File

advertisement

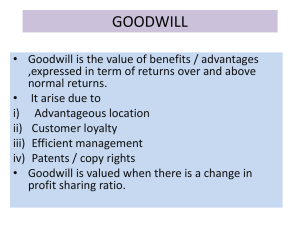

SSC DEEPAK GUPTA 9213975057 Admission of Partners Notes For Class – XII Meaning: When a new partner admits in to a existing firm and old partnership comes to an end and a new one between all partners comes in to existence. Admission of a new partner means reconstitution of the firm. According to the sec 31 (1) of Indian Partnership act 1932.a person can be admitted as a new partner only with the consent of all the existing partners. Two Main Rights Of Partner (New) : 1. Right to share the assets of the firm. 2. Right to share future profit of the firm. Adjustments Required At The Time Of Admission Of A New Partner: 1. Adjustment in profit sharing ratio 2. Adjustment of Goodwill 3. Adjustment of profit / loss arising due to Revaluation of assets and liabilities 4. Adjustment of accumulated profits Reserves and losses 5. Adjustment of capital (if agreed) Change In Profit Sharing Ratio: Old Ratio : In which existing partners (before the admission of a new partner) share their profits or losses. Sacrificing Ratio : In which the old partners have agreed to sacrifice their share in profit in favour of a new partner. New Ratio : The ratio in which all partners (including incoming partner) share the future profit and losses. Calculation Of New Profit Sharing Ratio (Nr) And Sacrificing Ratio:1. Case I : when only OR and New Partner’s share is given Hint -1 – In such situation we should take total share I and find remaining share after deducting new partner’s share from total share. Then remaining share is distributed by the old partners in their old Ratio. Hence we find New Ratio. In this situation OR is always equal to SR 2. Case II : when a new partner acquires his share from the old partners in a particular ratio: SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 Page | 1 SSC DEEPAK GUPTA 9213975057 Hint -2 – The existing partner’s share of profit in the new firm (NR) is ascertained by deducting the sacrifice made from the existing share of profit (OR) . The following formula will be applied. NR = OR – SR (share) 3. Case III : when old partner’s surrendered a part of his share in favour of a new partner. Hint – 3 – first of all, in this situation we have to find sacrificing shares by multiplying surrendered fraction with old shares of existing (sacrificing partners). Then Applying following formula : NR = OR – SR (shares) 4. Case IV : when OR and NR is given. Hint – 4 – In this situation we find sacrificing Ratio by applying formula SR = OR – NR Accounting Treatment Of Goodwill Under Different Situation Situations – I when the incoming partner pays his share of goodwill in cash(privately) No entry is passed in the books of the firm. Situations – II when the new partner bring in his share of goodwill in cash. (1) To record the amount brought in by new partner cash A/C/ Bank A/C Dr (with total amt) To New Partner’s Capital A/C (with capital) To Premium A/C (with share of G/W) (Being amount of Goodwill and Capital brought by new partner in cash) (2) To record the distribution of G/W in sacrificing partner premium A/C Dr To Sacrificing Partner’s capital A/C (Being the amount of goodwill brought by new partner distributed by the sacrificing partner’s). (3) When amount of Goodwill withdrawn by the partners sacrificing partners Capital A/C Dr. To cash A/C/ Bank A/C. (Being the goodwill brought by new partner with draw by sacrificing partner’s) Situations 3. When the incoming partner does not bring his share of goodwill in cash. (1) To record entry for goodwill. New Partner’s capital A/C Dr To sacrificing Partner’s capital A/C (being the amount of goodwill change from the new partner’s capital A/C) SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 Page | 2 SSC DEEPAK GUPTA 9213975057 SITUATION 4: When only a part of premium (G/W) brought by new partner in cash. (1) With the amount of cash brought by new partner. a. Cash A/C | Bank A/C To new partner’s cap. A/C To Premium A/C Dr b. Premium A/C To sac. Partner’s cap. A/C Dr (2) Amount of Goodwill does not brought by new partner c. New partner’s cap. A/C Dr To sacrificing partner’s cap. A/C When Goodwill account already appears in the book. To write off the existing book value of goodwill old partner’s capital A/C Dr To Goodwill A/C (Being the existing goodwill written off in the Ratio) TREATMENT OF WORKMENS COMPENSATION FUND: (1) If WCF existed in Balance Sheet only – Distributed