Brown-Forman - Michelle YangE

advertisement

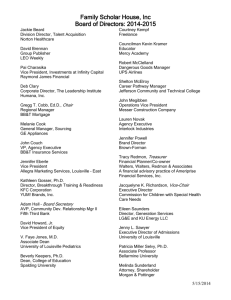

MNGT 481 Brown-Forman Michelle Biondo, Collin Morstein, Greg Silverman, & Michelle Yang 5/2/2013 Section I: Overview Who is Brown-Forman? Brown-Forman is considered to be one of the largest American-owned spirits and wine companies and amongst the top 10 largest global spirits companies. Brown-Forman sells their brands in more than 135 countries and has offices in cities across the globe (Brown-Forman, 2012). According the Brown-Forman’s Corporate Responsibility Report, their mission is to “enrich the experience of life, in their own way by responsibly building beverage alcohol brands that thrive and endure for generations” (Corporate Responsibility, 2013). Brown-Forman produces a wide array of products from “wines, ready-to-drink products, vodka, whiskey, tequilas, liqueur, and other distilled spirits” (Our Company, 2012). The Brown-Forman Company competes in the 312140 classification of the NAICS which corresponds to distilleries. Overall, the company “engages in manufacturing, bottling, importing, exporting, and marketing alcoholic beverages” (Brown-Forman, 2013). Competitors There are many competitors that Brown-Forman competes each and every year. The largest competitor of Brown-Forman is Diageo, which is considered to be the largest distiller in the world. Following Diageo, some other competitors of Brown-Forman are Beam, Inc., Constellation Brands Inc, and Globus Spirits Ltd (Brown-Forman, 2013). Globus Spirits Ltd. is traded on the National Stock Exchange. Below is a chart of the market cap of the four major competitors of Brown-Forman: 2 Company Market Cap Brown-Forman 13.9 Billion Diageo 75.3 Billion Beam, Inc. 9.8 Billion Constellation Brands 8.0 Billion Globus Spirits Ltd 2.5 Billion *Information retrieved from Yahoo Finance, 2013 Trends, Challenges and Opportunities for Brown-Forman According to the Value Line Industry Analysis for the Wine, Beer and Spirits industry, the trend for this industry remains stable and is neither growing nor shrinking. “Demand is somewhat inelastic across good and bad economic times” (Maharaj, 2012). This is because alcohol remains a commodity with a variety of price levels and quality. Alcohol has cultural connections around the globe providing tradition to many and a way of life to others. In the distilling industry the degree of product regulation varies from country to country. “Liquor boards, rather than the distillers, largely determine the marketing practices and pricesetting policies and, ultimately, the profitability of the industry” (Canadian Distilling Industry, 2009). Another issue that faces the distilling industry is the high demand for products and the lack of supply. For example, the producers of the widely known Kentucky whiskey, Maker’s Mark, reduced the alcohol content from 45 percent to 42 percent in order to meet the growing demand (Associated Press, 2013). Therefore, there is a growing demand of spirits and also strict regulation of alcoholic beverage sales. On the other hand, distillers may be able to capitalize on the maturing taste preferences of young alcohol drinkers. Specifically, dark liquors are experiencing resurgence in demand amongst young consumers. Also, the distilling industry may be able to capitalize on the growing 3 demand for craft spirits and the increased interest in the “creative cocktail culture” (Nolt, 2011). In addition to renewed interest in cocktails, low-calorie alcoholic beverages have gained momentum. For example, SkinnyGirl Cocktails, owned by Beam Inc. provides their target market with an alcoholic beverage that is all natural and a low calorie option versus other higher calorie beverages. Section II: Financial Analysis Brown-Forman’s Gross Revenue Brown-Forman recorded $3.614 million in revenue in the fiscal year ending April 29, 2012 (BF-B Income Statement, 2013). In comparison with smaller competitors, (Beam Inc., Globus Sprits Ltd, and Constellation Brands) Brown-Forman has higher total revenue than competitors by about a million dollars. Diageo out sells all competitors based on total revenue with $16,880,000 in the fiscal year ending June 29, 2010 (DEO Income Statement, 2013). The table below