The Effects of Dissolving Ties with a Misconduct Firm on Director

advertisement

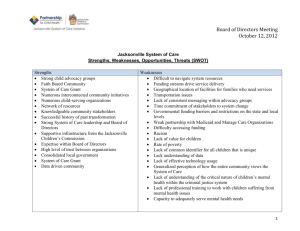

DEPARTURE STATUS: THE EFFECT OF DISSOLVING TIES WITH A MISCONDUCT FIRM ON DIRECTOR LABOR MARKET OUTCOMES JO-ELLEN POZNER Haas School of Business University of California, Berkeley 545 Student Services Building, #1900 Berkeley, CA 94720 + 1 (510) 643-1413 pozner@haas.berkeley.edu OCTOBER 2012 1 DEPARTURE STATUS: THE EFFECT OF LEAVING A MISCONDUCT FIRM ON DIRECTOR LABOR MARKET OUTCOMES ABSTRACT Although directors sitting on the boards of organizations shown to have engaged in financial misconduct typically lose their seats on other boards, such consequences are not equally felt by all directors. This paper explores one of the factors that impact individual outcomes following revelations of misconduct: departure from the misconduct firm. Departure is an ambiguous signal that can be seen as either pro-active distancing on the part of the director or scapegoating on the part of the firm. I argue that the market interpretation of director departure from the misconduct firm is moderated by the network status of both the individual director and the firm. Using a sample of U.S. corporations that restated earnings between 1997 and 2003, I find that high-status directors fare significantly better on the market for directors than their lower-status peers when they dissociate from the restating firm, even if they depart before their terms expire. In contrast, directors departing high-status boards before their terms expire fare worse than others when. Taken together, my results suggest that high-status firms may pass the stigma of accounting fraud onto their directors, whereas high-status individuals are buffered from stigma by dint of their social position. KEYWORDS: Misconduct; Stigma; Status 2 The subject of financial misconduct, and specifically accounting fraud, has recently become a topic of particular interest for accounting and organizational scholars. Scholars have investigated the antecedents of fraud, and to a lesser degree, its consequences for the guilty organizations and other firms to which they are linked. Considerably less is known, however, about the consequences of illegitimate behavior across levels of analysis, and how fraud at the organizational level affects those tasked with organizational oversight. In particular, although scholars have demonstrated that revelations of misconduct lead to consequences for organizational elites (e.g., Srinivasan, 2005; Desai, Hogan, and Wilkins, 2006; Cowen and Marcel, 2011) we still have scant theory explaining how the taint of fraud is transferred from organizations to individuals. Do all directors suffer the same consequences, or are labor markets more attentive to subtle cues in the social context, suggesting more severe consequences for some than for others? I focus on director outcomes on external labor markets to elaborate how negative consequences of financial misconduct are transferred from organizations to individuals. An important aspect of director behavior that has so far been neglected is dissociation from the misconduct firm, which is a particularly ambiguous signal to external labor markets. The economic interpretation of dissociation, promoted by the theory of ex post settling up (Fama and Jensen 1983; Fama 1980), holds that directors of misconduct firms lose their positions and finds it harder to find new board appointments because firm misconduct is a direct reflection of poor director quality. While a compelling mechanism, ex post settling up focuses on rational information processing and accurate inferences and neglects other factors that may influence corporate boards. Given that board decisions are not made on purely rational bases, but rather are influenced by symbolic concerns (e.g. Davis, 1991; Westphal and Zajac, 1995), we must consider how these forces inform labor markets. Another possible interpretation of departure is that directors exit tainted firms to protect their reputations from damage through association with misconduct. This explanation is 3 consistent with stigma theory (Goffman, 1963; Wiesenfeld, Wurthmann, and Hambrick, 2008), which holds that actors’ social identities are tarnished by association with either discrediting characteristics or discredited others (Goffman, 1963). If read as a symbolic action aimed at avoiding becoming tarnished, dissociation could instead provide a positive signal, leading to better external labor market outcomes. Because public accounts of the process leading to the dissolution of ties between director and firm are exceedingly rare, external labor markets must find a framework within which to interpret director departure from the misconduct firm. One useful heuristic for interpreting director exit is provided by social status, both of the departing individual and the misconduct organization. Status may buffer director reputations, leading to more positive affect affect (Zajonc, 1980; Wiesenfeld, et al., 2008) and more positive external evaluations (Geis, 1977; Giordano, 1983; D'Aveni, 1990). Consequently, high-status individuals may be perceived by outsiders as dissolving ties with misconduct firms to save their reputations. In contrast, highstatus organizations are perceived to have access to better quality information and greater evaluative capacity than their low-status peers (Rao, 1998; Stuart, 2000). Because high-status organizations’ evaluations are more salient to the public (Rindova, et al., 2005) and their reputations resilient to contravening evidence (Cianci and Kaplan, 2010), director departure from high-status boards may be perceived to indicate poor director quality. Thus individual and organizational status may both moderate the relationship between director departure and subsequent labor market outcomes. Using a sample of U.S. companies restating earnings between 1996 and 2003, I show the effects of departure from the misconduct firm on directors’ subsequent loss and gain of seats on other boards are moderated by the social status of both the director and the misconduct organization. My findings suggest that the market for directors interprets the ambiguous signal of departure differently based on individual and organizational social position. 4 THEORY AND HYPOTHESES Vaughan (1999: 288) defines misconduct as “[an act] of omission or commission by individuals or groups of individuals acting in their organizational roles who violate internal rules, laws or administrative regulations on behalf of organization goals.” Based on this definition, misconduct may involve either organized or individual action, purposive or unintended action, and action that is grounded in the environmental, organizational, and individual levels. This suggests that misconduct is a routine, predictable and pervasive consequence of social interaction found in any organization. In fact, misconduct is so pervasive that the business press reported on misconduct at 40% of the Fortune 100 firms within a five year period (Clement, 2006). Interpreting director departure following misconduct Despite its prevalence, revelations of wrongdoing continue to engender consequences for both organizations and organizational elites. One mechanism through which such consequences are transferred to individuals is signaling; organizational outcomes are seen as signals of director quality. Through the