lep hispanic initaitive

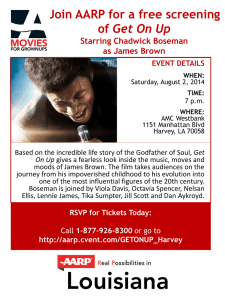

advertisement

AARP Tax-Aide Regional Meetings October 2011 St. Louis, Missouri Presentation Overview Agenda Topics • 2011 Accomplishments • 2012 Changes/Enhancements • Program Sustainability • TaxWise Customer Service Updates • Quality and Ethics Update 2011 Filing Season Results Returns prepared 3,167,863 E-filed returns 2,942,294 E-file rate was 93.8% Total Refunds $3.735 Billion Direct Deposit Returns 1,453,862 2011 Filing Season Results Returns Prepared E-Filed Returns 2010 2011 % Change 3,077,068 3,167,863 + 3% 2,811,259 2,969,123 + 5% 94% + 2% 1,453,862 + 12% E-File Rate 92% Direct Deposit 1,313,744 AARP Accomplishments 2011/2010 Comparison Total Paper FS 2010 FS2011 % Growth 99,248 69,192 -30 % 1,423,710 1,467,528 3% 93.5 95.5 1% 1,522,958 1,536,720 2% 8.5% 5.6 % -31 % Direct Deposit Requested 537,746 or 36% 589,785 or 38% 9% Primary/Secondary 60+ 939,736 or 63% 1,007,441 or 66% 7% $1,232,956,552 $1,278,728,389 3% 1,141,499 1,175,633 3% e-file “returns accepted” e-file rate Total Returns E-file Reject Rate Total Refund Dollars State Returns 2011 Quality Results QSS Return Reviews • Planned 780 Completed 724 • Overall Accuracy Rate 87.18% QSS Site Reviews • Planned 260 Completed 245 • Adherence to QSR 78.23% TIGTA Shopping Reviews • Planned 39 Completed 36 • TIGTA Accuracy Rate 39% Key Quality Findings - AARP AARP Return Review Results Accuracy Rate: 89% • Top 3- Measured Return Review Errors: – ID used to Validate Identity – Other Income – Investment Income AARP Site Review Errors Adherence Rate: 77% Top 3- Site Review Errors: • Quality Review Tool not used • Unique User ID not used for every volunteer • Correct SIDN not used 2012 Filing Season Changes/Enhancements Form 8879 Process • Waiver received for free tax programs – Partners are no longer required to retain • Copy of Form 8879, IRS e-file Signature Authorization • Supporting documents such as Form W-2 and 1099 • Volunteers should now return the signed Form 8879 to the taxpayer along with copy of return • Partners still need to retain consents required under IRC 7216. • IRS requested states waive their retention requirements Schedule D Changes (Form 8949) • • • • Assets can no longer be entered on the Schedule D All asset information goes on Form 8949 Page 1 for short term; Page 2 for long term (Form 8949) Removal of the Long/Short Term Capital Gains Worksheets from Find a Form • Capital Gains worksheet will load the Form 8949 and put the assets on the appropriate page • The new A/B/C indicators will be located on the Capital Gains worksheet under the 1099 column Program Sustainability Program Sustainability • Free Tax Preparation Program Milestones: • 1968 – AARP Tax-Aide Started With 4 Volunteers in DC • 1969 – VITA Authorized - 104,000 Taxpayer’s Served • 1978 – TCE Authorized by Congress • 1986 – Electronic Filing Option Offered • 2000 – 1,127,362 Served (AARP 459,309; 20% e-file) • 2006 – 2,111,344 Served (AARP 1,047,383; 70% e-file) • 2009 – 3,047,622 Served (AARP 1,498,184; 91% e-file) 2 Increase Confidence in Program Driver: Accuracy of Returns • Expand Utilization of Intake/Interview and Quality Review Processes • Strengthen Ethical Standards • Revisit VITA/TCE Scope • Complete Shopping Reviews Increase Confidence in Program Intake/Interview Process Usage AARP Intake/Interview Process Number of Returns Accuracy Rate Number of Completed Form 13614C Intake/Interview Sections 26 92% Number of Completed Form 13614C Intake/Interview Sections 244 91% AARP Completed Approved Partner Created Forms 2 100% Number of Incomplete Forms 13614C Intake/interview Sections 6 83% Number of Incomplete Form 13614C Intake/interview Sections 113 89% AARP Incomplete Unapproved Partner Created Forms 1 0% Number of Incomplete TaxWise Forms 13614C 1 0% AARP Completed Unapproved Partner Created Forms 2 50% No Intake Sheet Used 3 67% Total Reviews 398 89% Increase Confidence in Program Quality Review Process Uptake AARP Quality Review Process Number of Returns Accuracy Rate Number of Completed Forms 13614C, Quality Review Section 282 94% Number of Complete Forms 13614C, Quality Review Section 24 83% Number of Incomplete Forms 13614C, Quality Review Section 9 100% Number of Incomplete Forms 13614C, Quality Review Sections 50 80% Number of Completed Unapproved Quality Review Processes 3 33% No Quality Review Sheet/Process Used 30 70% Total Reviews 398 89% Resource Optimization Driver: Budgetary Constraints • Resources Declining – SPEC – Partners • Expand Efficient Use of