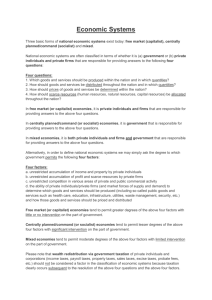

Economic Development: Essay Outlines by Students Independent

advertisement

Economic Development: Essay Outlines by Students Independent SEA states experienced unqualified success in their economic development. Discuss with the period 1946-1997 Intro: Economic development refers to economic growth, nationalization and equity. Unqualified success refers to absolute success with regards to achieving all three goals concurrently, especially economic growth and equity. As all SEA states experienced extensive government intervention into the economy, the extent of success depends heavily on the success of government intervention. 1. Capitalist Economies vs Socialist Economies: - Average annual GDP growth rates of capitalist economies from 1961-1997 were much higher than socialist economies (Singapore - 8.3% vs Burma – 4.3%) hence demonstrating that only capitalist economies experienced far more success than socialist economies, thus only capitalist economies can be said to have experienced unqualified success if any. Why Socialist economies did not experience any success in terms of economic growth, much less unqualified success. I. Ideology and aims of economic development affected the nature of government intervention. Socialist economies valued equity over growth; capitalist economies prioritized economic growth. In their pursuit of equity, this often came at the expense of efficiency and growth. As a result, agricultural productivity fell and thus slower growth rates since the government were dependent on agricultural production and export. Burma: Tenancy Law in 1965 abolished tenancy and re-distributed land to farmers, especially the poor who were equipped with neither skills nor expertise thus grain productivity stagnated at 31 baskets per acre Vietnam: Private rice sales were forbidden and collectivisation was enforced in 1978, thus washing out the incentive for efficient production. II. Socialist economic rationale underlying intervention Government intervention in the socialist economies were ideologically driven thus led to the focus on heavy industry despite having a comparative advantage in agriculture. The lack of sound economic rationale precipitated slower growth because of the lack of expertise and resources in heavy industries which were complex industries. Burma: Under Ne Win, manufacturing rose by 25% while state investments in agriculture dropped during the period 1962 – 1973, rice exports fell by more than 1300 thousand tons without a similar increase in the exports of heavy industries. Vietnam: 1st and 2nd Five Year Plans prioritized heavy industry over agriculture, this saw agriculture productivity stagnate (18.7% achieved vs 50% target) thus by the late 1970s, Vietnam was in economic crisis due to shortages in grain and food. 2. III. Explaining Differing Extents of Success amongst Capitalist Economies SEA states managed to achieve success in terms of nationalization and ensuring that SEA states had full autonomy on strategic resources that were once controlled and exploited by colonial powers and foreign immigrants. Indonesia: Under Sukarno’s Guided Democracy, he confiscated Dutch and Chinese property and nationalised businesses in 1957. Philippines: ‘Filipino First’ policy through the implementation of the Anti-Chinese Retail Trade Nationalisation Act in 1954 and the Congress Bill in 1958 which stated that important industries had to be 60% owned by natives. However, while there were short run benefits, nationalization generally failed in the long run due to forms of cooperation between indigenous and non-indigenous businessmen and politicians. This came in the form of a sleeping indigenous partner who fulfilled the requirements on the surface. Indonesia: The Cukong system allowed big conglomerates and the Chinese businessman to continue their domination of the economy. (4% of the population but controls 73% of the economy) Philippines: Any apparent success was reversed in Marcos’ New Society where the Chinese were viewed as valuable political and economic allies, such as Lucio Tan Chairman of Fortune Tobacco Co. IV. SEA states achieved unqualified success in terms of economic growth by courting foreign investments and aid to overcome the lack of domestic capital Singapore: Singapore’s transition to EOI was financed by foreign capital and foreign investment in manufacturing sector rose 24 times during the period 1965-1970. Philippines: Martial law under Marcos attracted foreign investment opened up all sectors and foreign borrowing also greatly extended in the late 1970s and the 1967 Investment Incentive Act was meant to encourage foreign investment in industrial development. V. SEA states achieved unqualified success in terms of higher economic growth by pursuing diversification and developed its manufacturing and industrial base thus reducing the volatility of its initial dependence on primary products. Indonesia: ISI under the “bunteng” programme stabilized banks like the State Industrial Bank thus facilitating the growth of industrial businesses and expanded manufacturing by 13.4% to 27% of total exports from the period 1953-1957. Share of non-oil exports also increased from 31-50% of total exports. Malaysia: ISI was achieved through policies like the Pioneer Industries Programme of 1958 incentivized formation of new industrial firms successfully resulting in the establishment of 146 “Pioneer firms” by 1968 and also extended protectionist policies to protect their domestic manufacturing and industrial firms, thus manufacturing as a percentage of GDP increased from 11.1 - 17.1%. VI. SEA States achieved unqualified success in terms of sustained economic growth by creating a competitive and efficient economy for successful EOI to take place. This can only be achieved with the decline of state intervention in terms of inefficient state corporations and excessive intervention would prove to be a disincentive for foreign