Demonstration Exercise 12.4

advertisement

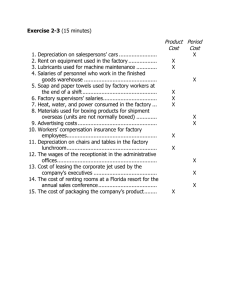

Accounting What the Numbers Mean 9e Demonstration Problem Chapter 12 – Exercise 4 Estimating Costs Based on Behavior Patterns Problem Definition • The following table shows the amount of cost incurred in May for the cost items indicated. During May 16,000 units of the firm’s single product were manufactured. Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used $83,200 81,000 198,400 12,200 8,400 1,600 Problem Requirements a. How much cost would you expect to be incurred for each of the above items during June when 19,200 units of product are planned for production? b. Calculate the average total cost per unit for the 16,000 units manufactured in May. Explain why this figure would not be useful to a manager interested in predicting the cost of producing 19,200 units in June. Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Cost Behavior Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Cost Behavior Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Is the cost item a variable cost or a fixed cost? Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Variable costs change as activity changes. Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Fixed Fixed costs remain constant as activity changes. Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Fixed Variable Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Fixed Variable Fixed Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Fixed Variable Fixed Fixed Problem Solution • Step 1 – Determine the cost behavior pattern for each cost item: Raw materials Factory depreciation expense Direct labor Production supervisor’s salary Computer rental expense Maintenance supplies used Cost Behavior Variable Fixed Variable Fixed Fixed Variable Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit $ 5.20 Variable rate calculation: $83,200 / 16,000 units = $ 5.20/unit Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit $ 5.20 81,000 Fixed costs items will remain constant regardless of the level of activity (within the relevant range). Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit $ 5.20 40,500 12.40 Variable rate calculation: $198,400 / 16,000 units = $12.40/unit Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit $ 5.20 40,500 12.40 12,200 Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost 16,000 units Behavior Raw materials $ 83,200 Variable Factory depreciation expense 81,000 Fixed Direct labor 198,400 Variable Production supervisor’s salary 12,200 Fixed Computer rental expense 8,400 Fixed Maintenance supplies used 1,600 Variable Total Cost $384,800 Fixed Variable Amount Rate/Unit $ 5.20 40,500 12.40 6,100 8,400 Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost Fixed Variable 16,000 units Behavior Amount Rate/Unit Raw materials $ 83,200 Variable $ 5.20 Factory depreciation expense 81,000 Fixed 40,500 Direct labor 198,400 Variable 12.40 Production supervisor’s salary 12,200 Fixed 6,100 Computer rental expense 8,400 Fixed 4,200 Maintenance supplies used 1,600 Variable 0.10 Total Cost $384,800 Variable rate calculation: $1,600 / 16,000 units = $ 0.10/unit Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost Fixed Variable 16,000 units Behavior Amount Rate/Unit Raw materials $ 83,200 Variable $ 5.20 Factory depreciation expense 81,000 Fixed 81,000 Direct labor 198,400 Variable 12.40 Production supervisor’s salary 12,200 Fixed 12,200 Computer rental expense 8,400 Fixed 8,400 Maintenance supplies used 1,600 Variable 0.10 Total Cost $384,800 $ 101,600 $17.70 Problem Solution • Step 2 - Determine the fixed amount or variable rate for each cost item at 16,000 units of activity: Cost @ Cost Fixed Variable 16,000 units Behavior Amount Rate/Unit Raw materials $ 83,200 Variable $ 5.20 Factory depreciation expense 81,000 Fixed 81,000 Direct labor 198,400 Variable 12.40 Production supervisor’s salary 12,200 Fixed 12,200 Computer rental expense 8,400 Fixed 8,400 Maintenance supplies used 1,600 Variable 0.10 Total Cost $384,800 $ 101,600 $17.70 Cost formula = $101,600 fixed cost + $17.70 per unit variable cost Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 Factory depreciation expense Fixed 81,000 Direct labor Variable 12.40 Production supervisor’s salary Fixed 12,200 Computer rental expense Fixed 8,400 Maintenance supplies used Variable 0.10 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 Calculation: Direct labor Variable 12.40 19,200 units * Production supervisor’s salary Fixed 12,200 $5.20 per unit Computer rental expense Fixed 8,400 Maintenance supplies used Variable 0.10 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Direct labor Variable 12.40 Fixed costs do Production supervisor’s salary Fixed 12,200 not change at Computer rental expense Fixed 8,400 19,200 units. Maintenance supplies used Variable 0.10 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Direct labor Variable 12.40 238,080 Production supervisor’s salary Fixed 12,200 Calculation: Computer rental expense Fixed 8,400 19,200 units * Maintenance supplies used Variable 0.10 $12.40 per unit Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Direct labor Variable 12.40 238,080 Production supervisor’s salary Fixed 12,200 12,200 Computer rental expense Fixed 8,400 Maintenance supplies used Variable 0.10 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Direct labor Variable 12.40 238,080 Production supervisor’s salary Fixed 12,200 12,200 Computer rental expense Fixed 8,400 8,400 Maintenance supplies used Variable 0.10 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Calculation: Direct labor Variable 12.40 238,080 19,200 units * Production supervisor’s salary Fixed 12,200 12,200 $0.10 per unit Computer rental expense Fixed 8,400 8,400 Maintenance supplies used Variable 0.10 1,920 Total Cost $ 101,600 $17.70 Problem Solution • Step 3 – Calculate the cost expected to be incurred in June when 19,200 units are manufactured using the cost formula determined in Step 2: Cost Fixed Variable Cost @ Behavior Amount Rate/Unit 19,200 units Raw materials Variable $ 5.20 $ 99,840 Factory depreciation expense Fixed 81,000 81,000 Direct labor Variable 12.40 238,080 Production supervisor’s salary Fixed 12,200 12,200 Computer rental expense Fixed 8,400 8,400 Maintenance supplies used Variable 0.10 1,920 Total Cost $ 101,600 $17.20 $441,440 Problem Requirements a. How much cost would you expect to be incurred for each of the above items during June when 19,200 units of product are planned for production? b. Calculate the average total cost per unit for the 16,000 units manufactured in May. Explain why this figure would not be useful to a manager interested in predicting the cost of producing 19,200 units in June. Problem Solution • Average total cost for May: $384,800 / 16,000 = $24.05 per unit • It would not be meaningful to use this average total cost figure to predict costs in the subsequent months; that would involve unitizing the fixed expenses – and they do not behave on a per unit basis. Problem Solution • Average total cost calculations are only valid for the number of units used in the calculation. Average total cost for any other number of units produced would be different because the fixed expenses per unit would decrease for each additional unit produced. • Using the average total cost of $24.05 to estimate the cost of producing 19,200 units would give an estimate of $461,760, which is significantly higher than the $441,440 calculated in part a using the cost formula: Total Cost = $101,600 fixed cost + $17.70 per unit variable cost Accounting What the Numbers Mean 9e You should now have a better understanding of using cost behavior information. Remember that there is a demonstration problem for each chapter that is here for your learning benefit. David H. Marshall Wayne W. McManus Daniel F. Viele