The Payment System

advertisement

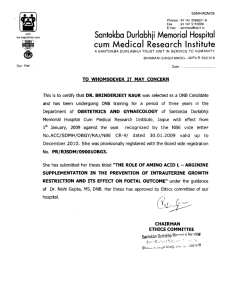

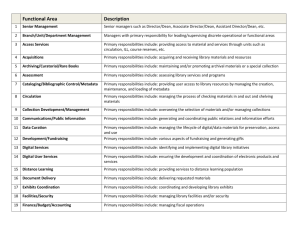

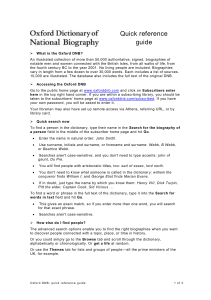

The quality of the Payment System Who’s concern? Copyright NCB Consulting www.ncbconsulting.nl 1 Content Definition Payment System Oversight (tasks and organisation) Poll/survey Concern quality payment system Concluding remarks Questions 2 The Payment System - Definition 3 The Payment System - Definition ALL LINKS IN THE CHAIN SHOULD BE STRONG 4 The payment chain: Payment instrument Channel/ medium Transaction processing 5 Clearing Settlement The Payment System - Definition • Starts and ends at the client • Starts with Payment Instruments like: credit transfer, direct debit, debit and credit cards, epurses and • In Payment Instruments are included Input Devices like the POS terminal, the home PC, the telephone equipment, an ATM with input facilities 6 The Payment System - Definition •Channels: mail system and telecommunication connections like telephone lines, local networks, wide area networks like internet •Other institutions like Acquirers, Clearing institutions, Issuers, Processors, Settlement institutions (incl. for securities settlement) •Ends at the client via paper or electronic output 7 Scheme oriented organisation retail payments Legal Owner Issuer Clearing Institution Acquirer Acquirer Acceptant Payment Acceptantser Service vice Provider Consumer Issuing processor Clearing processor Acquiring processor Settlement processor Network processor Settlement Institution 8 providor Retailer Basis of the Payment System: 9 Payment system is all about trust... Trust Trust Trust Trust Trust Currency Issuer Payment system Authenticity Legal system 10 Mission of the central bank A National Central Bank (NCB) is responsible for safeguarding financial stability. More particularly, a NCB contributes to – defining and implementing the monetary policy; – promotes the smooth operation of the payment system; – and can supervise financial institutions and the financial sector. – All NCB’s have an active role in payments. – Per NCB differences may exist in the active role in payments. 11 Mission of the central bank Scope Monetary stability: stable currency Financial sector stability: institutions reliable financial Payment system: smooth and secure payments 12 Payments: different roles of a NCB Operator - Cash - Large value payment system - Services to securities settlement systems Overseer - Payment systems - Payment products Catalyst 13 Oversight task Oversight is a task of a central bank aiming: – Contributing to the reduction of systemic risks by performing oversight on the payment system – Promoting the adequate functioning of the payment system by performing oversight on this system – Contributing to financial stability 14 Systemic risk Systemic risk is the risk that propagation of a serious failure in a sector of the society will imperil other sectors (a ‘domino’ effect). The infection is propagated via the interfaces between the sectors 15 Systemic risk In case propagation leads to a … effect, a systemic risk has occurred 16 Oversight’s objectives Objectives Reduce systemic risk Smoothen payment system Maintaining public confidence in the safety of the payment system 17 Staffing: organisation at DNB Multidisciplinary staff (11, including head of department): lawyers, risk management experts, (IT) auditors, economists experience in securities, payments and / or supervision 18 Deliverables of oversight Assessment reports: Initial assessment in case of new system Partial assessment in case of major change Annual oversight report Internal: extensive, including sensitive findings External: summary of conclusions Regular oversight Regular meetings (monthly, quarterly) Regular reporting of statistics, incidents, financials (monthly quarterly) Ad hoc reporting in case of crises 19 Standards Assessments based on standards Use of international standards if available By using standards the level of playing field is guaranteed Authority to set up minimum standards for the objects of oversight (oversight framework) 20 Oversight standards (1) Wholesale Core principles for systemically important payments systems (SIPS) (BIS, 2001) Terms of Reference for the assessment of Large Value Payment Systems (LVPS) (ECB) 21 Oversight standards (2) Retail Framework for the Oversight on Card Payment Systems (ECB) Recommendations for Payment Products (DNB) Oversight standards for Euro Retail Payment Systems (ECB) Electronic Money Security System Objectives (ECB) 22 Oversight standards (3) Securities Recommendations for Central Counterparties (CCPs) (CPSS/IOSCO, 2004) Recommendations for Securities Settlement Systems (SSS) (CPSS/IOSCO, 2001) 23 Annual report Oversight Transparency - ´Central banks should set out publicly their oversight policies, including the policy requirements or standards for systems and the criteria for determining which systems these apply to´, CPSS 2005 Enforcement tool – no legal instruments for Oversight, except ´moral suasion´ 24 Trends / developments Consolidation / concentration European consolidation underway – TARGET2 – Single European Payment Area (SEPA) – LCH.Clearnet