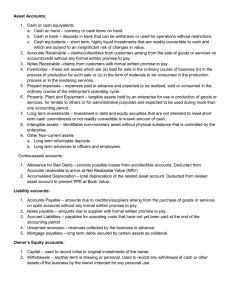

Measuring Assets

advertisement

Investments in Assets Both A Strategic and a Control issue Why long term investment is a strategic issue Long term investment decisions are made after long term strategy is decided (not the other way around). Also, strategic leverage affects how much investments in long term assets are necessary. Consequently, if decisions about long term investments are made incorrectly, strategy and strategic leverage are less likely to be accomplished. Why long term investments is a control issue? Long term investments are generally huge in their monetary and non-monetary impact. As such, if managers and others do not take all precautions when investing and later, in measuring the usefulness of the assets and their contribution, it will have significant adverse impact. Therefore, measuring long term assets is also a control issue of great importance. Before we discuss measurement of long-term assets and alternative measurement methods, let us discuss why it is important to measure long term assets and what specific factors confound the valuation process. Characteristics of long-term assets Long-term assets (Building, Plant, Machinery, Information Technology) Short-term assets (Inventory, Accounts Receivable, Cash) Long-term assets - an organization is committed for a long period of time. The lack of investment could cause opportunity losses or the investment could cause excess capacity. The investment amount is usually large. Regardless, when an organization makes long term investment The investment must: – Lead to generation of adequate profits and – the return (ratio of profits generated compared to total investments) must be adequate. – What is “adequate” return and which investment is better than other alternatives are the focus of this chapter. Please remember that Every investment competes with alternative investments and, No organization, however large it is, has resource constraints; and therefore, A company must choose its investment strategy judiciously and such a strategy Must be carried out within the overall strategic framework – deciding priorities and allocating resources. Before choosing an evaluative methodology, a manager must determine the following: How to determine investment priorities (what tangible and intangible benefits must be taken into account)? How to assess the risk of each investment? How to establish a process for managing the realization of expected benefits? This is a long term issue, and How to justify the investments (how it fits within the overall strategy)? Perfoming investment analysis Why relate profits to investments? Unless an organization is a 100% service organization, profits are generated ONLY if you have investments. Therefore, earning a satisfactory return on the investments employed is necessary. The investors in stock compute such a return routinely (e.g. Ford and G.M.). To compare two units, A and B, without considering the investment made in each is meaningless. Why relate profits to investments? The Manager’s Responsibility First, a manager should invest in assets only if the assets will produce adequate returns. Second, when an asset is not providing adequate return (the expected return could change over the years), it is time to “disinvest” or reduce further investments into this asset. Two ways to relate profits and investments and to compare investment alternatives Return on Assets (ROA) and Economic Value Added (EVA). Return on Assets (ROA) (let us use Exhibit 7.1 of your textbook) ROA is a ratio of two numbers: Income ROI = -------------------------------------Average Assets (or Investment) Note: Most times, average assets is - (the beginning of the year equity + end of the year equity / 2). Equity for this purpose would be defined as the stockholders’ equity + long term liabilities. From exhibit 7.1, ROA = 100 (net income) / 500 (Equity) = 20% (In exhibit 7.1, there are no long term liabilities). Economic Value Added (EVA) EVA= Net income - (operating assets)*cost of capital EVA or Economic Value Added EVA= Net income - (operating assets*cost of capital) Note: Unlike ROA, EVA is not a ratio but a monetary amount Note: Operating Assets*Cost of Capital = Capital charge. Use exhibit 7.1 to compute EVA Net Income = 100 Capital charge – Equity * .10 = 50 EVA = 100 – 50 = 50 What is cost of capital? The minimum return an organization must earn on its investments to meet investor expectations. Cost of capital is specific to each organization and depends on several factors such as the type of industry in which it operates, how risky the organization is, the rate at which it can borrow from outside and more (borrowing, in this context, refers to both debt and equity). If an investment returns more than the cost of its capital, the investment is positive and if not, it is negative and as well not invested. How asset values can distort ROA and EVA Computations ROA and EVA computations are simple. However, depending on the asset based used, they can give misleading signals. Most long term assets are depreciated. Everyone comfortable with depreciation computations? Depreciation reduces the book value of the assets as they age. Depreciation distorts ROA, EVA Computations We will use the numbers from Exhibit 7.1, 7.3 and 7.4 New Machine costs 100,000. Life 5 years Savings by using the new machine $27,000 per year or on a Present Value basis for five years, $102,400 with a net present value of $2,400 (102,400 - $100,000). Before this new asset is acquired, the annual depreciation on fixed assets was $50,000 per year and After the new asset is purchased, the annual depreciation will go up by $50,000 + 100,000 /5) = $70,000. See computations for before and after purchase of asset - ROI and EVA are overstated (See exhibit 7.1) Before 1 year after Profit before depreciation Expenses (w/o Deprecn.) Profit before depreciation Depreciation Profits after depreciation Purchase Purchase of asset of asset $ 1,000,000 $ 1,000,000 ( 850,000) ( 823,000) 150,000 177,000 (50,000) (70,000) $ 100,000 $ 107,000 Equity $ Capital charge at 10% EVA (Profits – Cap. Charge) ROA 500,000 $ 50,000 50,000 20% 500,000 60,000 47,000 21.4% Interpretation of the previous slide The profit before depreciation has remained constant at $100,000 before and after purchase of the asset and yet The ROA went up from 20% to 21.4%. Why? Simply because