process of ex post settling up (Fama, 1980; Fama and Jensen, 1983), organizational leaders are penalized for negative outcomes or rewarded for strong performance on internal and external labor markets. Empirical research has found support for the process of ex post settling up, demonstrating that external markets for directors do account for performance at the focal director’s home organization, albeit imperfectly. In general, directors are better compensated and have more new offers of board seats when their firms perform well, but lose their positions when performance is poor (Yermack, 2004). Signals of sound corporate governance, such as rejecting anti-takeover provisions (Coles and Hoi, 2003) and forcing out under-performing CEOs (Farrell and Whidbee, 2000), also lead to longer tenure in existing board appointments and invitations to join new boards. Negative outcomes, particularly those that signal declining performance, dampen the 5 future opportunities of professionals at all levels of the organization (Hamori, 2007) and perceptions surrounding their competence (McKinley, Ponemon and Schick, 1996). According to this logic, the departure of a director from a firm known to have engaged in misconduct should have predictable results. If directors’ labor market outcomes are a direct reflection of their oversight ability, external labor markets are likely to read the departure of a director from the misconduct board as an indication that the focal director is directly or indirectly responsible for the misconduct. This is consistent with scapegoating of individual directors, or shifting the perception of blame by severing relationships (Burke, 1969; Gephart, 1978). Because of these attributions, directors who depart misconduct firms are likely to suffer additional penalties on the external market for directors. That is, their penalties should accrue beyond that which is attributable to association with the misconduct itself, which has already been widely demonstrated (e.g., Arthaud-Day et al. 2006; Srinivasan 2005). Boards prefer directors who represent positive signals associated with social connectedness (Mizruchi, 1996), legitimacy (Pfeffer and Salancik, 1978) and strong organizational performance (Herman, 1981; Mace, 1986). In contrast, they sever ties with actors that present unfavorable signals of firm quality and poor performance (e.g., Lorsch and MacIver, 1989; Baum and Oliver, 1991; Jensen, 2006). Because organizations are seen as a reflection of their elites (Hambrick and Mason, 1984), evidence of poor oversight reflects badly on the organization itself, making affiliation with tainted directors a potentially negative signal. If read as involuntary departure, directors who leave the boards of misconduct firms should suffer labor market penalties beyond those experienced by their peers who remain. Hence, I predict: H1. Directors leaving the misconduct firm will face greater penalties on the external market for directors than those who stay Despite the evidence in support of ex post settling up, several studies find no significant evidence of that process at work following misconduct (Agrawal, Jaffe, and Karpoff, 1999; 6 Beneish, 1999), casting doubt on the argument that the market alone accounts for director outcomes. Semadeni, Cannella, Fraser and Lee (2008), for example, find that executives who depart in advance of organizational failure suffer fewer labor market consequences than those who remain, although they may also be responsible for firm failure. This finding suggests that markets respond to symbolic action, highlighting the importance of the social context in which labor markets operate. Fundamental to understanding the role of symbolic factors in allocating the consequences of misconduct is the concept of stigma. Stigmatization is the process through which actors’ social identities are diminished through association with either discrediting characteristics or discredited others (Goffman, 1963). Stigmatization leads others to perceive the stigmatized actor as an unreliable interaction partner (Jones, et al., 1984; Kurzban and Leary, 2001), thus contaminating the stigmatized actor’s social identity (Goffman, 1963; Jones, et al., 1984) and engendering discrimination (Link and Phelan, 2001; Devers, et al., 2009; Walker, 2008). What distinguishes stigmatization from other types of negative evaluation, and what makes it analogous to the process of ex post settling up, is that it forms the basis for reduced social interaction (Kurzban and Leary, 2001; Link and Phelan, 2001; Pozner, 2008). Actors drop ties with stigmatized others because the association might compromise their own identities (Adut, 2005; Jensen, 2006; Jonsson, et al., 2009), a phenomenon known as stigma by association. Stigma by association is driven not by attributions of specific deviance, but rather by the fear that mere proximity might taint others, a symbol tied to social position rather than substantive evidence of wrongdoing. Understanding the dynamics of stigma by association may lead to a different interpretation of director dissociation from misconduct firms. Instead of a mark of poor oversight capacity or possible culpability, dissolution of ties with a stigmatized firm may indicate that the focal director is interested in maintaining the integrity of his reputation. Leaving the 7 tainted firm may therefore be seen as pro-active distancing on the part of the focal director in an attempt to avoid stigma by association. Because they are constrained in their ability to publicly critique the companies on whose boards they sit by rules of propriety and to avoid developing a reputation for being “difficult,” exiting the misconduct firm is the only way to give voice to their concerns (Hirshman, 1970). Thus, when director reputation is critical, visible dissociation from a tainted firm may become a powerful symbol of director orientation toward and tolerance of misconduct, rather than a signal of director ability to detect and prevent misconduct. If their departure is read as voluntary, directors departing the misconduct firm may be less likely to suffer on external labor markets than are those who stay. Hence: H1a. Directors leaving the misconduct firm will face fewer penalties on the external market for directors than those who stay The effect of status Individual status. Some directors may be less discreditable than others despite their association with financial misconduct because their positions within the social structure afford them personal status (Wiesenfeld, et al., 2008). Status is a symbol of quality that may or may not be linked to underlying objective measures of quality, but which confer advantages upon the status holder to which he might not otherwise have access and that perpetuate others’ perceptions of his or her quality (Podolny, 1993; Washington and Zajac, 2005). Although some argue that social position exposes actors to greater potential denigration (Adut, 2005), others find that highstatus, central actors may be protected from stigmatization because of the influence, solidarity and information inherent in their social status (Granovetter, 1973; Burt, 1997; Adler and Kwon, 2002). More central directors, who sit on multiple, influential boards (Davis, Yoo, and Baker, 2003) and have close ties with influential others (D'Aveni and Kesner, 1993; Westphal, 1999) are able to draw on their networks when