Tata Tea

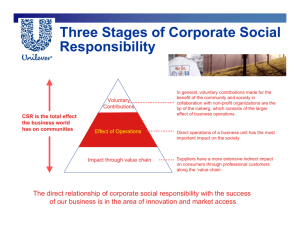

advertisement

Roll Nos. 41 - 50 Tea can be considered as a health drink (known of its antioxidant properties) Demand for tea has been growing at some 2% per annum and should accelerate further Draconian Indian labor laws, do more harm to industry and labor. Labor intensive industry so related problems Limited scalability; it’s a US $ 5 billion market globally and growing at a very slow pace. Supply from more efficient players like Kenya, Vietnam, Sri lanka Climate change may harm tea growing region, escalating prices and hampering the capacity. Visible trend towards the health drink; up to the tea industry to make aware consuming population of the facts. Tea has a distinct advantage over more popular beverage – coffee To make tea more acceptable and fashionable like coffee To come up with new flavors/formulation of the tea To retain young population from being lured by multinationals to aerated and flavored drinks. Labor problems Cost escalation Fragmented production Vision Be India’s foremost tea based beverage company Mission Achieve market and thought leadership for branded tea in India Be recognised as the foremost innovator in tea and tea based beverage solutions Drive long term profitable growth Co-create enhanced value for all stakeholders Make Tata tea a great place to work A part of the Tata group of companies, one of the largest and most respected business houses of India. Tata Tea was formed in 1983. Headquartered in Kolkata, India. Set up in 1964 as a joint venture with UK-based James Finlay. Tata Tea has been involved in the tea extract business for last 40 odd years. Leads market share (in volume) in India Hot beverages Tata Tea, Tetley, Kanan Devan, Chakra Gold, Gemini Mineral water Non carbonated drinks Chai Unchai outlets STRENGTHS Market leader in tea segment Backward integration Wide market coverage WEAKNESS Concentration risk over single category OPPORTUNITES Potential in fruit & herbal teas Global existence Low penetration level THREAT Competition from regional and local players Threat of new entrants: High level Encouraging govt. policies Easy to imitate Bargaining power of suppliers: High; as suppliers are few Bargaining power of buyers: Low; as demand is high Loyalty for taste Threat of substitute products: Moderate to high Substitutes – Coffee, Cold drinks, etc (young generation new to tea) Existing consumers are loyal Competition: Intense competition Lipton, Brooke bond, other local players, loose tea market Ad-spend of cos. : indication of competition Resources : • • • • • 51 tea estates in states of Assam, West Bengal, Tamil Nadu, Kerela. Area of 26,500 hectares under tea cultivation. Produces about 60 million kg of black tea annually. Subsidiaries & Associated companies Overseas business Capabilities • • • • Distribution system. Strong and trusted management. Research and development. Marketing. Core competencies. • Brand name • Distribution network Bought leaf factories & co-operatives to change the structure of green leaf production Un-remunerative operations are 1st given the opportunity to transform and if not hived off Re-organisation of 20 tea estates in clusters of 5 Identified branded tea as its thrust area To exit the beverage retailing business to focus on branded products Tata Coffee sold off its stake in Barista, no plans of re-entering the business Introducing drinks like TiON, all over India ‘Jaago Re’ campaign followed by the 'Aaj Se Khilana Bandh, Pilana Shuru' campaign to target the youth for voting and work against corruption Focus on brands like Chakra Gold, Gemini and Kanan Devan in regions where they are strong Competitors: Firms operating in the same market, offering similar products and targeting similar customers. Competitive Dynamics: Ongoing actions and responses taking place between all firms competing within a market for advantageous positions. Competitive Rivalry: Ongoing actions and responses taking place between an individual firm and its competitors for advantageous market position. Competitive Rivalry (Individual firms) ◦ Market commonality and resource similarity ◦ Awareness, motivation and ability ◦ First mover incentives, size and quality Competitive Dynamics (All firms) ◦ Market speed (slow-cycle, fast-cycle, and standardcycle ◦ Effects of market speed on actions and responses of all competitors in the market 5–17 Competitive Analysis • Market commonality • Resource similarity Feedback Outcomes • Market position • Financial performance Drivers of Competitive Behavior • Awareness • Motivation • Ability Inter firm Rivalry • Likelihood of Attack • First-mover incentives • Organizational size • Quality • Likelihood of Response • Type of competitive action • Reputation • Market dependence 5–18 Slow cycle market Fast cycle market Standard cycle market Shielded from imitation for long periods of time Not shielded from imitation Moderately shielded Sustainability High Low Partial Imitation Costly Quick & inexpensive Moderate Strategy Concentrate on competitive action & try to protect ,maintain & extend proprietary advantage Competitors quickly imitate or improve on firm’s products. Upgrade quality continuously, seek large market share, gain customer loyalty Competitive advantage 5–19 Competitors with their Market Share & Profit: Market Cap. Net Profit (Rs. cr.) (year 2008-09) Tata Tea 5,239.07 159.06 Mcleod Rus 2,196.78 88.79 Tata Coffee 593.84 18.64 Assam Company 503.36 -2.82 Bombay Burmah 411.65 -13.88 Jayshree Tea 326.29 13.88 CCL Products 206.06 19.00 Harrisons Malay 191.84 6.04 Dhunseri Tea 179.18 16.66 Duncans Ind 50.83 -38.61 Rivalry The competitors are using same resources to acquiring product here Tea leaves. It is working for