Section 9 Other deductions from Pay - WMAC-APA

advertisement

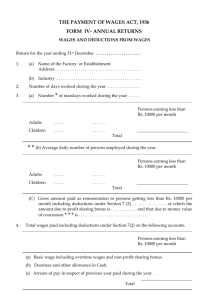

Involuntary & Voluntary Deductions Notice of Levy - Form 668-W Part 2 thru 5 must be given to employee Part 2 – Employee copy Part 3 – to be received back from EE, completed and sent to IRS Part 4 – to be received back from EE, kept Unemployment compensation Workers Compensation Railroad Retirement Act pension and annuities Some armed services personnel retirement and disability payments Certain Public Assistance Payments Child Support Order ALREADY on the books (received prior to the levy) Use part 4 of form 668-W to determine the number of exemptions claimed – do not use Form W4 Obtain IRS Pub. 1494 Table for Figuring Amount Exempt from Levy on Wages, Salaries, and Other Income Based on the pay period and number of exemptions claimed, determine the exempt amount If you do not receive the completed parts 3 & 4 the exempt amount is determined using the Married Filing Separate bracket on Pub. 1494 Take-home pay is the amount of an employee’s wages that remains after all normal deductions in effect at the time a levy is received have been subtracted from the gross pay Pre-existing deductions • If deductions increase as a result of a pay increase, continue to subtract from gross wages • If deductions increase as a voluntary decision by employee, do not subtract increase amount from gross wages Example: an employee with a 3% 401K deduction cannot increase their percentage. However, if they receive a pay increase, the resulting additional 401K amount is allowed as a subtraction from gross wages Form 668-D, Release of Levy/Release of Property from Levy – the form will include the final payment amount Voluntary Deduction Agreement – Form 2159 Uniform Withholding Notice for Child Support Start withholding based on the effective date OR 14 days of the order date Disposable Pay – all deductions required by LAW – not benefits, might vary by state 50% EE is Married 60% EE is Single 55% EE is Married +12 weeks in arrears 65% EE is Single +12 weeks in arrears Total of all support orders has to be at or below the maximums – state limits may be lower State law governs the multiple orders are handled. If the orders are from different states – work state law applies . Allocation methods for multiples: • Allocate based on percentage • Allocate equally • 1st come/1st serve Internet accessible way of obtaining, accepting, rejection, termination & lump sump payments Medical Insurance Support Provision – by state. Non custodial parent provides medical insurance coverage (at equal cost as other employees) for their children. Governed by Federal and State law Under the DOL, W&H Division Consumer Credit Protection Act, Title III • Restricts states regulations • Restricts amount that can be garnished • Employee may not be terminated because of their wages being garnished Covered in CCPA • Administrative Wage Garnishment • Alimony • Child & Medical Support • Creditor Debt • Student Loan 25% of weekly disposable earnings OR amount over the 30 times federal minimum wage (30x7.25=217.50) Order is from court – until received, employer pays all garnishments in place. Once received all orders stop EXCEPT child support. Bankruptcy order supersedes all orders including levies. Once received all bankruptcy orders are paid to trustee that delegates the funds – again, exception is child support. Higher Education Act allows garnishment Max for single garnishment is 15% or 30x federal minimum wage Max for multiple garnishments is 25% or 30x federal minimum wage Can not discharge, 30 day notice before start of garnishment Termed EE who is rehired in 12 mo’s is given 12 additional mo’s from reemployment before garnishment can be put into effect. Non tax debt Agency will provide 30 day notice. Limits are the same as loans (15% on one, 25% on multiple, or 30X federal minimum wage) 1. Child support 2. Bankruptcy 3. Federal administrative garnishments* 4. Federal tax levies* 5. Student loan** 6. State tax levies 7. Local tax levies 8. Creditor garnishments 9. Employer deductions (e.g., for benefits) 10. Employee voluntary deductions *All deductions in effect when a federal admin. Wage garnishment or fed. tax levy is received have priority over the order **The law provides no guidance, but the Dept. of Ed allows child support to have priority Contact Bankruptcy trustee if there are any questions on support orders or any other garnishments All orders are legal documents - any omissions may result in fines and penalties on the employer Never deduct more than what’s allowed by law Board, lodging, and other facilities provided by the employer for the employee’s benefit may be deducted even if the employee’s wages will then be below the minimum wage. The employee’s participation must be voluntary. • Facilities are board, lodging, meals, housing, etc. • Facilities ARE NOT tools, required uniforms, company provided security, etc. Section 9.1-7 Wage Assignments – agreement with a creditor in lieu of garnishment – state laws may apply Union Dues – based on collective bargaining agreement US Savings Bonds – Not allowed to be thru direct deposit as of 2011 Donations from payroll of $250 or greater must be substantiated • Must include: amount of cash and noncash contributed, whether goods or services were provided in return, description and estimate of value of services • Documents include: pay stub, W2, document from org., pledge card $250 is applied to each deduction separately