Paris, September 24th 2012

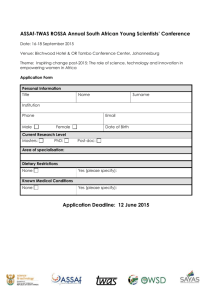

advertisement

Smart Specialisation & the Bioeconomy Dr Alessandro Rosiello Innogen Institute – University of Edinburgh ICABR - Ravello 21/06/2013 Economic Growth • Neo-classical Economy (Solow 1950-70) – Capital-driven growth; trade-off between scale and efficiency; Chandler’s visible-hand • Neo-classical Economy (Romer 1980-90) – Knowledge-driven; spill-over effects • Entrepreneurial Capitalism (1990 – present) – New sources of economic growth – New firm entry: radical innovation, technological diffusion, competitive advantage based on knowledge creation, exchange and recombination – Placed-based development – The Entrepreneurial University/Triple helix “Entrepreneurs are agents of change and growth in a market economy and they can act to accelerate the generation, dissemination and application of innovative ideas… Entrepreneurs not only seek out and identify potentially profitable economic opportunities but are also willing to take risks to see if their hunches are right “ Audretsch DB Keilbach M (OECD1998) - Entrepreneurship Capital and Economic Growth Evidence studies • Rodrik and Hausmann (2003) – First-mover advantages associated with “entrepreneurial departures” – Growth requires smart specialisation • Evolutionary Economics – Avnimelech and Teubal (2006): ICT cluster in Israel (+ GDP: 4%) – Bresnahan and Gambardella (2004): 7 worldwide cases of ICT clusters – Cooke, Feldman, Rosiello and Niosi: several case studies of Biocluster emergence worldwide – Saviotti (2008-12), Porter et al (2012), Boschma & Martin (2010), OECD (2010): clusters in various industries/countries OECD (2012) new sources of growth… • IP, brains and multi-purpose technologies >> productivity + structural change • Created, accumulated and stored in specific locations • Shaped by techno-scientific institutions • Tacit/non-codifiable knowledge > hard to transfer > regional quasi-monopolies • Incremental dynamics/Critical Mass Placed-based growth/Structural Change OECD (2009) Clusters, Innovation and Entrepreneurship EU COM (2007-2010) Innovation Clusters in Europe • up to 40% of jobs in clustered areas (especially in innovative sectors) • Majority of newly created jobs in innovative start-ups • Statistically significant relationship between clustering on innovative firms and prosperity (EU 2007-10) Innovation & Growth 70 Index of economic output 60 50 40 30 20 10 0 0 10 20 30 40 Index of innovative output Source: Mikel Navarro et al, Basque Competitiveness Institute 2010 50 60 70 Region types… OECD 2011 – regional knowledge specialisation Knowledge hubs Industrial production zones Non-S&T-driven regions Source: Ajmone Marsan G and Maguire K (2011), Regions and Innovation Policy, OECD publishing Extra-regional links • Local buzz within Global networks – Multinationals with similar/complementary activities in various countries - providing differentiated products to national/regional markets; – Multinationals with differentiated subsidiaries worldwide – Companies with geographically dispersed specialisations - whether or not dictated by local market specialisation; – globally-connected companies, with links to various centres of excellence Sources of competitive advantage “indigenous” not “endogenous” • Knowledge generators and users plus public government actors must work together > holistic strategy regional innovation!! • European SMEs not working together/not exchanging knowledge (Autant-Bernard et al, Research Policy, 2013) “Knowledge producers and exploiters also participate in their external networks, and the value to them of regional co-operation is in providing a means to secure a unique knowledge advantage that is not as easily secured elsewhere” OECD (2011) Strengthening Global-Local Connectivity in Regional Innovation Strategies SMART Specialisation • Too much specialisation: locked-in dead-ends! • Too much diversity: fragmentation and/or lack of critical mass! • Knowledge/asset variety: key driver for cluster emergence and growth • Diffusion of multi-purpose technologies • Targeting areas of strength…without picking winners! SMSP & Regional Growth • Emerging clusters drivers for economic growth • Cohesion policies: entrepreneurship & innovation have the potential to – Revitalise declining regions – Uplifting lagging-behind regions • Drop barriers to – Trans-regional collaboration – Access to innovation markets • In line with Grand Challenges & EU Strategic Priorities Cohesion Policy 2014-2020 • ERDF + ESF + CF: €201 billion • RIS3 – conditionality • Cohesion < Smart & Inclusive Growth • 1. Smart & inclusive growth (€491bn) Education, Youth, Sport • • • • Connecting Europe