illustrates the total revenue of each of the competitors: Company Year Ending Revenue Brown-Forman April 29, 2012 $16,880,000 Diageo June 29, 2012 $9,780,000 Beam Inc. December 30, 2012 $2,465,900 Constellation Brands Inc. February 28, 2012 $2,654,300 Globus Spirits Ltd March 30, 2010 $2,650,000 *Information retrieved from Yahoo! Finance Brown-Forman recorded $1,819,000 in cost of goods sold in the 2012 fiscal year, leaving them with $1,795,000 in gross profits and a profit margin of 49.67% (BF-B Income Statement, 4 2013). Diageo recorded $10,200,000 in gross profits in 2012 (DEO Income Statement, 2013). Beam Inc. had a total of $1,438,400 in gross profits (BEAM Income Statement, 2013). Constellation Brands Inc. recorded $1,062,100 in 2012 and Globus Spirits Ltd recorded $608,000 in gross profits in 2010 (GLOBUSSPR.NS Income Statement, STZ Income Statement, 2013). Below is a table representing the profit margins for each competitor in comparison with Brown-Forman: Brand Year Ending Profit Margin Brown-Forman April 29, 2012 49.67% Diageo June 29, 2010 60.43% Beam Inc. December 30, 2012 58.33% Constellation Brands Inc. February 28, 2012 40.01% Globus Spirits Ltd March 30, 2010 22.94% Trends for Brown-Forman Below is a graph representing the revenue recorded by Brown-Forman over the last three years: Dollars Total Revenue 3,700,000 3,600,000 3,500,000 3,400,000 3,300,000 3,200,000 3,100,000 3,000,000 3,614,000 3,404,000 3,226,000 Total Revenue 4/29/2010 4/29/2011 4/29/2012 Date *Information retrieved from Yahoo! Finance 5 Below is a graph representing the total profits earned by Brown-Forman over the past three years: Total Profits 1,850,000 1,795,000 1,724,000 Dollars 1,750,000 1,650,000 1,611,000 Total Profits 1,550,000 1,450,000 4/29/2010 4/29/2011 4/29/2012 Date *Information retrieved from Yahoo! Finance Below is a graph representing the stock price for Brown-Forman over the past three years: Stock Price Dollars 150.00 100.00 60.03 84.18 70.70 72.00 50.00 Stock Price 0.00 4/30/2010 4/29/2011 4/27/2012 4/23/2013 Date *Information retrieved from Yahoo! Finance As seen in the charts above, Brown-Forman has had an increase in revenue and profits over the last three years. With that said, their profit margin decreased in 2012, going from 50.64% in 2011 to 49.67% in 2012. Their stock price has also fallen in the last year by about $12, or 6 14.47% from 2012. It is a positive sign to see that profits and revenue are continually increasing with time, but the company needs to cut costs of goods sold in order to have higher profit margins. Section III: Bases of Competition Principal Bases on Which Firms in This Industry Compete According to the Brown-Forman 2012 Annual Report, the company competes “based on taste, product quality, brand image, and price” (Annual Report, 2012). The alcoholic beverage industry has recently seen the beer market decline, as opposed to the wine and spirits market. According to the Distilled Spirits Council of the United States, spirits volume sold increased by 2.7% in 2011 and revenue also increased at a rate of 4% (Kwon, 2012). Not only has the beer industry been on the decline, but it has become quite clear in the United States in particular, spirits have become a popular choice for alcoholic beverage drinkers. Competitive Advantage of Brown-Forman One strong competitive advantage Brown-Forman has over its primary competitors such as Diageo and Beam Inc. is their strong brand portfolio. Brown-Forman offers mid-priced brands such as Jack Daniels and Southern Comfort. The company also offers premium brands such as Woodford Reserve, Sonoma-Cutrer, Chambord, Collingwood, and Tuaca. The wide variety of products offered gives Brown Forman the competitive edge. In 2010, Jack Daniel’s was ranked seventh among all other alcoholic beverages by Drinks International, a monthly trade magazine coving global spirits, wine, and beer markets. Jim Beam bourbon, owned by lead competitor Beam Inc., was ranked eleventh by Drinks International (Kwon, 2012). With this said, “Jack Daniel’s is the company’s leading brand and is the largest-selling American whiskey in the world (Brown Forman Corporation Company Information, 2013). With the success of Jack Daniel’s, 7 Brown-Forman continues to