Binghamton University

Thomas J. Watson

School of Engineering

and Applied Science

State University of New York

WARNING

All rights reserved. No part of the course materials

used in the instruction of this course may be

reproduced in any form or by any

electronic or mechanical means, including the use

of information storage and retrieval systems,

without written approval from the copyright owner.

©2006 Binghamton University

State University of New York

ISE 211

Engineering Economy

Engineering Costs

(Chapter 2)

Engineering Costs (CHAPTER II)

Evaluating a set of feasible alternatives requires that many costs

analyzed.

Examples: initial investment, new construction, facility modification,

general labor, parts and material, inspection and quality, material

handling, overhead costs.

Classification of costs:

Fixed, Variable, Marginal, and Average costs

Sunk costs

Opportunity costs

Recurring and Non-recurring costs

Incremental costs

Cash costs Vs. Book costs

Life-cycle costs

Fixed, Variable, Marginal, and Average costs

Fixed costs: constant (unchanging) regardless of the level of output

or activity.

Variable costs: depend on the level of output or activity.

Marginal cost: the variable cost for one or more unit.

Average cost: total cost divided by the number of units.

Example: A production environment

fixed costs:

variable costs:

Example 1

Let’s say:

Fixed cost is $50, variable cost is $1 per unit

If we make 10 units:

Total cost is $60

Average cost is total cost/number of units:

$60/10=$6 per unit

Marginal cost is the extra cost if we increase our

production by 1 unit: $1 per unit

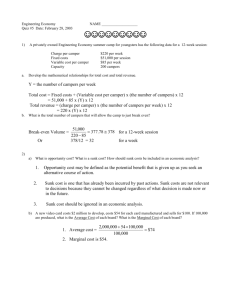

Example 2

An entrepreneur named DK was considering the money-making potential

of chartering a bus to take people from his hometown to an event in a

larger city. DK planned to provide transportation, tickets to the event, and

refreshments on the bus for those who signed up. He gathered data and

categorized these expenses as either fixed or variable:

DK’s fixed costs

DK’s variable costs

Bus rental

$80

Event ticket

$12.5/person

Gas expense

$75

Refreshments

$7.5/person

Other fuels

Bus driver

$20

$50

Develop an expression of DK’s total fixed cost, total variable cost, and

total revenue for chartering this trip.

Example 2 Solution

Example 2 (cont’d…)

Figure 1: Fixed, variable, and total costs

Example 2 (cont’d…)

Figure 2: Profit-loss breakeven chart

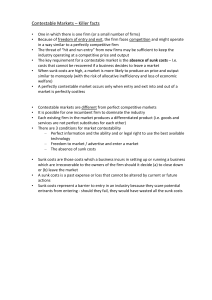

Sunk Costs

A sunk cost is money already spent due to past decisions.

Sunk costs should be disregarded in engineering economic analysis

– current decisions cannot change the past.

Example: money spent last year to purchase new production

machinery.

Why is sunk cost always irrelevant?

Decisions between alternatives should be made on the basis of

their differences

All identical factors can be canceled out

Sunk costs have already been spent:

Will be the same regardless of what you do

Can be ignored in making that decision

Sunk Costs (cont’d…)

How should you take sunk cost into account?

To learn why it went wrong for future decisions

Example:

You should ignore sunk costs in deciding whether to finish a

half-completed project

Study them to learn:

Why your project went wrong

How to avoid similar problems in the future

Opportunity costs

An opportunity cost is cost incurred by choosing to do one thing with

your resources instead of doing another.

Examples:

Say a person wants to go to Mexico for Spring Break, taking one

week off from their part time job. By doing so, it costs them the cost

of the trip plus the lost wages.

The assembly line at a manufacturing facility could be used to

produce product B, and the parking lot could be rented out, or used

as a building site, etc, which will provide benefits to the company.

Example

A distributor of electric pumps must decide what to do with a “lot” of

electric pumps that was purchased 3 years ago. Sooner after distributor

purchased the lot, technology advances were made, which made the

pumps less desirable to customers. The pumps are becoming more

obsolescent as they sit in inventory. The pricing manager has the

following information:

Distributor’s purchase price 3 years ago

$7,000

Distributor’s storage costs to-date

1,000

Distributor’s list price 3 years ago

9,500

Current list price of a “lot” of new-pumps

12,000

Amount offered for the old pumps from a buyer 2 years ago

5,000

Current price that the lot of old pumps it could be sold for

3,000

What would be your advice on the price?

Recurring and Non-Recurring Costs

Recurring costs refer to any expense that is known, anticipated, and

occurs at regular intervals. Examples: rent, car payment, regular

payment, etc.