faced with negative organizational outcomes (Wiesenfeld, et al., 2008). Better networked directors can rely on their many connections to 8 disseminate information that contradicts negative attributions (Wiesenfeld, et al., 2008), resulting in fewer consequences of financial misconduct for those more central to the network of directors. Moreover, as Wiesenfeld, Wurthmann and Hambrick (2008) point out, high-status directors are viewed differently by external audiences. Those that occupy central positions within networks are generally perceived as more competent, credible, and trustworthy than their lower-status peers (Geis, 1977; Giordano, 1983; D'Aveni, 1990), and thereby less susceptible to social sanctions. Social capital may also engender positive affect (Zajonc, 1980; Wiesenfeld, et al., 2008), which counters the negative affect-laden attributions inherent in stigmatization (Devers, et al., 2009). Central, high-status actors may also have more idiosyncrasy credits (Hollander, 1958) upon which they can draw to excuse their behavior. In addition, others may be ill-inclined to punish elites for their infractions, although their excuses are no better received than their lower-status peers (Ungar, 1981). Therefore, high-status, central social position is likely to reduce the effect of association with financial misconduct on director outcomes. Perhaps more importantly, individual status is likely to temper the way departure from the misconduct firm is interpreted by external labor markets. More central directors are found to be more concerned with the effects of financial misconduct on their reputations than are less well-networked directors (Hunton and Rose, 2008), making them more likely to pro-actively sever potentially damaging ties. If high-status directors are thought to be more credible, competent and trustworthy than their lower-status peers (Geis, 1977; Giordano, 1983; D'Aveni, 1990), external audiences are more likely to make favorable attributions and thus to view their actions as reflections of intentional, agentic behavior. Similarly, the positive affect generated by central status is likely to engender sympathetic, rather than antagonistic, interpretations of events. Highly-central actors are also better able than their less-connected peers to successfully utilize their networks to disseminate favorable private accounts of their departure from misconduct firm. In sum, high-status directors who leave the misconduct firm are more likely to 9 be seen as having done so voluntarily to distance themselves from misconduct, whereas lowerstatus directors are more likely to be seen as having been dismissed involuntarily because of their poor quality. I therefore predict that highly central, high-status actors will suffer fewer penalties on external labor markets than lower-status actors when they depart the misconduct firm. Hence: H2. Directors occupying central social positions will suffer fewer penalties on the external market for directors than less-central directors when they depart the misconduct firm Organizational status. In addition to individual status, organizational status may affect the impact of misconduct on directors’ labor market outcomes. First, high-status organizations possess a broad array of high-status connections through which they can disseminate countervailing information (Rao, 1998; Rao, Greve, and Davis, 2001) when faced with attributions of deviance. D’Aveni (1990) shows that organizations with more influential and prestigious connections were less likely to go bankrupt than less well-networked firms, controlling for financial performance. High status actors are also perceived to have superior access to and capacity to evaluate information (Rao, 1998; Stuart, 2000), making their evaluations even more salient to the public (Rindova, et al., 2005). Research on organizational resilience likewise shows that organizational reputation derived from third parties and network ties may also direct attention toward positive, non-stigmatized aspects of the firm or downplay the importance of the discrediting revelation (Masten, 2001; Rhee and Valdez, 2009). Similarly, the Matthew effect (Merton, 1968) predicts that high-status organizations accrue greater rewards for the same positive outcomes and fewer sanctions for the same negative outcomes than lower-status firms (Podolny, 1993; Devers, et al., 2009; Ciancia and Kaplan, 2010). They further benefit from the favorable affective response and evaluation engendered by their prominence, making them less susceptible to social sanction (Wiesenfeld, et al., 2008). This is consistent with recent work which finds that organizations of high standing possess a 10 “reservoir of goodwill” (Jones, Jones, and Little, 2000), which causes external stakeholders to react less severely to the announcement of bad news (Jones, et al., 2000; Pfarrer, Pollock, and Rindova, 2010). Because high-status organizations are likely to be buffered from negative consequences of misconduct, their directors are be more likely to take the brunt of negative attributions, resulting in stronger labor market penalties. Organizational status is also likely to affect the way departure from the misconduct firm is interpreted on external labor markets. High-status organizations are able to spread favorable private accounts through their social networks (Rao, 1998; Rao, Greve, and Davis, 2001), leading to less organizational stigmatization, but worse outcomes for individual directors. Similarly, organizational resilience (Masten, 2001; Rhee and Valdez, 2009) and the positive affect derived from central social status and positive organizational reputation (Wiesenfeld, et al., 2008) are likely to engender favorable interpretations of organizational action, and less favorable interpretations of individual action. Thus external audiences are more likely to read director departure from high-status misconduct firms as reflective of poor oversight capacity, suggesting the efficient functioning of the ex post settling up mechanism. This is likely to result in more severe penalties on external labor markets for directors who depart high-status boards than those who depart lower-status boards. Hence: H3. Directors of firms occupying central social positions will suffer greater penalties on the external market for directors than directors of less-central firms when they depart the misconduct firm DATA AND METHODS Emipirical setting One of the obstacles to conducting research on financial misconduct is the availability of reliable data. Researchers have been able to overcome this obstacle by studying an unusually 11 well-documented form of accounting misconduct: earnings restatements. Earnings restatements are tantamount to restatements of a company’s history (Wu, 2002), whereby firms announce that the figures stated in prior SEC filings were materially incorrect, often on the recommendation of the SEC or outside auditors. The number of restatements, summarized in figure 1, has grown exponentially over the past decade; in 2006, approximately 1,420 publicly traded U.S. companies restated their earnings, representing a full ten percent of the organizational population (Harris, 2007); this was up from 1,255 restatements in 2005, 330 in 2002 (Harris 2007), and just 58 in 1997 (Wu, 2002). Consequently, earnings restatements have been the focus of attention from the government (D'Agostino, 2002) and