Welcome to AR System's Training Library

advertisement

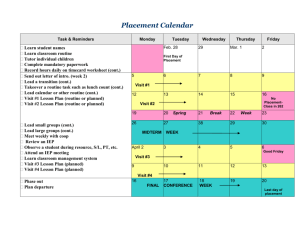

Welcome to AR System’s Training Library “Surgery/Invasive Procedure, Recovery and Supplies – Opportunity w/Challenges” Presented by: Day Egusquiza President “Finding HealthCare Solutions… together” P.O. Box 2521 Twin Falls, ID 83303 (208) 423-9036 daylee1@mindspring.com 1 Special Olympic’s Oath Help me Win But if I Can Not Win Help me be BRAVE in the Attempt… 2 What is the current charging structure? Main OR & Day Surgery Time with levels GI/Endo Time with levels Procedure based Levels with procedures Cath Lab Procedure based Interventional Radiology Procedure based Recovery Set charge Time based Time based with phases PACU vs outside PACU 3 Why Make a Change? New World of Consumerism Can the patient understand their charges? Is the current charge structure understood by the care team? Conduct a benchmark audit. Are all supplies Nonroutine? Are all costs being addressed thru the charge structure? Has nursing charted and is charging cut to close with other costs captured? 4 It is all about Transparency.. Pts want understandable, comparable quality information. Pricing is a mystery, unfortunately. Meaning pts want the Business Office to be more open, i.e. glass walls concept Health care model different state to state Pts really want to know what they will owe (Richard Clarke, Pres/CEO HFMA, article: What is Price Transparency, Feb 17, 2006. hfma.typepad.com/views/2006/02/what_is_price_t.html 5 Procedure vs Timed Win: Actual time is billed; not averages Win: Can ‘see’ real cost of procedures Win: Cost to charge alignment Con: Slow physician = higher charge Con: Estimates rather than procedure charges Con: Each pt’s charges could be different 6 And then there were multiple procedures… Procedure based billing for multiple procedures should reflect a reduced pricing as the room was only set up once, cleaned up once, one set of staff, one scheduling cost, one billing cost, one instrument cleaning cost, etc. Difficult to automate but needs done. 7 . 1. 2. 3. 4. 5. Things to remember Billable time Non-routine supplies are separately billable Nursing must chart & physician must order all non-routine supplies Create ‘rules’ to accompany leveling system Use existing sample for comparison and historical process. 8 Think Outside the Box Move to time based charging in OR, Day Surgery, endo, and recovery Create a service line with individual leveling system FOCUS: Align costs to charges Ensure 3 areas are addressed: put me to sleep/anesthesia; do the procedure; wake me up/recovery. All present? 9 New Charge Structure OR, Day Surgery, Endo, etc. Focus: per minute only or front load 1st 15 minutes and each min thereafter. 1. Time based for all surgeries 2. Identify potential service lines: Ortho, Neuro, Vascular, Plastics, Podiatry, Gyn, Endo, Cataract, ENT, Transplant, Urology, Cardic, General 3. 4. Begin to complete all direct costs and indirect costs for each service line –per service line Based on significantly different costs, create levels within the service lines including inpt vs outpt. Ortho level 1-2 outpt Ortho level 3-4 inpt (as preop costs for inpt significantly higher) 10 OR, Day Surgery, Endo and more Move to a cost based, timed system –includes pre-op costs Identify direct costs = staff in the room Identify indirect costs –both in the care area and outside the area. Identify routine supplies/not separately billable with the cost rolled into the per minute charge (costs, not chgs) Identify billable time Cut to close (However, time in/out is used for productivity) Scope in/scope out Identify current billing in all invasive procedure areas Create a work team to accomplish the transformation 11 Focus on Aligning Cost to Charge Determine direct and indirect costs –both within and outside the care area. (See work papers) Determine scheduled costs separate from unscheduled costs and create charging accordingly. (Ensure the unscheduled criteria is well understood and not assigned as after hrs, call back, etc.) 12 And then you sample………. Once the service line levels are completed, ensure sampling/testing occurs prior to implementation to ensure at least budget neutrality. Don’t forget the finance-driven expenses Overhead allocation to the OR areas Depreciation on non-movable equipment and other cost report items Management costs IT costs (dedicated OR computer plus % of mainframe) Last step – add the mark up %. 