Non-Recurring costs are one-of-a-kind and occur at irregular intervals

-- difficult to plan for or anticipate from a budgeting perspective.

Examples: replacing equipment, ending/starting production of a

product, emergency maintenance expense, etc.

Anticipated costs, whether recurring or non-recurring costs can be

modeled / handled easily in engineering economic analysis, as cash

flows that occur at regular or irregular intervals (e.g., every year or every

five years).

Incremental Costs

Differences in costs between two alternatives – how much more or

less does one cost than the other.

Example: Philip is choosing between model A (a budget model) and

model B (with more features and a higher purchase price). What

incremental costs would Philip incur if he chose model B instead of the

less expensive model A?

Cost Items

Model A

Model B

Purchase price

$10,000

$17,500

Installation costs

3,500

5,000

Annual maintenance costs

2,500

750

Annual utility expenses

1,200

2,000

Disposal costs after useful life

700

500

Cash Costs Vs. Book Costs

A Cash cost requires the cash transaction of dollars “out of person’s

pocket” into the “pocket of someone’s else”.

Cash costs and cash flows are the basis of engineering

economics.

Book costs are cost effects from past decisions that are recorded “in

the books” (accounting books) of a firm – they do not require transaction

of dollars.

Book costs do not ordinarily represent cash flows and thus are not

included in engineering economics.

Exception: the impact of asset depreciation on tax payments –

which are cash flows included in after-tax analyses.

Life-cycle Costs

Life-cycle costs refers to the costs associated with the various phases

of a product/goods/services life cycle.

Typical life-cycle of products, goods, and services.

Cumulative life-cycle costs committed and dollars spent

Life-cycle design change costs and ease of change

Cost Estimating

We cannot always know exact costs ahead of time – need to

estimate.

Different methods will lead to different estimates – uncertainty.

Types of Estimates

1) Rough estimates

The accuracy of rough estimates for initial values/feasibility

is -30% to +60% -- humans tend to be optimistic.

2) Semi-detailed estimates

Used for budgeting purposes at the preliminary design

stage

-15% to +20%.

Cost Estimating (cont’d)

3) Detailed estimates

Used for detailed design and contract bidding phases

Based on detailed quantitative models: blueprints, vendor

quotes, product specification sheet, etc.

-3% to +5% accurate.

Cost more to develop b/c they take more to develop.

Cost Estimating (cont’d)

Why is estimation difficult?

One-of-a-kind projects -- Space station, Hoover Dam

Time and effort available -- the more detail needed, the

more time and effort required.

Estimator experience – the more you estimate and then

see how the true values come out, the better you become.

How to build experience without estimating things wrongly?

Mentors

Auditing past experience

Starting on small projects

Review meetings

Estimating Models

1. Per Unit Model

Uses a “per unit” factor, times the number of units to

determine the total costs.

Simple – provides rough estimates.

Ignores economies of scale (higher quantities cost less on

a per unit basis

Used often in the construction industry.

Example

Use the per unit model to estimate the cost per student that you will incur for hosting 24

foreign exchange students at a local island campground for 10 days. During camp you

are planning the following activities:

2 days of canoeing

3 days hiking

3 days at the lake beach

Nightly entertainment

After calling the campground and collecting other information you have accumulated the

following data:

Van rental (per person, one way, and plus gas): $50/15 person

van

Camp is 50 miles away, van gets 10 mpg, and gas is $1 per

gallon

Cabins at the camp hold 4 campers, rent is$10 per day per cabin

Meals are $10 per day per camper (no outside food is allowed)

Boat transportation to the island is $2 per camper (one way)

Insurance/grounds fee/overhead is $1 per day per camper

Canoe rental are $5 per day per canoe (canoes hold 3 campers)

Day hikes $2.5 per camper (plus cost of meals)

Beach rental is $25 per group per ½ day.

Nightly entertainment is free!

Estimating Models (cont’d)

2. Segmenting Model

Described as “divide and conquer”.

Was used in previous example to break total estimates into

smaller and smaller pieces: travel, living, etc.

3. Cost Indexes

Numerical values that reflect historical change in

engineering costs (and others).

Dimensionless, and reflect relative price change in either

individual items (labor, material, etc) or group/aggregated

of costs (consumer and producer prices).

Cost at time A

Index Value at time A

Cost at time B

Index Value at time B

Example

Miriam is interested in estimating the annual labor and material costs for

a new production facility. She was able to obtain the following labor

and material cost data:

Labor Costs:

Labor Cost Index values at 124 ten years ago and is 188

today

Annual labor costs for a similar facility were $575,500 ten

years ago

Material Costs:

Material Cost Index values at 544 three years ago and is

715 today

Annual Material costs for a similar facility were $2,455,000

three years ago