maintain a strong brand image as well as gain worldwide recognition. Currently, “the principal international markets for Brown-Forman’s brands are the United Kingdom, Australia, Mexico, Poland, Germany, France, Canada, Japan, Spain, Turkey, South Africa, Russia, Italy and China” (Brown-Forman Corporation SWOT Analysis, 2012). With the continuing geographic expansion, Brown-Forman has competitive advantage with their strong growth in different markets. Role of Technology and Intellectual Property In this industry, intellectual property often consists of patents, trademarks, and licensing. According the 10-K report, “brand names, trademarks, and related intellectual property rights are critical assets” and the company devotes “substantial resources to protect intellectual property rights around the world” (10-K Report, 2012). Specifically, patents for Brown-Forman have been obtained in the United States, and several Asian and European countries. One of Brown-Forman’s most important patents is for a process of adding food grade solvent to an alcohol mixture in order to produce “an extract of a mature oak aged alcoholic beverage” (Zimlich, J.A., 1995). A top competitor of Brown-Forman, Diageo, filed a patent for a “new method involving the mixture of a spirit with yeast and a fermentable carbohydrate, which create sparkle” (Diageo, 2006). At one point, international English Distillers had attempted to launch sparkling vodka, “Vodka O2” but only to be challenged by a mobile phone operator called O2. Competitors are constantly trying to create innovative alcoholic beverages that would potentially attract consumers. Patents and intellectual property rights are extremely critical in this industry because of the risk of piracy and counterfeiting can put the business at risk and adversely affect business prospects. 8 Section IV: Logistical Management and Value Chain Core Competencies of the Company The core competencies of Brown-Forman are to “manufacture, bottle, import, export, and market a wide variety of alcoholic beverage brands” (10-K Report, 2012). The alcoholic beverages that are distributed by Brown-Forman are listed below: Jack Daniel’s Tennessee Whiskey Chambord Vodka Jack Daniel’s Single Barrel Don Eduardo Tequila Jack Daniel’s Ready-to-Drinks Early Times Bourbon Jack Daniel’s Tennessee Honey Early Times Kentucky Whisky Gentleman Jack el Jimador Tequilas Southern Comfort Herradura Tequilas Southern Comfort Ready-to-Drinks Korbel California Champagnes Southern Comfort Ready-to-Pours Maximus Vodka Southern Comfort Lime New Mix Ready-to-Drinks Southern Comfort Fiery Pepper Old Forester Bourbon Southern Comfort Bold Cherry Little Black Dress Vodkas Finlandia Vodka Collingwood Whisky Antiguo Tequila Pepe Lopez Tequilas Canadian Mist Blended Canadian Whisky Sonoma-Cutrer Wines Chambord Liqueur Tuaca Liqueur Woodford Reserve Bourbon Inbound (Upstream) Logistics and Supplier Dependencies According to the 10-K Report, “the principal raw materials used in manufacturing and packaging our distilled spirits are corn, rye, malted barley, agave, sugar, glass, cartons, PET (polyethylene terephthalate), labels, and wood for barrels, which are used for storage of whiskey and certain tequilas” (10-K Report, 2012). Also, “the principal raw materials used in liqueurs are neutral spirits, sugar, and wine, while the principal raw materials used in our ready-to-drink products are sugar, neutral spirits, whiskey, tequila, or malt” (10-K Report, 2012). All of these raw materials have no shortage of supply and are not predicted to have a shortage in the future. 9 The production of raw materials into a finished product requires a significant amount of time due to the long ageing process of whiskey and tequila. Because of the long aging process, BrownForman must predict future demand in order to meet inventory requirements. This can lead to an abnormal amount of inventory compared to current sales and total assets. Brown-Forman also distills wine. “The principal raw materials used in the production of wines are grapes, packaging materials and wood for wine barrels” (10-K Report, 2012). The grapes used for wine come from a variety of California owned vineyards and “external contracts with independent growers; from