be provided to the covered plan are complete. To this end, responsible plan fiduciaries should appropriately review the disclosures made by covered service providers. Fiduciaries should be able to, at a minimum, compare the disclosures they receive from a covered service provider to the requirements of the regulation and form a reasonable belief that the required disclosures have been made.” * Translation: If you don’t fulfill Step Two, YOU are party to a prohibited transaction! *77 FR 5647-48 (2-3-12) Can’t I just pass on the CSP’s disclosure? “The regulation requires two things to happen: The disclosure to be made, and then, the determination that the disclosure is reasonable, that the contract is necessary, and that the fees are reasonable. So relying on the service provider’s disclosure would be a mistake on the part of the plan fiduciary. The whole idea is to go through a prudent process and make sure that everything is reasonable. So if he just accepted the disclosures on the part of the service providers, it wouldn’t meet the terms of the exemption… Clearly the regulation sets out that it’s the responsibility of the sponsor to make the determination. So I guess a short answer to the question is no, a plan sponsor cannot rely on service providers.” Mary Rosen, Associate Regional Director, DOL Employee Benefit Security Administration Plan Fee Disclosures Due August 30th – Action Required Page 23 Take Action – Step Three What do I do with the disclosures? • Read the disclosures & any referenced disclosure documents • Understand what services are being provided • Determine if there are conflicts of interest • Determine if fees/comp are reasonable • Determine if the disclosures meet 408(b)(2) requirements. • Prepare & deliver participant 404(a)(5) disclosure by August 30th If the disclosures don’t make sense, or if you aren’t able to use them to complete the tasks above, see Step Two! Take Action – Step Three What do I do with the disclosures? The DOL will be looking for: - Documentation that a prudent process was used - Actions that are taken in response to an unreasonable finding - Conflicts of interests are identified and addressed - Prohibited Transactions • So you want evidence that: - Fees are reasonable relative to services - Services are necessary - The contract under which services are provided is reasonable - 404(a)(5) Participant disclosure Plan Fee Disclosures Due August 30th – Action Required Page 25 The Potential Challenges of Step Three • Regulations permit disclosures that are a patchwork, requiring plan sponsors and participants to do a scavenger hunt without the clues to put the pieces together… Dalbar, Inc. • The burden of having to reasonably believe that service providers disclosed the requisite information is of great concern. Jeff Mamorsky • That, in effect, requires the employer plan sponsor to retain experts to ascertain compliance with the regulations and identify all “hidden” fees. Jeff Mamorsky Plan Fee Disclosures Due August 30th – Action Required Page 26 . “Disclosures that are a patchwork” How bad could it be? Three approaches to disclosure: - Spirit of the Law - Letter of the Law - Business as Usual / Needle in a Haystack Spirit of the Law What should’ve happened “Based on an understanding of what plan sponsors are required to do, the service provider presents the required disclosure in an easily understood format that can be used directly to fulfill the plan sponsors obligations under both 408(b)(2) and 404(a)(5).” Lou Harvey, Dalbar Inc. . Plan Fee Disclosures Due August 30th – Action Required Page 28 Letter of the Law Consolidates existing language and tables from various sources into a single document, thus requiring the plan sponsor to navigate the legal and technical language to assess reasonableness. Lou Harvey, Dalbar Inc. Plan Fee Disclosures Due August 30th – Action Required Page 29 Letter of the Law “In 2011, when viewed in relation to total MSSB client assets of in excess of $1.6 trillion, the payment made by each* such service provider…equaled an amount of not more than 31/10,000 of one basis point (otherwise expressed, 31/1,000,000 of one percent). We do not believe that such payments were made in connection with retirement plan business specifically, and were certainly not made in connection with any particular retirement plan, but, for perspective, the amount of retirement plan assets included in the total MSSB client asset number set forth above is approximately $112 billion.” *28 service providers listed below this paragraph How do you use this info to prepare your 404(a)(5) disclosure? Plan Fee Disclosures Due August 30th – Action Required Page 30 Letter of the Law “In 2011, when viewed in relation to total MSSB client assets of in excess of $1.6 trillion, the payment made by each such service provider… equaled an amount of not more than 31/10,000 of one basis point (otherwise expressed, 31/1,000,000 of one percent).” 31/10,000 = 0.0031% or 0.00000031 $1,600,000,000,000 x 0.00000031 = $496,000 $496,000 from EACH 28 listed (“but other providers may have made similar payments.”) 28 x $496,000 = $13,888,000? Problem disclosure? Plan Fee Disclosures Due August 30th – Action Required Page 31 Take Action “If you have any questions regarding our services or compensation in connection with your qualified retirement plan, or if you would like to request hard copies of the referenced disclosure documents, please reach out to your MSSB Financial Advisor or call MSSB Client Support line…” If you receive a problematic disclosure from your CSP immediately demand, in writing, a comprehensible explanation! Putting your CSP on the spot is the only way to protect yourself from a prohibited transaction! Plan Fee Disclosures Due August 30th – Action Required Page 32 Needle in a Hay Stack Does not present the relevant information in one place but instead list a number of references, prospectuses, websites, plan documents, etc., where the plan sponsor can search for answers. Lou Harvey, Dalbar Inc. Plan Fee Disclosures Due August 30th – Action Required Page 33 Needle in a Hay Stack Plan Fee Disclosures Due August 30th – Action Required Page 34 Needle in a Haystack QUIZ • How many documents / pages must a plan sponsor review in order to read all of the available fee & compensation information before adopting a group annuity 401(k) plan? (Lets assume there is just one mutual fund in the plan!) • a) 2 documents / 127 pages • b) 7 documents / 539 pages • c) 34 documents / 827 pages Answer: B 1. 