investments. Singapore: Government intervention was limited to stimulating private capital and via EDB compensate for the lack of industrial expertise and to provide long term loans. Furthermore, it helped to encourage EOI with numerous export incentives. Thailand: 6th Five Year Plan (1987) transformed the public sector into a planner, supporter and facilitator of private sector and participation was limited to eliminating inefficient state corporations such as NESDB in 1988. VII. The success of economic development in SEA states largely depended upon the principles of governance which affected the outcome of government policies. Where principles of governance were based on political criteria and cronyistic, governments in some capitalist countries participated extensively for their self interests which limited the extent of economic success. This led to the failure of several government policies such as attempts to create a competitive economy for EOI in order to achieve sustained economic growth. Furthermore, the principles of governance can also create new problems for the countries thus it is not unqualified success. Philippines: Vested interests and cronyism precluded the implementation of necessary reforms towards a competitive export economy. Marcos bailed out Benedicto’s sugar empire with 14 billion pesos despite the collapse in sugar prices in the 1970s, which led to complacency and the lack of incentive to produce efficiently. Furthermore, this was coupled with extensive overborrowing from foreign sources and the mismanagement of these funds, which were often invested in bankrupt government entities and structures that were not income generating. As a result, by the end of Marcos’ era, Philippines was nursing one of the world’s largest debts, much less move to EOI. Indonesia: Despite attempted deregulation, the highly protected automobile industry continued to be dominated by Soerjadjaja and Liem Sioe Leong, such that tariffs reached 300% in the 1990s and indonesia never developed efficiency in producing engines for the industry due to rampant cronyism and self-interest.The result was that Indonesia remained dependent on export earning from primary commodities where export earnings from primary commodities remained at 70-80%. In contrast, the same cannot be said for transparent governments whose decisions were based on sound economic rationale to achieve high and sustained economic growth, by allowing the successful transition to EOI and diversification. Conclusion: It is incorrect and inaccurate to make any generalizations about every SEA country. Firstly, it is impossible to say that socialist countries enjoyed any success in economic development except in terms of equity, much less unqualified success. Furthermore, though capitalist countries were generally more successful in attaining economic growth, the extent of success differs from country to country. The extent of economic growth in Indonesia and Philippines were largely limited due to excessive government intervention and poor principles of governance that explains their inability to achieve high levels of economic growth, evident as Singapore averaged annual GDP growth rate of 8.3% as compared to the Philippines, which averaged a mere 3.9% in the same time period. The unsustainability of these countries in achieving sustained economic growth is evident in the 1997 AFC where the lack of sound principles of governance created a myriad of problems. Hence, in conclusion socialist countries and this group of capitalist countries though enjoyed a small degree of success in economic development, it would be highly inaccurate to say unqualified success. The only countries who can hope to have had unqualified success are Singapore and Malaysia. NJC (4) “An economic miracle” How accurate is this statement with reference to SEA economies in the post-independence era? Introduction: Economic miracle can be defined as unprecedented success of the SEA governments in achieving economic growth, economic nationalism as well as a form of equity in society as compared to the pre-independence era. 1. The statement is accurate as seen in the success of capitalist economies in achieving high levels of economic growth despite early challenges - Following the immediate period after independence, there were a multitude of challenges to such economies, including the lack of expertise as well as the lack of technology required to stimulate growth. Despite that, SEA economies, most prominent those capitalist in nature, were still able to overcome such challenges and achieve high economic growth rates Case Study 1: Indonesia Under the New Order, GDP growth rates doubled from 3.9% -7.6% During the ISI phase, rice production rates grew at 50%, which was unparalleled in Asia This was despite the lack of a strong domestic bourgeoisie that stemmed from the exploitative nature of Dutch colonial rule pre-independence Case Study 2: Singapore Averaged GDP growth rates were at 8.5%, which was among the highest in the region Transition to EOI was one of the earliest amongst the SEA economies 2. At the same time, socialist economies were further able to achieve high and unprecedented rates of economic growth in the later years - As socialist economies were forced to open and pursue an outward looking approach in the later years, this observed high and unparalleled rates of economic growth Case Study 1: Vietnam When Vietnam opened their economy with the Doi Moi reforms in 1986, this led to highly unexpected rates of economic growth, with GDP rates doubling from 3%-6% and total trade volume from 1 billion to 2 billion Furthermore, this was accompanied with high growth rates averaging at 8.2% a year, which was a sharp contrast to the economic stagnation under the 5 Year Plans 3. The statement is further accurate as SEA countries were able to liberate their economy from foreign dominance - SEA economies were largely controlled by the colonial powers