Electronic Check Payment Protocols and Systems

Speaker: Jerry Gao Ph.D.

San Jose State University

email: jerrygao@email.sjsu.edu

URL: http://www.engr.sjsu.edu/gaojerry

May, 2000

Topic: Electronic Cash Payment Protocols and Systems

Presentation Outline

- Overview of electronic cash system

- Ecash (Digital Cash)

- NetCash

- Comparisons and summary

Jerry Gao Ph.D. 5/20000

All Rights Reserved

Topic: Electronic Cash Payment Protocols and Systems

Overview of Electronic Cash Payment Protocols and Systems

What is an electronic cash payment system?

E-commerce application systems must provide payment processing and

transaction service to buyers and sellers.

A payment system, as a part of E-commerce application system, is a

such system which support secured payment processes by providing

reliable, secured, and efficient transaction services between sellers and

buyers.

The basic requirements of a payment system:

- Provide secured and confidential transaction processes.

- Conduct authentication and authorization for all involved parties.

- Ensure the integrity of payment instructions for goods and services.

- Simple, availability, cost-effective, efficient, and reliable.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Cash Payment Protocols and Systems

Actors Involved in Electronic Cash Payment Systems

- Customers: Customers use the digital cash payment systems to make purchases.

- Dealers:

Dealers have to bear the costs of payment transactions.

- Providers for digital payment systems:

Providers are intermediaries between dealers and financial institutions.

They provide services and training.

- Development vendors for digital payment systems:

- Financial institutions:

Banking systems or organizations who use electronic payment systems.

- Trust Centers:

They control digital signature keys, and help to secure customer

confidence in certain payment systems. They are responsible for the

integrity of transmitted data and authenticity of contractors.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Cash Payment Protocols and Systems

Basic Requirements for Electronic Cash Payment Systems

- Digital money:

Payment systems must provide customers and private households with acceptable

digital money.

Security:

Ensure the security of transactions and information privacy of users.

- Scalability:

A large number of customers and concurrent transactions should be handled in a

scalable manner.

- Efficient and effective:

Payment systems must support efficient and effective payment processing and

accounting services for small payment transactions.

- Simple:

Payment systems must provide customers with simple transparent transactions.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Cash Payment Protocols and Systems

Basic Requirements for Electronic Cash Payment Systems

- Anonymous:

Usually, customers wish to stay anonymous for all involved transactions..

- Double spending:

Digital coins consists of a number of bits. Payment systems must be able to recognize

and/or prevent repeated payments with the same digital coin.

- Exchange:

Digital money should be convertible into “real” money whenever necessary.

- Store:

Digital money must be stored locally on hard disks or other media.

- Value:

Digital cash payment systems must provide a large number of digital coins for

circulation and perform authentication checking.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Cash Payment Protocols and Systems

Advantages of Electronic Cash Payment Systems

- Saved time:

- Reduce transaction process time

- Speed up transaction processes

- Reduced costs:

- Reduce transaction costs

- Reduce cash distribution costs

- Flexibility:

- Digital cash can take many forms, including prepaid cards

- Digital cash can be converted into different currencies

- Reduce cash distribution risk:

- Reduce the regular cash distribution risk

- Error free and efficient:

- Reduce transaction errors

Jerry Gao Ph.D. 5/2000

Topic: Online Payment Protocols and Systems

Special Features of Electronic Payment Protocols

Important features of electronic cash payment protocols and systems:

- Anonymity: This ensure that no detailed cash transactions for customer

are traceable. Even sellers do not know the identity of

customers involved in the purchases.

- Liquidity: Digital cash have to be accepted by all concerned economic

agents as a payment method.

- Prepaid cards:

Buyers can buy prepaid cards that are accepted by special sellers.

- Electronic payment processing:

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Special Features of Electronic Check Protocols

and Payment Systems

Important features of electronic cash payment protocols and systems:

- Anonymity: This ensure that no detailed cash transactions for customer

are traceable. Even sellers do not know the identity of

customers involved in the purchases.

- Liquidity: Digital cash have to be accepted by all concerned economic

agents as a payment method.

- Prepaid cards:

Buyers can buy prepaid cards that are accepted by special sellers.

- Electronic payment processing:

Jerry Gao Ph.D. 5/2000

Topic:Elect ronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Overview of NetBill:

- ECash is a payment protocol for anonymous digital money on the Internet.

- It is developed by DigiCash Co, of Amsterdam, The Netherlands.

- It is currently implemented and offered by Mark Twain Bank,

St. Louis since 1995.

- DeutscheBank Ag, Frankfurt (Main) offers Ecash as a pilot project to its

customers since October 1997.

