Commercial 104

Commercial 104

1

TWFG Commercial Business School

Commercial 104

Commercial 101 – 104

Commercial 101

Overview

Commercial Insurance Basic Terms

Commercial Insurance Polices: Overview

Important Auxiliary Coverages

ACORD Forms Overview

Commercial Lines Workflow Process

Submission Checklist

Post-Binding Checklist

2

TWFG Commercial Business School

Commercial 104

Commercial 101 – 104

Commercial 102

How Does the Underwriting Process Operate?

Commercial Insurance Policy Coverages: First Level Detail

Silverplume Overview (Live Demo)

3

TWFG Commercial Business School

Commercial 104

Commercial 101 – 104

Commercial 103

Commercial Lines Basics Property: COPE

Commercial Lines Basics Property: Building

Commercial Lines Basics Property: Business Personal Property (BPP)

Module 3 Case Study

4

TWFG Commercial Business School

Commercial 104

Commercial 101 – 104

Commercial 104

Commercial Auto

Multi-Line Policy Types

Workers Compensation Overview

Endorsements Common to Most Policies

5

TWFG Commercial Business School

Commercial 104

Learning Objectives

Understand what exposures are covered under the Commercial Auto

Policy

Understand the difference between a Business Owners Policy (BOP) and a Commercial Lines Package Policy and when using each is the best choice

To gain a basic understanding of what coverages are provided the basics of rate classification under the Workers Compensation Policy

6

TWFG Commercial Business School

Commercial 104

Commercial Auto

Most businesses use some type of auto in their operations.

For some the use is incidental, such as a contractor driving to and from a job site.

For others, the use is essential, such as furniture delivery.

Obviously, the more an auto is on the road, the greater the exposure, or chance of loss, and therefore the greater the premium

7

TWFG Commercial Business School

Commercial 104

Commercial Auto

This class is designed to help you become more familiar with auto coverages, how commercial autos are rated, and the exposures that an underwriter evaluates

8

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Definition:

A land motor vehicle or trailer designed for use on public roads

Any other land vehicle subject to a compulsory insurance law

For a vehicle to be properly insured on a Commercial Auto Policy, it must be registered in the company’s name (or individual for a sole proprietor)

9

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Definition:

Mobile equipment is NOT a commercial auto: Farm equipment, forklifts, bobcats, bulldozers and other vehicles not designed for use over public roads.

Also included are mobile chassis with permanently attached pieces of heavy equipment designed specifically for movement of that equipment.

Exempted are vehicles with snow plows attached and street cleaning vehicles. These are considered “autos”

10

TWFG Commercial Business School

Commercial 104

Commercial Auto

Definition of Insured:

You, meaning the corporation, partnership or sole proprietor listed as the name insured

Anyone else using a covered auto with your permission. There are some exceptions for family members and employees if they own the vehicle in question. These situations can be addressed by specific endorsements

11

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Coverages:

UM/UIM:

Uninsured and underinsured motorist coverage is similar to the same coverages found in the Personal Auto Policy, as are PIP, Med

Pay and Towing. UM/UIM is mandatory in most states. In others, it may be rejected, but must be done so by signing a specific form, and the form normally must be signed with each renewal. (Key Concept) This is an area where enormous E&O exposures exist. It is vital that each agent maintain an auto “checklist” both for new business and renewals, which includes verification of the acceptance/rejection and collection of the signed rejection form

12

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Coverages:

BI/PD:

The definitions for bodily injury, property damage and accident match those of the CGL

The bodily injury or property damage must result from the ownership, maintenance or use of a covered auto

We will discuss what a covered auto is in a later section

13

TWFG Commercial Business School

Commercial 104

Commercial Auto

Physical Damage Coverages:

Comprehensive, Collision, and Specified Causes of Loss apply similarly as they do with Personal Auto Policies

14

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Several factors used to determine classification and rating

Understanding needed to be able to apply these factors to properly write commercial auto

15

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Weight and Vehicle Type:

Private passenger

Form of commercial truck including vans

Weights – classified as, and based on GVW:

Light

Medium

Heavy

Extra Heavy

16

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Private Passenger: Sedan/SUV/Coupe/Non-Commercial Van

Light Trucks: Pick-up Trucks/Commercial Vans up to 10,000lbs

Medium Trucks: Box Trucks/Commercial Vans up to 20,000lbs

Heavy Trucks: Large box and Non-Semi up to 45,000lbs

Extra Heavy Trucks: Large box and Non-Semi over 45,000lbs

Service or Utility Trailers: Load capacity up to 2000lbs

Trailers: Load capacity over 2000lbs

Semi-Trailers

17

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Use of Vehicle: Classifications based on the degree of “Over-The-

