Financial Accounting: Liabilities & Equities Question 1 (12 marks

advertisement

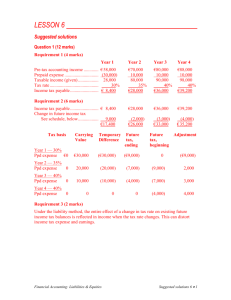

Financial Accounting: Liabilities & Equities Question 1 (12 marks) The records of Morgan Corporation provided the following data at the end of years 1 through 4 relating to income tax allocation: Pre-tax accounting income Taxable income Tax rate Year 1 Year 2 Year 3 Year 4 €58,000 28,000 30% €70,000 80,000 35% €80,000 90,000 40% €88,000 98,000 40% The above amounts include only one temporary difference; no other changes occurred. At the end of year 1, the company prepaid an expense of €30,000, which was then amortized for accounting purposes over the next three years (straight-line). The full amount is included as a deduction in year 1 for income tax purposes. Each year’s tax rate is enacted in each specific year — that is, the year 2 tax rate is enacted in year 2, and so on. Required 1. Calculate income tax payable for each year. 2. Calculate income tax expense. 3. Comment on the effect that use of the liability method has on income tax expense when the income tax rate changes. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P16-3, page 948. Adapted with permission. Question 2 (13 marks) (3 marks for Requirement 1; 9 marks for Requirement 2; and 1 mark for Requirement 3) Note: Answer requirement 2 for 20X7 only. The Beeville Company has a future income tax liability in the amount of €6,000 at December 31, 20X6, relating to a €20,000 receivable. This sale was recorded for accounting purposes in 20X6, but is not taxable until the cash is collected. In 20X7, €10,000 is collected. Warranty expense in 20X7 included in the determination of pre-tax accounting income is €50,000, with the entire amount expected to be incurred and deductible for tax purposes in 20X8. Pre-tax accounting income is €140,000 in 20X7. The tax rate is 40% in 20X7. Required 1. What is the accounting carrying value and the tax base of the account receivable, and the warranty liability, at the end of 20X6 and 20X7? What was the tax rate before 20X7? 2. Calculate taxable income, income tax payable, compute the balance in the future income tax accounts, and prepare journal entries for each year end. 3. Calculate the future income tax that would be reported on the balance sheet at the end of 20X7. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question E16-11, page 944. Adapted with permission. Question 3 (21 marks) (16 marks for Requirement 1 and 5 marks for Requirement 2) At the beginning of 20X5, Farcus Corporation had the following future tax accounts: Future tax asset €19,600 Warranty expense to date has been €126,000; claims paid have been €70,000. There is a €56,000 warranty liability included in short-term liabilities on the balance sheet. Future tax liability €497,000 The net book value of plant and equipment was €2,276,000 at the beginning of 20X5; the tax base was €856,000. Over time, depreciation for tax purposes has been €1,420,000 higher than depreciation for accounting purposes. Information relating to 20X5 and 20X6: 20X5 Net profit Items included in net profit: Golf dues Gain on disposal of non-current asset (Note 1) Tax penalties Depreciation for accounting purposes Warranty expense Percentage of completion income (reported for the first time in 20X5) (Note 2) Other information Depreciation for tax purposes Warranty claims paid Completed contract income (used for tax purposes) Tax rate — enacted in each year 20X6 €625,000 €916,000 8,000 0 3,000 287,000 22,000 17,000 9,000 14,000 1,000 309,000 41,000 10,000 395,000 16,000 0 40% 116,000 50,000 27,000 42% Note 1: €4,000 is the tax-free portion. The remainder is fully taxable. Note 2: The construction-in-progress inventory is classified as a current asset. Required 1. Indicate the amount and classification of all items that would appear on the balance sheet in relation to income tax at the end of 20X5 and 20X6. Assume no tax is paid until the subsequent year. 2. Draft the bottom section of the income statement for 20X6, beginning with “Income before gain on disposal of non-current asset.” Show all required disclosures. Include comparative data for 20X5. Note: For Requirement 1, complete the following table: Income tax payable Future income tax, long-term Future income tax, short-term 20X5 20X6 _____ _____ _____ _____ _____ _____ Show calculations. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P16-11, pages 952 and 953. Adapted with permission. Question 4 (16 marks) (2 marks for Requirement 1; 1 mark each for Requirements 2, 3, and 4; 4 marks for Requirement 5; 3 marks for Requirement 6; and 4 marks for Requirement 7) Creek Ltd. shows the following on its December 31, 20X7, balance sheet: Future income tax liability, long-term €580,000 All this income tax liability relates to the difference between the NBV and tax base of plant and equipment. At December 31, 20X7, NBV is €6,420,000 and the tax base is €4,970,000. In 20X5, 20X6, and 20X7, the company has reported a total taxable income of €216,500 and paid taxes of €54,300. In 20X8, Creek Ltd. reported an accounting loss before tax of €320,000. Depreciation for accounting purposes of €45,000 was included in this calculation. No depreciation for tax purposes will be claimed in 20X8. The enacted tax rate was 40% in 20X8. Required 1. Calculate the taxable loss in 20X8. 