Employee Benefits Blue Care HMO Benefits

advertisement

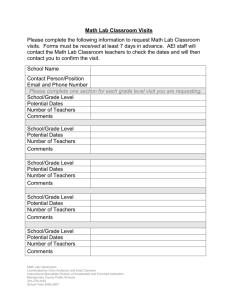

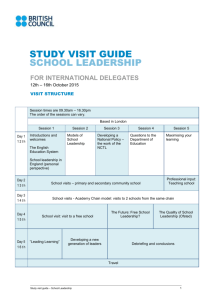

Flexible Benefits Enrollment 2009-2010 Plan Year Employee Benefits Outline of Presentation • • • • • • Plan Year Highlights Core Benefits Benefit Choices Life Events Employee Contributions Questions Employee Benefits Plan Year Highlights • Flexible Benefits Budget – $2,700/year ($112.50/pay) – June 15, 2009 • Medical Insurance – No Plan Design Changes – Employee Contributions will remain the same. • Dental Insurance – No Plan Design Changes – Decrease in Employee Contribution Employee Benefits Plan Year Highlights cont… • Vision Insurance – No Plan Design Changes – Increase in Employee Contributions • Flexible Spending Accounts – Loomis to AmeriFlex • Life Insurance – AIG to SunLife – Special “Guaranteed Issue” Open Enrollment Employee Benefits Core Benefits • Core Life Insurance/ Core Accidental Death and Dismemberment (AD&D) Insurance – SunLife – $50,000 Core Life Insurance Benefit – $50,000 AD&D Insurance Benefit • Long Term Disability – Provides 60% Of Monthly Base Pay ($4,500 Monthly Max) – Benefit Begins Following 180 Days of Continuous Disability – One-year services requirement Employee Benefits Core Benefits cont… • Long Term Disability – Provides 60% Of Monthly Base Pay ($4,500 Monthly Max) – Benefit Begins Following 180 Days of Continuous Disability – One-year services requirement • Employee Assistance Program (EAP) • Flexible Benefits Budget – $2,700/year ($112.50/pay) Employee Benefits Core Benefits Cont… • Tuition Remission – Wilkes University – King’s College – Misericordia University • Paid Holidays • Vacation/Sick/Personal Leave • 403(b) Retirement Savings Plan • Bookstore Discount • Wilkes-Barre YMCA Employee Benefits Benefit Choices • • • • • • • Medical Insurance Prescription Plan Dental Insurance Vision Insurance Voluntary Term Life Insurance Voluntary AD&D Insurance Flexible Spending Accounts Employee Benefits Medical Insurance Three medical plan options: • Blue Care HMO • Blue Care HMO Plus – (formerly Blue Care POS) • Blue Care PPO www.bcnepa.com Employee Benefits Blue Care HMO Benefits – – – – Benefit Period : Calendar Year Deductible: None PCP Office Visit: $15 Co-pay Specialist Office Visit: $30 Co-pay Preventive Services – – – – Immunizations: $15 Co-pay Routine pediatric/adult and well child care: $15 Co-pay Routine gynecological exam: $30 Co-pay Mammography Screening/diagnostics: No Charge Employee Benefits Blue Care HMO Emergency and Urgent Care – Emergency Room: $100 Co-pay – Urgent Care through your PCP: $15 Co-pay Inpatient Services – Inpatient hospital services, including maternity: $100 per admission – Skilled Nursing Care (60 days per benefit period): $100 per admission Mental Health – Inpatient services (30 days /benefit period): $100 per admission – Outpatient services (60 visits/benefit period): $30 per visit Employee Benefits Blue Care HMO Outpatient Services – Chemotherapy, dialysis, or radiation: No Charge – High-tech Imaging (MRI, MRA, CT scans, pet scans, nuclear cardiology): $75 Co-pay – Diagnostic testing (lab tests, x-rays, etc.): No Charge – Maternity Care: $30 initial visit – Outpatient Surgery: $100 Co-pay Other Services – Chiropractic Care (12 treatments/benefit period; ages 13+): $30 Co-pay – DME: $5,000 maximum/benefit period Employee Benefits Blue Care HMO Substance Abuse – Outpatient Services (30 visits/benefit period; 120 visits/lifetime): No Charge – Detoxification (7days/admission; 4 admissions/lifetime): $100 per admission – Inpatient non-hospital residential treatment (30 visits/benefit period; 90 days/lifetime): No Charge for Initial Visit; 50% Subsequent Visits Employee Benefits Blue Care HMO Plus Two Network Options – FPH Network • Blue Care HMO Benefit Plan Design – Blue Card Network (www.bcbs.com) • Additional Costs Employee Benefits Blue Care HMO Plus Benefits – Benefit Period : Calendar Year – Deductible: $250.00 (Maximum 3 per family) – Coinsurance: 20% – Coinsurance (Maximum 3 per family): $1,000 – Lifetime Maximum: $1,000,000 – PCP Office Visit: 20% – Specialist Office 20% Employee Benefits Blue Care HMO Plus Coinsurance (20%) Applies To: • Preventive Services • Urgent Care through your PCP • Inpatient Services • Outpatient Services • Mental Health (50% for Outpatient Services) • Substance Abuse (50% for Inpatient Subsequent Visits) Employee Benefits Blue