Industry Issue Resolution (IIR) Program PPT

advertisement

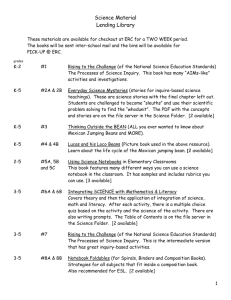

Industry Issue Resolution (IIR) Cheryl P Claybough Director PFTG May 2012 IIR Program - Rev Proc 2003-36 The program goals are to: Address frequently disputed or burdensome business tax issues that affect a significant number of taxpayers. Provide clear guidance to reduce the time and resources associated with resolving issues during tax examinations. The IIR process includes the following: Issue Submission and Selection, Planning, Analysis and Development, and Resolution and Guidance. 2 IIR Submission Taxpayers, associations, and others can submit an issue anytime: Not required to be in a particular format. Should include: - Issue statement and description of why the issue is appropriate for the Program, - Explanation of the need for guidance and estimated number of taxpayers affected, and - Name and telephone number of a person to contact if additional information is needed. May include a recommendation as to how the issue could be resolved. 3 Issues Appropriate for IIR Issue should have two or more of the following attributes: Uncertain tax treatment of common factual situation, Uncertainty results in frequent, repetitive exam of the same issue, Uncertainty results in taxpayer burden, Significant and impacts a large number of taxpayers, or Extensive factual development, understanding of industry practices and views would assist the Service in determining the proper tax treatment. 4 Issues Not Appropriate for IIR Generally, issues not appropriate for the IIR program include: Issues unique to one or a small number of taxpayers. Issues primarily under the jurisdiction of the Operating Divisions of the Service other than the LB&I and SB/SE Divisions. Issues that involve transactions that lack a bona fide business purpose, or transactions with a significant purpose of improperly reducing or avoiding federal taxes. Issues involving transfer pricing or international tax treaties. 5 Recently Completed IIRs IIRs recently submitted and completed include: Telecom Class Life for Wireless Assets- submitted Aug 2009 for clarification of class life for wireless telecom assets resulted in issuance of Rev. Proc. 2011-22 and Rev. Proc. 2011-28. Telecom Network Assets- submitted Feb 2010 for clarification of telecom network assets to be capitalized vs. expensed resulted in issuance of Rev. Proc. 2011-27. Unit of Property – Utility Transmission & Distribution- submitted Apr 2010 for clarification of utility transmission and distribution assets to be capitalized vs. expensed resulted in issuance of Rev. Proc. 2011-42 and Rev. Proc. 2011-43. 6 IIRs in Process Unit of Property – Electric Power Generation Determination of power generation assets to be capitalized under section 263 vs. expensed under section 162. Unit of Property – Cable Determination of cable industry network assets to be capitalized under section 263 vs. expensed under section 162. The Life Insurance Variable Rate Annuities Hedging Application of regulation 1.446-4 to hedging of guarantees under variable products. Conclusive Presumption of Worthlessness Whether Reg. 1.166-2(d) applies to insurance companies as “other regulated corporations”. Unit of Property – Natural Gas Determination of distribution pipeline assets to be capitalized under section 263 vs. expensed under section 162. 7 IIR Questions? All guidance is posted on IRS.gov Refer to Rev. Proc. 2003-36 for IIR application process Refer to IIR page on IRS.gov Melanie Perrin, Senior Program Analyst (202-283-8408) Maria Dolan, Program Manager (813-367-8475) 8