time to time, our grape costs are adversely affected by weather and other forces that may limit production” (10-K Report, 2012). Outbound (Downstream) logistics and principal Distribution Channels of the Company Brown-Forman uses many different distribution models depending on the geographical area. According the Brown-Forman’s 10-K Report, in the United States, the company sells their brands to wholesalers or state governments that then distribute the products (10-K Report, 2012). The company owns and operates distribution networks in Australia, Brazil, Canada, China, the Czech Republic, Germany, Korea, Mexico, Poland, Taiwan, and Turkey, where products are either directly sold to retail stores or to wholesalers (10-K Report, 2012). In the United Kingdom, the company partners with other suppliers to sell a combined portfolio of brands. In many other markets, including France, Spain, Italy, Russia, and South Africa [the company relies] on others to distribute [the company’s products]” (10-K Report, 2012). Vertical Integration As stated before, Brown-Forman is able to buy raw materials from suppliers and make their products at their owned or leased facilities. With this said, the company is highly integrated 10 because of their ability to produce their products from raw materials, as well as distribute them to the best of their ability in all the countries they do business with. Outsourcing All of Brown Forman’s products are produced within company run facilities with the exception of Finlandia Vodka. Currently “a Finnish corporation distills and bottles Finlandia Vodka products” for the company (10-K Report, 2012). Below is a list of the facilities the company owns, leases, and operates: Owned facilities: • Stave and heading mills: • Corporate offices (including renovated historic structures) — Louisville, Kentucky • Clifton, Tennessee Production and warehousing facilities: • Stevenson, Alabama (production to begin June 2012) • Lynchburg, Tennessee Cooperage • Louisville, Kentucky • Louisville, Kentucky • Collingwood, Ontario, Canada • Woodford County, Kentucky Leased facilities: • Windsor, California • Manufacturing facility in Dublin, Ireland • Cour Cheverny, France • Stave and heading mill in Jackson, Ohio • Amatitan, Mexico Although Brown-Forman may produce their products in their own facilities, “In 2005, Brown-Forman implemented the EMC® Documentum® enterprise content management platform along with EMC Captiva® to consolidate information silos and more efficiently manage a wide variety of content spread across its extended, global enterprise” (Customer Profile, 2007). Today, Brown Forman is “reaping many benefits in accounts payable, accounts receivable, marketing, sales, legal, and other departments” through outsourcing to EMC2 (Customer Profile, 2007). Brown-Forman also “selected BrassRing's on-premise Recruitment 11 Process Management (RPM) solution to manage its strategic recruiting and staffing functions” (Newsroom, 2003). The company also contracts some “production in Australia, Belgium, Finland, Ireland, Japan, Mexico, the Netherlands, Poland, South Africa, and the United States” (10-K Report, 2012). Overall, the company outsources technological functions of the company but does most of the manufacturing of the products themselves. Off shoring Only four of the thirteen facilities owned by Brown-Forman are operated outside of the United States. These facilities are located Ireland, France, Canada and Mexico. Section V: Market and Marketing Market Segments Brown-Forman focuses the majority of their marketing efforts on the U.S. market, which accounted for 42% of total net sales in 2012. However, increased focus on overseas consumers had led to an increase in international sales. Specifically, international sales contribution has doubled since 2002; currently making up 58% of total sales (10-K Report, 2012). The growth of international sales is congruent with their corporate goal of maintaining brand diversity and appealing to foreign markets. Brown Forman believes that diversifying their brand will lead to the "health, prosperity and longevity of our company" (Annual Report, 2012). Within the United States, the Brown-Forman marketing team has specifically targeted 'Gen Xers' as ideal the recipients of their message. According to an article in Ad Age magazine, Brown Forman "looks to sophisticated, free-spending Gen Xers to fuel sales of its Jack Daniel's, Finlandia and Southern Comfort brands"(Chura, 2000) Hoping to appeal to the Gen X population, Brown Forman continues to tailor their message to fit the needs of this segment. 