File

advertisement

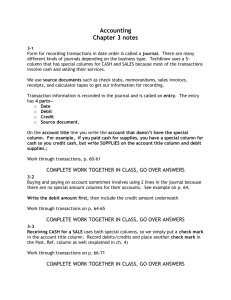

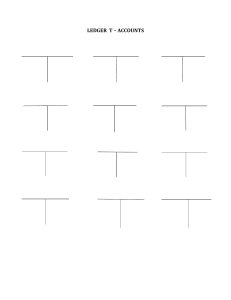

DID YOU EVER KEEP A DIARY? Did you (or someone you know) ever keep a diary or journal to record events in your (their) life? Why do people keep a diary or journal? WHY KEEP A DIARY? People keep a diary to record events in their lives. Diaries and journals can remind us of (1) the date that an event happened (e.g., a concert, a party, the day you received an award, a great play in a sporting event), (2) what happened, (3) who was there to share the event with us, and (4) any important effects the experience may have had on us. WHAT DOES THIS HAVE TO DO WITH ACCOUNTING? A Journal is the Accounting version of a diary . Journal Diary WHAT IS AN ACCOUNTING JOURNAL? • A form, or book for recording transactions in chronological order. In other words, the transactions are recorded in the order that they happen – from earliest to most recent (Just like a diary.) So, the first item recorded in a journal is the first thing that happened. JOURNALS A journal is the first place a transaction is recorded–i.e., the original (first) accounting entry for a transaction is in a journal. WHAT IS A JOURNAL (CONTINUED) • Businesses usually have a general journal, as well as special journals for specific types of transactions (e.g., payroll). JOURNAL ENTRIES Journal entries are made / analyzed in a T- account, in terms of debits and credits. This is called “double-entry” accounting. Each transaction affects at least 2 accounts. (Can affect more than 2.) JOURNAL ENTRIES (CONTINUED) When making journal entries for a transaction, debits will always equal credits. ALWAYS. QUIZ: • If a journal records 4 transactions, which one happened most recently (last) -#1, #2, #3, or #4? • Which happened first (earliest)? ANSWER: #4 happened most recently (last). #1 happened earliest (first). Transactions are recorded in the order that they happen (chronologically). TWO TYPES OF JOURNALS: There are two types of journals: (1) Journals without special columns and (2) Journals with special columns FORM OF A JOURNAL ENTRY – WITHOUT SPECIAL COLUMNS • There is a place to enter the date, the name of the account, and at least one Taccount for debits and credits. • There is also be a place to enter a “posting reference” and the “source document.” FORMAT OF A GENERAL JOURNAL / ENTRY EXPLANATION OF FORMAT • The date is entered on the far left. The day is entered, but month and year only when they change (or on a new page.) FORM OF JOURNAL ENTRIES (CONTINUED) Names of accounts are next. Debits are listed first, then credits. Credits are indented. Underneath the names of the accounts is a short explanation of the transaction JOURNAL ENTRIES (CONTINUED) The dollar amount of the transaction goes on the far right, on the correct side of the T-account. (Debits on the left, credits on the right.) Debits must equal credits! JOURNALS WITH SPECIAL COLUMNS Many businesses use a journal with 5 amount columns. (See book, pages 73, 84.) The five columns are: 1.General Debit 2.General Credit 3.Sales Credit 4.Cash Debit 5.Cash Credit SPECIAL COLUMNS When you have special columns, you do not need to write the account title in the account title column for transactions where you can use a special column. This saves time. SPECIAL COLUMNS When you have special columns, you need to write the account title in the account title column ONLY if there is no special column that applies. Then you use the general debit and credit columns. WHEN DO YOU MAKE A JOURNAL ENTRY O.K., you know what a journal entry is. How do you know when you need to make one? Journal entries are based on source documents. WHAT IS A SOURCE DOCUMENT? • A source document is a business paper or writing that describes or represents a transaction. • A source document is objective evidence of a transaction; objective means that anyone can review it and determine what occurred. • A source document proves that a transaction occurred (i.e., it provides a paper trail.) SOURCE DOCUMENTS -- EXAMPLES Example of source documents are checks / check stubs, receipts, cash register tapes, memoranda, sales invoices, contracts, and deposit slips WHAT INFORMATION IS IN A SOURCE DOCUMENT? A source document should contain the following information: 1. the dollar amount involved, 2. the date of the transaction, and 3. (possibly) the name of the other business or person involved SOURCE DOCUMENTS (CONTINUED) What type of transactions would a particular source document describe? Check (or check stub) – We call it cash, but businesses rarely use cash. Checks or electronic fund transfers are usually used (paper or electronic trail!). Examples: to describe the purchase of an asset, the payment of an expense, or a payment