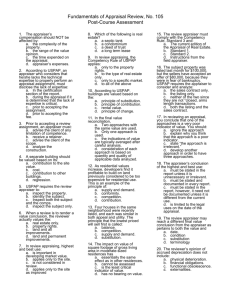

Types of Appraisals

advertisement

Real Estate Principles Tenth Edition Real Estate: An Introduction to the Profession Tenth Edition Chapter 18 Real Estate Appraisal _________________________ Appraisal An estimate of value. Three approaches to estimating value: Market – comparable sales data Cost – construction cost plus land value Income – monetary returns of property capitalized Valuing a House Market Comparison Approach -$7,560 +$2,960 -$2,700 Competitive Market Analysis Calculating Gross Rent Multiplier Gross Rent Multiplier $245,000 Gross Annual Rents $34,900 No.2 $160,000 $22,988 = 6.96 No.3 $204,000 $29,352 = 6.95 No.4 $196,000 $27,762 = 7.06 As a Group: $805,000 $115,002 = 7.00 Building Sales Price No.1 = 7.02 Costs Approach to Value Step 1: Estimate land as vacant $ 30,000 Step 2: Estimate new construction cost of similar building $120,000 Step 3: Less estimated depreciation -12,000 Step 4: Indicated value of building $108,000 Step 5: Appraised property value by the cost approach $138,000 Square-foot Method of Cost Estimating Income Approach Variation by Direct Capitalization Income / Rate = Value $18,000 / 0.09 = $200,000 Projected Annual Operating Statement (Pro Forma Statement) Operating expense ratio: $31,070 / $79,800 = 38.9% Direct Capitalization Using an Overall Rate Income = Value Overall Rate $45,400 0.09376 = $484,215 Overall Rates - 10-year Holding Period, 25-year Loan for 75% of the Purchase Price, 10% Investor Return Reconciliation Market Approach Cost Approach Income Approach Final Indicated Value $180,000 x 75% = $135,000 $200,000 x 20% = $ 40,000 $160,000 x 5% = $ 8,000 $183,000 Types of Appraisals and Reporting Options under USPAP Types of Appraisals • Complete appraisal • Limited appraisal Reporting Options • Self-contained appraisal report • Summary report • Restrictive report Formats of Appraisal Reports 1. Letter report 2. Form report 3. Narrative report 4. Review appraisals 5. Real estate analysis Appraiser License Certified General Appraiser Certified Residential Appraiser State licensed appraiser Provisional licensed real estate appraiser Appraiser trainee Principles of Value Principle of Anticipation Principle of Substitution Highest and best use of a property Principle of competition Principle of supply and demand Principle of change Principle of contribution Principle of conformity Value Market value Assessed value Insurance value Loan value Estate tax value Plottage value Rental value Replacement value Markets Buyer’s market – excess supply of housing for sale. Seller’s market – demand exceeds supply. Professional Appraisal Societies The American Institute of Real Estate Appraisers (AIREA) MAI SRA Society of Real Estate Appraisers NATIONAL Association of Independent Fee Appraisers Farm Managers and Rural Appraisers National Society of Real Estate Appraisers American Society of Appraisers Key Terms Appraisal Capitalize Comparables Cost approach Depreciation FIRREA Gross rent multiplier Highest and best use Income approach Market approach Market value Operating expenses Scheduled gross, Projected gross USPAP