A public trial of the Millicent system was scheduled for the summer of 1997.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocols: NetBill

NetBill model:

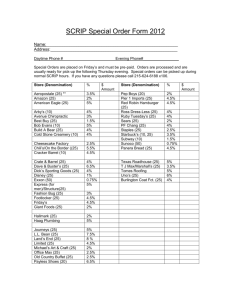

MilliCent protocols use a form of electronic currency called Scrip to connect three

involved parties:

- vendors, customers, and brokers.

Scrip is vendor specific.

A Millicent broker:

--> medicate between vendors and customers to simplify the tasks they perform.

--> aggregate micro-payments

--> sell vendor Scrip to customers

--> handle the real money in the Millicent system.

--> maintain customer accounts and vendors (subScripion services)

--> buy and produce large chunks of vendor Scrips (for licensed vendors)

Vendors: --> are merchants selling low-value services or information to customers

Customers: --> buy broker Scrip with real money from selected brokers.

--> use the vendor Scrips to make purchases.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

NetBill Archecture: (Source: NetBill 1994 Prototype)

Consumer

Application

Merchant

Application

Checkbook

Till

Security

Server

Transaction

Server

User Admin.

Server

Payment &

Collection Server

System Admin.

Server

DB

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Consumer

Merchant

NetBill Server

1. Credit card # (macropayment protocol)

2. $5.00 Broker

scrip(Millicent protocol)

1. $0.19 Vendor scrp + request

Start of week

Transaction Sequence

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Customer

Broker

Vendor

1.0 Broker scrip

2. $0.20 Vendor scrip

$4.80 Broker scrip

Purchasing

from a vendor

3. $0.20 Vendor scrp + request

4. $0.19 Vendor scrip change + purchased ino/service

Transaction Sequence

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Customer make purchases

with vendor Scrips

Vendor

Customer

Vendor sell low-value

information and services

Broker sell vendor Scrip

Broker

Jerry Gao Ph.D. 5/2000

Brokers buy/produce large

chunks of “vendor Scrip”

for licensed vendors

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

About Scrip:

---> a piece of data used to represent microcurrency within the Millicent systems.

Scrip has the following properties:

- Scrip is vendor specific, thus has value at one specific vendor only.

- Scrip can be spent only once by its owner.

- Scrip can be represented any denomination of currency.

- Scrip represents a prepaid value.

- Scrip make no use of public-key cryptography.

- Scrip cannot provide full anonymity. It can be traced and recorded.

Scrip like cash has a defined value and can be used to purchase merchandise.

Major differences between Scrip and cash:

- Scrip can only spent once, and cash can be spent many times.

- Scrip is vendor specific, and cash is not.

- Scrip can only spent by the customer who obtained it from the broker.

- Scrip has an expiration date and a digital signature.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Scrip Message Structure

Vendor

Jerry Gao Ph.D. 5/2000

Value

Scrip-id

customer-id expiration-date

info

certificate

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Millicent Security Checking: ---> Provide three different security levels.

All transactions should be protected, and fraud must be detectable and traceable.

----------------------------------------------------------------------------------------------Millicent Protocol

Efficiency Ranking

Secure

Private

Scrip in the clear

1

No

No

Encrypted connection

3

Yes

Yes

Request signatures

2

Yes

No

________________________________________________________________

.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Authentication and signature: Millicent protocol uses one-way has functions

- such as 128-bit MD5 and HMAC-MD5.

- The message is sent in clear, but is protected by the customer_secret in hash function.

- Upon receiving the request, the vendor calculates the hash function using

a pre-selected message digest function.

- The vendor returns, upon receiving this information, the customer can compute the

message digest to ensure authenticity.

- Signature: a request signature is generated based on the customer_secret by hashing

Encryption: No encryption,

but maintains a level of security that prevents Scrip being stolen.

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

1. Scrip, Request, Request signature

Customer

Vendor

2. Change, Reply, Reply signature

Purchase using a request signature

Customer Secret

Scrip

Hash

Request

Request Signature

Compare

Request Signature

Vendor verifies the request signature

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Vendor secret keys

Master Scrip secret 5

Master Scrip secret 6

Master Scrip secret 7

Vendor Value

“certificate”

To customer

Jerry Gao Ph.D. 5/2000

Scrip-id

customer-id expiration-date info

Master Scrip secret 6

Hash eg. MD5

Scrip certificate generation

Topic: Electronic Check Payment Protocols and Systems

Electronic Check Payment Protocol: NetBill

Vendor secret keys

Master Scrip secret 5

Master Scrip secret 6

Master Scrip secret 7

Vendor Value

Scrip-id

customer-id expiration-date info

Master Scrip secret 6

certificate

From

customer

compare

certificate

Jerry Gao Ph.D. 5/2000

Scrip validation

Topic: Electronic Check Payment Protocols and Systems

Comparisons of Electronic Check Payment Protocols

Jerry Gao Ph.D. 5/2000

Topic: Electronic Check Payment Protocols and Systems

Analysis of Electronic Check Payment Protocols

Jerry Gao Ph.D. 5/2000