Care PPO Two Network Options – Preferred (www.bcbs.com) – Non-Preferred • Additional Costs Employee Benefits Blue Care PPO Benefits - Benefit period - Deductible (Maximum 3 separate deductibles per family) - Coinsurance (Insured responsibility) - Coinsurance maximum (Maximum 3 separate coinsurance maximums per family) - Lifetime maximum - Precertification penalty (facility) Insured Responsibility Preferred Non-Preferred Calendar Year $300 $600 None 20% of allowable charge None $3,000 Unlimited $500,000 None $500 Preventive Services - Childhood Immunizations (not subject to deductible; copay applies for office visits) No charge 20% - Routine gynecological exam and pap smear (one per benefit period; not subject to deductible) $30 20% - Routine mammography (one per benefit period, limited to age 40+; not subject to deductible) No charge 20% Employee Benefits Blue Care PPO Emergency and Urgent Care Services - Outpatient emergency room visit (not subject to deductible; copay waived if admitted to hospital) $100 copay $100 copay No charge No charge 20% 20% No charge $75 copay (after deductible) No charge $30 (after deductible) 20% 20% 20% 20% No charge No charge No charge 20% 20% 20% Inpatient Services - Inpatient hospital services (unlimited days per benefit period) - Skilled nursing care (60 days per benefit period) Outpatient Services - Chemotherapy, dialysis or radiation - High-tech imaging (MRI, MRA, CT scans, pet scans, nuclear cardiology) - Diagnostic testing (lab tests, x-rays, etc) - Physical (20 visits per benefit period), speech (12 visits per benefit period), or occupational therapy (12 visits per benefit period) - Cardiac rehabilitation (36 visits/benefit period) - Pulmonary therapy (18 visits/benefit period) - Respiratory therapy (18 visits/benefit period) Employee Benefits Blue Care PPO Other Services - Allergy extract/injections - Chiropractic care (18 treatments per benefit period ages 13 and up) - Durable medical equipment/prosthetics/orthotics - Home health services (100 visits/benefit period) - Home infusion services - Hospice care (180-day lifetime maximum) - Surgery - Maternity services (physician office visits) - Primary Care Physician office visits (preferred not subject to deductible). Unlimited visits. - Specialty Physician office visits (preferred not subject to deductible). Unlimited visits. No charge 20% $30 (after deductible) 20% No charge 20% $5,000 benefit period maximum $30 (after deductible) 20% $30 (after deductible) 20% No charge 20% No charge 20% $30 initial visit 20% $15 copay $30 copay 20% 20% Employee Benefits Blue Care PPO Mental Health - Inpatient services (30 days/benefit period) - Outpatient services (60 visits/benefit period) No charge 20% 50% 50% No charge No charge 20% 20% Substance Abuse - Outpatient services (30 visits/benefit period; 120 visits/lifetime) - Detoxification (7 days/admission; 4 admissions/lifetime) - Inpatient non-hospital residential treatment (30 days/benefit period; 90 days/lifetime) No charge 1st course; 50% 2nd 20% 1st course; 50% 2nd and & subsequent courses subsequent courses Employee Benefits Prescription Drug Coverage • BCNEPA • National Pharmacy Network - Express Scripts Inc. https://member.express-scripts.com • Based off of a formulary listing which includes all therapeutic categories. • Co-pay will depend on what tier the prescription drug is categorized. • Formulary:http://www.bcnepa.com/PDF/RxFormulary3.pdf . Employee Benefits Prescription Drug Coverage Express Scripts Network Pharmacy Retail Copay (30-day supply) Tier 1 Tier 2 Tier 3 $15.00 $30.00 $50.00 Home Delivery Copay (90-day supply) Tier 1 Tier 2 Tier 3 $30.00 $70.00 $150.00 Employee Benefits Prescription Drug Coverage Three Ways to Save Money on your Prescription Drug Costs: • Tier 0 (Zero) • Request Generic Medications • Utilize the Mail Order Pharmacy Program Employee Benefits Prescription Drug Coverage Tier 0 (Zero) • July 1, 2008 • 65 Generic Drugs • Co-pay Free • List of Drugs www.bcnepa.com Employee Benefits Dental Insurance • Provider: United Concordia • Two Dental Plans – Basic – Enhanced • Flexibility • Maximum Allowable Charge (MAC) • Website Functions Employee Benefits Dental Insurance Benefits/Services Diagnostic and Preventive Basic Services Major Services Orthodontics (Dependent Children to Age 19) Deductible Predetermination Plan Maximums (Dental) Plan Maximums (Orthodontia) Basic 100% MAC* 100% MAC* Not Covered