13 More billable services Discontinued procedures If the discontinue procedure was due to the pt’s condition – create a flat rate Prior to Anesthesia with 73 modifier After Anesthesia with 74 modifier Rate should only cover costs as the full procedure charge will be created when the pt has the procedure 14 Recovery Guidance Services that are covered under Part A, such as a medically appropriate inpt admission or as part of another Part B service, such as postoperative monitoring during a standard recovery period (4-6 hrs) which should be billed as recovery room services. Similarly, in the case of pts who under diagnostic testing in a hospital outpt dept, routine preparation services furnished prior to the testing and recovery afterwards are included in the payment for those dx services. Obs should not be billed concurrently with therapeutic services such as chemotherapy. (Pub 10002, Ch 6, Sec 70.4 15 Recovery Charging Define Phase 1 and Phase 2 Keep it very simple Phase 1 = immediate post procedure Phase 2 = outside PACU; or once moved past Phase 1 Extended recovery -= beyond 6 hrs routine recovery Look for all areas where ‘recovery’ is being done. Billable with non-dx procedures in all areas. Floors, PACU, front of day surgery. 16 Recovery vs Observation Options 17 Starred* Procedure = Exception Appendix G/CPT = list of included CPTs Conscious sedation is used 99.9% of the time; therefore, inherent to the procedure and not separately billable. Since C/S was used, see 99148-50 for guidelines for billing recovery. Inherent to the procedure and not billed separately. Ensure procedure pricing includes all. 18 ROUTINE VS NON-ROUTINE SUPPLIES—HELP! The Medicare Reimbursement Manual defines Routine Services in 2202.6 on page 22-7: “Inpatient routine services in a hospital or skilled nursing facility generally are those services included by the provider in a daily service charge—sometimes referred to as the “room and board” charge. Routine services are composed of two broad components: (1) general routine services, and (2) special care units (SCU’s), including coronary care units (CCU’s) and intensive care units (ICU’s). Included in routine services are the regular room, dietary and nursing services, minor medical and surgical supplies, medical social services, psychiatric social services, and the use of certain equipment and facilities for which a separate charge is not customarily made. “In recognition of the extraordinary care furnished to intensive care, coronary care, and other special care hospital inpatients, the costs of routine services furnished in these units are separately determined. If the unit does not meet the definition of a special care unit (see § 2202.7), then the cost of such service cannot be included in a separate cost center, but must be included in the general routine service cost center. (See § 2203.1 for further discussion of routine services in an SNF.) 19 Routine Supplies –always a challenge Medical supplies are those items that, due to their therapeutic or diagnostic characteristics, are essential to the care ordered by the physician to treat or diagnose the patient’s illness or injury. These supply items fit into two categories: • Routine (not separately billable) supplies are customarily used during the usual course of treatment, are included in the unit supplies and are not designated for specific patient. • Non-routine (separately billable) supplies are necessary to treat a specific patient’s illness or injury based on a physician’s order and a documented plan of care. 20 Capturing Non-Routine Supplies While Not Losing Revenue For Routine Supplies – the how tos Guidelines: • • • The Medicare regulation excludes a separate payment for ‘minor medical and surgical supplies.” (HFCA Pub 15, Section 2102.2) The costs are considered to be covered in the inpatient room and board, OR time, observation time, & ER levels. Unfortunately, there is little further clarity – other than individual Medicare Fiscal Intermediaries (FIs) ‘interpretations’ – which vary greatly. Therefore, it is important for each facility to use the best information available to: • Create a policy defining ‘routine’ and ‘non-routine’ • Outline the internal process for reviewing the charge master to determine those items that can be billed separately and those that can not. • Include how new supply items will be reviewed prior to being added to the charge master. • Include any ‘questionable’ items, such as portable xray add on charge where Medicare may have given a negative opinion, but the site is going to challenge it and continue to bill to Medicare and/or other payers. 21 OPERATING ROOM IDEAS How do you pass all three elements? 1) Specific to one patient’s Injury and Illness Usually items associated with a specific surgery should pass. However, all ‘items available for all patient use” such as syringes, pads, gloves – would be considered routine and not separately billable. Items that are specific to the procedure should pass the non-routine test. 22 2) Physician’s Order. It is important that the physician has ordered the non-routine items. Idea: Have the physician sign/date the preference cards with an internal policy as to periodic review. Additional items beyond the preference card would still need ordered. Idea: Nursing must also chart the non-routine supplies. Supply charge card, date/sign by nursing and physician. Orders and documentation. 