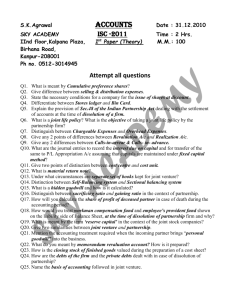

Partners' Capital Account

advertisement