Road” exposure according to how the vehicle is normally used

Service Use: Vehicles used to transport workers/supplies to and from job sites. Parked most of the time. Ex.: Electrical Contractor’s truck

Retail Use: Vehicles used for deliveries to residences, such flower/furniture delivery. Frequently changing routes

Commercial Use: All other vehicles, such delivery trucks (to businesses)

18

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Radius of Operation: Distance normally traveled from the place of business

Local: 50 – 100 miles

Intermediate: 51 – 200 miles

Long Distance: Over 200 miles

19

TWFG Commercial Business School

Commercial 104

Commercial Auto

Commercial Auto Rating & Classification:

Special Industry Classifications: The last classification and rating factor applies to special classes, such as dump trucks and trailers, concrete trucks, and food delivery

Garaging Address: Determines the rating territory for each unit. For large fleet schedules, units may be garaged at multiple addresses

20

TWFG Commercial Business School

Commercial 104

Commercial Auto

Symbol Values:

For each coverage selected the insured will select a Symbol, which determines which vehicles are included for that coverage.

Symbo1 1

Symbol 2

Any Auto: Any owned, non-owned, or hired auto.

Typically only allowed for liability coverages

Owned auto only: Used for liability, UM/UIM and other coverages.

21

TWFG Commercial Business School

Commercial 104

Commercial Auto

Symbol Values:

Symbol 3

Symbol 4

Symbols 5/6

Owned Private Passenger Autos: Used by entities which strictly use private passenger autos, such mobile computer repair service. Need to include symbols 8 and 9

Owned Autos other than Private Passenger: Could be used by commercial trucking outfit. Need to include symbols 8 and 9

Apply to UM/UIM, PIP, and Med Pay

22

TWFG Commercial Business School

Commercial 104

Commercial Auto

Symbol Values:

Symbol 7

Symbol 8

Symbols 9

Specifically Described Autos: Typically used for

Physical Damage coverage when some units will not have the coverage, such as older units

Hired Autos: Extends selected coverages to autos the insured leases, hires, rents, or borrows but NOT those belonging to employees for partners

Non-Owned Autos: Extends coverage to autos which ARE owned by employees or partners.

Typically only liability coverage is extended to Hired and Non-Owned autos

23

TWFG Commercial Business School

Commercial 104

Commercial Auto

Symbol Values:

Other Items:

Need to supply complete list of drivers with DL number

Driving records and experience will be evaluated by UW

You must determine if insured has a formal “Fleet Safety

Program”

24

TWFG Commercial Business School

Commercial 104

Commercial Auto

Who is an Insured?

The named insured for a covered auto

A permissive user of a covered auto (employees)

Who is not an Insured?

The owner of a Hired Auto

An employee in their own auto

A partner/member in an auto they own

25

TWFG Commercial Business School

Commercial 104

Commercial Auto

Important Endorsements:

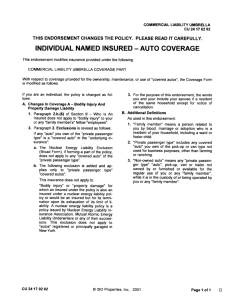

CA 99 17 Individual Named Insured

Designed for sole proprietors, partners and LLC members when the car they drive (covered auto under the BAP) is their personal car

CA 99 10 Drive Other Car Coverage

Designed for officers, partners, or employees who are furnished a company car and it’s the only vehicle available to that individual (does not own a personal auto)

26

TWFG Commercial Business School

Commercial 104

Commercial Auto

Important Endorsements:

CA 99 16 Hired Auto Specified as Covered Auto You Own

This extends liability and/or physical damage to autos owned by owners or employees and used in the business.

Specific autos are scheduled. CA 99 33 should also be used

CA 99 33 Employees as Insureds

Extends liability coverage to all employees whose autos are listed on the CA 99 16

27

TWFG Commercial Business School

Commercial 104

Commercial Auto

Important Endorsements:

CA 20 01 Lessor-Additional Insured and Loss Payee

Effectively turns a leased auto into a covered auto rather than a hired auto. This makes the insured’s auto coverage primary

CA 99 47 Employee as Lessor

Adds the scheduled auto (which is owned by an employee and leased to the business) as a covered auto and the employee who leases it as an insured

28

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Use of Vehicles

How vehicles are used is a major component in underwriting

Service vehicles presents the lowest exposures

Retail vehicles presents the highest exposures

29

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Age and Condition of Vehicles

While older, well maintained vehicles are acceptable, newer units are preferred

Older units have more maintenance issues

Newer units indicates financial success, and a planned budgetary commitment to vehicle safety and quality

30

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Formal Safety Program

For fleets of 5 or more units a formal safety program is preferred and should include:

Designated Safety Officer

Daily Vehicle Inspections

Regular Safety Meetings

Accident Investigation Process

Driver Safety Training Classes

31

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Driver Selection Program

Does the insured have procedures for selecting drivers?