the depreciation expenses went up. In contrast, the EVA declined from 50,000 to 47,000 making it look like profits decline after purchase of the asset (even though the income before taxes had actually increased from $100,000 to $107,000). That is, a manager can make the wrong decision not to purchase the asset based on these computations. In later years, the EVA will go up and so will the ROA because of additional depreciation. One more example of ROA increase just by the passage of time and even without acquiring a new asset. Year 1 Year 2 Year 3 Profit before depreciation $ 110,000 Depreciation $ 50,000 Profit after depreciation $ 60,000 $ 110,000 $ 50,000 $ 60,000 $110,000 $ 50,000 $ 60,000 Equity ROI $ 450,000 13.3% $400,000 15% $ 500,000 12.0% ROI can lead to poor decisions Encourages division managers to retain assets beyond their optimal life and not to invest in new assets which would increase the denominator. Can cause corporate managers to over- allocate resources to divisions with older assets because they appear to be relatively more profitable. Capital may be allocated towards least profitable divisions, at the expense of the most profitable divisions. ROI – the bad decisions Can lead to different inventory policies and decisions in different divisions, even for identical items of inventory. If corporate managers are not aware of these distortions or do not adjust for them, they can do a poor job of evaluating the divisional managers and their performances. How to deal with this issue? When computing ROA or EVA, don’t use net book value of the asset but use gross book value (original purchase price ignoring depreciation). See ROA computations from your exhibit using gross value Before Profit before depreciation Expenses (w/o Deprecn.) Profit before depreciation Equity Capital charge at 10% ROA 1 year after Purchase Purchase of asset of asset $ 1,000,000 $ 1,000,000 ( 850,000) ( 823,000) 150,000 177,000 $ 500,000 $ 50,000 150/500 = 30% 500,000 60,000 177/500 35.2% Advantages of using EVA (residual income) EVA ranks project on profits in excess of the cost of capital (EVA increases). With EVA, all business units have the same profit objective for comparable investments. EVA permits the use of different interest rates for different investment projects. EVA has greater correlation with a firm’s market value (it optimizes shareholder value). ROA versus EVA In practice, most businesses use ROA because it is simpler to compute and understand. It is also comprehensive in the sense that it considers the entire balance sheet and income statement. Unlike ROA – a percentage, EVA is a dollar amount and does not allow for intra and inter company comparisons. Then, why use EVA? The Advantages EVA uses the same profit objectives; this overcomes the problem of depreciation and varying incentives to invest in assets. EVA, on the contrary, finds any investment that returns over the cost of capital as worth investing. EVA permits use of different rates of interest to each project (since some investments or more/less risky than others. EVA (unlike ROA) is more positively correlated to stock values. What are intangible assets? Not all benefits that accrue are so easy to objectively measure and not all investments are in tangible form (physical). Intangible assets include items that lack of a physical form but are nevertheless important for a firm to measure and understand. e.g. R& D, Marketing promotions, investments in IT. Why should a firm invest in intangible assets? Intangible assets signal a firm’s ability to: Introduce new products Develop customer relationships (marketing, advertising, promotional schemes) Approach new customer segments Improve product quality and services Manage cost, reduce lead times, and more. Since the benefits from these efforts accrue over a long time and into the future, these investments could be capitalized. How does an organization measure intangible assets? Relative value. Measure progress, not a quantitative target, that is the ultimate goal. Example: have 80% of employees involved with the customer in some meaningful way. Balanced scorecard: we will discuss these in the performance measures chapter. Competency models. By observing and classifying the behaviors of "successful" employees ("competency models") and calculating the market value of their output. Measuring Intangible Assets 4. Subsystem performance. Sometimes it's relatively easy to quantify success or progress in one intellectual capital component. For example, Dow Chemical was able to measure an increase in licensing revenues from better control of its patent assets. 5. Benchmarking. Involves identifying companies that are recognized leaders in leveraging their intellectual assets, determining how well they score on relevant criteria, and then comparing your own company's performance against that of the leaders. Measuring Intangible Assets 6. Business worth. Ask 3 questions: What would happen if the information we now use disappeared altogether? What would happen if we doubled the amount of key information available? How does the value of this information change after a day, a week, a year? Evaluation focuses on the cost of missing or underutilizing a business opportunity, avoiding or minimizing a threat. Measuring Intangible Assets 7. Brand equity valuation. Methodology that measures the economic impact of a brand (or other intangible asset) on such things as pricing power, distribution reach, ability to launch new products as "line extensions." 8. "Calculated intangible value." Compares a company's return on assets (ROA) with a published average ROA for the industry. Measuring Intangible Assets 9. "Colorized" reporting. Suggested by SEC commissioner Steven Wallman, this method supplements traditional financial statements (which give a "black and white" picture) with additional information (which add "color"). Examples of "color" include Brand values, customer satisfaction measures, value of a trained work force. Intangible assets and investment analysis Calculate ROA/EVA ignoring intangible benefits. If the return is less than what is acceptable, ask whether the intangible benefits are worth at least the amount of the difference between what is acceptable and what the expected return is. Project rough, conservative estimates of the value of the intangible benefits, and incorporate these values into the investment calculation.