preindependence, and their success in removing foreign control over the economy despite long term reliance on such can be perceived as a “miracle” Case Study 1: Burma Allocated 60% of import controls to locals and imposed the Land Tenancy Law in 1965 to encourage greater local participation in the economy Adopted anti-Indian policies etc. to remove foreign influences in the economy Case Study 2: Philippines The Philippines economy was heavily dependent on US aid and patronage, and US policies such as Bell Trade Act resulted in strong US control over the Philippines economy Despite this, Philippines still took measure to liberalize their economies, as seen when Congress passed a bill that made it compulsory for all important industries to be at least 60% owned by locals 4. Growth in such economies were not a “miracle”, but rather can be attributed to the establishment of strong macroeconomic policies by the government - While the word “miracle” suggests that the strong economic performance was highly improbable and unexpected, this was hardly the case as it was a more of a result of strong government intervention to achieve such success Case study 1: Indonesia High growth rates were a result on the immediate focus on economic development under the New Order. Suharto’s focus on FDIs and external aid, as seen in the establishment of the 1967 Foreign Investment Law and the end of Konfrontasi to promote economic ties were largely able to draw in technology and capital required for the development of industries Also, strong central control by the government in the economy was able to compensate for the lack of expertise. Through the Berkeley Mafia, strong domestic economic policies were drafted while SOEs such as Pertamina directly led industrialization In comparison to the poor economic policies under Sukarno, which resulted in a high national debt and hyperinflation of over 600% in the economy, the role of the government was significant in determining the success of the economy 5. Not so much a miracle in socialist economies, which were unable to achieve economic growth but instead experienced a stagnant and lackluster economy - Unlike capitalist economies, socialist economies were largely unable to achieve economic growth especially in the initial years where it was focused more on achieving a degree of nationalism and equity Case Study 1: Burma Pursued an extreme degree of nationalism, choosing to adopt a closed and inward looking economic outlook This aversion to FDIs and export oriented growth observed economic stagnation with 2% export growth. Rather, the economy’s focus on industrialization was a failure, and remained largely dependent on primary production, as agriculture constituted 57.3% of its overall GDP 6. Furthermore, it was hardly a miracle as strong economic performance was not sustained but problems started to emerge - It was not so much an economic miracle in the long term as the initial strong economic performance of such SEA economies gave way to emerging problems such as the burden of a large external debt, a dependent private sector as well as cronyism that bred inefficiency within the economy Case Study 1: Indonesia Despite the high levels of economic growth in the initial years, there were emerging problem in the economy in the later years, as the mismanagement of FDIs and external debt resulted in the accumulation of a $58 billion foreign debt, which was one of the largest in the world Furthermore, the economy became overly reliant on oil production, with oil revenue constituting 82% of its GDP at a period of time. This resulted in severe economic fluctuations during the fall in the oil prices in the 1970s Case Study 2: Philippines Elite dominance of the economy resulted in patron client relations as well as cronyism in the economy, as seen when Marcos abused 14 billion pesos to bail out the Sugar Commission when prices of sugar fell. This bred inefficiency and complacency, and the risky credit loans were detrimental to the economy in the long run Q: “An economic miracle”. How accurate is this statement with reference to Southeast Asian economies in the post-independence era? Introduction ● “Economic Miracle”: A period of high, rapid growth. This label also takes into account how countries were still able to succeed despite circumstances which may have worked to their disadvantage. ● SEA countries can be classified under two general categories: capitalist and socialist. The label of “economic miracle” better describes the capitalist states as they were generally more successful at achieving economic growth than the socialist states, which directed most of their efforts towards achieving equity. ● Among the capitalist countries, there were varying degrees of successful economic development. The “economic miracle” label appears to be more applicable to countries with sound principles of governance of transparency, such as Singapore, which experienced higher growth. Economic growth in capitalist countries 1. SEA countries overcame obstacles in the immediate post-independence context like a rough transition from colonial powers and inexperienced leaders to forge successful economic plans that created a solid foundation for economic growth. a. E.g. Singapore: Singapore utilized entrepot trade to its advantage following an unprecedented separation, focusing on investments and human capital development. Under Goh Keng Swee, the Development Plan from 1960-1964 was formed and foreign investment in manufacturing rose by 24 times before 1970. b. E.g. Thailand: Upon the end of the Japanese Occupation, Thailand expanded its irrigation land from 600 000 hectares to 2.2 million hectares by 1969, hence creating a stable agricultural system in which the export value for crops exceeded that of rice for the first time. 2. An “economic miracle” is accurate to the extent that many capitalist countries employed protectionist policies that were extremely successful in developing