change in profit-sharing ratio - e-CTLT

advertisement

Presentation

On

Admission of a Partner

PREPARED BY:

NAVDEEP KAUR

PGT COMMERCE

KV 2, PATHANKOT

ADMISSION OF A PARTNER

Admission of a partner means reconstitution of the firm

because with admission of a partner, the existing

agreement comes to an end and a new agreement among

all the partners (including incoming or new partner) comes

into effect. The capital contribution by the new partner, his

share of profits and other conditions are agreed upon. The

new partner on joining becomes liable for the liabilities of

the firm and entitled to assets and profits of the firm.

Section 31 of the Indian Partnership Act, 1932 provides

that a new partner shall not be inducted into a firm without

the consent of all the existing partners, unless it is a

agreed otherwise by the partners in the Partnership Deed.

Thus, a new partner can be admitted into a partnership

firm with the consent of all the partners.

Effects of Admission of a Partner

The effects of admission of a new partner are:

1. The old partnership comes to an end and new

partnership comes into existence.

2. New or Incoming partner becomes entitled to share

future profits of the firm and the combined share of the

old partners gets reduced.

3. New or Incoming partner contributes an agreed

amount of capital to the firm.

Adjustments made on the Admission of a Partner

1. Change in the profit-sharing ratio.

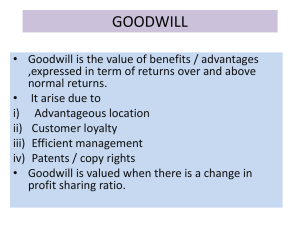

2. Goodwill.

3. Adjustment of accumulated profits, reserves and

losses.

4. Adjustments of capital (if agreed).

CHANGE IN PROFIT-SHARING RATIO

The new or incoming partner is entitled to a share in the

future profits of the firm. In effect, there will be a change in

the old profit-sharing ratio. Since, the new or incoming

partner acquires his share from the old partners,

therefore, it becomes necessary to determine the new

profit-sharing ratio and also the sacrificing ratio.

New Profit-Sharing Ratio

The new profit-sharing ratio is the ratio in which all the

partners, including the new or incoming partner, share the

future profits and losses o the firm.

1. In their old profit-sharing ratio; or

2. In a particular ratio or the surrendered ratio; or

3. In a particular fraction from some of the partners.

Let us now discuss each of the above cases in detail.

Case 1: When a new or incoming partner acquires his

share from the old or existing partners in their old profitsharing ratio.

In such a situation, the share of the new partner is given

and it is assumed that the new partner has acquired his

share from the old partners in their old profit-sharing ratio.

The old partners, therefore, continue t share the balance

profits or losses in their old profit-sharing ratio. In other

words, unless otherwise agreed, the profit-sharing ratio

among the existing partners remains unchanged. The new

profit-sharing ratio among all the partners is determined

by deducting the new or incoming partner’s share from 1

and then dividing the balance in old profit-sharing ratio of

the old partners.

Illustration 1 A and B are partners sharing profits in the

ratio of 5 : 3. C is admitted for 1/4th share in the profits.

Case 2: When a new or incoming partner acquires his

share from the old or existing partners in a particulars

ratio.

If new or incoming partner acquires a part of share of

profits from one partner and a part of share of profits form

another partner. In such a case, the existing partner’s

profit-sharing ratio will change to the extent of share

sacrificed on admission of the new or incoming partner.

The existing partner’s share of profits in the reconstituted

firm is determined by deducting the sacrificed made from

the existing share of profits.

Illustration: A and B are in partnership sharing profits and

losses in the ratio of 5 :3. C is admitted as a partner for

1/5th share which he takes 1/10th from A and 1/10th form B.

Calculate the new profit-sharing ratio of the partners.

Sacrificing Ratio

Sacrificing Ratio is the ratio in which the told or existing

partners forego, i.e., sacrifice their share of profit in

favour of the new or incoming partner. Thus, Sacrificing

Ratio can be defined as the ratio in which the new partner

is given the share by the old partners. This share may be

given to the new or incoming partner by all the old

partners equally or by all or some of the partners in

agreed share.

Let us discuss how the sacrificing ratio is determined.

1. When share of a new partner is given without giving the

details of the sacrifice made by the old partners.

2. When the old ratio of the old partners and the new ratio

of all the partners if given; and

3. When the new or incoming partner acquires his share

by surrender of a particular fraction of shares by old

partners.

Situation 1: When share of a new or incoming partner is

given without giving the details of the sacrifice made by

the old or existing partners.

In this situation, it is assumed that the old partners make

sacrifice in their old profit-sharing ratio. Therefore, the

sacrificing ratio is always in the old profit-sharing ratio.