Enhanced 100% MAC* 100% MAC* After Deductible 50% MAC* After Deductible Not Covered N/A 50% MAC* After Deductible $50 Individual/$150 Family Required for treatment plans of $150 or more, or the extraction of 6 or more teeth. $1,000 PP/CY $1,200 PP/CY N/A $1,000/Chld/Lifetime Employee Benefits Dental Insurance Routine Examination (Maximum Allowable Charge Example) Network Dentist Out-of-Network Dentist Provider Charge $ 45.00 $ 45.00 Allowable Charge $ 30.00 $ 30.00 Member Responsibility $ $ 15.00 Payment to Provider $ 30.00 $ 45.00 Employee Benefits Vision Insurance Provider: Davis Vision Inc. Plan: Fashion Excellence Gold Employee Benefits Vision Insurance FREQUENCY OF SERVICE Eye Exams, Frames, Lenses, Contacts 12 Months Each BENEFITS IN-NETWORK OUT-OFNETWORK Amount Amount Covered Reimbursed Eye Exam (Optometrist 100% $40 or Ophthalmologist) Standard Lenses (Pair) – Single Vision 100% $30 – Bifocal 100% $40 – Trifocal 100% $60 – Lenticular / Aphakic 100% $80 Frames Fashion level 100% Up to $30 Designer Level $20 Up to $40 Premier Level $40 Up to $60 Retail Allowance Up to $100 Up to $80 Contacts (In lieu of glasses) 100% $48 – Standard (Hard/Soft Daily $75 Off $48 Wear Spherical) Provider – Specialty (e.g. Charge Disposables, Gas Permeables) Employee Benefits Voluntary Term Life • Employee Coverage – Increments of $10,000 to the lesser of 5X salary or $300,000. Guaranteed Issue amount of $150,000 when first eligible for coverage and during this open enrollment period. • Spouse Coverage – Increments of $10,000 up to a maximum benefit of $100,000. Guaranteed Issue amount of $30,000 when first eligible for coverage and during this open enrollment period. • Dependent Child(ren) Coverage – Increments of $2,500 up to a maximum benefit of $10,000. All Dependant Child(ren) coverage is a guarantee issue. Employee Benefits Voluntary Term AD&D • Employee Coverage – Increments of $10,000 up to a maximum benefit of $500,000. • Spouse Coverage – Increments of $10,000 up to a maximum benefit of $250,000. • Dependent Child(ren) Coverage – Increments of $2,000 up to a maximum benefit of $50,000. Employee Benefits Flexible Spending Accounts • Medical Spending Accounts – $3,000/Plan Year – Use It Or Lose It Provision • Dependent Care Spending Accounts – $5,000/Plan Year – Use It Or Lose It Provision Employee Benefits Flexible Spending Accounts cont… • PY 2008-2009 – Loomis: prior to 06/01/2009 – Human Resources: after 06/01/2009 • PY 2009-2010 – AmeriFlex • Special Open Enrollment Sessions – Monday, April 6th and Thursday, April 9th Employee Benefits Flexible Spending Accounts If you are currently enrolled in a Flexible Spending Account, you must re-enroll for the new plan year. You will not be automatically enrolled. Employee Benefits Additional Benefit Choices Legal Services Plan Long Term Care Insurance Employee Benefits Life Events • Change In Status Spouse’s or Dependent’s Open Enrollment • Dependent Care Changes • Cost or Coverage Changes Within The Employer’s Plan • HIPAA Special Enrollment Rights • Judgment, Decree Or Court Order • Enrollment/Ceasing To Be Enrolled In Medicare Or Medicaid (does not apply to CHIP) • Family Medical Leave Act (FMLA) Special Requirements Employee Benefits Please Note: • The benefit change must be consistent with the Life Event. • You may add or delete dependents during the plan year, when you experience a Life Event. • You must contact the Human Resources Development Office within 30 days of the Life Event, and provide the required documentation, or the change will not take place until the next Open Enrollment. Employee Benefits Employee Contributions • Medical Insurance Deductions- SAME • Dental Insurance Deductions-Decrease • Vision Insurance Deductions- Slight Increase • Rate Sheet- HR Website- Ben Info & Forms Employee Benefits Wellness Programs • YMCA Membership • Wilkes Fitness Facilities • Weight Watchers at Work • College Town Challenge • Lunch & Learns Employee Benefits Open Enrollment Procedures • Review all Open Enrollment information. • If you are not making any changes to your benefit elections or do not wish to enroll or continue to participate in a Flexible Spending Account, no further action is needed on your part. • If you are making any benefit changes or participating in a Flexible Spending Account, you must return all paperwork to Brigid Peet, Benefits Coordinator (x4644) by Friday May 1, 2009. Employee Benefits Questions