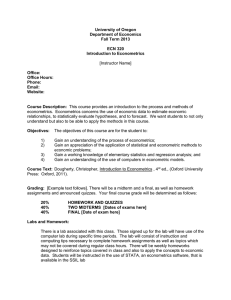

econometrics - WordPress.com

advertisement

EED 401: ECONOMETRICS • COURSE OUTLINE Meaning and purpose of econometrics Methodology of econometric research Correlation analysis and single equation models; simple linear & multiple linear regression models Functional forms of the regression model Special models in regression analysis; dummy variables, RTO. COURSE OUTLINE CONT’D Problems of single equation models; autocorrelation, heteroscedasticity, multicolinearity, errors in variables Simultaneous equation models and estimation Qualitative choice models Time series analysis SOME REFRENCES • A. KOUTSOYIANNIS (2003). THEORY OF ECONOMETRICS. 2ND EDITION. PELGRAVE • JEFFREY M. WOOLDRIDGE. INTRODUCTORY ECONOMICS- A MODERN APPROACH • DAMODAR N. GUJIRATI. BASIC ECONOMETRICS. FOURTH EDITION. • ETC, ETC. WHAT IS ECONOMETRICS? • The word ‘econometrics’ is derived from two Greek words, oikovoμia (economy), and μetpov (measure) • Definition: the social science in which the tools of economic theory, mathematics and statistical inference are applied to the analysis of economic phenomena (Arthur Goldburger, 1964). WHAT IS ECONOMETRICS? CONT’D • Thus, econometrics is an amalgam of economics, mathematics and statistics • The uniqueness of econometrics lies in the inclusion of a random element in models ILLUSTRATION (economic model of crime) • Based on economic reasoning (theory) time spent on criminal activity by an individual will depend on, hourly ‘criminal wage’ ( x1 ), x1 WHAT IS ECONOMETRICS? CONT’D • • • • • • x Hourly wage in legal employment, 2 Income other than from crime or employment, Probability of getting caught, x4 Probability of being convicted if caught, x5 Expected sentence if convicted, x6 Age, x 7 x3 WHAT IS ECONOMETRICS? CONT’D • The above depicts an exact relationship ie the time spent on crime is completely dependent on 7 factors • This is stated mathematically as: • Or y f ( x1, x2 , x3 , x4 , x5 , x6 , x7 ) y b0 b1x1 b2 x2 b3 x3 b4 x4 b5 x5 b6 x6 b7 x7 WHAT IS ECONOMETRICS? CONT’D • This still leaves us with a deterministic relationship • But there are other factors that influence crime apart from the 7. eg. health, vengeance, religion, etc. • Econometrics introduces a random factor (stochastic term) which takes care of these ‘other’ factors Econometric representation of the crime model y f ( x1 , x2 , x3 , x4 , x5 , x6 , x7 , u) y b0 b1x1 b2 x2 b3 x3 b4 x4 b5 x5 b6 x6 b7 x7 u Econometric representation of the crime model CONT’D. • U is the random factor encapsulating all other random factors that affect time spent on crime • PROCEDURE FOR TESTING ECONOMIC THEORY Reading assignment • Establish the superiority of econometrics to mathematical economics and statistics Branches of econometrics • Two main branches: -Theoretical econometrics –dev’t. of appropriate methods for the measurement of economic relationships -Applied econometrics: application of econometrics to specific fields of economic theory ( demand, supply, investment, production) for the analysis of economic phenomena and forecasting economic behaviour Purpose of econometrics • Policy-making: Provide numerical values for the parameters of economic relationships (elasticities, propensities, marginal values) for decision making • Analysis: Empirical verification of economic laws/theories • Forecasting: determining future values of economic magnitudes based on numerical estimates METHODOLOGY OF ECONOMETRIC RESEARCH Generally, econometric research involves 4 stages: 1. Formulation of the maintained hypothesis: ie. The specification of the model 2.Testing of maintained hypothesis: estimation of the model by appropriate econometric method 3. Evaluation of estimates: decide on the basis of certain criteria whether the estimates are satisfactory & reliable. METHODOLOGY OF ECONOMETRIC RESEARCH CONT’D. 4. Testing the forecasting validity of the model 1&3 are the most important for any econometric research. Require strong knowledge in the functioning of economic systems 2&4 are technical & require a deep understanding of econometrics Formulation of the maintained hypothesis • It involves determining 1. Dependent and explanatory variables 2. The a priori theoretical expectations about the signs & the size of the parameters of the function to form the basis for the evaluation of the model 3. The mathematical form of the model: single vs. simultaneous equation; linear vs. nonlinear functional forms Reasons for incorrect specification of economic models 1. Looseness/ imperfection of statements in economic theories 2. Limitation of our knowledge about factors which are operative in a particular situation 3. Problems associated with large data requirements of large models. Errors of specification- omission of variables, equations, & wrong mathematical form of functions 2. Estimation of the model The estimation process involves the ff. Stages: 1. Gathering data-: cross-sectional, time series & panel data 2. Examination of the identification condition of the function 3. Examination of the aggregation problems of the function (aggregation over individuals, commodities, time,& space) 4. Examination of the degree of correlation among the explanatory variables 5. Choice of the appropriate econometric technique:i. Single equation techniques:- Classical Least Squares (CLS) OR ordinary Least Squares(OLS) method, Indirect Least Squares (ILS) or reducedform technique, 2SLS, Limited information maximum likelihood method,etc. ii. Simultaneous equation techniques:- 3SLS, FIML 3. Evaluation of estimates Are the parameters theoretically meaningful and statistically satisfactory? We use 3 criteria for the evaluation; 1. Economic ‘a priori’ criteria: are the parameters of the correct signs and the right size? 2. Statistical criteria: first-order tests- usually by using the correlation coefficient & the standard deviation (error) 3. Econometric criteria: second-order test (test of the statistical tests). This may involve tests of consistency, efficiency, unbiasedness, assumptions, identification, etc. 4. Evaluation of the Forecasting Power of the Model • Forecasting is one of the major objectives of econometrics. • Given data on personal consumption (Y) and GDP (X) from 1982-1996 in billions of dollars the estimated consumption function is given by: Y -184.08 0.7064Xi • We can forecast the mean consumption expenditure for 1997 given GDP=7269.8 billion dollars as Y1997 -184.0779 0.7064(7269.8) 4951.309 billion dollars • Actual consumption for 1997 was 4913.3 billion dollars • Forecast error is 37.81 billion dollars • Question is: is the error large or small? Properties of econometric models • • • • • • Econometric models are judged based on Theoretical plausibility Explanatory ability Accuracy of the estimates of the parameters Predictive power simplicity GOD BLESS YOU!