12 Outside of the United States, Brown-Forman distributes and markets their product in over a dozen foreign markets. "Australia, Brazil, Canada, China, the Czech Republic, Germany, Korea, Mexico, Poland, and Taiwan" are noted as thriving international markets for BF whiskey and spirits. Also, as of 2012, Turkey has been added as a new distribution location (Hoovers). To continue overseas expansion, Brown-Forman is hoping to increase product demand in Asia by ramping up country-specific marketing efforts (10-K Report, 2012). Platforms Utilized by the Company When it comes to advertising, Brown-Forman typically utilizes television, print, outdoor, radio and the internet to convey their marketing message. In 2012, Brown-Forman’s advertising budget amounted to $41,295,075. Cable TV advertisements garnered the most attention from the company, accounting for $23,902,553 or 60% of the budget, which is a 45% increase from the year prior. Magazine ads accounted for 16.6% of advertising dollars, followed by 7.7% spent on Network TV spots. Surprisingly, internet marketing expenditure only totaled $1,543,602, which is less than 4% of the total advertising budget (Brown Forman Corporation, 2013) Geographic Markets As mentioned before, Brown-Forman is truly an international enterprise. With over 50% of their net sales coming from overseas market, it is clear that their product is universally appealing. According to their 10-K Report, Brown Forman generated more than $2 billion of their total sales from foreign markets while the other $1.4 billion in sales is attributed to domestic sales. The company's principal export markets include, "Australia, Brazil, Canada, China, Czech Republic, France, Germany, Italy, Japan, Mexico, Poland, Russia, South Africa and Spain" (Hoovers). 13 In terms of specific product performance, Jack Daniels Tennessee Whiskey reigns supreme worldwide. The whiskey continues to be the distillery's top selling product both domestically and in foreign markets. The whiskey is overwhelmingly successful in Brazil where over 50,000 cases were sold in 2012 (Annual Report, 2012). Also, in Russia, where vodka is consumed in large quantities, Brown Forman's Finlandia brand vodka is the top selling premium imported vodka (Annual Report, 2012). Marketing Strategies Brown Forman believes that "diversity and performance of our brands are the keys to the health, prosperity and longevity of our company" (Annual Report, 2012). Their stance directly supports increased efforts to promote sales overseas. The more markets Brown Forman has penetrated, the less financial risk imposed upon the company. In the name of corporate social responsibly, "Brown-Forman only markets to consumers of legal drinking age and commits to ensure that underage drinkers are not and will not be targeted by our marketing and campaigns" (Ad Guidelines). No actors or models depicted in advertisements are underage and BF makes a concerted effort to only appeal individuals are of legal drinking age. Also, in order to differentiate from competitors, as well as to interact with loyal customers, Brown Forman has used crowd-sourcing techniques to generate television commercial ideas. Rather than hiring an advertising agency, the distillery relied on consumer written copy for the 2012 Southern Comfort advertising campaign (National, 2012). 