2. How much of the tax loss can be used as a loss carryback? What will be the benefit of this loss carryback? 3. How much of the loss is available as a tax loss carryforward? What is the benefit of this tax loss carryforward? 4. Under what circumstances can the benefit of the tax loss carryforward be recorded as an asset? 5. Record income tax for 20X8 assuming that the tax loss carryforward can be recorded. 6. Record income tax for 20X8 assuming that the tax loss carryforward cannot be recorded. 7. Assume that accounting and taxable income was €100,000 in 20X9, and the enacted tax rate was still 40%. Prepare the journal entry to record income tax in 20X9 assuming that the tax loss carry forward (a) was recorded in 20X8 as in Requirement (5), and (b) was not recorded in 20X8 as in Requirement (6). Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question E17-11, page 991. Adapted with permission. Question 5 (20 marks) (15 marks for Requirement 1 and 5 marks for Requirement 2) Boom Corp. was incorporated in 20X7. Its records show the following: 20X7 Pre-tax income (loss) Non-deductible expenses Depreciation for accounting purposes Depreciation for tax purposes Tax base of plant and equipment (note 1) Net book value of plant and equipment (note 1) Tax-free revenue Tax rate — enacted at year end 20X8 20X9 €0 0 25,000 25,000 225,000 225,000 €(1,700,000) 40,000 150,000 0 3,220,000 3,070,000 €900,000 14,50,000 250,000 500,000 2,770,000 2,870,000 4,000 38% 10,000 40% 12,000 45% Note 1: As calculated at year end after appropriate recognition of acquisitions and the yearly charge for depreciation, both accounting- and tax-based, respectively. Required 1. Present the lower portion of the 20X7 through 20X9 income statements. Assume that the likelihood of the tax loss carryforward realization is probable in all years. 2. Repeat requirement (1) assuming the likelihood of the tax loss carryforward realization is not probable in all years. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Question P17-13, page 998. Adapted with permission. Question 6 (18 marks) European Products Limited (EPL) is a large public company. Recently, the president issued a public letter to standard-setters and to the Securities Commission complaining about international tax standards. We at EPL are very concerned that our current operating performance and debt-toequity position are grossly misstated due to the international standards for accounting for income tax. These standards do not reflect the economic reality of our tax position. Our future income taxes balances arise because we are allowed to depreciate our plant and equipment far more rapidly for tax purposes than they actually wear out. Thus, deductible expenses for tax purposes exceed our book expenses. Last year, our tax expense exceeded taxes payable by €17.2 million. When combined with prior amounts, we have a cumulative difference of €190.6 million, and this difference is expected to continue to increase. We estimate that this year’s €17.2 million would not possibly be required to be repaid for at least 12 years — and perhaps never if we continue to expand. I understand that if we used partial allocation, we wouldn’t have to expense this amount at all this year. That approach seems far more realistic. We are also disturbed that discounting is not allowed for future tax amounts. If we had any other non-interest-bearing, long-term liability on our books, discounting would be considered appropriate. This inconsistency in the way supposedly analogous liabilities are treated highlights the fact that the future income tax liability is, in fact, different. Another complicating factor is the effect of tax rate changes. If the tax rate were to go up, and governments are notorious for increasing taxes, our income would decline by the effect of the tax rate change on all outstanding tax balances. This is despite the fact that we really don’t know when, if at all, we would have to pay the tax and what the tax rate will be in the future. Because our tax balances are large, the potential decrease in earnings would be material. Since we pride ourselves on stable earnings, and we believe our shareholders react positively to such a trend, this uncontrollable volatility is highly unwelcome. We urge international standard-setters and market regulators to take a second look at the standards governing accounting for corporate income taxes. Required Evaluate this statement, looking at both sides of each issue raised. Note: Your response should be written in essay format (not case analysis format) and limited to 1,000 words. Source: Thomas Beechy and Joan Conrod, Intermediate Accounting, Vol. 2, First Edition (Toronto: McGraw-Hill Ryerson, 2000), Case 16-1, page 938. Adapted with permission. Suggested solutions Question 1 (12 marks) Requirement 1 (4 marks) Year 1 Pre-tax accounting income ............. € 58,000 Prepaid expense .............................. (30,000) Taxable income (given) .................. 