Illustration:- (Partners make sacrifice in the old ratio). A

and B are partners sharing profits in the ratio of 3:1. C is

admitted into partnership for 1/8th of the profits. Calculate

the sacrificing ratio and the new ratio.

Solution:- Since, C’s share is given without mentioning as

to what c acquires from A and B separately, It is assumed

that c takes it from the partners in their old-profit sharing

ratio. Therefore, the sacrifice made by A and b is in the

ratio of 3:1.

Situation 2: When the old ratio of the old or existing

partners and the new ratio of all the partners are given.

In this situation, sacrificing ratio of the old partners is the

difference between old ratio and the new ratio, i.e, it is

calculated by deducting the new share from the old share

of the old partners.

Illustration: (New ratio of all partners are given). A and B

are partners sharing profits in the ratio of 3:2. C is

admitted into partnership. The new-profit sharing ratio

among A.B and c is 5:3:2. Find out the sacrificing ratio.

Situation: When the new or incoming partner acquires the

share by surrender of a particular fraction of shares by

old partners.

In this situation, shares surrendered by the old partners in

favour of a incoming partner are added. It is the share of

the new partner. The share surrendered by the old partner

is deducted from his old share to determine the share of

new or incoming partner in the reconstruction firm.

Illustration:- (Old partners surrender a particular fraction

of their shares in Favour of a new Partner). A and B are

partners in a firm sharing profits and losses in the ratio of

5:3. A surrenders 1/20th of his share, whereas b

surrenders 1/24th of his share in favour of c, a new partner.

Calculate the new profit-sharing ratio and the sacrificing

ratio.

Distinction between Sacrificing Ratio and new ProfitSharing Ratio

Basis

Sacrificing Ratio

New Profit-Sharing Ratio

1. Meaning

It is the ratio in which the old

partners agree to sacrifice their

shares in profits in favour of a new

partner.

It is the ratio in which all

partners including the

incoming partner share

the future profits and

losses.

2. Related Partners

It is related to the old partners only.

It is related to all partners

including the new partner

3. Calculation

Sacrificing Ratio=Old Ratio-New Ratio

TREATMENT OF GOODWILL

AS-26 prescribes that goodwill be recorded in the books

only when consideration in money or money’s worth has

been paid for it, i.e., goodwill is purchased. Thus in case of

admission or retirement/death of a partner or in case of

change in the profit-sharing ratio among partners,

goodwill, should not be raised in the books of the firm

because no consideration in money or money’s worth is

paid for it. If any partner brings any premium over and

above his capital contribution at the time of his admission,

such premium should be distributed among the existing

partners in their sacrificing ratios.

If goodwill is evaluated at the time of change in the

constitution

of

the

firm

(by

way

of

admission/retirement/death/change in profit-sharing ratio),

the goodwill should not be brought in books since it is

inherent goodwill. The value of goodwill should be

adjusted through partners capital accounts.

1. Goodwill (premium for goodwill) paid privately: when

goodwill premium is paid privately (i.e.. Outside the

business) by the new or incoming partner to the old

partners, no entry is recorded in the banks of accounts.

2. Goodwill/Premium for goodwill brought in cash by the

new or incoming partner and retained in the business:

when the new partner brings cash for his share of

goodwill, it is transferred to the capital accounts of the

sacrificing partners. In other words, the amount of

goodwill brought in by the partner is shared by the

sacrificing partners in their sacrificing ratio.

Illustration:- A and B are partners in the firm sharing profit

in the ratio of 3:2. A and B surrender 1/2th of their

respective shares in favour of C. C is to bring his share of

premium for goodwill in cash. The goodwill of the firm is

estimated at rs40,000. pass the necessary journal entries

for recording of the goodwill in the above case.

Solution:JOURNAL

Date

Particulars

Cash A/c

Dr….

To Premium for Goodwill A/c

(Being the share of premium brought in cash by

C)

Premium for Goodwill A/c

To A’s Capital A/c

To B,s Capital A/c

(Being the distribution of premium among old

partners in their sacrificing ratio, i.e., 3:2) (Note)

L.F.

Dr.

cr

20,000

20,000

20,000

12,000

8,000

3. Premium for Goodwill (Goodwill) brought in Kind: New

or incoming partner may bring his share of premium for

goodwill in the form of assets. In this situation, the value of

assets brought in is debited and premium for goodwill or

goodwill account is credited for his share of goodwill

besides crediting the new partner’s capital account for his

capital. Thereafter, premium (Share of Goodwill) is

transferred to the capital accounts of the sacrificing

partners in their sacrificing ratio.