14 Product Lifecycles: Introduction: Tennessee Honey Collingwood Ready-to-Drink Maturation: Old Forester Growth: Single Barrel Woodford Reserve Country Cocktails Gentleman Jack Jack Daniels Tennessee Whiskey Decline: Canadian Mist Early Times Source: Brown Forman Corporation Strategy According to the table above, Brown Forman is positioned for success for the years to come. The majority of their products are in the growth stage and only three selections have matured or are on the decline. Section VI: Strategic Analysis Brown-Forman has a wide brand portfolio and “from time to time, [they] acquire or invest in additional brands or businesses” (10-K Report, 2012). With this said, according to the company’s 10-K Report, they “expect to continue to seek acquisition and investment opportunities that [they] believe will increase long-term shareholder value, but [they] cannot assure that [they] will be able to find and purchase brands or businesses at acceptable prices and terms. It might also prove difficult to integrate acquired businesses and personnel into [the] existing systems and operations, and to bring them into conformity with our trade practice standards, financial control environment, and U.S. public company requirements” (10-K Report). Clearly, Brown-Forman uses horizontal integration and related diversification to further their brand when possible. Brown-Forman does not take part in unrelated diversification in order to achieve financial leveraging. The company stays strictly within the distilling industry. In 2007, Brown-Forman “agreed with the Orendain family of Mexico to end their joint ventures in the tequila business. Brown-Forman went on to purchase the remaining portion of the global 15 trademark for the Don Eduardo super premium tequila brand from the Orendain family” (News Release, 2007). The company is no longer involved in any other joint ventures or alliances at this time, but based on their 10-K Report the company would not be opposed to this strategy in the future. Section VII: Strategic Recommendations Product Elimination According to the 2012 10-K Report, Brown-Forman has identified Korbel Champagne and Canadian Mist as “challenging” products (10-K Report, 2012). These products are slow growing and low profit for the company. Based on the BCG model, these products are dogs, as opposed to Jack Daniels and Southern Comfort identified as stars. With this said the company should divest these products and use the capital towards a new product that is growing rapidly. This process would not be new to the company. In 2009 the company divested “Italian wine brands, Bolla and Fontana Candida” (10-K Report, 2012). New Product Introduction While a few of Brown-Forman’s particular brands are underperforming, replacing these brands with new products. In 2011 Beam Inc. acquired Skinnygirl which provides a low calorie brand of wine and spirits. Skinnygirl offers a long line of wines and premixed cocktails. According to an Associated Press report, Skinnygirl “was the fastest growing brand of spirits in the US in 2011, posting a 388% sales increase according to a new booze industry report.” Skinnygirl started off as a premixed margarita on its own in 2009, it has now evolved and grown extremely successfully. The name itself speaks for itself; Skinnygirl offers all-natural ingredients and low calories all while backed by an appropriate price. “Liquor’s popularity grew at the expense of 16 beer and America’s appetite for top shelf-booze was growing despite the wobbly economy” (Associated Press, 2011). By replacing Brown-Forman’s underperforming products with a lowcalorie like product line, similar to Beam Inc.’s Skinnygirl, consumers will be highly attracted to the new products Brown-Forman would have to offer. Strategic Alliance with United Spirits In order to penetrate the Asian market, Brown-Forman should for a strategic alliance with United Spirits of India. United Spirits is the largest distillery in the world and has set up distribution channels throughout Asia. Once the strategic alliance is finalized, United Spirits will assist in distributing Brown-Forman’s spirits all over Asia. Brown-Forman will then reciprocate United Spirits’ actions by allowing access to their distribution channels within the United States. Both companies will benefit from the alliance because U.S. market is virtually untapped by United Spirits. Brown-Forman considers perpetual international growth as a corporate goal; therefore, a strategic alliance with the Asian distiller is consistent with the objectives of the corporation. Outsourcing More Operations Currently Brown-Forman’s profit margins are significantly lower than some of their competitors. In comparison to Diageo, Brown-Forman’s profit margin is 10% lower. In order to increase profit margins, Brown-Forman can outsource more of their operations outside of the United States. Currently, nine of the thirteen Brown-Forman operated facilities are in the United States. Costs of production are drastically higher in the United States and by outsourcing the production of more of their products, Brown-Forman would decrease production costs and lead to an increase in profit margins. 