by the old Partners in their old Profit sharing Ratio in Capital Accounts. (2) If WCF is given only in Additional information Transferred to debit side of Revaluation A/c. (3) If WCF is given in both Balance Sheet and Additional Information. Case:- Balance Sheet > Additional Additional Information >Balance Sheet Information Difference between Difference between (A.I. – B|S) (B|S – A.I. ) transferred to capital Transferred to debit side of Revaluation A/c in OR. A/c Revaluation Account The increase and decrease in the value of assets and liabilities are effected though Revaluation account or profit loss adjustment account. Profit or loss arises due to revaluation of assets and liabilities is distributed among the partners in their old profit sharing ratio. Accounting Treatment For Revaluation Of Assets And Liabilities : (1) Revaluation A/c Dr To increase in liab To decrease in Assets SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 Page | 3 SSC DEEPAK GUPTA 9213975057 To unrecorded liab. (2) Increase in Assets A/C Dr Decrease in liab. A/C Dr unrecorded Assets A/C Dr To Revaluation A/C (3) For Profit :Revaluation A/C Dr To old partner’s capital A/C (In old Ratio) Dr. Particular To Increase in liability To Decrease in Assets To Unrecorded liability To Profit transferred to : A (OR) B - for loss :Partner’s capital A/C To Revaluation A/C Dr. Revaluation Account Amount Particulars By Increase in Assets By Decrease in liability By Unrecorded Assets By Loss transferred to : A - (OR) B - Cr. Amount Dr. Capital Accounts (Partner’s) Cr. Particulars A B Particulars A To sacrificing Partner’s Cap. A/c By Balance b|d To Goodwill (w/o In Old Ratio) (opening Balances of capital (when appears in B/S) given in B/S) To P & C A/C (In OR) By Cash | Bank A/C To Advertisement susp. A/C (OR) (capital brought by new (appears in Assets side of Balance partner) sheet) By Premium A/C (when premium (Goodwill) brought by new partner in cash) By New Partner’s Cap. A/C By General Reserve/ By Workmen’s Compensation Reserve By P&L A/C (cr.) (appears in liab. Side of old B|S SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 B Page | 4 SSC DEEPAK GUPTA 9213975057 Treatment Of Reserves & Accumulated Profit . Investment Fluctuation Reserve A/C General Reserve | Reserve Fund | Reserve A/C Workmen’s compensation Fund A/C Profit & Loss Account (cr.) Dr. Dr. Dr. Dr. To OLD Partner’s Capital A/C (Being the accumulated Profit transferred……) Treatment Of Accumulated Losses :Old Partner’s Capital Account To Profit & Loss Account (loss) A/C To Advertisement suspense A/C (Being losses transferred in old Ratio) Capital Adjustment :They decided to keep their capital in their profit sharing ratio. It is a condition, when new partner is admit and it is decided that either the new partner will contribute as capital an amount in proportion to his share of profits or that the capital of old partners will be adjusted to make them proportionate to their respective share of Profit – Method - I When old partners adjust their capital on the basis of the incoming partner’s capital. First of all we calculate total capital of firm by multiplying the capital of new partner by the capital of new partner by the inverse of his share. Then the Total Capital of firm is to be divided in their new profit sharing ratio. Method – II Calculating capital of the incoming partner on the basis of old partner’s capitals. (or when amount of capital brought by new partner is not given) a) Combine Capital Method b) Total Capital Method Combine Capital Method : Step 1 : Determine the Total adjusted Capital of Old Partner’s = Combine Capital Step 2 : Determine the Capital of Incoming Partner = Combine Capital × Share of incoming Partner’s. SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 Page | 5 SSC DEEPAK GUPTA 9213975057 Total Capital Method : Step : Determine the Total adjusted capital of old partner’s = Combine Capital Step : Determine the Total Capital of new firm = combine capital × Reciprocal of remaining share Step: Determine the capital of incoming partners = Total Capital × share of incoming partner. # Note : Remaining Share = Let Total Share = Remaining Share = 1 – Incoming Partner’s share # Note 2 : Adjusted Capital = Capital of Partner (+) Reserves (+) Accumulated Profit (–) Accumulated Losses. SUCCESS STUDY CIRCLE (REGD.) A gateway of sure success… 14A, 40 Ft. ROAD, JAIN NAGAR, DELHI – 110081, PH.: 8800929191, 011-64506028 Page | 6