Earnings Management

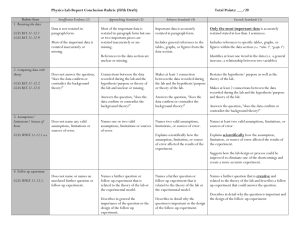

advertisement

Earnings Management What is earnings management? Why do managers do it? How do they do it? How can we detect it? What? • Aggressive Accounting • Earnings Management • Income Smoothing • Fraudulent Reporting • Creative Accounting What? The active manipulation of accounting results for the purpose of creating an altered impression of performance. Managers choosing accounting policies so as to maximize their own utility and/or the market value of the firm. Accounting Tricks - Examples Waste Management Inc. – Understated depreciation and capitalized interest improperly, failed to write down impaired assets. Total restatement $2 billion. Waste Management Overstated Income 900 800 700 600 500 400 300 200 100 0 -100 Original Restated 92 93 94 95 96 97 Accounting Tricks - Examples WorldCom – Recorded expenses as capital expenditures, doublebooked revenues, booked revenues as cost reductions. Total restatement $4.6 billion WorldCom – Reported vs. Restated EBITDA 14000 12000 EBITDA (in millions) 10000 8000 Reported EBITDA Restated EBITDA 6000 4000 2000 0 1999 2000 2001 Year 1st Qtr 2002 How would you detect this type of fraud? • A decrease in the asset turnover ratio. A fictitious asset cannot produce revenue • PPE increases while revenue decreases • When an expense that is fixed remains constant as a percentage of sales, despite decreases in revenue • Possible from disclosures on significant accounting policies • Writing off previously capitalized cost Ratio Analysis 2nd Qt 2000 to 1st Qt 2002 Line costs/revenue 40.73% 38.49% 42.53% 42.26% 41.83% 41.77% 42.09% 42.84% Asset Turnover 10.47% 10.16% 9.71% 9.76% 47.4% 45.5% 8.74% 8.55% 8.16% 7.82% Sales/PPE 59.2% 55.1% 44.1% 40.7% 35.6% 32.2% Accounting Tricks - Examples Xerox – Recorded revenue on long-term leases of copiers prematurely. Total restatement $3 billion (but part of this increased later revenues). Xerox – Reported and Restated Revenue 20,000 19,500 19,000 18,500 18,000 17,500 Original 17,000 Restated 16,500 16,000 15,500 15,000 14,500 1997 1998 1999 2000 2001 How would you detect? • Examine Days in receivables – if this increases because revenue is being recognized significantly earlier than it is collected. • The relationship between CFFO and revenue significantly decreases Accounting Tricks - Examples Adelphia – Hid billions in debt off-balance sheet in unconsolidated subsidiaries, diverted undetermined millions to the family stockholders, inflated subscriber numbers in press reports, overstated earnings. Adelphia Debt Load $3.5 Billion Reported $12.6 Billion Actual Accounting Tricks - Examples Sunbeam – Inflated revenues by channel stuffing and bill &hold. Reduced expenses by capitalizing advertising costs, reducing allowance for bad debts. Sunbeam – Revenues and Net Income 1,400,000 1,200,000 1,000,000 800,000 Reported Revenue 600,000 Actual Revenue 400,000 Reported NI Actual NI 200,000 0 (200,000) (400,000) 1996 1997 Signals of this type of fraud • • • • Days in Receivables increases An increase in Gross Margin percentage CFFO falls Change to a more aggressive revenue recognition policy • Offers large discounts or other inducements to get orders • Revenue is recorded despite a right of return Accounting Tricks - Examples Rite-Aid – Inflated revenues by recording vendor rebates that pertained to future purchases. Reduced expenses by capitalizing expenses, not recording certain expenses, failing to write off inventory shrinkage, understating depreciation. Rite-Aid – Net Income Restatement 250 200 150 Reported 100 Restated 50 0 1998 -50 1999 1Q2000 Detecting overstated inventory • Not recording “shrinkage” of inventory • Recognizing rebates from vendors before Rite Aid actually sold the goods Accounting Tricks - Examples Enron - Hiding debt and losses in unconsolidated entities Enron – Reported and Restated Net Income 1200 1000 800 Reported 600 Restated 400 200 0 1997 1998 1999 2000 2001 Why? -- Share price effects -- Borrowing cost effects -- Bonus plan effects -- Political cost effects How? 1. Flexibility of accounting principles 2. Choices, estimates, & judgments 3. Rule-based accounting loopholes How? 1. Flexibility of accounting principles Choices: –Inventory –Depreciation –Expensing vs. Capitalizing –Software sales recognition Why do we allow choices? What problems does choice create? How? 2. Choices, Estimates, & Judgments • Depreciation –method –useful life –salvage value • Allowance accounts –bad debts –sales returns –warranties Choices etc., cont’d. • • • • • • • Asset and goodwill impairments Restructuring costs Inventory write-downs Environmental liabilities Pension assumptions In-process R&D Percentage of completion contracts How? 3. Rule-based versus principle-based accounting • What is rule-based accounting? –What are its advantages and disadvantages? •What is principle-based accounting? –What are its advantages and disadvantages? Sickening example – SPE’s