mergers – Euroclear mergers 25 Trends / developments Competition, fragmentation MiFID and Code of conduct for clearing and settlement New trading platforms and CCPs compete with incumbents (EMCF new CCP in the Netherlands) Interoperability between trading platforms, CCPs and CSDs create equal access and competition 26 Trends / developments Specialisation multiple operators/owners: card schemes, transaction networks, imaging and clearing new providers of payment products/ payments services telecom providers network providers public transport non bank ATM’s acceptant payment service providers 27 Trends / developments (1) Consequences Standardisation increasingly important Increasing (need for) co-operation between overseers (criteria, standards, approach) Legal and oversight frameworks need to be harmonised (MoU’s) 28 Trends / developments (2) Consequences Increasing (need for) co-operation with other regulators (e.g. supervisors, securities regulators, etc.) Currently cooperative oversight on VISA and MasterCard has started 29 Cooperation other authorities System Lead overseer and/or regulator Wholesale TARGET2.NL TARGET2 CLS DNB ECB Federal Reserve SWIFT National Bank of Belgium Securities ECC EMCF Euroclear Nederland Euroclear SA MTS Amsterdam LCH.Clearnet Group Ltd LCH.Clearnet SA Retail Acceptgiro, Chipknip, iDEAL, Incasso, PIN Equens Telegiro Nieuwe Stijl UPSS BaFin AFM/DNB AFM/DNB National Bank of Belgium and CBFA AFM/DNB Commission Bancaire Rotating regulator Euronext countries chairmanship DNB DNB DNB DNB 30 Other overseers and/or regulators ESCB G10-central banks and other central banks of issue with a currency in CLS G10-central banks Bundesbank, AFM, DNB AFM, DNB and regulators from France and the United Kingdom AFM, DNB and regulators from France, Portugal and the United Kingdom Other regulators from Belgium, France, the Netherlands and Portugal Trust in The Payment System Who’s Concern? 31 Poll/survey POLL/SURVEY WITH THE AUDIENCE 32 Poll/survey (1) Who uses for mobile phoning a mobile phone service provider? Who expects /requires that mobile phoning also will be available abroad (using networks from other providers)? Who expects support of its provider for secure and continue telephoning? Who is of the opinion that you has user also have a role in the security of this service? 33 Poll/survey (2) Who expects continuity and security of the mobile communication as part of the services offered? Would you change from provider if this provider proves not to have this operational? Who has the opinion that the mobile telephone operator has to monitor (closely) that the services he offers meets the requirements of the clients? 34 Poll/survey (3) In case of availability of standards. Who has the opinion that this operator has to be compliant to available standards? Who has the opinion that clients of commercial banks may require the same as you require from your mobile telephone operator regarding the security and continuity of the payment services offered? 35 Poll/survey (4) Outcome poll/survey 36 Trust in The Payment System Who’s Concern? 37 What options are possible and fully or partly operational in the Netherlands Founding of a central owner of interbank payment products Setting by the owner of standards/regulations/rules Monitoring by the owner on compliancy to these rules and regulations Internal discussion and cooperation via a national organised association 38 What options are possible and fully or partly operational in the Netherlands Structured communication with DNB (Dutch NCB) Close cooperation with DNB regarding the security and continuity of the payment system (Payment Escalation Committee) Participation in sector wide testing 39 What improvements can still be made? (Periodic and structured) monitoring compliance to standards/rules set by supervising authorities. Showing more transparency to the public 40 Concluding remarks (1) Payment and securities (settlement) systems are of critical importance to a country and a country’s economy, especially during times of crisis Payment systems … … facilitate the exchange of goods and services … are necessary to conduct monetary policy … can be transmission channels of ‘disturbances’ (financial crises) 41 Concluding remarks (2) Both retail and wholesale payment systems are important but have different profiles and different risks Roles central bank: operator, catalyst and overseer Mission DNB: to promote the smooth operation of payment systems, i.e. safe, efficient and accessible 42 Concluding remarks (3) Securities settlement systems Are essential for monetary policy operations Link securities settlement and payment systems (via DVP) Are important for well-functioning financial markets INFRASTRUCTURES, in general Essential for Financial Stability 43 Concluding remarks (4) Central Banks Play Key Role But all participants have to cooperate to guarantee the required trust In the Netherlands the financial sector already showed its responsibility Further improvements are still possible/recommended Many developments going on European level 44 Questions… 45 Time’s up……… THANK YOU FOR YOUR ATTENTION P.W. Osse RE RA CISA NCB Consulting +31 06 25 06 27 80 pwosse@ncbconsulting.nl 46