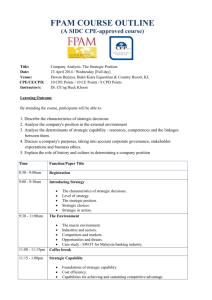

ce course outline

COURSE OUTLINE

Title: Putting Your CFP into Practice for Greater Results

(Practice Development Series: A 1-Day change program for professionals and

practitioners to transform them into Trusted Advisors)

Date:

Venue:

23 August 2011 / Tuesday [Full day]

Dewan Berjaya, Bukit Kiara Equestrian & Country Resort, KL

CE Points: 10 CE Points

Facilitator: Ms Tang Wee Hen

INTRODUCTION

“Financial planning has hit a tipping point,” says Mark Kordes, CFP®, of UBS Private Wealth

Management in Weehawken, NJ. “Demand from consumers is increasing rapidly. During the weak part of an economic cycle, there is always renewed focus on financial planning but now there's an accelerated demand that's commensurate with the economic environment we’re in.” This is a trend not only in the

United States but in many countries including Malaysia.

In our local market today, there are more practitioners in the unit trust, insurance, wills & trusts obtaining the CFP certification with the intention to become more professional in their practice. This can also be witnessed for professionals in the banks, finance companies, accounting firms to have the CFP to differentiate themselves from others and serve the clients better.

One of the challenges faced by these professionals and practitioners is how to put the CFP into their practice for greater results, transitioning from their current business/practice or workplace environment to become a professional and trusted advisor.

KEY OBJECTIVES

To have an overview of the 8 common building blocks for successful financial planning practice

To be clear of one’s journey and purpose as a professional or practitioner.

To identify the current gaps for greater practice in the areas of Knowledge, Attitude, Process,

Technology and Skills

To develop a business practice transition plan to achieve the desired goal

To learn and apply the 4D Client Engagement Skills throughout the 6-steps financial planning process in building a strong trusting relationship for client commitment

KEY LEARNING OUTCOME

A better understanding of 8 common building blocks for successful financial planning practice and to have clear purpose and goals as CFP professionals and practitioners

Learn how to manage the challenges and gaps in the current practice and to achieve the desired outcomes using the KAPTS model

Understand the importance and benefits of establishing the business practice transition plan and learn to develop your own game plan

Learn the 4D Engagement Skills to build trust, elevate and bring added value in your conversation with clients

12.15 – 1.00 pm

PROGRAM CONTENT

Time

9.00 -10.00 am

10.00 - 11.00 am An overview 8 common building blocks for successful Financial Planning practice

Program Outline

Connect & Contract

Connecting & Program Introduction

Setting Expectations

An introduction to program and setting the expectations of the participants;

Understand current gaps as financial planner and clarifying key issues

Become familiar with the 8 common building blocks of every successful practice and how they are used to create a critical path in your practice or profession

11.00 - 11.15 am

Tea Break

11.15 am - 12.15 pm Visioning & Goal Alignment

What is the empowering reason to be a CFP professional or practitioner?

What’s your vision? Mission? Belief?

Where do you want to go?

What role do you play?

Be clear and align your goal and role in your practice and workplace

1.00- 2.00 pm

2.00 - 2.30 pm

2.30 - 3.30 pm

3.30 - 3.45 pm

3.45 - 4.45 pm

4.45 - 5.30 pm

5.30 - 6.00 pm

Assessment & Gap Analysis

Self-assessment and identify the gaps in the areas of K.A.P.T.S. – 6 essential components in transition business and practice o

Knowledge o Attitude o

Process o Tools & Technology o

Skills

10 key traits/behavior for successful financial planners

Lunch

Assessment & Gap Analysis continued

Developing Business Transition Plan

Client Transition Strategy

Business Plan

Tea Break

Introduction of 4D Client Engagement Model

Learn the basic 4D Client engagement model and core skills ( Building Rapport,

Listening, Questioning & Feedback) which is the most important skills at the beginning and throughout the 6-steps FP process:

1. Design the Agenda

2. Discover the Gaps

3. Discuss the Solutions

4. Deploy the Game Plan

What’s next for you?

Overview of current trends local and global FP trends

Business Models

Issues and challenges - recruitment, retention & sales

The Advisor Tool Kit

Tools & Templates

Action Planning & Feedback

The session will review the tools and templates used during the day and will get commitment from the participants to take the action steps after the workshop.

This will followed by feedback and evaluation

Profile of Facilitator:

Tang Wee Hen

CFP, C.A (M), ACC, CPC

VP South East Asia, PlanPlus Inc

Coach Consultant, Harvest Global Resources SB

Wee Hen, a passionate and enthusiastic advocate of “putting client’s interest first by giving proper advice to clients” is active in promoting financial planning practice in the local, region and international scenes.

She is currently a member of the Board of Governors of the Financial Planning Association of Malaysia

(FPAM), a representative of the Financial Planning Association (FPA USA) Asia Pacific Geographic

Group, a member of Planipedia - a new community wiki that aims to raise the bar of professionalism for financial planning. She has appeared in the Personal Money magazine, PlanPlus biweekly Asia Planit

Learning Circle sessions and Coaching Clinic for CFP students at KMDC.