academia (e.g., Agrawal and Chadha 2005; Akhigbe and Kudla 2005; Arthaud-Day et al. 2006; Srinivasan 2005). *** Insert Figure 1 about here*** Restatements may result from legitimate errors, oversights, or mistakes in the interpretation of accounting regulations, or can result from “accounting irregularities” – fraudulent misapplication of accounting regulations or manipulation of facts – although it is often difficult to distinguish between intentional and unintentional misstatements (Wu, 2002). Restatements of this type generally involve prematurely recognizing anticipated or non-existent revenue or deferring current costs and expenses, to increase current period net income, but can also result from attempts to hide true costs of firm acquisitions or after reassessment of the value of investments (Wu, 2002). In contrast, technical restatements may result from changes in accounting principles or firm adoption of new accounting policies, or from such benign causes as change of accounting period or stock splits. Although restatements may take several forms that differ in severity and intentionality, because they result from purposive action rather than emerging as a necessary byproduct of firm performance, restatements are an extremely useful organizational outcome with which to study financial misconduct. The decision to misreport earnings can be seen as stemming from 12 managerial decisions (Arthaud-Day, et al., 2006), which are more easily controlled by organizational leaders than many other performance-related outcomes (DeFond and Jiambalvo, 1991). Because descriptions of and explanations for restatements are provided by the restating firms themselves, and are therefore difficult to verify and subject to impression management, audiences are often skeptical of the explanations they receive. Consequently, penalties are broadly apportioned to organizations and their elites, such that all restatements have the potential to discredit organizations and their directors. Consequences of restating earnings. Although we know relatively little about the consequences of restatements, the evidence supports the view that most restatements are broadly seen as admissions of misconduct, and are accompanied by various market and non-market penalties. Restatements are generally followed by a significant loss of shareholder value (Palmrose, Richardson, and Scholz, 2004; Akhigbe and Kudla, 2005), impaired credibility (Farber, 2005); diminished expectations of future earnings and an increased cost of capital (Hribar and Jenkins, 2004; Farber, 2005). In addition, both executives and outside directors may experience significantly diminished labor market opportunities (Desai, Hogan and Wilkins, 2006; Arthaud-Day et al., 2006; Srinivasan, 2005). The mechanisms associated with the consequences of restatement on individuals have been little explored, however, and tend to fall into the category of ex post settling up processes. Moreover, these studies focus mainly on the loss of seats on third boards following restatement at the focal firm, but do not test these effects robustly (Richardson, 2005). Data To test my hypotheses, I collected data on firms restating earnings between 1997 and 2003 as reported by the GAO (D'Agostino 2002), a population of approximately 1,239 restatements. Availability of complete data resulted in a final sample of 311 restatements issued by 234 firms listed on the S&P 1500 Index. The observation window begins in 1997, when 13 earnings restatements first became a salient phenomenon, based on press reports and results of the investigation of the U.S. General Accounting Office (D'Agostino 2002); prior to 1997, the number of companies restating each year was minimal. Although the GAO report covered restatements between 1997 and mid-2002, I extended the observation period to 2003. My observation window extends to 2006 to account for staggered board elections. Because most firms elect one third of the board every year, extending the observation by three years implies that each director is at risk for departure – be it through failure to be re-nominated (involuntary departure) or the individual decision not to stand for re-election (voluntary departure) – at some point during the observation window. Although data on later restatements is available, my sample is limited by the availability of reliable and complete data on board appointments, which was collected in the Thomson Financial database of proxy statements through the end of FY 2006. While similar director databases do exist, they are neither as comprehensive nor as reliable with respect to the entire population of corporate directors in the United States, and make applesto-apples comparisons impossible. Although the misconduct under investigation occurred at the organizational level, the outcome of interest is individual outcomes on external labor markets, which requires that the level of analysis be the individual director. I therefore gathered information on each restating firm’s board of directors from annual proxy statements. I corrected for non-independence among directors nested within firms by specifying my models with robust clusters by firm. My sample includes 2,524 observations representing specific directors in the year that the board on which they sat issued an earnings restatement. When analyzing the number of board appointments lost, I restricted my sample to those directors who sat on at least one other board at the time of restatement – i.e., putting them at risk of losing other board seats – which resulted in a subsample of 1,404 observations. Descriptive statistics and correlation coefficients are reported in table 1. 14 *** Insert Table 1 about here*** Dependent Measures. I test my hypotheses using two dependent measures of external labor market outcomes: Board seats lost, and Board seats added. These count variables, which I calculated from the Thomson Financial database of proxy statements, indicate the change in the number of board appointments, excluding the seat at the restating firm, by a given director within three proxy years following the year in which the restatement was filed. I use Board seats lost and Board seats added to get around the problem identified by Richardson (2005), who argued that no net change in the number of board seats could represent either no movement or the replacement of board seats lost with new appointments. Supplemental analysis of net change in board seats, not reported here, yields substantially similar patterns of results. The three-year observation window allows me to account for staggered board elections. The majority of U.S.-listed firms stagger board elections, so that one-third of the board is at risk of re-election in any given year. Although three years may seem to be a long lag period for responding to organizational misconduct, interviews with directors and executive recruiters indicate that departing before one’s term is through – either voluntarily or involuntarily – is nonnormative. This is supported by trends apparent in my data: approximately 50% of directors depart restating firms within three years (compared to approximately 30% of directors of nonrestating firms), whereas only 20% leave before their terms have expired. Thus it is reasonable to interpret departure at the end of one’s term as indicative of either mechanism proposed above. Anecdotally, most directors see ten years, or three terms, as the ideal tenure on any given board. Independent Measures. I created a binary variable, Depart misconduct firm, to indicate whether the focal director left the restating firm within three years of the restatement. This measure was based on data available in the Thomson Financial database of proxy statements. I further created the binary variable Departed before term expires, coded a 1 if the focal actor left the board of the restating firm before his or her term expired, as indicated in proxy reports. 