fledging domestic industries that were vital to the country’s transition to the ISI stage. a. E.g. Philippines: Import restrictions and foreign exchange controls that were extended to new industries led to rapid industrialization, and an expansion of manufacturing from 8% to 20% of Philippines’ GDP from 1950-1960. b. E.g. Malaysia: Pioneers industries programme in 1958 focused on processing and other consumables, leading to a 10% increase in consumption goods 3. “Economic miracle” is accurate as some capitalist countries were successful in transiting into the EOI stage which entailed export promotion, foreign investment, privatization an diversification of policies from the inward-looking ISI policies. a. E.g. Singapore: Singapore diversified into technology and services from manufacturing after 1979 with the establishment of the Government Investment Corporation (GIC) and Singapore Technologies Corporation (STC). Additionally, Singapore set up a SG$1b Cluster Fund to fund domestic and regional projects to promote Singapore as a “total business centre”. This led to strong average growth of 8.3% from 1961 to 2001. b. E.g. Malaysia launched “Malaysia Incorporated” in 1983 in a bid to privatize and promote public-private sector joints, alongside the 1986 Promotion of Investments Act which granted new incentives to foreign capital involved in export-oriented sectors. 4. “Economic miracle” is apt because wealth was successfully indigenized. This allowed for the control of vital resources and lucrative commodities. a. E.g. Indonesia: Nationalisation of oil through Pertamina, nationalised agriculture through Bulog which controlled price floors and ceilings of rice and food crops. b. E.g. Malaysia: PETRONAS, Malaysia Mining Corporation. c. E.g. Singapore: Singapore Petroleum Company 5. “Economic miracle” is apt because economic stability was achieved despite instances of political instability - an unusual circumstance. a. E.g. Thailand in particular was still able to succeed despite government inadequacies b. E.g. Economic growth proceeded in Malaysia despite the 1969 racial riots when Martial Law was imposed for two years. In fact, the racial riots created an impetus for equitable economic growth as emphasized in the 1971 New Economic Policy which was eventually successful in transiting Malaysia into the ISI phase. 6. “Economic miracle” is apt because governments were able to increase the level of FDI in their countries through policies, contributing to growth. a. E.g. Indonesia: Financial deregulation in the 1998 October Reform package boosted investor confidence. FDI increased 6-fold from 1980-1990. b. E.g. Vietnam: Under the 1986 Doi Moi reforms, measures to boost FDI included allowing wholly foreign owned companies in all sectors except defense. Consequently private sector growth increased from 10% to 25% from 1986-1990. Counter arguments 1. “Economic miracle” did not occur in countries that emphasized equity over economic growth. a. E.g. Burma: 1965 Tenancy Law abolished tenancy, established state as the owner of the land and redistributed it to farmers, especially the poor. Because the poor lacked the capital and the expertise to develop the land, such a policy while equitable, led to declining productivity, causing rice exports to fall from 1521 to 204 thousand baskets from 1962-1973, hindering growth b. E.g. Vietnam: Land collectivisation before 1974 had resulted in labour productivity and stagnation in output expansion - after grain output peaked at 7 million tons, it failed to exceed 6.5 million throughout the 1970s. 2. “Economic miracle” label is not apt as the growth experienced in some capitalist countries was dampened when political criteria replaced economic criteria, resulting in allocatively inefficient decisions being made, hindering growth. a. E.g. Indonesia: When Bank Dutta (70% owned by the Suharto family) made losses from its foreign exchange position held on behalf of a client, Suharto simply had his cronies bail it out. The failure to hold firms accountable for their losses removed the incentive for efficient production, and further strained the government budget. Additionally, extremely high tariffs (300% on vehicle parts imports) to protect the automobile industry dominated by Liem Sioe Leong and Soeryadjaya meant that domestic companies like Indomobil and Astra were extremely reliant on the government to survive. b. E.g. Philippines: When sugar prices rose in 1980, the cost was not passed on to Marcos’ crony, Roberto Benedicto, owner of the Philippines Sugar Commission. This cost the government a hefty 14 billion pesos, and contributed to its already swelling debt and declining economic situation. Hence, substituting political criteria for economic criteria had a damaging effect. This is even more evident when considering that the Philippines had one of the strongest headstarts to economic development in SEA, but by the 1990s such mismangement of wealth had led it to become SEA’s worse performing economy. Conclusion “Economic Miracle” is more applicable to the capitalist countries which made deliberate efforts to achieve growth and were therefore generally more successful. However, among the capitalist countries the label is less applicable across time and across different countries as problems such as substituting political for economic criteria dampened the extent of growth, and negated the “miraculous” growth of the initial period. The Philippines is the most extreme case, where GDP fell as low as 1% in the 1980s despite its strong start. Based on this criteria, only Singapore warrants the label of an “economic miracle”. Yet bearing in mind that some countries like Thailand and Malaysia succeeded despite the difficult circumstances faced such as government inadequacies and social instability, they therefore qualify to earn the title as well. Therefore the accuracy of the statement is partially dependent on the criteria one uses to define “economic miracle”.