To use to innovate products e.g. Tata Tea Gold To give aggressive advertising To invent or modify the product in R&D e.g. Tetley green Tea It become difficult for competitors to acquire market share of Tata Tea. The company has loyal customers. Approx 52.37% of market share is captured by Tata tea. Because of it’s quality standard. Variety of brands. Dynamics: Tea companies have competitive advantage of slow cycle market. In which - Tea needs less innovation & upgradation - All firms are like to protect their market share by maintaining quality. The firm Tata tea enjoys global market share of more than 38.76% ( Market is very sustainable for Tea because the user of tea are not ready to change their preferences for long time period. Revenue % Business Segment Revenue (Rs. Lakhs) Tea 378514.72 Coffee & other produce 104712.27 Others 4088.15 Total 487315.14 0.84 Tea 21.49 77.67 Coffee & other produce Others Started out with tea extract business, owned tea plantations Later on ventured into coffee business as both drinks go hand in hand (Related diversification) Entered the business of packaged drinking water (Himalaya) Now also venturing into RTD beverages (introduced a juice drink Tion in India) , seeking more opportunities in this space The Co entered in these businesses keeping in line with their focus on providing “a refreshing drink for a thirsty world” Taken a conscious decision to hive off their plantation business Taken a conscious decision to hive off their plantation business Tata Tea no longer a tea company, it is a “beverage company” The Co entered in these businesses keeping in line with their focus on providing “a refreshing drink for a thirsty world” New strategy - To diversify away from its core categories of tea and coffee and build positions in high growth areas of ‘good for you’ beverage through strong product innovation and growth. Product Growth Rate Star Question Mark T o C Cash Cow Market Share Dog TATA Tea has 3 subsidiary – Tata tea inc US, Tata Coffee, Tata Tea GB (formed to acquire and add Tetley into the group) Tata Tea along with Tata sons acquired Tetley group of UK – 100% owned for $453 million in Feb 2000. Tata Tea GB subsidiary acquired Joekels Tea Packers of South Africa with 33% for $0.91 million in Sep 2006. Tata Tea GB subsidiary acquired JEMCA Czech Republic $11.60million in May 2006 Tata Tea GB acquired Good Earth Corporation & FMali Herb Inc – US - 100% owned for $31 million in Oct 2005. Tata Tea Tetley subsidiary acquired Vitax and Flosana trademarks – Poland. Restructuring of the organization structure worldwide Strategy - Focused on 'Good for you' drinks along with coffee and tea - more like ready to drink beverages (have launched Tion drink in Chennai and planning national launch) Divest - Pulled out of retailing business - sold off stake in Barista and moved out of Chai Unchai chain of tea stores in Bangalore Emphasis on R&D - innovation (disruptive) in tea and coffee business - (first innovation in ready to drink with tea bags of liquid tea - Tetley fusion) Re-branding exercise for Tata Tea name Restructuring the operations in North India Revenue % Geography Sales Revenue (Rs. Lakhs) India 150816.83 UK 123942.34 USA & Canada 144671.83 Rest 65356.48 Total 484787.48 13.48 31.11 29.84 25.57 India UK USA & Canada Rest To be world’s no.1 tea-based beverage company West Asia, South America and Africa to be targeted Will soon begin operations in France and Australia Regional focus to be on brands like Vitax, Jemca, Eight O'Clock Coffee, etc Entity Year of formation Status Role Tata Tea, Inc, USA 1987 100 per cent subsidiary To process and market instant tea from its facility in Florida, based on sourcing of products from facility at Munnar Consolidated Coffee 1991 Ltd (Tata Coffee Ltd) Acquisition of 52.5 per cent stake To diversify into coffee via a company which was Asia's largest seller of coffee Estate Management 1992 Services (P) Limited, Sri Lanka Joint venture To manage 22 plantation companies involved in tea, rubber, coconut and palm oil, that were privatised by the Sri Lankan government Tata Tetley, India 1993 (merged with Tata Tea with effect from April 1, 2005) 100 per cent subsidiary Kochi-based EOU that services the branded business of specific Tetley and Tata Tea markets outside India Asian Coffee Ltd (later merged with Tata Coffee) 1995 Acquisition of 55 per cent stake To get into selling instant coffee globally Watawala Plantations Limited, Sri Lanka 1996 Acquisition of 49 per cent stake through EMSPL Production and marketing of tea, oil palm and rubber in Sri Lanka Tata Tea (GB) Limited 2000 100 per cent subsidiary Special Purpose Vehicle (SPV) established for the acquisition of Tetley, UK Tetley Clover Pvt Ltd., Pakistan 2003 50:50 joint venture of Tetley with Lakson group in Pakistan To import and sell tea in Pakistan as well as build a tea blending factory in Baluchistan Tetley ACI, Bangladesh 2003 50:50 joint venture of To distribute Tetley's products in Tetley with Advanced Bangladesh Chemical Industries (ACI) in Bangladesh Good Earth, USA 2005 Acquisition of 100 per cent stake by Tetley Establish Presence in the US and acquisition of strong product portfolio Jemca, Czech Republic 2006 Acquisition of 100 per cent stake by Tetley Market Leadership in Czech republic with a product portfolio which goes across both mainstream and speciality 8’ O Clock Coffee, USA 2006 Acquisition of more than 50 per cent stake, alongwith Tata Coffee and Tata Enterprises Overseas To help establish global presence in coffee and facilitate movement up the value chain Glaceau, USA 2006 30 per cent minority stake Presence in unfolding crossover space of alongwith Tata Sons the beverages market through enhanced water