28,000 Tax rate ........................................... 30% Income tax payable ......................... € 8,400 Year 2 Year 3 Year 4 €70,000 10,000 80,000 35% €28,000 €80,000 10,000 90,000 40% €36,000 €88,000 10,000 98,000 40% €39,200 €28,000 €36,000 €39,200 (2,000) €26,000 (3,000) € 33,000 (4,000) € 35,200 Requirement 2 (6 marks) Income tax payable ......................... € 8,400 Change in future income tax See schedule, below .................. 9,000 €17,400 Tax basis Carrying Value Temporary Difference Future tax, ending Year 1 — 30% Ppd expense €0 €30,000 (€30,000) (€9,000) Year 2 — 35% Ppd expense 0 20,000 (20,000) (7,000) (9,000) 2,000 Year 3 — 40% Ppd expense 0 10,000 (10,000) (4,000) (7,000) 3,000 Year 4 — 40% Ppd expense 0 0 (4,000) 4,000 0 0 Future tax, beginning 0 Adjustment (€9,000) Requirement 3 (2 marks) Under the liability method, the entire effect of a change in tax rate on existing future income tax balances is reflected in income when the tax rate changes. This can distort income tax expense and earnings. Question 2 (13 marks) Requirement 1 (3 marks) 20X6 Accounts receivable Accounting carrying value (accounts receivable per books) € 20,000 Tax basis (no receivable recognized as no revenue recognized unless cash is collected) ................................... 0 Warranty liability Accounting basis (20X5 expense of €50,000, paid in 20X6) 0 Tax basis (no expense until paid) ....................................... 0 20X7 € 10,000 0 € (50,000) 0 The income tax rate before 20X5 was 30% (€6,000 / €20,000) Requirement 2 (9 marks) 20X7 € 140,000 Pre-tax accounting income ................................................................ Temporary differences Account receivable collection...................................................... Warranty expense ........................................................................ Taxable income.................................................................................. Tax rate .............................................................................................. Income tax payable ............................................................................ 10,000 50,000 200,000 0.40 € 80,000 Income tax expense Income tax payable ............................................................................ Change in future tax Accounts receivable ..................................................................... Warranty liability ......................................................................... Income tax expense............................................................................ € 80,000 (2,000) (20,000) € 58,000 Future tax Opening Tax Accounting Temporary (Liab)/Asset Balance Basis Basis Difference @40% (given) Adjustment 20X7 Accounts receivable Warranty 0 0 10,000 (50,000) (10,000) 50,000 (4,000) 20,000 (6,000) 0 2,000 20,000 The journal entry to record income tax for 20X7 is Income tax expense ........................................................................... Future tax asset — receivable ............................................................ Future tax asset — warranty ............................................................. Income tax payable ...................................................................... 58,000 2,000 20,000 80,000 Requirement 3 (1 mark) Future tax asset (current) (€20,000 – €4,000).................................... € 16,000 Question 3 (21 marks) Requirement 1 (16 marks: In the schedule below, 4 marks each for 20X5 income tax payable and for 20X6 income tax payable; 2 marks each for future income tax balances) 20X5 20X6 Income tax payable (A) ...................................................... € 206,800 cr Future tax liability, long-term (B) ...................................... 611,200 cr Future tax asset, short-term, net (C) ................................... 18,000 dr € 477,540 cr 560,700 cr 22,260 dr Calculations (A) Income tax payable 20X5 Profit (excluding ex. item) ......................................... Permanent differences Golf dues .............................................................. Tax penalties ........................................................ Temporary differences Warranty expense ................................................ Warranty claims paid ........................................... Depreciation (accounting) ................................... Depreciation (tax) ................................................ Percentage-of-completion income ....................... Completed contract income ................................. Tax payable (40%, 42%) ........................................... 20X6 € 625,000 € 8,000 3,000 9,000 1,000 22,000 (16,000) 287,000 (395,000) (17,000) 0 € 517,000 € 206,800 Gain on disposal of non-current asset ........................ Tax-free portion ................................................... Taxable portion .................................................... Tax payable on gain ............................................. 0 0 0 0 Total tax payable........................................................ € 206,800 916,000 41,000 (50,000) 309,000 (116,000) (10,000) 27,000 € 1,127,000 € 473,340 14,000 (4,000) 10,000 4,200 € 477,540 (B) Future tax liability Tax Basis Carrying Value Temp. Diff. Future Tax Liability @.40 @ .42 Opening Balance Adjustment Property, plant and equipment 20X5 € 461,0001 € 1,989,0002 € (1,528,000) € (611,200) € (497,000) € (114,200) 20X6 345,0003 1,680,0004 (1,335,000) (560,700) (611,200) 50,500 Warranty 20X5 20X6 0 0 (62,000)5 (53,000)6 % of Completion 20X5 0 20X6 0 17,000 0 62,000 53,000 24,800 22,260 19,600 24,800 5,200 (2,540) (17,000) 0 (6,800) 0 0 (6,800) (6,800) 6,800 1 2 3 €856,000 – € 395,000 €2,276,000 – € 287,000 €461,000 – €116,000 4 5 6 €1,989,000 – €309,000 €56,000 + €22,000 – €16,000 €62,000 + €41,000 – €50,000 (C) €24,800 (above) – €6,800 (above) = €18,000 €22,260 above Requirement 2 (5 marks) 20X6 Income before tax .............................. Income tax expense (D) current (E) .................................... future (F) ...................................... Income before gain on disposal of non-current asset................ Gain on disposal of non-current asset, net of tax (G) ................ Profit ............................................ (D) Income tax payable ...................... Less: tax related to gain on disposal of non-current asset (€14,000 – €4,000) 0.42 ........... Plus/minus change in future tax: Property, plant, and equipment .... Warranty ...................................... % of completion ........................... 20X5 € 916,000 € 473,340 (54,760) 418,580 € 625,000 € 206,800 115,800 322,600 497,420 302,400 9,800 € 507,220 — € 302,400 € 477,540 cr € 206,800 cr 4,200 dr 50,500 dr 2,540 cr 6,800 dr € 418,580 0 114,200 cr 5,200 dr 6,800 cr € 322,600 (E) €477,540 – € 4,200; income tax payable (€206,800) for 20X1 (F) – (€50,500 – €2,540 + €6,800); for 20X1, €114,200 + €6,800 – €5,200 (G) €14,000 – [(€14,000 – €4,000) 0.42] Question 4 (16 marks) Requirement 1 (2 marks) Taxable loss Accounting loss ................................................... Add back: depreciation ........................................ Taxable loss ......................................................... € (320,000) 45,000 € (275,000) Requirements 2, 3, and 4 (3 marks) The loss carryback will be €216,500, resulting in a refund of €54,300 (1 mark). This leaves €58,500 (€275,000 – €216,500) as a tax loss carryforward. The benefit of this tax loss carryforward is €23,400 at 20X8 tax rates of 40% (1 mark). The tax loss can be recorded as an asset if it is probable that the company will realize the tax loss carryforward in the carryforward period (1 mark). Requirement 5 (4 marks) Income tax receivable ................................................ 54,300 Future income tax (LCF) ........................................... 23,400 Future income tax (€562,000 – €580,000)*............... 18,000 Income tax expense (recovery) ............................ * €4,970,000 – (€6,420,000 – €45,000) = (€1,405,000) 0.4 = €562,000 vs. €580,000 opening 95,700 Requirement 6 (3 marks) Income tax receivable ................................................ Future income tax ...................................................... Income tax expense (recovery) ............................ 54,300 18,000 72,300 Requirement 7 (4 marks) (a) LCF has been recorded Income tax expense (€100,000 0.4) .................. Future income tax (LCF) ............................... Income tax payable (€41,500 0.4) .............. (b) LCF has not been recorded Income tax expense.............................................. Income tax payable ....................................... Income tax payable .............................................. Income tax expense — LCF recognition ....... 40,000 23,400 16,600 40,000 40,000 23,400 23,400 Question 5 (20 marks) Requirement 1 (15 marks: 5 marks for calculation of taxable income/loss; 4 marks for calculation of future income tax; 4 marks for calculation of income tax expense; and 2 marks for income statement format) 20X7 20X8 20X9 Income before income tax ......................................... € — € (1,700,000) € 900,000 Income tax expense (recovery) .................................. (1,520) (668,080) 338,400 Profit .......................................................................... € 1,520 € (1,031,920) € 561,600 Taxable income (in thousands) 20X7 Income before income tax ......................................... € Plus/minus: Non-deductible expenses ........................................... Non-taxable revenues ................................................ Plus/minus: Excess of tax versus accounting depreciation ........... Taxable income (loss) ................................................ Tax payable ................................................................ — 20X8 € 20X9 (1,700) € 900 — (4) 40 (10) 50 (12) — (4) n/a 150 (1,520) n/a € (250) 688 309.6 Schedule of Temporary Differences (amounts in thousands) Future Tax basis Accounting Temporary basis difference (in 000s) 20X7 — 38% Property, plant, and equipment € 225 € 225 LCF 20X8 — 40% Property, plant, and equipment 3,220 3,070 LCF € 0 4 € 0.00 1.52 150 1,524 20X9 — 45% Property, plant, and equipment 2,770 2,870 LCF 1 income tax (100) 8361 Opening balance Adjustment € 0 0 € 0.00 1.52 60 609.6 0.00 1.52 60.00 608.08 (45) 376.2 60.0 609.6 (105) (233.4) €1,524,000 – €688,000 = €836,000 Entries (not required) 20X7 Future income tax (LCF; €4,000 0.38) ................... Income tax expense (recovery) ............................ 1,520 20X8 Future income tax (TDs; see above) .......................... Future income tax (LCF; see above) ......................... Income tax expense (recovery) ............................ 60,000 608,080 20X9 Income tax expense.................................................... Future income tax (TDs) ...................................... Income tax payable (€688,000 0.45) ................ Income tax payable (€688,000 0.45) ...................... Future income tax (LCF) ..................................... Income tax expense (LCF; rate change)* ............ 414,600 1,520 668,080 105,000 309,600 309,600 233,400 76,200 * €1,524,000 (0.40 – 0.45) Requirement 2 (5 marks) 20X7 Income (loss) before income tax.................... Income tax expense (recovery)* .................... Profit ................................................... € € 0 — — € 20X8 € (1,700,000) (60,000) (1,640,000) € 20X9 € 900,000 105,000* 795,000 * €414,600 – €309,600; components may be disclosed separately. 20X7 no entry; likelihood of tax loss carryforward realization is not probable. 20X8 Future income tax (TDs; see above) .......................... Income tax expense (recovery) ........................... 20X9 Income tax expense.................................................... 60,000 60,000 414,600 Future income tax (TDs) ...................................... Income tax payable (€688,000 0.45) ................ Income tax payable (€688,000 0.45) ...................... Income tax expense (recovery)(LCF) .................. 105,000 309,600 309,600 309,600 Question 6 (18 marks) Note: Students do have to cover all the points or issues. Up to 6 marks each are to be awarded for an appropriate answer. Issues raised: 1. Probable non-reversal of temporary differences. The president is viewing his plant and equipment as one amount, and points out that if these assets grow indefinitely, temporary differences will not reverse. This is true. However, for each individual asset, future income tax does reverse by the time the asset is sold or retired. This reversal may not be visible when it is masked by new originating temporary differences from new assets. The assertion that temporary differences do not reverse is simply not true. Accounts payable are repaid and replaced by new accounts payable when new inventory is bought: their relative permanence on the balance sheet is no argument that they should not be recognized. The future is uncertain. Who is to say that circumstances for this company will never change? Past growth does not guarantee future growth. Tax rules could also change to affect the rate and nature of reversals. Accounting cannot be based on uncertain future predictions. 2. Partial tax allocation The president is correct in saying that, under partial tax allocation, the company’s temporary differences would not have to be recognized. Under partial allocation, it might be suggested that the company need only recognize temporary differences that will reverse in say, the next five years. The danger is in the potential for error and bias in estimating reversals over the next five years. If the financial position were consistently misstated due to such bias, the credibility of the accounting model would be seriously hurt. 3. Discounting The conceptual arguments in favour of discounting are very appealing. If the future income taxes are to be classified as a liability, then to be consistent with the accounting practices for other low-interest or non-interest-bearing debt, discounting should be used. Discounting would also have the happy effect of decreasing the size of the future income tax amounts on the balance sheets. Future income would be decreased by the annual interest recognized, and the liability would grow over time because of the interest accrual. Unfortunately, discounting is not a practical alternative. In order to be workable, the discount rate and the stream of cash payments has to be established in a relatively objective fashion. In the case of future income tax, the appropriate discount rate to use is not clear, and the cash flow stream is dependent on various assumptions about the reversal of temporary differences.