memo - Controller's Office

advertisement

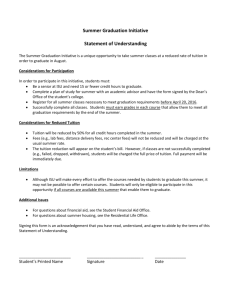

Memorandum To: Budget Officers, HR Unit Reps From: Terry Johnson, AVP & Controller Carroll Reasoner, VP Legal Affairs & General Counsel Tom Peifer, Tax Manager Subject: Taxability of Educational Assistance to Employees Date: July 9, 2013 University Tuition Assistance Program The University offers a Tuition Assistance program to its employees. The program allows eligible faculty and staff to apply for financial assistance to help defray the cost of tuition for one college credit course (up to four semester hours). For more information see http://www.uiowa.edu/learn/awards/tuitionassist.html. Employers may provide up to $5,250 annually in educational assistance to an employee on a tax free basis under Internal Revenue Code Section 127. This tax provision was recently made permanent by the American Taxpayer Relief Act that was signed into law by the President on January 2, 2013. Special Tax Provisions Available to Educational Institutions Undergraduate level education provided to employees of educational institutions can generally be provided tax free under various Internal Revenue Code sections, primarily Section 117(d). Graduate level education for graduate students engaged in teaching or research activities can also be provided tax free. Educational Assistance Outside of the Tuition Assistance Program As a general rule, graduate level educational assistance paid to or on behalf of an employee that is not awarded as part of University’s Tuition Assistance is considered taxable income to the employee. Tax may be avoided if the job-related education meets the working condition fringe benefit exception for education described below. Working Condition Fringe Benefit Tax may be avoided if the job-related education meets the working condition fringe benefit exception for education as described on page 21 of the 2013 IRS Publication 15B (http://www.irs.gov/pub/irs-pdf/p15b.pdf), see pertinent language shown below. Excerpt from IRS Publication 15-B: Education. Certain job-related education you provide to an employee may qualify for exclusion as a working condition benefit. To qualify, the education must meet the same requirements that would apply for determining whether the employee could deduct the expenses had the employee paid the expenses. Degree programs as a whole do not necessarily qualify as a working condition benefit. Each course in the 1 program must be evaluated for qualification as a working condition benefit. The education must meet at least one of the following test conditions: The education is required by the employer or by law for the employee to keep his or her present salary, status, or job. The required education must serve a bona fide business purpose of the employer. The education maintains or improves skills needed in the job. However, even if the education meets one or both of the above tests, it is not qualifying education (exempt from tax) if it: Is needed to meet the minimum educational requirements of the employee’s present trade or business, or Is part of a program of study that will qualify the employee for a new trade or business. These requirements are summarized in the flow chart below from IRS Publication 970,Tax Benefits for Education (http://www.irs.gov/pub/irs-pdf/p970.pdf) and should be utilized to determine whether an employee’s education is qualifying work-related education and exempt from tax. Chapter 12 of Publication 970 should be reviewed closely by anyone attempting to qualify the education as a working condition fringe. 2 Effective for the 2013 Fall Semester, any employee wishing to claim working condition fringe benefit treatment for classes taken at the graduate level or above must complete the Job-Related Graduate Course Certification Form which will be submitted to the Controller’s Office for review. This certification form will need to be completed each semester and will be signed by both the employee and the employee’s supervisor certifying the courses meet the definition of being job-related by the IRS as defined in Treasury Regulation Section 1.162-5. If this form is not received by the Controller’s Office, any graduate level or higher courses taken will be treated as taxable compensation. The Controller’s Office, University General Counsel and the University Payroll Department will review the certification forms submitted and will make determinations on each request for tax-exemption. Budget Officer Responsibility We need to determine a listing of the employees currently participating in graduate level or above courses. We’re asking the primary Budget Officers responsible for each Collegiate/Academic Unit to determine if any employees within their respective units are/will be taking graduate level or above courses and provide an email listing of the employees to Tom Peifer by July 19. It would be helpful if this employee listing also included employee’s that participated in graduate level or above courses for the 2013 Spring and Summer Terms (for informational purposes). Once the employee listing for the Fall 2013 Term has been determined, the Controller’s Office will email the Certification Form along with the IRS Regulations to the employees for completion. 3