Insurance

advertisement

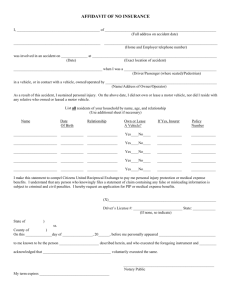

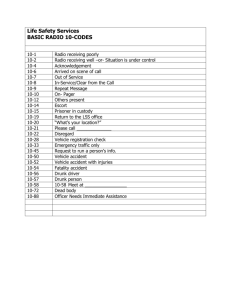

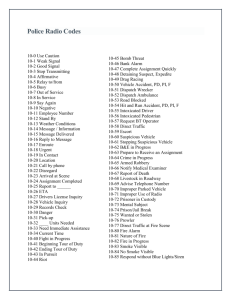

OBJECTIVE 6.00 U NDERSTAND SHOPPING OPTIONS AND PRACTICES FOR MEETING CONSUMER NEEDS . 6.02A S TUDENTS WILL UNDERSTAND OPTIONS AND PRACTICES FOR MEETING TRANSPORTATION NEEDS . 6.02 E SSENTIAL Q UESTIONS What are the options for meeting transportation needs? How can consumers make wise decisions when shopping for transportation needs? Setting priorities Doing the research Leasing/purchasing vehicle Obtaining insurance D ECISION M AKING T IME : S TEPS IN MEETING TRANSPORTATION NEEDS 1. Consider options for transportation needs 2. Set priorities 3. Do the research 4. Make decision 5. Implement 6. Evaluate S TEP 1. C ONSIDER OPTIONS FOR TRANSPORTATION NEEDS Public transit Taxicabs Walking, bicycling Motorcycle, moped Carpooling Purchase/Lease of a vehicle Which options are available in your area? Which options fit your personal needs in short term or long term? Which options are within your budget? S TEP 1. C ONSIDER OPTIONS FOR TRANSPORTATION NEEDS Public transit Taxicabs Widely available in cities, costs less than owning a vehicle, no responsibilities Convenient, but very costly; may be difficult to find in some situations Walking, bicycling Economical choice for short distances; less protection in foul weather S TEP 1. C ONSIDER Motorcycle, Moped Convenient, less expensive to buy and operate, conserves energy, requires less parking area, easy to maneuver, high accident/injury rate, especially on major highways or in heavy traffic Carpooling TRANSPORTATION OPTIONS Economical when convenient, saves energy, parking problems, reduces traffic, requires some rearrangement of personal schedule Purchase/Lease of Vehicle Convenient, costs more in energy, required parking, heavier traffic, maintenance costs, insurance expenses, property taxes, investment O UR A REA Since the community we live in has limited opportunities for public transportation, taxi services, & walking opportunities, we will primarily deal with leasing or purchasing a private passenger vehicle. VEHICLE PURCHASE / LEASE S TEP 2-S ET PRIORITIES Make a list of wants and needs for a vehicle Take into consideration: Who will be driving the vehicle? What you can afford? When and where it will be used? Whether to purchase an automobile, truck, motorcycle, or van S TEP 3. D O THE RESEARCH Research Used vs. New vehicles Used vehicle---one-to-two-year-old (late model year) vehicle is often good option for first-time buyers because: Initial cost fits budget needs Depreciates (loses value) more slowly and costs less to insure May have “Buyers Guide” sticker on window – check it out! May still have factory/dealer warranty; Look for one-to-two-yearold vehicle ; others have no warranty S TEP 3. D O THE RESEARCH U SED C ARS How can I know it is a “good” used car? 1. Look out for defects-disclosure sheetdescribes repairs/replacements done; if car has been in an accident- may need to have vehicle inspected by an independent technician 2. Ask about previous owner and maintenance records 3. Research performance, safety & service records for make & model on internet 4. Superstores, dealers and manufacturers sell “certified used cars”-have received thorough mechanical and appearance inspections, & necessary repairs and replacements 5. Check Official Used Car Guide and NADA Kelly Blue Book for info on used vehicles S TEP 3. D O THE RESEARCH Used vs. New vehicles New vehicle---the challenge is to find a vehicle to match one’s needs, wants, and budget Advantages of choosing new car…. Choice of features for safety, performance , economy, appearance & convenience Choose between domestic and foreign made Standard features at no extra charge Extra features add significantly to cost Custom vehicles can be ordered from factory S TEP 3. D O THE RESEARCH Where to buy Traditional dealership-represents one or two manufacturers, selling new and/or used Auto superstores sell new & used vehicles Have support of dealership Huge inventories of new and used vehicles Private sellers, classified ads, & auctions sell “AS IS” no warranty S TEP 3. D O THE RESEARCH Research makes and models What are important factors to consider? 