Resources – Products/Materials • Goal – Transition to Electronic Resources – SPEC Internal Efficiencies – Enhance Effectiveness of Electronic Products – Utilize Economies of Scale – Promote Best Practices Resource Optimization • Product Transition Example – Publication 4491Training Kit • • • • Publication 4491 (Paper) Publication 4491-W (Paper) Publication 4012 Publication 6744 – Test (Paper) – Publication 4480, Link & Learn Taxes Kit • Publication 4491-W (Paper) • Publication 4012 (Paper) • Publication 6744 – Test (Paper) • CD w/Pub 4491, 4491-W, 4012, 6744 – Stand Alone Products • CD w/Pub 4491, 4491-W, 4012, 6744 • 6744, 4012 and 4961 (Standards of Conduct) Expand Ability to Serve Taxpayers Driver: 19 Million Eligible for Services • Maximize Utilization and Efficiency of Limited Resources • Explore Alternative Methods for Completing Free Tax Returns • Expand Collaborative Efforts Nationally and Locally To Find New Opportunities to Serve Expand Ability to Serve Taxpayers Total Returns 2009 Total AARP % AARP of Total Returns Returns 3,030,247 1,498,184 49.44% 2010 3,077,068 1,522,958 49.49% 2011 3,162,483 1,536,720 48.59% Expand Ability to Serve Taxpayers FAST – Free Assisted Self-Service Tax Preparation • Designed to work “kiosk style” • Taxpayers prepare their own returns – Trained volunteers available to assist – Volunteers must be certified at basic or above • FAST sites can be: – Stand alone sites – “Added Service” at existing sites • Taxpayer’s utilize free online software provided by members of the Free File Alliance – H&R Block – Intuit (Turbo Tax) – Tax Slayer TaxWise Updates TaxWise Changes CCH Small Firm Services has made several changes in preparation for next filing season These changes will improve the volunteers experience with • Training on TaxWise Software • Customer Support TaxWise Software Training Lessons available for both TaxWise Online and Tax Wise Desktop. Lessons are grouped by task: • Administrative • Return Preparation Lessons are concise, interactive and provided in two formats: • Videos • PDF Manuals All training videos will be converted to Brainshark presentations. TaxWise Software Training Advantages of using Brainsharks for videos • Interactive Quizzes • Quizzes provide feedback fo incorrect answers Provide detailed user reports to IRS HQTR Analyst • Report on Users by name • Length of time each user spends on a lesson TaxWise Customer Support Center Expansion of hours in West Coast Support Center • Allowing primary SFS support to staff more appropriately for known peak hours Streamlining the Customer Relationship Management (CRM) system utilized to house customer records to expedite the call flow process Changes to screening and hiring process for Customer Service Reps (CSR) Changes to the training process for CSR Efforts to expand and retain experienced CSR TaxWise Customer Support Site Format is changing to be more inviting and easier to access information The Solutions Center will be the landing page that will give the sites immediate access to the following without requiring a login • Blogs • Hot Topics • Calendars and Charts • Knowledge Base • Links to key items on www.irs.gov TaxWise Customer Support Site Client Environment Page • Allows the sites to enter site specific computer information that is visible to the support reps • Operating Hours • Number of Computers • Captures the following for each workstation • • • • • • • Network Workstation Name and Number Operating System Internet Speed Version of Adobe Version of Internet Explorer RAM Printer Quality and Ethics Update Increase Confidence in Program • Strengthened Volunteer Standards of Conduct to include: – Revised Form 13615, Volunteer Standards of Conduct Agreement • All volunteers are required to sign Form 13615 • All Forms 13615 requires certification by a designated approver • Site Coordinators must validate identity of volunteers • Includes statement that partners may conduct Background Checks – All volunteers required to complete VSC Training, and certify competence with a passing score of 80% or higher – Volunteers removed from VITA and TCE for ethical violations will be added to a SPEC created and maintained Volunteer Registry Increase Confidence in Program SPEC Oversight for 2012: – QSS Reviews – SPEC Shopping Reviews – Field Site Visits – Post-Filing Season Quality Reviews – Internal/External Site Referrals – SPEC Criteria Reviews Eliminated – Partner Reviews AARP Tax-Aide Thank you for making a difference in the lives of millions of American taxpayer’s each and every year!!