Competitive Cohesion Business SMEs Horizon 2020 €80 billion 2. Sustainable growth, natural resources (€383bn) 3. Security and citizenship (€18.5bn) 4. Global Europe (€70bn) 5. Administration (€62.6bn) EU Multiannual Financial Framework 2014-2020 €1,025 Billion Policy rationale: market or systemic failure? or neither of them? • Business R&D expenditure • Spillovers • Financial gaps • • • • • Excessive cognitive distance/Information asymmetries Dynamic coordination failures Eco-system management Local/extra-regional networks Inappropriate institutional structure Lack of critical mass • Neither top-down nor bottom-up Approach • Policy-mix coordination • Entrepreneurship: main translator of knowledge capacity > growth “A successful smart specialisation strategy will not be found by reading the tables of contents of the most recent issue of Science or Nature but rather by observing the structures of the economy and supporting the processes of discovery undertaken by the firms and other organisations operating in this economy” Foray et al (2011) –MTEI-Working Paper SMSP - Policy mix RATIONALE • About diffusion/application of GPTs to revitalise declining regions/areas of the economy • Not about deciding which sectors of the economy R&D should focus on; about improving the mechanisms through which R&D innovation structural change growth Approach • Picking winners X • Selecting Sectors X • Patterns • Transition, Modernisation, 2 types of discovery • Entrepreneurial departures • Targeting functional areas • Multi-level governance SMART Industrial Policy • Specialisation vs Diversification • Policy Mix • Effective coordination • Pro-active strategy Problems with SMSP Discovering the right domains is by no means trivial and technology foresight exercises or critical technology surveys ordered by administrations tend to produce the same ranking of priorities, without any consideration of the context and specific conditions of the “client” for whom the exercise is carried out. Too many regions have selected the same technology mix – a little bit of ICT, a little bit of nanotech and a little bit of biotech – showing a lack of imagination, creativity and strategic vision. Foray et al (2011) – MTEI WP • Specialisation… • A realistic perspective for lagging behind regions? – Entrepreneurial discovery? – Dynamic coordination failures: how? • 3 types of regions? • (Lack of) absorptive capacity • What kind of advantage? • Multi-level governance Source: Innovation Clusters in Europe, DG Enterprise and Industry Report 2010 Smart Specialisation: Policy – EU Commission 2012, RIS3 Guide What are the main requirements?: • Leadership: a long-term commitment of national and regional authorities • Strategy: a plan with clear objectives and measurable deliverables based on a SWOT-analysis • (Tough) Choices: select few priorities on the basis of international specialisation and integration in international value chains • Competitive Advantage: mobilise talent by matching RTD + i and business needs & capacities • Critical Mass: identify areas where scale and scope can be developed (e.g. foresight exercises) • Stakeholder involvement / Ownership of the strategy Cohesion policy: 11 Thematic Objectives towards 2020 • • • • • • • • • • • Strengthening research, technological development and innovation Enhancing access to, and use and quality of, information and communication technologies Enhancing the competitiveness of small and medium-sized enterprises, the agricultural sector (for the EAFRD) and the fisheries and aquaculture sector (for the EMFF) Supporting the shift towards a low-carbon economy in all sectors Promoting climate change adaptation, risk prevention and management Protecting the environment and promoting resource efficiency Promoting sustainable transport and removing bottlenecks in key network infrastructures Promoting employment and supporting labour mobility Promoting social inclusion and combating poverty Investing in education, skills and lifelong learning Enhancing institutional capacity and an efficient public administration Innovating for Sustainable Growth: A Bioeconomy for Europe – EU Commission 2012 • Bioeconomy crucial to deliver EU Cohesion Policy, especially in restructuring/lagging-behind regions – Transition towards more sustainable production – Transition towards increased environmental stability – Security in food supply (p.20/21) • Bio-based industries – Animal-bio, agro-bio, industrial-bio, marine-bio (knowledge enabling technologies – KETs) • Health-bio not included; however better health in Europe part of the Oslo GCs

![[I-2] Mahr](http://s2.studylib.net/store/data/005533114_2-575c16bb39129d77e4fc404ccab7077e-300x300.png)