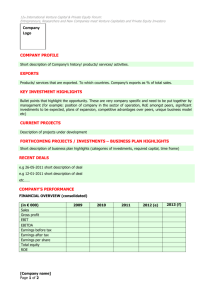

Sub

advertisement