15 I included two variables measuring social status. Centrality measures director centrality within the network of directors, a measure of social prominence or interconnectedness. To calculate this variable, I used the PAJEK software for large network analysis to create a personby-person matrix of all the directors within the universe of directors for each year of my observation window; the universe was culled from director lists included in the Thomson Financial database of proxy statements. This gave me the number of ties each director had with each other; adding across rows yielded an annual centrality measure for each director. I also created a firm-level measure of centrality within the network of publicly listed corporations, Firm Centrality. To construct this variable, I used PAJEK to create a firm-by-firm matrix of all corporations listed in the Thomson Financial database of proxy statements. This gave me the number of ties, represented by shared directors, each firm had with each other firm; adding across rows yielded degree centrality for each firm each year. Finally, I created four interaction terms to test the effect of individual and organizational status on the impact of departing the restating firm. These measures are Depart * Centrality; Depart * Firm centrality; Depart early * Centrality; and Depart early * Firm centrality. Control Measures. I included several firm-level controls. First, because poor results may lead to director turnover, regardless of earnings restatements, I control for organizational performance. I therefore include Return on Assets, lagged one year prior to restatement controlled for performance, collected from the Compustat database. To control for organizational size, which may impact director prominence and proxy director quality, I included the logged value of Total Assets collected these from the Compustat database. To control for differences in restatements themselves, which might impact the interpretation of the restatement and director departure on the market for directors, I constructed four additional variables. Post-2002 is coded as 1 if the restatement occurred in the years 2002 through 2003, and 0 if it occurred in or prior to the year 2002, to account for the salience of the 16 corporate scandals that peaked around Enron’s collapse Enron and the passage of the SarbanesOxley Act (see, e.g., Carnegie and Napier, 2010). I also included a dummy, Error with fraud, indicating that the restatement involved allegations of fraud based on SEC filings; error with fraud is the most agentic type of restatement, and is thought to engender more severe penalties for involved parties. 10Q restated is a dummy variable indicating whether a quarterly statement was amended, which may be perceived to be a less serious infraction than the restatement of a 10K or annual filing. Finally, I include the variable Net impact on net income, which measures the natural log of the total impact on net income of each restatement, to proxy the magnitude of the infraction itself. I also included several director-level controls. Age is a continuous variable measuring director age as reported in annual proxy statements. Female is a dummy coded with a 1 if the focal director is a woman, as indicated in annual proxy statements. I classified any director who was not and had not been an employee of the focal firm as an outsider, represented by Outside director. Tenure is measured as years in office at the time of restatement, based on annual proxy statements, and is positively related to director independence. I included a dummy for Audit Committee Member, coded with a 1 if the focal director was a member of the audit committee, which Srinivasan (2005) found to moderate labor market outcomes. Total External Board Seats represents a count of the number of other boards on which the focal actor sits, and controls for the number of seats potentially lost or the relative number of seats to be gained; this variable was collected from the Thomson Financial database of proxy statements. I added the dummy variable One Other Seat, coded with a 1 if the focal actor sat on only one external board in the year the restatement was issued, to control for floor effects. Finally, I included measures of Board seats dropped and Board seats added as a control where appropriate to account for the possibility of replacement or substitution of one board seat for another within the observation period. 17 Analysis To test my hypotheses, I used Poisson regression specified with the poisson command in the Stata/IC 11.1 statistical package. Poisson regression is a count model with regression coefficients that represent differences between the log of the expected count (or rate) as a function of the predictor variables. The Poisson regression coefficient is expressed as: β = log( μx0+1) - log( μx0 ) where β is the regression coefficient, μ is the expected count, and x0 and x0+1 represent a one unit change in the predictor variable x. Taking the exponential of the regression coefficient eβi derives the incidence rate ratio (IRR), or the change in the predicted count of the outcome variable for a one-unit change in the predictor variable, holding all else constant (Hilbe, 2007); I report IRR values below in interpreting my results. I use the Poisson specification rather than the negative binomial specification because there is no evidence of over-dispersion in my data, as evidenced by a Z-test (Hilbe, 2007). I conducted supplemental, unreported analyses using negative binomial regression; the results of these analyses were identical to those reported here. Because individual directors are clustered within organizations, a violation of the assumption of independence among observations, I calculated the standard errors of coefficient estimates using a robust estimation procedure and clustering within organizations. To test for the clustering of restating organizations within industries, and as a robustness check, I also ran the models using robust estimation and clustering on three-digit SIC codes, as listed in the Compustat database, and fixed effects models for both three-digit SIC and year. The unreported results of these models were not significantly different in direction, magnitude or significance from those reported. RESULTS 18 I present the results of my poisson regression analysis of the number of board appointments lost by directors within three years of restatement in table 2. Model 1 is a control model. Model 2 indicates that directors who depart restating firms drop board seats at 1.64 times the rate of those who remain at the misconduct firm (IRR= 1.6445, p<0.001), providing support for H1 over H1a. Model 3 includes terms for individual and organizational centrality. While model 3 does not provide evidence that firm status affects individual labor market outcomes, it strongly suggests that