2. 3. 4. 5. 6. 7. Prospectus – 72 pages Statement of Additional Information (SAI)– 285 pages Annual Report – 44 pages Semi-Annual Report – 36 pages Group Annuity Contract – 33 pages Plan Level Documents – 58 pages Admin. Service Agreement – 11 pages How long will it take to prepare your 404(a)(5) participant disclosure? Plan Fee Disclosures Due August 30th – Action Required Page 36 7 Documents 539 Pages One Needle in the Haystack • …Each sub-adviser may cause a fund to pay a broker-dealer an amount in excess of the amount that another broker-dealer would have charged for the same transaction, in exchange for “brokerage and research services”… Neither the management fees nor the sub-advisory fees are reduced because the sub-advisers receive these products and services. These products and services may be of value to the sub-advisers in advising their clients (including the funds), although not all of these products and services are necessarily useful and of value in managing the funds. • • These products and services may include research reports, access to management personnel, financial newsletters and trade journals, seminar and conference fees… Hartford Advisor SAI Page 167 of 285 Under Step Three, how would you handle this disclosure? TAKE ACTION When in doubt ALWAYS remember the three requirements required in order to gain the protection of the prohibited transaction exemption: 1. The services must be necessary for the operation of the plan; 2. The services must be furnished under a contract or arrangement which is reasonable and; 3. No more than reasonable compensation is paid for the service Plan Fee Disclosures Due August 30th – Action Required Page 38 Another Needle in a Haystack 1.10% 0.98% 0.37% 0.25% 2.7% Avg. Expense Ratio Investment Management & Admin Charge Annual Charges & Fees Contract Asset Charge Total Cost These were the expenses on an $8 million plan Investment Management & Admin Charge The IM and Admin Charges are 0.93% The IM and Admin Charges are 0.94% The IM and Admin Charges are 1.11% The IM and Admin Charges are 0.97% The IM and Admin Charges are 1.21% Page 66 of 68 Plan Fee Disclosures Due August 30th – Action Required Page 40 What if the plan sponsor fails to spot excessive compensation? Both the plan sponsor and the service provider engaged in a PT. The service provider’s PT is the receipt of the excessive compensation; The plan sponsor’s PT is that it allowed the plan to pay unreasonable compensation. In these circumstances, there is no relief for the plan sponsor or for the service provider. Fred Reish, Esq. What’s Unreasonable? Plan Fee Disclosures Due August 30th – Action Required Page 42 What’s Unreasonable? Haystack Plan 1.10% 0.98% 0.37% 0.25% 2.7% Avg. Fund Costs IM & A Charge Annual Charges & Fees Contract Asset Charge Total Cost Spirit of the Law Plan 0.40% 0.20% 0.06% 0.50% 1.16% Avg. Fund Costs Admin Custodial Fee Fiduciary Adv. Fee* Total Costs 2.7% - 1.16% = 1.54% $8,000,000 x 1.54% = $123,200 $123,000 / 63 participants = $1,955 per participant annually Which set of fees would you want to disclose to your participants? Plan Fee Disclosures Due August 30th – Action Required Page 43 *This quote included an ERISA 3(38) fiduciary Fiduciary Status • Pay special attention to your service provider’s fiduciary status in the 408(b)(2) disclosure, and ignore marketing materials. • Excerpt from a “Fiduciary Warranty”: “…we are committed to helping you meet the highest fiduciary standards in the investment selection and monitoring process and commit to restore losses and pay litigation costs in the event that legal action is brought against qualifying plans. Now that’s security for your plan!” • “Review the minimum Fund requirements and a copy of the Warranty Certificate (PS 9613) to see if your plan qualifies.” Fiduciary Status “Also, since past performance is not a guarantee of future results, we cannot warrant or guarantee either that any investment option will yield any specific return, or even that it will yield a positive return. Nor does our Fiduciary Standards Warranty extend to claims that any expenses paid directly or indirectly by the Plan are reasonable.” John Hancock Warranty Certificate, PS9613, 12/05 – 10024 Take Action – Step Three Can I handle this in-house? If you have a: Spirit of the Law 401k – Probably yes Letter of the Law 401k – Probably not Haystack 401k – Highly unlikely What if I’m not comfortable doing this in-house? “Unless they possess the necessary expertise to evaluate such factors, fiduciaries would need to obtain the advice of a qualified, independent expert.” DOL Reg. § 2509.95-1(c)(6) Plan Fee Disclosures Due August 30th – Action Required Page 46 408(b)(2) Outsourcing Dalbar, Inc. is the nation's leading financial services market research firm and performs a variety of ratings and evaluations of practices and communications that are committed to raising the standards of excellence in the financial services and healthcare industries. With offices in both the US and Canada, Dalbar develops standards and measurement systems that improve the quality of products, service and compliance for the retirement, mutual fund, broker/dealer, discount brokerage, life insurance, healthcare and banking industries. Additional info www.PrudentChampion.com • • Independent Third Party support for advisors and plan sponsors to comply with ERISA Fee Disclosure Outsourcing of Service Provider & DOL communication requirements in the event CSP provides problem disclosure • Negotiations with CSPs in the event plan fails to comply with 408(b)(2) • RFP & Vendor Search Services in the event a CSP needs to be replaced • Information regarding 408(b)(2), 404(a)(5), fiduciary best practices, delegating fiduciary responsibility under ERISA 402(a), ERISA 3(21) & ERISA 3(38) • Free fiduciary education webcast series from US Department of Labor - EBSA: www.dol.gov/ebsa/newsroom/webcasts.html Q&A Robert A. Lavenberg, CPA, JD, LL.M BDO USA LLP rlavenberg@bdo.com 215.636.5576 Mark D. Mensack, AIFA®, FDE® Mark@PrudentChampion.com (856) HIT-401K