Accounting Entries

For assets brought in by the new partner:

Assets A/c

To New partner’s capital

To Premium for Goodwill A/c

For giving credit of goodwill to sacrificing partners in their

sacrificing ratio:

PREMIUM FOR GOODWILL A/C

To Sacrificing Partner’s Capital A/cs

Illustration:- (Premium brought in Kind). X and Y are

partners in a firm sharing profits in the ratio of 3:2. on 1st

April, 2012, they admit Z as a new partner for 3/13th share

in the profits. The new ratio will be 5:5:3. Z contributed the

following assets to his capital and his share for goodwill:

stock rs80,000. debtors rs1,20,000; Land rs2,00,000; Plant

and Machinery rs1,20,000. on the date of admission of Z,

goodwill of firm was valued at rs10,00,000. record the

necessary journal entries in the books of the firm on Z’s

admission.

Solution

Date

2012

April

Particulars

L.F.

Dr.

Stock A/c

…..Dr

Debtors A/c

…..Dr.

Land A/c

…..Dr.

Plant and Machinery A/c

…..Dr.

To Z,s Capital A/c

To Premium for Goodwill A/c (WN 1)

(Being the assets contributed by Z on his admission

as his capital and his share of goodwill premium)

80,000

1,20,000

2,00,000

1,20,000

Premium for Goodwill A/c

……Dr..

To X’s capital A/c

To Y’s capital A/c

(Being the goodwill premium transferred to the

capital accounts of X and Y on Z’s admission in

their sacrificing ratio) (WN 2)

2,40,000

Cr.

2,80,000

2,40,000

2,24,000

16,000

4. Goodwill/Premium for goodwill is brought by the New or

Incoming Partner and is withdrawn by the old partners

fully or partly: The premium brought by the new or

incoming partner is shared by the old partners in the

sacrificing ratio. The sacrificing partners may withdraw

the premium amount fully or partly.

Accounting entries

For premium for goodwill brought in cash by the partner:

Cash/Bank A/c

Dr.

Amount of premium

To premium for goodwill A/c

For sharing of premium for goodwill

Premium for goodwill A/c

Dr.

Amount of premium

For withdrawal of

premium money fully/partly Dr.

Sacrificing partner’s capital A/cs

Amount withdrawal

5. When only a part of the Goodwill/ Premium for Goodwill

is brought by a New or Incoming partner in cash: The new

or incoming partner may not be able to bring the full

amount of his share of goodwill/premium for goodwill in

cash, i.e. brings only a part in cash. In this case, the

premium for goodwill account is credited for the amount of

premium brought by him. At the time of recording the

transfer entry, the new or incoming partner’s Capital

Account is debited with his unpaid share of premium

besides debiting the premium for goodwill account with

the amount of premium brought by him.

Illustration 25 And B are partners sharing profits and

losses in the ratio of 3:2. they admit C into the firm for

1/4th share in profits which he takes 1/6th from A and 1/12th

from B. C brings Rs. 18,000 as goodwill out of his share of

Rs. 30,000.No Goodwill Account appears in the books of

the firm.

Solution

Dat

e

Particulars

L.F.

Dr. (Rs.)

Cash A/c

…..Dr

To premium for goodwill A/c

(Being the amount brought in by C as his share of goodwill

18,000

Premium for Goodwill A/c

……Dr..

C’s Capital A/c (Rs.30,000-Rs.18000)

…….Dr.

To A’s capital A/c

To B’s capital A/c

(Being the goodwill credited to the sacrificing partners in their

sacrificing ratio, i.e., 2:1)

18,000

12,000

Cr. (Rs.)

18,000

20,000

10,000

3.Revaluation of assets and reassessment of liabilities

The value of assets may be different from its book value

because with the time, value of some assets increases

while of some decreases. In the case of liabilities, It is

possible that the amount payable is different from the

value recorded in the books. It is also possible that some

assets or liabilities are not recorded in the books. The

value of assets and the liabilities payable need to be

brought to their correct value so that the incoming partner

is not put to an advantage or a disadvantage. For this

purpose, a Revaluation Account or Profit and Loss

Adjustment Account is opened in the books of the firm.

The value of assets and liabilities nor recorded in the

books is accounted through the Revaluation Account. The

profits' losses arising there from are adjusted in the Old

Partners’ Capital Accounts in their old profit-sharing ratio.

When the assets and liabilities Appear in the Books at the

New Values

The adjustments in the value of assets and liabilities are

effected through an account called Revaluation Account or

Profit and Loss Adjustments account. It is debited by

decrease in the value of assets and increase in the amount

of liabilities and credited by the increase in the value of

assets of decrease in the amount of liabilities.

