Chapter 1 - LearnNow Publications

advertisement

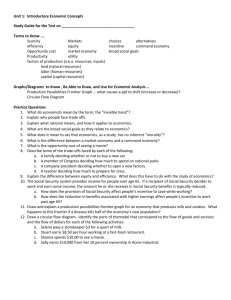

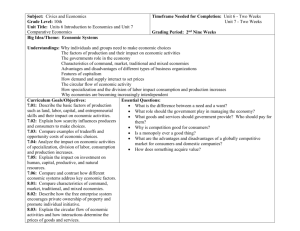

Chapter 1 Introduction to Economics 1.1 1.2 1.3 1.4 1.5 1.6 1.7 www.learnnowbiz.com What is Economics? The Language of Economics What is a Market? The Circular Flow of Income The Economic Problem The Production Possibility Frontier Economic Systems Apply Economic Principles to Work in the Financial Services Industry 1 What is Economics? • Economics is the study of the allocation of scarce resources. • Resources are scarce because they are limited and can be used up (e.g: time, crops, oil, water). www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 2 Scarcity • A basic assumption of economics is that a person’s wants are unlimited and never satisfied. • Resources are used to satisfy wants. • As our wants are unlimited and resources are scarce, we must make choices as to how to use these scarce resources most efficiently, so that as many wants as possible (and the most important ones) are satisfied. • Example Page 11 www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 3 Opportunity Cost • Is the next best choice for the use of an available resource. • Opportunity cost measures the trade-off consumers face when choosing how to use a scarce resource. • When we use a resource for one purpose we are giving up using it for something else. • Example Page 12. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 4 The Language of Economics • Positive economics: When economists state a fact. “The price of butter is $3.00 for 250 grams.” • Normative economics: When economists make a value judgment or a statement of what something should be. Used by policy makers such as politicians. “The price of butter is too high and ought to be cheaper.” www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 5 The Role of Assumptions • Economists make a range of assumptions to simplify complex real world situations to make them easier to understand. Some Common Economic Assumptions: • People act rationally. • A firm’s goal is to maximise profits. • “Ceteris Paribus” a Latin phrase meaning “all other things being equal” www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 6 Incentives • Basic economic assumption that people respond to incentives. “What’s in it for me?” • A financial incentive is payment for a job or task. • A negative incentive is gaol time for breaking the law. • An incentive can be the good feeling or the happiness we get out of doing something for somebody else. • See example pg 15. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 7 What is a Market? • A market is a “place” where buyers and sellers of goods or services come together. • In today’s world that place no longer has to be physical e.g. EBay, the ASX. • Case Study EBay pg 16. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 8 The Circular Flow of Income • Firms are the producers in the economy; they produce goods and services using the factors of production. • Households are the consumers in the economy; they consume goods and services and provide the factors of production to firms. • The factors of production are land, labour and capital. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 9 The Circular Flow of Income www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 10 The Economic Problem • The set of basic decisions that must be made by society regarding goods and services produced and consumed. • What to produce? • How much to produce? • How to produce? • How to increase productivity? • How much to consume? www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 11 The Production Possibility Frontier • Shows the set of all feasible production combinations of two alternate goods. • At any point on the frontier the economy is using its scarce resources in the best way to produce the highest possible level of output. • Any point inside the frontier is inefficient as the economy is producing less than it could be with its available resources. • A good example of opportunity cost. At the frontier, an economy cannot produce more of one good without giving up some production of another good. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 12 The Production Possibility Frontier www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 13 Economic Systems: Command Economies • A command economy is one in which a central authority or government controls every aspect of the economy. • Usually associated with communism or socialism. • No private ownership of land or goods, everything is owned by the state. • Does not take advantage of the fact that people respond to incentives. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 14 Economic Systems: Free Market Economies • Decisions made by a central planner in a command economy are replaced by the individual decisions of millions of individuals, households and firms. • The market is free to look after itself. (No government regulation) • Advantages : – Recognises incentives – Market mechanisms create efficient outcomes (“The invisible hand” see pg 26) • Disadvantages: – Large inequalities between rich and poor – Promotes overproduction and waste – Under-produces public goods e.g. parks, hospitals and schools. www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 15 Economic Systems: Mixed Economies • Between a free-market economy and a command economy. • Uses market mechanisms and incentives. • Some government intervention (public goods, unemployment benefits, etc.) • No pure free market or command economies left. All today’s economies have elements of both types of systems i.e. mixed economies. • What is the best mix? How much government intervention is the right amount? www.learnnowbiz.com Apply Economic Principles to Work in the Financial Services Industry 16