ACT 240H1F Sum08 Term Test 2 Post-exam

advertisement

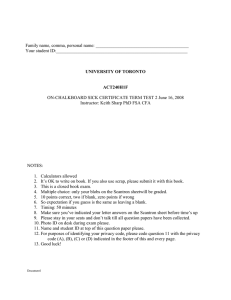

Family name, comma, personal name: _________________________________________ Your student ID:__________________________________________________________ UNIVERSITY OF TORONTO ACT240H1F TERM TEST 2 6:00 pm June 5, 2008 Instructor: Keith Sharp PhD FSA CFA NOTES: 1. Calculators allowed 2. It’s OK to write on book. If you also use scrap, please submit it with this book. 3. This is a closed book exam. 4. Multiple choice: only your blobs on the Scantron sheetwill be graded. 5. 10 points correct, two if blank, zero points if wrong 6. So expectation if you guess is the same as leaving a blank. 7. Timing: 50 minutes 8. Make sure you’ve indicated your letter answers on the Scantron sheet before time’s up 9. Please stay in your seats and don’t talk till all question papers have been collected. 10. Photo ID on desk during exam please. 11. Name and student ID at top of this question paper please. 12. For purposes of identifying your privacy code, please code question 11 with the privacy code (A), (B), (C) or (D) indicated in the footer of this and every page. 13. Good luck! Document1 UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 1. You deposit into an account a quarter of your annual pay at the end of each year for w=35 years. The rate of interest is 5.25% per annum effective. Your salary increases by 4.72637% each year. Your last deposit is $25,000. Calculate your wealth just after you make that last deposit at time 35. (A) Less than $950,000.000 (B) $950,000.000 but less than $955,000.000 (C) $955,000.000 but less than $960,000.000 (D) $960,000.000 but less than $965,000.000 (E) $965,000.000 or more Document1 UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 2. (Assignment May 29, 2008) A discount snowmobile store announces the following financing arrangement: “We don’t offer you confusing interest rtes. We’ll divide your total cost by 11 and you can pay us that amount each month for a year” The first payment is due on the date of sale and the remaining eleven payments at monthly intervals thereafter. Calculate the effective annual interest rate the store’s customers are paying on their loans. (A) Less than 20.000% (B) 20.000% but less than 21.000% (C) 21.000% but less than 22.000% (D) 22.000% but less than 23.000% (E) 23.000% or more Document1 UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 3. (Question of class, May 29, 2008) You deposit $100,000 into an account at Blue Bank at time 0. At times 1, 2, 3,…..10 Blue Bank pays 5% interest (per annum effective rate) and you pay the interest into Red Bank, which pays interest annually at 7% per annum effective. Every year you pay the Red Bank interest into Green Bank, and you let it accumulate there at 9% per annum interest effective. Just after time 10 you withdraw all your money from all three banks. Calculate the total of your withdrawals (A) (B) (C) (D) (E) Document1 Less than $165,400.00 $165,400.00 but less than $165,500.00 $165,500.00 but less than $165,600.00 $165,600.00 but less than $165,700.00 $165,700.00 or more UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 4. Analysts expect UTSG stock to pay a dividend of $5.00 twelve months from now, whether the economy is good or bad, but that all dividends further in the future would increase from the $5.00 at a rate which depends on the economy. The current rate long-term rate of interest is 6% per annum effective. Dividend increase rates are 4% per annum effective in good times, 3% per annum effective in bad times. In the course of a few minutes, news of a disastrous earthquake in Japan causes analysts to change their forecasts from ‘good’ to ‘bad’ economic times. Calculate the percentage drop in the UTSG stock price. (A) (B) (C) (D) (E) Document1 Less than 30.0000% 30.0000% but less than 31.0000% 31.0000% but less than 32.0000% 32.0000% but less than 33.0000% 33.0000% or more UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 5. In order to expand her office, accountant Mary Wong borrows $200,000 from Hongkong and StGeorge Bank Incorporated (HSBI). Terms are that interest is at 6% per annum convertible (compounded) monthly and repayments are level, at the end of every month for five years. Just after the 24th. payment Mary pays off the loan principal OB24. Calculate OB24. (A) (B) (C) (D) (E) Document1 Less than $126,600.00 $126,600.00 but less than $126,800.00 $126,800.00 but less than $127,000.00 $127,000.00 but less than $127,200.00 $127,200.00 or more UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 6. On a certain loan with annual payments, the first payment is made one year after the loan was made. The interest portion of the first payment is 38.79 , the principal repaid in the first payment is 156.00 and the outstanding balance just after the first payment is 706.00 . What is the annual effective interest rate on the loan? Give the answer to the nearest 0.1% per annum. (A) 4.5% (B) 5.0% (C) 5.5% (D) 6.0% (E) The correct answer is not given by (A), (B), (C) or (D) 7. (Class) We amortize a $20,000 loan to buy a car, 4 years at 10% interest, payable at the end of each year. Just after the 1st payment, the loan is renegotiated to be extended to 1+6 years (so the last payment is at time 7). The interest rate used is the new market rate of 9% but the balance of the old loan uses the initial 10%. Calculate the new annual payment (A) Less than $3,400.000 (B) $3,400.000 but less than $3,500.000 (C) $3,500.000 but less than $3,600.000 (D) $3,600.000 but less than $3,700.000 (E) $3,700.000 or more 8.(Question of class May 27, 2008) You and your spouse buy a house for $500,000, borrowing $400,000 in the form of a 25 year Canadian mortgage with an interest rate of 7% per annum compounded semi-annually. Payments, as usual, are level at the end of each month. After 7 years you sell the house, which has inflated at 6.3% per annum effective. On the sale you pay a real estate commission of 5.5%, transfer tax of 1.25%, legal fees of $2,000 and zero mortgage prepayment penalty. Calculate the amount of the ‘can spend this on champagne’ cheque which your lawyer gives you after the sale is finalized (A) (B) (C) (D) (E) Document1 Less than $350,000.00 $350,000.00 but less than $355,000.00 $355,000.00 but less than $360,000.00 $360,000.00 but less than $365,000.00 $365,000.00 or more UNIVERSITY OF TORONTO: ACT240H1F SUMMER 2008 TEST 2 9. (Tutorial June 3, 2008) Jan receives a 10-year increasing annuity-immediate paying 50 the first year and increasing by 50 each year thereafter. Mary receives a 10-year decreasing annuityimmediate paying X the first year and decreasing by X/10 each year thereafter. At an effective annual interest rate of 5%, both annuities have the same present value. Calculate X to the nearest $10. (A) 340 (B) 370 (C) 400 (D) 430 (E) The correct answer is not given by (A), (B), (C) or (D) 10. You are repaying a loan with a series of level-dollar end-of-month payments of $4,100 each. $100 of the last (n th) $4,100 payment is interest. Calculate the amount of principal repaid in the (n-3) rd payment. (A) Less than $3,680.000 (B) $3,680.000 but less than $3,700.000 (C) $3,700.000 but less than $3,720.000 (D) $3,720.000 but less than $3,740.000 (E) $3,740.000 or more 11. Document1 Please code question 11 with the privacy code (A), (B), (C) or (D) indicated in the footer of this and every page.