on account. CHECKS AS SOURCE DOCUMENTS Checks are prenumbered. In the “Doc. No.” column of the journal, you would put “C” for check and the number of the check. (E.g, if check #4 is your source document, you would put “C4” in the “Doc. No.” column.) SOURCE DOCUMENTS - EXAMPLES Cash register (or calculator) tapes can describe the total day’s sales. Only one entry is needed for the total sales that day. CALCULATOR OR CASH REGISTER TAPES Tapes are abbreviated “T” plus the day of the month that the tape represents. For example, the tape for December 12 would be abbreviated “T12” in the “Doc. No.” column. SOURCE DOCUMENTS (CONTINUED) Receipts – a written acknowledgment for cash / payment received. Example: they could describe the purchase of an asset (e.g., supplies). A business may also give out a receipt when they receive cash or payment (e.g., sale of an asset.) RECEIPTS Receipts are abbreviated “R” plus the number of the receipt. (Receipts are usually pre-printed with a number.) If your source document is receipt #6, then you would put “R6” in the “Doc. No.” column. SOURCE DOCUMENTS Memoranda (memorandums) – when there isn’t any other source document, or if additional explanation is needed. MEMORANDA Memoranda are abbreviated with an “M” and the number of the memorandum. If your source document is the 7th memorandum, then you would enter “M7” in the “Doc. No.” column. QUICK QUIZ: 1. What is a source document? 2. Why are they important? 3. Give some examples of types of source documents. 4.What information is in a source document? ANSWERS: 1. A source document is a business paper that proves a transaction occurred. Journal entries are based on source documents. 2. It is important because it provides objective evidence that a transaction occurred; it’s a paper trail. 3. Examples: checks / check stubs, receipts, cash register tapes, memoranda; sales invoices, deposit slips, contracts ANSWERS (CONTINUED) 4. A source document should contain the dollar amount involved, the date of the transaction, and possibly the name of the other business or person involved in the transaction HOW DOES IT GET FROM THE SOURCE DOCUMENT TO A JOURNAL ENTRY? Your co-worker hands you a source document. You know you have to enter the information / transaction in a journal. How do you enter it? What do you do? MAKING A JOURNAL ENTRY 1.Read the source document. 2.Determine what kind of transaction it is. Ask the following: 3.What accounts are affected? 4.Are the accounts being increased or decreased? 5. Are the accounts being debited or credited? (DEAD CLOR) MAKING A JOURNAL ENTRY (CONTINUED) 6.Enter the date the transaction occurred (far left.) Only enter the month and year if either changes. Always enter the day of the month. 7.If there are no special columns involved, then enter the name of the account being debited first. Then indent, and enter the name of the account being credited. Enter the debit amount in the debit column, and the credit amount on the next line down, in the credit column. LAST STEP: Write the source document number (e.g., R6) in the Doc. No. column. ONLY SPECIAL COLUMNS If the transaction involves only special columns (i.e.., a sale for cash): 1.Enter the date (only the day unless it is a new page or a new month); 2.Enter the amount of cash received in the correct column: cash debit or cash credit (cash debit – an increase to an asset is a debit) ONLY SPECIAL COLUMNS 3.Enter the dollar amount of sales in the sales credit column, and 4.Write the source document and number in the source document column. (e.g., “T6”). ONE SPECIAL COLUMN If the transaction involves only one one special column (e.g., paid cash for supplies), then: 1.Enter the date in the left hand column, 2.Write the title of the account being debited (Supplies) in the Account Title column. (There is no special amount column for supplies, so you must write in the account title.) ONE SPECIAL COLUMN 4. Enter the dollar amount of the transaction in the General Debit column. 5. There is a special column for Credits to Cash, so you do not need to write “cash” in the account title column. Write the amount of the credit to cash in the “Cash Credit” column. 6. Write the source document (e.g. “C5”) in the “Doc. No.” column. QUIZ 1. What is a journal? 2. True or false: debits usually equal credits. 3. True or false: a transaction may only affect one account. 4. True or false: a transaction may affect three accounts. 5. True or false: in a journal, debits are entered first. ANSWERS 1. A journal is the business version of a diary. It is a book for recording transactions. It is the first place where a transaction is recorded. 2. FALSE. Debits ALWAYS equal credits. ALWAYS ALWAYS ALWAYS. 3. FALSE. A transaction must always affect at least 2 accounts. ALWAYS ALWAYS ALWAYS. 