Accounting Entries

1. For an increase in the value of assets

Assets A/c (Individually)

…Dr.

To Revaluation (or Profit and Loss Adjustment) A/c

2. For a decrease in the value of assets

Revaluation (or Profit and Loss Adjustment) A/c

To assets A/c (Individually)

...…Dr.

3. For an increase in the amount of liabilities

Revaluation (or Profit and Loss Adjustment) A/c

To Liabilities A/c (Individually)

………Dr.

4. For a decrease in the amount of liabilities

Liabilities A/c (Individually)

…….Dr.

To Revaluation (or Profit and Loss Adjustment) A/c

5. For accounting unrecorded assets

Assets A/c (Individually)

……..Dr.

To Revaluation (or Profit and Loss Adjustment) A/c

6. For accounting unrecorded liabilities

Revaluation (or Profit and Loss Adjustment) A/c

…….Dr.

Reserves and Accumulated (Undistributed) Profit/Losses

If, before the admission of a new partner, there is balance

in a Reserve Fund and accumulated profit/losses in the

Balance Sheet, they are transferred to the Old Partners’

Capital Accounts in their old ratio. They are transferred the

Old Partners’ Capital Accounts because they had been set

aside out of the profits in the earlier periods, i.e., before

the new partner was admitted.

Thus the Journey will be:

Profit and Loss A/c

Reserve Fund or General Reserve

Workmen’s Compensation Reserve

Investments Fluctuation Reserve

To Old Partners’ Capital A/cs

……Dr.

……Dr.

..Dr.{Excess of Reserve over Actual Liability}

……Dr. {Excess of Reserve over the difference

between Book Value and Market Value}

[In old ratio]

Adjustment of Capital

It may be decided on the admission of a new partner that

either the new partner will contribute as capital an amount

in proportion to his share of profit or that the capitals of

other partners will be adjusted to make them

proportionate to their respective shares of profit. So, we

shall discuss adjustment of capital as under”

1. Adjustment of old partners’ capitals on the basis of

incoming partners’ capital or

2. Calculating the capital of incoming partner on the basis

of the old partners’ capitals.

1. Adjustment of the Old Partners’ Capital Accounts on the

Basis of the Incoming Partners’ Capital: For this, we

take the following steps:

Step2. Determine the new capital of each partner. Total

capital is divided in their new profit-sharing ratio.

Step3: Ascertain the present capital of the old partners

(after all adjustment).

Step4: Find out the surplus capital/deficit capital by

comparing the proportionate capital (ascertained by step

2) and the present capital (ascertained in Step 3).

Surplus= Present capital > Proportionate Capital (New capital)

Deficit= Present capital< Proportionate Capital (New capital)

Step5: Pass the necessary Journal entry for adjusting the

above surplus/deficit.

Journal Entry

(i) In case the present capital in less than the New Capital:

Cash A/c or Concerned partner’s current A/c

..Dr.

To Concerned Partner’s capital A/c

(ii) In case the present capital is more than the new

Capital:

Concerned Partner’s Capital A/c

..Dr.

To Cash A/c or concerned Partner’s Current A/c

Illustration 52: X and Y are partners in a firm sharing

profits in the ratio of 3:2. The remaining capitals of X and Y

after adjustment are Rs. 80,000 and Rs. 60,000

respectively. They admit Z as a partner on his contribution

of Rs. 35,000 as capital for 1/5th share of profits to be

acquired equally from both X and Y.

Solution:

(i) Calculation of New PROFIT-SHARING Ratio:

(a) Their Existing Shares

X

Y

(b) Share transferred to Z

3/5

2/5

(c) Their New Share (a-b)

1/10 1/10

(d) New Profit-Sharing ratio of X, Y and Z=5/10

:3/10:1/5= 5: 3: 2.

(ii) Calculation of Total capital of the Reconstituted Firm:

Total capital of the firm = Capital of the new partner x Reciprocal of

share of profit of the partner

Total capital = Rs. 35,000x5/1=Rs. 1,75,000.

(iii) Calculation of New Capitals of All Partners:

New capitals (Rs.1,75,000 in ratio of 5:3:2)

X

Rs. 57,500,

Y

Z

Rs.52,500, Rs.35,000

(iv) Calculation of Actual Cash to be Paid off/Brought in by

Old Partners:

X (Rs.)

Y (Rs.)

(a) New Capitals

87,500

52,500

(b) Existing Capitals

80,000

60,000

(c) Cash to be paid (to be brought in)

7,500

7,500