Week 4: International Business

Mr. Niall Douglas

9am-9.20am: Exam results

9.20am-9.30am: How to get a better grade

9.30am-11am: Vocab and comprehension check

11.20am-11.40am: Company Law

11.40am-12.20pm: Business vocab

12.20pm-12.50pm: Pronunciation

12.50pm-1pm: Explain tonight’s reading

1pm-1.20pm: Check on group task work plan

Average, Max, Min in Vocab: 61%, 83%, 40%

Average, Max, Min in Written: 64%, 90%,

55%

Average, Max, Min in Project: 53%, 65%, 40%

Average, Max, Min in Class: 62%, 81%, 53%

4

3

2

1

0

0% 5% 50% 55% 60% 65% 70% 75% 80% 85% More

Bin

100%

90%

80%

70%

60%

50%

40%

30%

1 2 3 4 5 6 7 8 9 10 11 12 13 14

Vocab Written Project

People who did better in vocab tended to do slightly better in the written, but that performance in the two is not linked (0.46 correlation, 0.005 covariance)

Tends to imply studying the vocab != studying the readings

I figure therefore that I better explain what I look for in essays and written answers ...

What I look for in written answers:

1.

Evidence of reading (regurgitation) = 55%+

2.

Evidence of understanding (first order inferences) =

60%+

3.

Evidence of argument (second order inferences) =

65%+

4.

Evidence of intelligence (third order inferences and beyond) = 70% and beyond+

Each lecturer has their own personal preference for grading

In some subjects (e.g. Languages, History, Philosophy,

Management) two lecturers can give grades varying by

20% for the same essay or exam question

In British and Irish universities, qualitative subjects have a typical maximum grade of 75%

In quantitative subjects (e.g. Economics, Maths) grades only vary by 5%. And the typical maximum grade is 95%!

HOWEVER far more top grades are given out in some subjects. In Britain, 20% of Philosophy students get the top grade, so it is therefore

“worth” less (most Philosophy graduates can only find work in McDonalds or cleaning)

Compared to just 8% for Business Students

Compared to just 3-5% for Economics Students

Each subject has its own peculiar style – it penalises interdisciplinary studies!!!

Vocab and Comprehension Check

Remember me telling you about KitKat adverts on YouTube?

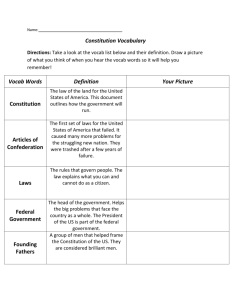

Tonight’s reading is on Company Law differences in the EU (fun!)

So here’s how a company comes to exist ...

There are several main types of business:

1.

A sole trader

2.

A partnership

3.

A private company

4.

A public company

5.

A Cooperative

A sole trader is an individual who simply goes into business

Business income is counted as personal income for taxation, BUT you can register for

VAT and therefore deduct 15-25% from your costs

No registration is required except for VAT deductions. You could start tomorrow!

Partnerships involve more than one person coming together to operate a business

Business income is still taxed as personal income

They don’t offer much more than being a sole trader

However again, they are very easy to form – no registration required!

A private company is a “legal person” with separate legal identity

It can separately own property, has its own taxes and has limited liability

In other words, no matter what happens its owners can

NEVER lose more money than they invest

A private company has shares and lots of people can co-own the company. In the EU, a single person can own all the shares i.e. “a single member company” and if they do they can avoid holding Annual General

Meetings (AGMs) and get other advantages

A private company must register itself with the government (in Ireland and Britain this department is called “Companies House”). It must provide to the government:

A “governing instrument” – this is a notarised legal document specifying the rules for the company

At least TWO directors and ONE company secretary

(the secretary can also be a director)

Annual accounts showing the true state of the company. These must be audited if turnover exceeds

€1m each year

Who owns what shares at any time

A private company can take a while to be formed

Ireland is the fastest and cheapest in the EU – just ten days guaranteed maximum and €100 fee (and maybe €500 for the solicitor to write the legal instrument)

Poland is currently one the most expensive and slowest – taking over a year and costing €1000’s

(this is about to change, they are adopting the

Irish solution)

Lastly, a public company differs from a private company because it must offer its shares to the public on a stockmarket

It must also do LOTS more regulation and overheads

And a cooperative is when a company is owned equally by its members, so one member = one share with no exceptions

In most EU countries cooperatives are very expensive and difficult to set up and operate. Governments dislike them as they challenge governmental monopoly of power

By the way, a company secretary is NOT a real secretary

Historically the secretary is the most powerful person in a company because they are responsible for all legal matters and the company

The Directors give instructions, but the company secretary has the power to fire directors or override their orders

The Company Secretary can also be a Director

Lastly, because companies are a separate legal person, they get their own taxes

Corporation Tax (12.5%-45% in the EU) is charged on any profits

“Close Company” Corporation Tax (+15%-35%) is additionally charged on any undistributed profits if the shareholders and directors are related as family

Payroll taxes (10%-45% in the EU) are charged on any wages or salaries paid to employees or directors

Dividend Withholding Taxes (20%-40% in the EU) are charged on any non-business payments to others OR non-salary payments to anyone who is a shareholder

Professional Service Withholding Taxes (20%-40% in the EU) are charged to any business payment involving a non-trade person

Investment Taxes (15%-30%) are charged on income if the company saves or invests money e.g. In a bank savings account

With all these taxes, why bother setting up a company?

1.

2.

3.

4.

Limited liability

You can creatively deduct all sorts of “expenses” from revenues to minimise profits

You can funnel profits through Ireland to avail of its

12.5% corporation tax and funnel products through the Island of Jersey to avoid paying any VAT (this is what Amazon does)

If you’re clever, you can halve the costs of running a business (ESPECIALLY in France)

Multiple choice Business Vocab ...

Explain Tonight’s reading

Check Group Task Work Plans