1. Safety- brakes, airbags, head restraints 2. Reliability-check consumer magazines and Internet for quality and reliability marks 3. Fuel economy-type of fuel used and miles per gallon 4. Power & performance-acceleration, handling, braking, & acceleration 5. Comfort & convenience-headroom, legroom, & storage for cargo 6. Insurance-rates vary according to data tables on repair costs of various models 7. Warranties-generally provide for repair/replacement of defective parts during warranty period H OW TO COMPARE MPG http://www.fueleconomy.gov/feg/printguides.shtml Actual mileage will vary with options, driving conditions, driving habits, and vehicle condition New Vehiclesvehicle specific information required by the EPA Used Vehiclesgeneral information on internet, but may not be the exact model with features, not required by EPA S TEP 3. D O THE RESEARCH Research prices Used vehicles---book value is the estimated value of a given make, model and model year New vehicles---types of prices *Invoice price-price the dealer pays the manufacturer *Base price- the price of a vehicle with standard equipment *Options and option package-features available at extra cost *MSRP – (Manufacturers Suggested Retail Price) base price +price options installed by manufacturer+ *Sticker price-dealer’s initial asking price as found on the sticker on the window S TEP 3. D O THE RESEARCH L EASING V S . P URCHASING Research options for Leasing: monthly payments in exchange for exclusive use of vehicle for a specified period of time; (like renting an apartment) financing Lease term- length of contract, usually 24, 36 or 48 months Up front costs-made when signing lease--includes deposit, taxes, and registration fees Residual value*-worth of vehicle end of lease; higher residual = lower payments Monthly lease payments-made by lesseepays for vehicle depreciation during lease Interest- generally lower than when buying video link: leasing basics At End of Lease Disadvantage: No asset value in vehicle because you have only been renting Written into contract: Disadvantage: End-of-lease costs cover reduced value of vehicle, excess mileage, penalties for ending lease early, significant wear & tear Option to purchase at end of lease or to extend lease (usually at *residual value) video link- leasing benefits S TEP 3. D O THE RESEARCH L EASING V S . P URCHASING Purchasing---buyer pays cash or takes out a loan and pays for the vehicle with monthly payments---costs more than paying cash because includes interest on amount borrowed Paying cash from savings Dealer financing---easy, on-the-spot source Installment loans-regular – repay in monthly payments of approximately same $ until loan paid in full Secured at banks, credit unions, finance companies, savings & loans Lender holds title until paid in full Variables affecting loan: Get separate quotes for car and for financing Check financing terms at other sources Check online for rates and terms Length of time to repay (T)Time Dealer holds title until paid (collateral) Annual percentage rate (R)Rate Amount of $ borrowed (P) Principle Bank (Credit Union, Financial Institution) Financing Get separate consumer loan for vehicle Pay back in installments Either option may include trading in another vehicle for part of price Review Simple Interest Formula_ I=PRT O BTAIN AUTOMOBILE INSURANCE http://www.griffithfoundation.org/uploads/classroom.wmv The basic concept of insurance Liability Insurance is Required by NC law Types of auto insurance available Liability insurance covers driver’s responsibility toward other people (when at fault) Bodily injury liability -covers others when other people are injured or killed Property damage liability- covers when other people’s property of others is damaged Collision-pays for loss/damages to insured person’s vehicle due to AT FAULT accident Comprehensive physical damage- pays for losses due to fire, theft, vandalism, falling objects, hail, windstorm, flood, impact with wild animal Medical payments- Pays insured’s medical expenses resulting from accident Uninsured/Underinsured motorist- Protects against driver who causes accident, but does not carry insurance or has low limits of insurance coverage Rental reimbursement- Costs of renting a car while yours is being repaired Towing & Labor – Costs of labor & towing a vehicle broken down or wrecked V EHICLE I NSURANCE No-fault auto insurance pays claims regardless of who is at fault NOT AVAILABLE IN NORTH CAROLINA WHAT HAPPENS TO YOUR INSURANCE WHEN YOU FILE A CLAIM? means points apply to your insurance if there is claim on this coverage Bodily injury Liability Property damage Liability What happens if you do not have this insurance? Review Previous slide for or means points are NOT charged on your insurance Which insurance coverage is required by North Carolina law? Surrender your license tag, pay fine, may impound vehicle What if you are in an accident and the “at fault” party does not have this coverage? Your Uninsured Motorist pays for your damages or injuries. B ODILY I NJURY L IABILITY C OVERAGE