17 Works Cited 10-K Report. (2012, June 27). Brown-Forman. Annual Report. (2012). Brown-Forman. Associated Press. (2013, February 11). Maker's Mark Waters Down Bourbon to Meet Demand. Retrieved February 25, 2013, from CBS News website: http://www.cbsnews.com/8301505144_16257568818/makers-mark-waters-down-bourbon-to-meet-demand/ BEAM Income Statement. (2013). Retrieved April 23, 2013, from Yahoo! Finance website: http://finance.yahoo.com/q/is?s=BEAM+Income+Statement&annual BF-B Income Statement. (2013). Retrieved April 23, 2013, from Yahoo! Finance website: http://finance.yahoo.com/q/is?s=BF-B+Income+Statement&annual Brown-Forman. (2013, February 18). Retrieved February 18, 2013, from Yahoo Finance website: http://finance.yahoo.com/ Brown-Forman Corporation. (2013). Retrieved April 26, 2013, from Red Books website: http://www.redbooks.com/advertiser/BROWN_FORMAN_CORPORATION/ Brown-Forman Corporation Company Information. (2013, March 31). Brown-Forman Corporation SWOT Analysis. (2012). Brown-Forman Corporation SWOT Analysis, 1-7 Chura, H. (2000, March 13). Brown-Forman Brands Target Gen X. Retrieved April 26, 2013, from Advertising Age website: http://adage.com/article/news/brown-forman-brandstarget-gen-x/59052/ Corporate Responsibility. (2013). Retrieved April 29, 2013, from Brown Forman website: http://www.brown-forman.com/responsibility/ Customer Profile: Brown Forman. (2007). Retrieved April 29, 2013, from EMC2 website: http://www.emc.com/collateral/customer-profiles/h2832-brown-forman-cp.pdf DEO Income Statement. (2013). Retrieved April 23, 2013, from Yahoo! Finance website: http://finance.yahoo.com/q/is?s=DEO+Income+Statement&annual Diageo patent application heralds 'sparkling' spirits. (2006). Marketing Week (01419285), 29(44), 7. GLOBUSSPR.NS Income Statement. (2013). Retrieved April 23, 2013, from Yahoo! Finance website: http://finance.yahoo.com/q/is?s=GLOBUSSPR.NS+Income+Statement&annual 18 Maharaj, N. (2012, February 2). Industry Analysis: Beverage. Retrieved February 18, 2013, from Value Line Website: http://www.valueline.com/Stocks/Industries/Industry_Analysis__Beverage.aspx National, international media follow Brown-Forman’s marketing moves including new Southern Comfort crowd-sourced ads. (2012, August 1). Retrieved April 28, 2013, from Insider Louisville website: http://insiderlouisville.com/news/2012/08/01/master-class-nationalinternational-though-not-so-much-local-media-folllow-brown-formans-every-marketingmove/ Newsroom: Brown-Forman Selects BrassRing's Outsourced Recruitment Solution. (2003, July 28). Retrieved April 29, 2013, from BrassRing website: http://candidate.brassring.com/en/html/ company/accomplishments/news/2003/07_28_03.asp News Release. (2007). Retrieved April 29, 2013, from Brown Forman website: http://investors.brown-forman.com/phoenix.zhtml?c=98415&p=irol newsArticle&ID=1003029&highlight= Nolt, B. (2011, March 4). Bryan Nolt Talks About the Distilling Industry. Retrieved February 25, 2013, from Denver Business Journal website: http://www.bizjournals.com/denver/print-edition Our Company. (2012). Retrieved February 18, 2013, from Brown-Forman website: http://www.brown-forman.com/company/ Skinnygirl Cocktails are Fastest Growing Liquor Brand, Reports Says. Associated Press. Retrieved April 29, 2013, from http://www.nbcnews.com/business/skinnygirlcocktails-are-fastest-growing-liquor-brand-report-says-746584 STZ Income Statement. (2013). Retrieved April 23, 2013, from Yahoo! Finance website: http://finance.yahoo.com/q/is?s=STZ+Income+Statement&annual The Canadian Distillery Industry. (2008, May 5). Retrieved February 25, 2013, from Agriculture and Agri-Food Canada website: http://www4.agr.gc.ca/AAFC-AAC/displayafficher.do?id=1171995761751&lang=eng#ico Zimlich, J. A., III. (1995). U.S. Patent No. US6132788 A. Washington, DC: U.S. Patent and Trademark Office. 19