4. TRUE. A transaction must affect at least 2 accounts, but may affect more than two. 5. TRUE. Debits are listed first, then credits. QUIZ, PART 2 1. True or false: Journal entries are listed from the highest dollar amount to the lowest. 2. True or false: Source documents are created after a journal entry is made. 3. If a transaction results in an asset (e.g., cash or supplies) increasing, would you debit or credit the asset? 4. If a transaction results in revenue decreasing, would you debit or credit revenue? ANSWERS 1. FALSE. Journal entries are made in chronological order, from the earliest to the most recent. 2. FALSE. Journal entries are based on source documents. You receive a source document, and then make an entry. 3. You would DEBIT the asset. DEAD. 4. You would DEBIT revenue. CLOR. WHAT DO YOU PROVE? You will prove Journal pages and Cash. WHAT IS PROVING? “PROVING” means showing that two things are equal. Proving a Journal page means showing that total debits equal total credits. WHAT IS RULING? After a Journal page is proved, it must be ruled. Ruling the page shows that you have checked the totals and they are correct. Double underlining shows that the totals are correct. WHEN DO YOU PROVE A JOURNAL PAGE? • At the end of the page, when there is only one line left, you prove (and rule) that page and carry forward totals. • At the end of the month (even if you are not at the end of a page) you must prove (and rule) the last page of the journal. PROVING A JOURNAL PAGE When you have used every line on a page except the last one, you “prove” the page: 1. Total the amounts in each debit column (General Debits and Cash Debits). 2. Write in the totals for each debit column on the last line. PROVING A JOURNAL PAGE 3. Add the 2 Debit columns together (this is total debits). 4. Total the amounts in each credit column (General Credits, Sales Credits, and Cash Credits). Write each total on the last line underneath that column. PROVING A JOURNAL PAGE (CONTINUED) 5. Add the 3 Credit columns together (this is total credits). 6. Check that total debits equal total credits. 7. If total debits equal total credits, that page of the Journal is proved. 8. If total debits do NOT equal total credits, then you did something wrong. Check your math. RULING A JOURNAL PAGE After a Journal page is proved, you must rule it. • Draw a line across all of the amount columns, below the last entry, to show that they are being added. • On the next line, write the day of the month (and a new month / year if they have changed) in the Date column. RULING A JOURNAL PAGE (CONTINUED) • You prove and rule a Journal page the same way, whether it is the end of the month or the end of the page. • If it is the end of the month, but not the end of the page, then write “Totals” in the Account title column. RULING A JOURNAL PAGE (CONTINUED) • If it is the end of thepage,write “Carried Forward” in the column for Account Titles. Place a check mark in the “Post. Ref.” column (no posting needed). • “Rule” -- draw double underlines -- below the column totals, across all the amount columns. Double lines mean that the totals have been verified and are correct. START A NEW JOURNAL PAGE 1. Write the page number of the new page at the top. 2. Write the date in the Date column. Since it’s the first time you are writing the date on the page, you must write the year, the month, and the day. NEW JOURNAL PAGE (CONTINUED) 3. Write “Brought Forward” in the Account title column, and place a check in the Post. Ref. column. (This will tell you that you don’t need to post it – Chapter 6). 4. Write the column totals from the previous page. WHEN DO YOU PROVE AND RULE? • At the end of the page, when there is only one line left, you prove and rule the page and carry forward totals. • At the end of the month (even if you are not at the end of a page) you must prove and rule the last page of the journal. PROVING CASH Proving cash means showing that the amount of cash you have agrees with the accounting records. WHEN DO YOU PROVE CASH? • Cash can be proved anytime you need to verify that the cash records are correct. • Most businesses prove cash at the end of the month; sometimes at the end of every day. HOW TO PROVE CASH Calculate the cash balance: 1.Start with the cash on hand at the beginning of the period. 2.Add total cash received (the Journal’s total Cash Debit column). 3. The sum of (1) and (2) is total cash HOW TO PROVE CASH (CONTINUED) 4.Subtract total cash paid out during the month (the Journal’s total Cash Credit column) from Total Cash. 5.The result is the cash balance at the end of the period. 6.The answer in (5) should be equal to the checkbook balance on the next unused check stub (or the actual cash you have.)