Liability Insurance is Required by NC law If you are AT FAULT and there are damages, you are LIABLE to pay for the injuries you cause. Both bodily injury liability & property damage liability charge points! Bodily Injury Liability protects the insured person from liability claims for injury to: People in other cars Passengers riding with the insured person DOES NOT cover the insured person (driver) P ROPERTY D AMAGE L IABILITY COVERAGE Liability Insurance is Required by NC law Property Damage Liability protects the insured person from liability claims for damage to property of others, such as: Personal property including vehicles, animals Business property including telephone poles and other utility structures Government property such as bridges, signs, and other road structures Real property (land & permanent attachments) Does NOT cover the insured person’s property O PTIONAL A UTO C OVERAGE C OLLISION Usually required by creditor if there is a loan If you are AT FAULT in an accident and your vehicle is damaged, file a collision claim. Collision covers the cost of repair to insured’s vehicle! Protects the vehicle owner against damage from a collision with another object or the vehicle turning over Charges points to insurance Points make premiums increase Does NOT cover injuries to people O PTIONAL A UTO C OVERAGE C OLLISION Although not required by financial responsibility law, collision is Usually required by a lienholder if loan on vehicle is not paid in full A lienholder is a bank, individual or loan company who holds a secured interest in the property until the loan is paid in full. Example: If car catches fire and loan is still outstanding, the claim dollars are paid to insured and lienholder. C OMPREHENSIVE A UTO I NSURANCE Usually required by creditor if there is a loan Protects the insured vehicle against damage from almost all damages except collision Fire Theft Vandalism Hail Windstorm Windshield damages Collision with wild animal including fowls Does NOT charge points when claim is filed U NINSURED /U NDERINSURED M OTORIST C OVERAGE Protects policyholder against drivers Without insurance insurance to cover the loss suffered Without enough insurance to cover the loss suffered Examples: Hit and run drivers Drivers who let insurance policy lapse and cause an accident Drivers involved in serious accidents who carry low $ liability limits of coverage O THER A UTO C OVERAGE Medical payments - Covers anyone in vehicle or hurt by vehicle, even if not moving Ex: Broken finger by closing finger in door or trunk, pedestrians Towing Expense - Pays tow fees Rental Reimbursement - Covers cost of rental when vehicle being repaired due to accident FACTORS IMPACTING VEHICLE I NSURANCE P REMIUM C OSTS $ limit on amount of coverage – the more you buy, the higher the premium Driver classification – experience, marital status of driver Driving record and habits---high-risk drivers premiums are higher State of residence Number of cars insured Cost of vehicle---higher rates for luxury/hot cars Whether young driver has completed a driver’s education course Amount of deductible for comprehensive & collision coverages--amount insured pays before insurance company pays on claim A UTO C LAIMS The at fault driver of a vehicle that damages other property or injures other people is liable for the cost of repairs. In a one car accident…you are at fault! Hitting a bridge, tree, ditch, etc. North Carolina financial responsibility laws mandate that drivers carry bodily injury and property liability insurance coverage. Financially protects the NOT at fault party from someone causing an accident C OST OF I NSURANCE Insurance companies legally discriminate by using: Relevant statistical data and Risk factors related to the insurance type Underwriters at companies “rate” to determine the premium cost for the coverage requested. Standard premiums may be rated up for hazards/risks Points for tickets or accidents on auto insurance Health issues on life/health insurance FACTORS A FFECTING C OST OF A UTO I NSURANCE Type of coverage $ Limit of coverage Risk retention -Deductible amount Experience rating – how long driver has been licensed (AGE IS NOT A FACTOR!!) At fault Accidents (Points) Tickets (Points) Type of Vehicle - Value, repairability, engine size, style, HOT Geographic area- Urban, suburban, rural Use of Vehicle - Distances driven and purpose pleasure only, <10 miles to work, >10 miles to work, business use Company video link: auto insurance basics video link: tips on buying auto insurance W HAT IF YOU BUY A DEFECTIVE VEHICLE ? www.autopedia.com/#lemonlaw http://www.ncdoj.com/Consumer/Automobiles.aspx Class Activity