With her passion to serve and nurture people, she believes that every individual has potential to perform in all areas of life, especially in the area of financial life planning. With her many years of experience in the financial advisory industry, she specializes herself as a Financial Advisor Consultant Coach in assisting financial planners/advisors (both individual and corporate) in developing, transitioning and performing in their current multiproduct selling to become trusted financial planners/advisors.

Wee Hen a Chartered Accountant upon obtaining the Certified Financial Planner (CFP), started her practice in financial planning as a Mutual Fund and Insurance Agent with Prudential Malaysia. Not to her satisfaction as a true to label financial planner, she decided to spearhead as the Vice President of

Financial Care Centre at CIMB Wealth Advisors Berhad, a subsidiary of CIMB Group, the 2 nd largest banking group in Malaysia in 2004. One of Wee Hen’s roles was to set up, manage and develop the

Financial Care Centre, as one of the pioneer licensed financial planning companies providing comprehensive financial planning services in Malaysia.

As a Manager Coach, she conducted financial planning technical knowledge, process and tool trainings, provided marketing and sales support for more than 100 financial planners to transition from multiproduct sellers to become trusted financial planners. During her 5 year tenure, she was a Licensed Financial

Planner under the Capital Market Service Act 2007, reviewed financial plans, and assisted more than 300 clients to achieve their financial life goals.

Wee Hen is a Certified Professional Coach (CPC) with Corporate Coach Academy (CCA), is an Associate

Certified Coach (ACC) credentialed under International Coach Federation (ICF). She left CIMB in 2009 to join PlanPlus Inc, a world class financial planning software and training company based in Canada, as the South East Asia VP. She is also a Consultant Coach with Harvest Global Resources Sdn Bhd that specializes in sales coaching and sales talent development initiatives. She is also a certified Coach Trainer for the Advice Transition Program (ATP), an award winning 1 year coaching program to transition from

product sales to client centric advice by Wealth Enhancement Academy and PlanPlus Inc based in

Canada.

With her coaching skills and experience, currently she is focusing on business development, support, training and coaching of PlanPlus Planit as a performance tool in growing the financial planning industry in this region. Her clients include financial intuitions such as banks (private banking, wealth management), insurance, mutual funds and securities firms, independent licensed financial planners/financial planning boutiques and other financial services providers.

Besides financial planning, Wee Hen is a member of the Subang Mandarin Toastmaster Club, ICF

Malaysia Chapter and ICF USA. She is also passionate about inspiring and coaching children about money management and developing their self-confidence and leadership.

*************************************************************************************

IMPORTANT NOTICE

For those who sign-up for this course, preference will be given to you to attend a 3-hour follow-up coaching clinic – Financial Planning Practice Clinic (see details below) at only RM30/-. You will also enjoy attractive discounts on our next 2-day Practice workshop on soft skills, “ 4D CLIENT

ENGAGEMENT MODEL FOR FINANCIAL PLANNERS . So sign-up now to enjoy the benefits of this course and upcoming Practice Development Series / Practice Clinic at attractive discounts.

FINANCIAL PLANNING PRACTICE CLINIC

Month : October (date to be confirmed)

Time : 2-5pm

Place : Financial Planning Association of Malaysia

Unit 1109, Block A,

Pusat Dagangan Phileo Damansara II

No.15, Jln 16/11

Off Jalan Damansara,

46350 Petaling Jaya

Facilitator : Ms Tang Wee Hen

CE COURSE REGISTRATION FORM / INVOICE

Title of Course: Putting Your CFP into Practice for Greater Results

Speaker:

Date:

Venue:

Registration:

Time:

Fees:

Ms Tang Wee Hen

23 August 2011 / Tuesday[ full day ]

Dewan Berjaya, Bukit Kiara Equestrian & Country Resort

Jalan Bukit Kiara, Off Jalan Damansara, 60000 Kuala Lumpur

8.30 am – 9.00 am

9.00 am – 6.00 pm

RM280 ( FPAM Member), RM 350 (Public)

Fee includes seminar materials, buffet lunch and refreshments.

CE Points (FPAM)

Instructions:

Ten ( 10 )

Please fill-up this form and fax to +603 7954 9400 or e-mail to aniza@fpam.org.my

Payment/Invoice: By cheque:

Payable to ‘Financial Planning Association of Malaysia’.

Address: Unit 1109, Block A, Pusat Perdagangan Phileo Damansara II,

No 15, Jalan 16/11, off Jalan Damansara, 46350 Petaling Jaya, Selangor.

Enquiries:

By credit card: We will process and charge your credit card upon receipt of this form. This page serves as our official invoice. No further invoice will be issued.

Send e-mail to aniza@fpam.org.my

or call Cik Aniza at +603 7954 9500

Terms: Registration is on a first-come-first-served basis. Confirmation is subject to payment before the course. Walk-in participant/s will be admitted on the basis of space availability. FPAM reserves the right to amend the program, speaker, date, venue, etc, without prior notice.

YES, PLEASE REGISTER ME!

Name:

IC No.:

Company&

Address:

E-mail:

FPAM No. :

Telephone:

Mobile:

Mode of Payment

By cash, please bank into Maybank A/C 5140-7512-8677 and email or fax in bank-in slip

Cheque payable to Financial Planning Association of Malaysia

Cheque no.: Amount: RM

Charge my credit card:

☐

Visa

☐

Mastercard

☐

Amex

☐

Diners

Credit card no.: Expiry date:

Amount :

FAX TO +603 7954 9400