individual status mitigates the penalties associated with financial misconduct. As individual centrality dramatically increases, the rate at which directors lose board appointments drops significantly (IRR= 0.9977, p<0.01). *** Insert Table 2 about here*** In model 4, I include the interactions Depart * Centrality and Depart * Firm centrality. I find strong support for H2, which predicted that high-status actors who depart the misconduct firm would lose fewer board appointments than their low-status peers, with a highly significant interaction (IRR= 0.9969, p<0.01). No support is found for H3, which predicted that directors who left high-status restating firms would lose more board appointments than those who left lower-status boards. Model 5 tests the interaction of individual and organizational status with departing the restating board before the director’s term expires. Approximately 42% of directors who departed the restating firm within three years, and approximately 20% of all directors in my sample, did so before their terms expired. Because early departure from a board is a relatively rare event in the absence of financial misconduct, it can be interpreted as a stronger statement of the desire to dissolve ties than is departure at the time one’s term expires, making it a more precise test of my hypotheses. Model 5 suggests that central directors lose significantly fewer board appointments than their lower-status peers when they depart the restating firm before their terms expire (IRR= 0.9966, p<0.05). Model 5 also suggests that directors who leave the boards of high-status firms 19 before their terms expire lose significantly more board seats than those at lower-status firms (IRR= 1.0120, p<0.01). Thus model 5 provides substantial support for both H2 and H3. *** Insert Table 3 about here*** Table 3 presents the results of my poisson regression analysis of the number of board appointments gained by directors within three years of restatement. Model 6 presents the control model. Model 7 indicates that directors who depart restating firms add board seats at less than half the rate of those who remain at the misconduct firm (IRR= 0.4447, p<0.001), presenting further support for H1 over H1a. Model 8 includes terms for individual and organizational centrality, neither of which significantly impact the number of appointments added. Similarly, no significant effects are found for the interaction terms Depart * Centrality and Depart * Firm centrality, which are entered in model 9. I do find strong support for H2, however, which predicted that high-status actors who depart the misconduct firm would add more board appointments than their low-status peers, in model 10, which tests my hypotheses with respect to directors who depart the misconduct firm early; the interaction Depart early * Centrality is significant (IRR= 1.0099, p<0.01). This indicates that high-status directors who leave restating boards before their terms expire add significantly more board seats than lower-status directors, providing support for H2. DISCUSSION It is clear that financial misconduct serves as a strong signal of director quality, as evidenced by the main effect of restatement on the change in the number of board appointments held by associated directors following restatements. My findings thus build upon previous research demonstrating the labor market penalties associated with earnings restatements (e.g., Srinivasan, 2005; Desai, et al., 2006; Fich and Shivdasani, 2007). My findings go much further, 20 however, in identifying some of the social forces that impact the degree to which individual directors suffer on external labor markets. The main effect of departure from the misconduct firm strongly supports the ex post settling up hypothesis. That is, when a director leaves the board of a restating firm, he loses significantly more board appointments and adds significantly fewer board appointments than those who remain. This suggests that organizations interpret departure from the restating board as a signal of director quality, and distance themselves from actors they perceive as untrustworthy or unhelpful (Cowen and Marcel, 2011). My results do not support the alternate hypothesis, which suggests that departure from a misconduct firm can be read by labor markets as directors’ attempts to pro-actively disentangle themselves from potentially stigmatizing relationships. A different picture is painted by my results with respect to individual status, however. Certain directors’ social positions may present a countervailing force, protecting their reputations and improving their labor market outcomes. Highly central directors are treated more favorably on labor markets, losing substantially fewer board appointments than their lower status peers. What’s more, their departures are also apparently interpreted more sympathetically. My results suggest that the departure of a high-status director from a misconduct firm is seen as a strategy for giving voice to concerns about firm quality (Hirshman, 1970). Rather than resulting in ostracism, these directors may be embraced by other firms, and although the magnitude of these results may be low, they are highly statistically significant. Consequently, those directors lose substantially fewer seats on other boards after departing the misconduct firm, particularly when they do so before their terms expire. Moreover, they are rewarded with substantially more new board appointments when they take action that can be interpreted as pro-active attempts to distance themselves from tainted organizations. Thus, at least for certain directors, the ex post settling up argument does not hold. 21 In contrast, I find that directors of high-reputation firms suffer more than those at relatively low-status firms. When directors depart a high-status firm before their terms expire, they lose significantly more board appointments than those that remain. Again, this suggests that it is status within the social structure, rather objective assessments of one’s role in creating a negative organizational outcome, that predominates as boards make decisions regarding nominations. Interestingly, individual status does not impact this relationship; in unreported models, the interaction of individual and organizational status had no significant impact on directors’ success on external labor markets. Thus individual and organizational status have discrete effects on director outcomes. These interpretations of my results are guided by the implicit assumption that directors prefer to remain involved in corporate governance. An alternate explanation would suggest that directors of firms found to have engaged in misconduct voluntarily withdraw from the market for directors. Anticipating difficulty in interactions with potential colleagues, and wishing to avoid the embarrassment of discussing their experience with misconduct, directors may simply vacate the board positions they currently occupy and avoid engaging with new boards (Goffman, 1963; Wiesenfeld, et al., 2008). This explanation is impossible to rule out; because explanations of director departure provided by investor relations departments and regulatory filings are fairly uninformative, one cannot conclude with certainty whether departure is chosen or imposed upon directors. What we can conclude, instead, is that such directors are in greater demand when they occupy