Lecture 4

advertisement

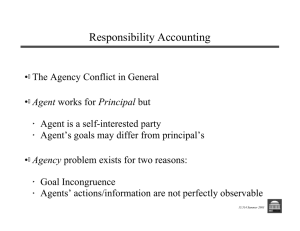

Advanced Corporate Finance FINA 7330 Ronald F. Singer Agency Problems and Control Lecture 4 Fall, 2010 Agency Problem • The Principal-Agent Relationship Typically in a Corporation, there are what is called agents and principals: The Agent is the “person that acts,” whereas the Principal is the person that receives the benefits from the actions. Typical Principal/Agent relationships: • The Agency Problem tries to solve the natural conflict of interest that arises as a result of this principal agent problem Conflicts of Interest • • • • • Reduced effort on the part of the agent Excessive perks consumption Empire building Entrenchment Risk avoidance Agency Problem • How do you resolve these conflicts? – Monitoring • • • • • • Stockholders Bondholders Board of Directors Financial Press SEC and other government regulators Outside auditors – Issues opinion regarding whether reports are consistent with generally accepted accounting standards – Qualified or unqualified opinion Agency Problem – Incentives • Provide a compensation package to managers that try to induce them to act in stockholders’ interest • Can’t determine this directly –Difficult to separate effort from luck • Usually this is performance (or value) based incentives –Stock options Agency Problem • Problems with value based compensation – Difficult to distinguish between effort and competence, versus luck – Could be subject to manipulation • Enron, Fannie Mae, • Stock options backdating scandal – Compensation determined by Board • Sarbanes Oxley: SOX: Compensation Committee must be independent directors Agency Problem • The Basic problem is how do you measure performance, and how do you get information that is unbiased? • You get what you measure Incentive Issues • Monitoring - Reviewing the actions of managers and providing incentives to maximize shareholder value. • Free Rider Problem - When owners rely on the efforts of others to monitor the company. • Management Compensation - How to pay managers so as to reduce the cost and need for monitoring and to maximize shareholder value. Residual Income & EVA • Emphasizes NPV concepts in performance evaluation over accounting standards. • Looks more to long term than short term decisions. • More closely tracks shareholder value than accounting measurements. Performance Evaluation • How do you know if management is doing a good job or not: • What you measure is what you get • Must consider tradeoffs of high early return versus growth • You want to capture the economic value of investment not book values Message of EVA + Advantages Managers are motivated to only invest in projects that earn more than they cost. EVA makes cost of capital visible to managers. Leads to a reduction in assets employed. Present Value of EVA measures NPV and thus consistent rewarding via EVA leads to good decisions - Disavantages EVA does not directly measure present value Rewards quick paybacks and ignores time value of money What is Economic Value Added (EVA) EVA = Residual Income = Income earned – Income required = Income earned – Cost of Capital X Capital Invested Note: Earned income can be written as: ROI X Book Value of Capital Income required can be written as: CoC X Book Value of Capital SO: = (ROI – CoC) X BV of Capital (see spreadsheet) EVA of US firms - 2003 ($ in millions) Wal-Mart Stores Johnson & Johnson Microsoft Merck Coca Cola Intel Corp. Dow Chemical Boeing Delta Airlines Viacom IBM Correlation Econimic Value Capital Return on Added (EVA) Invested Capital 4,525 79,177 12.30% 4,459 51,508 17.6 4,027 24,677 29.8 3,347 40,941 16.9 2,729 20,503 20.1 (57) 31,216 15.6 (1,503) 44,158 3.6 (1,974) 50,046 2.2 (2,288) 27,238 -0.9 (5,508) 96,515 3.5 (7,505) 108,926 4.6 0.97 0.51 Cost of NPV of Capital Cash Flow 6.60% 8.9 13.5 8.7 6.7 15.8 7 6.1 7.5 9.2 11.5 68,380 50,351 29,795 38,588 41,006 (395) (21,448) (31,997) (30,507) (59,797) (65,356) Summary of Performance Valuation • • • • • Use EVA Measure Use Economic Depreciation Estimate Cash Flows Estimate Economic Depreciation from above Find EVA using existing Economic Depreciation estimates • Then value performance on that basis