23 3) Part of the documented care plan. Idea: Conduct a review of existing Op Report documentation. Common sense should be used in determining ‘documentation of supplies.’ The focus is to ensure the physician is directing the supplies used and that the facility is not arbitrarily adding items that the physician did not order. 24 Equipment The following is an excerpt from Medicare newsletter #488: To: Administrator of all Medicare Certified Facilities From: Bonnie Irwin, Acting Director of Federal Programs Date: June 22, 1995 Subject: Billing Ancillary versus Routine Services and Equipment This bulletin reemphasizes Medicare policy with regard to billing ancillary versus routine services and billing for equipment. It is not allowable to bill for either the replacement cost of equipment or operating equipment. Equipment is considered by the Health Care Financing Administration (HCFA) to be capital equipment under the heading of “major medical, surgical or rehabilitation equipment.” As such, the replacement cost is reimbursed as a capital pass thru on the Medicare cost report. To bill for this equipment would result in a minimum of double reimbursement and even more, depending on the total amount billed over the life of the equipment. This would be considered, at a minimum, abuse of the Medicare program and potentially fraudulent. The operating of equipment by hospital staff is considered routine as defined above. These services are assumed to be included in the accommodation charge for inpatients and the emergency room fee / facility charge for outpatient. Medicare considered reimbursement of these services to be included in the DRG for inpatients and in the prevailing charges / fee schedules used to reimburse outpatient services. Again, billing for this type of service would, at a minimum be considered abuse and potentially fraudulent. If your facility is currently billing for equipment, please cease immediately. (Also reference: Section 441, Hospital Manual, HCFA Publication 10) 25 SUMMARY is important that the facility develop it’s own It definition for routine and non-routine that supports the Medicare regulation. Once developed, a policy should outline the steps for adding new items to the charge master (going through a charge master integrity team) and any exceptions. The ‘due diligence’ should include all references used (preferably the FI’s input too) that support the billing of supplies. DON’T FORGET OTHER PAYERS. Many times items are lost to audit from 3rd party payers (WC, Commericals) because the facility can not ‘defend’ their practices. The policy along with the Medicare-supported definitions can help in this environment as well. Have fun! 26 AR Systems’ Contact Info Day Egusquiza, President AR Systems, Inc Box 2521 Twin Falls, Id 83303 208 423 9036 daylee1@mindspring.com www.arsystemsdayegusquiza.com Thanks for joining us! RAC2008 27 NOT SEPARATELY BILLABLE ITEMS (Kansas FI 10/00) The purpose of this bulletin is to provide cost report reimbursement instructions for supplies/items pertaining to hospital patients. A list such as this cannot be all inclusive nor can it be current with all technology advances. The final determination of an item or service as routine or non-routine is that of the fiscal intermediary. Generally, the definitions listed below and section 2202.6 of HCFA Pub 15-1, should be used to determine if an item/service is routine or ancillary. Your facility should coordinate these cost report reimbursement instructions with its UB-92 billing procedures. 28 Routine or Ancillary Supplies / Equipment (Examples) The following is a reference tool (not all inclusive) to be used to determine whether a supply item should be considered routine (and therefore not separately billable to Medicare) or ancillary (separately billable to Medicare) [Source: Medicare Part A Bulletin, no. 95-10-12- by AdminaStar Federal, Oct 17, 1995]: Preparation Kits Any linen Gowns Gloves Oxygen masks Syringes and needles Saline solutions Sponges Reusable items Cardiac monitors Oximeters Oxygen supplies IV pumps Blood pressure monitors Thermometers Ice bags or packs Heat light or heating pad Wall suction Specimen collection containers Alcohol or peroxide 29 Routine or Ancillary Supplies / Equipment (Examples) Continued… Betadine / phisohex solution Slippers Iodine swabs / wipes Powders Lotions Blood pressure cuffs Pads Drapes Cotton balls Urinals / bedpans Irrigation solutions Pillows Towels Diapers Soap Tourniquets Gauze Supplies (self-admin inj) IV tubing 30