more central positions, consistent with a market perception of voluntary departure, and in less demand when they depart high-status firms, consistent with a market perception of involuntary departure. Regardless of whether departure is voluntary, however, labor market interpretations of departure are clearly influenced by social structure. Although the scope of this study is limited to restatements of earnings, its findings should generalize to most forms of financial misconduct, but not necessarily to all potentially 22 stigmatizing events. Nevertheless, the results should generalize beyond the specific acts in this study to a range of behaviors that exist in any social system; those that are controllable, and the costs of which can range from very limited to quite broad (Vaughan, 1999). Although further investigation is merited, I expect that my findings would vary with the degree to which the misconduct is perceived to be controllable and with the severity of the social costs incurred. This paper makes several contributions. First, it draws attention to the consequences of fraud across levels of the organization. Research has only recently begun to take the potentially adverse consequences of organizational action seriously (e.g., Vaughan, 1999; Hirsch and Pozner, 2005). Although the topic has received increased attention in the aftermath of the corporate scandals that dominated the early 2000s, research in this area has focused on the consequences of misconduct for organizations (e.g., Jensen, 2006; Kang, 2008; Jonsson, Greve, and Fujiwara-Greve, 2009), while largely neglecting the impact on individual outcomes (exceptions include Pozner, 2008; Wiesenfeld, et al., 2008; Cowen and Marcel, 2011). My work demonstrates that accounting misconduct has ramifications at different levels of analysis, and suggests that organizational illegitimacy ought to be understood as situated in social contexts, rather than as a discrete organizational phenomenon. In addition, this study demonstrates that multiple mechanisms link financial misconduct to individual outcomes. It demonstrates that labor markets are not driven only by rational actors acting rationally, but are also influenced by social context, and highlights the potential contribution of organizational sociology to an area heretofore dominated by a market logic. This insight enriches both the rational and the socially-determined arguments regarding the market for directors. A more socialized understanding of these markets also demonstrates that misconduct and its costs are consequential to organizations, individuals, and the social systems in which they operate in a way that merits more attention from organizational scholars. 23 Table 1. Descriptive Statistics (n=2,524) 24 Table 2. Board Seats Dropped Within 3 Years of Restatement (Poisson Regression) 25 Table 3. Board Seats Added Within 3 Years of Restatement (Poisson Regression) 26 Figure 1. Number of Earnings Restatements in the U.S., by Year 1500 1200 900 600 300 0 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 27 References Adler, P. S., and S.W. Kwon (2002). Social Capital: Prospects for a New Concept. The Academy of Management Review, 27, 17-40. Adut, A. (2005). A Theory of Scandal: Victorians, Homosexuality, and the Fall of Oscar Wilde. American Journal of Sociology, 111, 213-248. Agrawal, A., and S. Chadha (2005). Corporate Governance and Accounting Scandals. Journal of Law & Economics, 48, 371-406. Agrawal, A., J. F. Jaffe, and J. M. Karpoff (1999). Management Turnover and Governance Changes Following the Revelation of Fraud. Journal of Law & Economics, 42, 309-342. Akhigbe, A., and R. J. Madura J. Kudla (2005). Why Are Some Corporate Earnings Restatements More Damaging? Applied Financial Economics, 15, 327-336. Arthaud-Day, M. L., S. T. Certo, C. M. Dalton, and D. R. Dalton (2006). A Changing of the Guard: Executive and Director Turnover Following Corporate Financial Restatements. Academy of Management Journal, 49, 1119-1136. Baum, J. A. C., and C. Oliver (1991). Institutional Linkages and Organizational Mortality. Administrative Science Quarterly, 36, 187-218. Beneish, M. D. (1999). Incentives and Penalties Related to Earnings Overstatements That Violate GAAP. Accounting Review, 74, 425-457. Burke, P.J. (1969). Scapegoating: An alternative to role differentiation. Sociometry, 32(2), 159– 168. Burt, R. S. (1997). The Contingent Value of Social Capital. Administrative Science Quarterly, 42, 339-365. G.D. Carnegie, C.J. Napier (2010). Traditional accountants and business professionals: Portraying the accounting profession after Enron. Accounting, Organizations and Society, 35, 360–376. Cianci, A.M., and S.E. Kaplan (2010). The effect of CEO reputation and explanations for poor performance on investors’ judgments about the company’s future performance and management. Accounting, Organizations and Society, 35(4), 478-495. Clement, R.W. (2006). Just How Unethical Is American Business? Business Horizons, 49, 313327. Coles, J. L., and C. K. Hoi (2003). New Evidence on the Market for Directors: Board Membership and Pennsylvania Senate Bill 1310. Journal of Finance, 58, 197-230. Cowen, A.P. and J. Marcel (2011). Damaged Goods: The Board’s Decision to Dismiss Reputationally-Compromised Directors. Academy of Management Journal, 54, 509 – 527. 28 D'Agostino, D.M. (2002). Financial Statement Restatements: Trends, Market Impacts, Regulatory Responses, and Remaining Challenges. Government Accounting Office. D'Aveni, R. A. (1990). Top Managerial Prestige and Organizational Bankruptcy. Organization Science, 1, 121-142. D'Aveni, R. A., and I. F. Kesner (1993). Top Managerial Prestige, Power and Tender Offer Response: A Study of Elite Social Networks and Target Firm Cooperation During Takeovers. Organization Science, 4, 123-151. Davis, G. F. (1991). Agents without Principles? The Spread of the Poison Pill through the Intercorporate Network. Administrative Science Quarterly, 36, 583. Davis, G. F., M. Yoo, and W. E. Baker (2003). The Small World of the American Corporate Elite, 1982-2001. Strategic Organization, 1, 301-326. DeFond, M. L., and J. Jiambalvo (1991). Incidence and Circumstances of Accounting Errors. Accounting Review, 66, 13. Desai, H., C.E. Hogan, and M.S. Wilkins (2006). The Reputational Penalty for Aggressive Accounting. Accounting Review, 81, 83-112. Devers, C., T. Dewett, Y. Mishina, and C. Belsito (2009). A General Theory of Organizational Stigma. Organization Science, 20(1), 154-171. . Fama, E. F. (1980). Agency Problems and the Theory of the Firm. Journal of Political Economy, 88, 288-307. Fama, E. F., and M. C. Jensen (1983). Separation of Ownership and Control. Journal of Law & Economics, 26, 301-325. Farber, D.B. (2005). Restoring Trust after Fraud: Does Corporate Governance Matter? Accounting Review, 80, 539-561. Farrell, K. A., and D. A. Whidbee (2000). The Consequences of Forced CEO Succession for Outside Directors. Journal of Business, 73, 597-627. Fich, E.M., and A. Shivdasani (2007). Financial Fraud, Director Reputation, and Shareholder Wealth. Journal of Financial Economics, 86, 306-336. Geis, G. (1977). The Electrical Equipment Anti-Trust Cases of 1961. In G. Geis, and R. F. Meier (Eds.), White Collar Crime: Offenses in Business, Politics and the Professions (pp. 117-132). New York: Free Press. Gephart, R. P., Jr. (1978). Status degradation and organizational succession: An ethnomethodological approach. Administrative Science Quarterly, 23, 553-581. Giordano, P.G. (1983). Sanctioning the High-Status Deviant: An Attributional Analysis. Social Psychology Quarterly, 46, 329-342. 29 Goffman, E. (1963). Stigma: Notes on the Management of Spoiled Identity. New York: Simon and Schuster. Granovetter, M. S. (1973). The Strength of Weak Ties. American Journal of Sociology, 78, 1360-1380. Hambrick, D. C., and P. A. Mason (1984). Upper Echelons: The Organization as a Reflection of Its Top Managers. Academy of Management Review, 9, 193-206. Harris, R. (2007). Say Again? An Explosion in Accounting Errors. CFO.com Online Magazine. Herman, E.S. (1981). Corporate Control, Corporate Power. Cambridge, England: Cambridge University Press. Hilbe, Joseph M. (2007). Negative Binomial Regression. New York: Cambridge University Press. Hirsch, P.M., and J.E. Pozner (2005). To Avoid Surprises, Acknowledge the Dark Side: Illustrations from Securities Analysts. Strategic Organization, 3, 229-238. Hirshman, A. O. (1970). Exit, Voice, and Loyalty: Responses to Decline in Firms. Cambridge: Harvard University Press. Hollander, E. P. (1958). Conformity, Status, and Idiosyncrasy Credit. Psychological Review, 65, 117-127. Hribar, P., and N. T. Jenkins (2004). The Effect of Accounting Restatements on Earnings Revisions and the Estimated Cost of Capital. Review of Accounting Studies, 9, 337-356. Hunton, J.E. and J.M. Rose (2008). Can directors’ self-interests influence accounting choices? Accounting, Organizations and Society, 33(7-8), 783-800 Jensen, M. (2006). Should We Stay or Should We Go? Status Anxiety in Client Defections from Arthur Andersen 2002. Administrative Science Quarterly, 51, 97-128. Johnson, J. L., C. M. Daily, and A. E. Ellstrand (1996). Boards of Directors: A Review and Research Agenda. Journal of Management, 22, 409-438. Jones, E. E., A.Farina, A.H. Hastorf, H. Markus, D.T. Miller, and R.A. Scott (1984). Social Stigma: The Psychology of Marked Relationships. New York: W.H. Freeman. Jones, G.H., B.H. Jones, and P. Little (2000). Reputation as Reservoir: Buffering against Loss in Times of Economic Crisis. Corporate Reputation Review, 3, 21-29. Jonsson, S., H. R. Greve, and T. Fujiwara-Greve (2009). Lost without Deserving: The Spread of Legitimacy Loss in Response to Reported Corporate Deviance. Administrative Science Quarterly, 54(2), 195-228. Kang, E. (2008). Director Interlocks and Spillover Effects of Reputational Penalties from Financial Reporting Fraud. Academy of Management Journal, 51, 537-555. 30 Kurzban, R., and M. R. Leary (2001). Evolutionary Origins of Stigmatization: The Functions of Social Exclusion. Psychological Bulletin, 127, 187-208. Link, B. G., and J. C. Phelan (2001). Conceptualizing Stigma. Annual Review of Sociology, 27, 363-385. Lorsch, J.W., and E. MacIver (1989). Pawns or Potentates: The Reality of America's Corporate Boards. Cambridge: Harvard Business Press. Mace, M.L. (1986). Directors: Myth and Reality. Boston, MA: Harvard Business School Press. Masten, A. S. (2001). Ordinary Magic: Resilience Processes in Development. American Psychologist, 56, 227-238. McKinley, W., L.A. Ponemon and A.G. Schick (1996). Auditors’ perceptions of client firms: the stigma of decline and the stigma of growth. Accounting, Organizations and Society, 21, 193213. Merton, R.K. (1968). The Matthew Effect in Science: The Reward and Communication Systems of Science Are Considered. Science, 159, 56-63. Mizruchi, M.S. (1996). What Do Interlocks Do? An Analysis, Critique, and Assessment of Research on Interlocking Directorates. Annual Review of Sociology, 22, 271-298. Palmrose, Z. V., V.J. Richardson, and S.Scholz (2004). Determinants of Market Reactions to Restatement Announcements. Journal of Accounting & Economics, 37, 59-89. Pfarrer, M.D., Pollock, T.G., and Rindova, V.P. (2010). A Tale of Two Assets: The Effects of Firm Reputation and Celebrity on Earnings Surprises and Investors' Reactions. Academy of Management Journal, 53(5), 1131-1152. Pfeffer, J., and G. R. Salancik (1978). The External Control of Organizations: A Resource Dependence Perspective. New York: Harper & Row. Podolny, J.M. (1993). A Status-Based Model of Market Competition. American Journal of Sociology, 98, 829-872. Pozner, J. E. (2008). Stigma and Settling Up: An Integrated Approach to the Consequences of Organizational Misconduct for Organizational Elites. Journal of Business Ethics, 80, 141-150. Rao, H. (1998). Caveat Emptor: The Construction of Nonprofit Consumer Watchdog Organizations. American Journal of Sociology, 103, 912-961. Rao, H., H.R. Greve, and G.F. Davis (2001). Fool's Gold: Social Proof in the Initiation and Abandonment of Coverage by Wall Street Analysts. Administrative Science Quarterly, 48, 502. Rhee, M., and M.E. Valdez (2009). Contextual Factors Surrounding Reputation Damage with Potential Implications for Reputation Repair. Academy of Management Review, 34, 146- 168. 31 Richardson, S. A. (2005). Discussion of Consequences of Financial Reporting Failure for Outside Directors: Evidence from Accounting Restatements and Audit Committee Members. Journal of Accounting Research, 43, 335-342. Rindova, V. P., I. O. Williamson, A. P. Petkova, and J. M. Sever (2005). Being Good or Being Known: An Empirical Examination of the Dimensions, Antecedents, and Consequences of Organizational Reputation. Academy of Management Journal, 48, 1033-1049. Semadeni, M., A. A. Cannella, D. R. Fraser, and D. S. Lee (2008). Fight or Flight: Managing Stigma in Executive Careers. Strategic Management Journal, 29, 557-567. Srinivasan, S. (2005). Consequences of Financial Reporting Failure for Outside Directors: Evidence from Accounting Restatements and Audit Committee Members. Journal of Accounting Research, 43, 291-334. Stuart, T. E. (2000). Interorganizational Alliances and the Performance of Firms: A Study of Growth and Innovation Rates in a High-Technology Industry. Strategic Management Journal, 21, 791-811. Ungar, S. (1981). The Effects of Status and Excuse on Interpersonal Reactions to DeviantBehavior. Social Psychology Quarterly, 44, 260-263. Vaughan, D. (1999). The Dark Side of Organizations: Mistake, Misconduct, and Disaster. Annual Review of Sociology, 25, 271-305. Walker, S.P. (2008). Accounting, paper shadows and the stigmatized poor. Accounting, Organizations and Society, 33(4-5), 453-487. Washington, M., and E. J. Zajac (2005). Status Evolution and Competition: Theory and Evidence. Academy of Management Journal, 48, 282-296. Westphal, J. D. (1999). Collaboration in the Boardroom: Behavioral and Performance Consequences of CEO-Board Social Ties. Academy of Management Journal, 42, 7-24. Westphal, J. D., and E. J. Zajac (1995). Who Shall Govern? CEO/Board Power, Demographic Similarity, and New Director Selection. Administrative Science Quarterly, 40, 24. Wiesenfeld, B.M., K. Wurthmann, and D.C. Hambrick (2008). The Stigmatization and Devaluation of Elites Associated with Corporate Failures: A Process Model. Academy of Management Review, 33, 231-251. Wu, M. (2002). Earnings Restatements: A Capital Market Perspective. Stern School of Business, New York University. Unpublished results. Yermack, D. (2004). Remuneration, Retention, and Reputation Incentives for Outside Directors. Journal of Finance, 59, 2281-2308. Zajonc, R. B. (1980). Feeling and Thinking: Preferences Need No Inferences. American Psychologist, 35, 151-175.