Components would include:

Minimum number of years driving experience

Driver training program where appropriate

Acceptable driving record

Regular check of MVRs

32

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Vehicle Maintenance Program

Regular scheduled vehicle maintenance documented

Regular oil changes

Perform manufacturer’s recommended maintenance

Replacement of tires, etc. all done on a regular basis

33

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Overnight Garaging/Protection

Are vehicles taken home at night?

Parked on the street, access by other family members?

Proper endorsements in place?

Parked inside a secured area?

Left at job sites overnight (larger units)- properly secured/use of anti-theft devises?

34

TWFG Commercial Business School

Commercial 104

Underwriting Auto Exposures

Loss History

For fleets of 5 or more units a formal safety program is preferred and should include:

Severity vs. Frequency

Frequency indicates an ineffective loss control program.

Severity may be a one-off issue, but where there preventable factors

35

TWFG Commercial Business School

Commercial 104

Multi-Policy Types

Business Owner’s Policy (BOP)

Designed for small and medium sized businesses

Combines basic property and general liability coverages into one packaged policy

Less expensive than purchasing separately

Most carriers include enhancement endorsements for a nominal fee

Can be endorsed to include coverages such as EPL and Cyber

Liability, and an Umbrella

36

TWFG Commercial Business School

Commercial 104

Multi-Policy Types

Commercial Package Policy (CPP)

Designed for more complicated medium sized accounts and most all large accounts

Combines property and general liability but has more flexibility in the extend of coverage options available

Allows more in-depth analysis of exposures and a more tailored approach to coverages

These are risks where “knowing the business” is essential for the agency and where credibility is a must both win and retain the account

37

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Background

Began in 1911 due to burden on society from injured employees without health insurance

Employer to bear the cost of work-related injuries and illness without regard to negligence

Workers covered regardless of fault, and employers could not be sued by employees

Workers Compensation became the sole remedy for occupational injuries

38

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Coverages Provided

Workers Compensation policies provide two different coverages

Workers Compensation

Employers Liability

39

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Workers Compensation

Provides no-fault coverage to employees for work related injuries and illness

When purchased, WC is the sole remedy for injured workers

Payments are partial and periodic, with emphasis on returning employee to work

No limit on reasonable and necessary medical coverage

40

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Employers Liability

Provides coverage to employer for injury-related claims made by employees for things not covered by WC statutes

Legal Liability to Employees Not Covered by WC:

Gross Negligence

Intentional Injury

Dual Capacity Claims

41

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Employers Liability

Legal Liability to Others:

Loss of Services by Family Members

Third-Party (action-over) Claims

Consequential Bodily Injury Claims

42

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Coverage by State

WC is mandatory in all states except Texas and New Jersey, where it is elective

A sole proprietor with no employees in not eligible for WC

4 states have Monopolistic State Funds- no private insurers: ND,

OH, WA and WY

43

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Premium Basis

Payroll is the basis for WC premium.

If payroll reaches min premium threshold the risk qualifies for experience rating

Experience rating worksheet calculates the Experience Mod which applies a debit or credit the rating process

Carries have option to apply a Schedule Rating based on peculiarities of a specific risk

44

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Stop Gap Coverage

A form of “stand alone” Employers Liability coverage used in

Monopolistic Fund states which do not combine EL with WC.

Usually added to the CGL

45

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Management Attitude Toward WC

Is the employer involved in minimizing hazards/reducing costs?

Are safety programs mandatory and enforced?

Are accidents investigated and results incorporated in an ongoing program of loss improvement?

Does employer provide back-to-work programs?

Are employees involved in safety process?

Evidence of good housekeeping/maintenance of building, machinery, and processes

46

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Independent Contractors:

Contracting risks are impacted by how an Independent

Contractor is defined

If sub-contractor does not meet the definition of an independent contractor, then the subs payroll must be included in the hiring contractors WC exposures

Most definitions include reference regarding who controls the work, and the relationship between the contractor and the sub

47

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Descriptions of Coverages: Items 3A, 3B, and 3C

The information page (Dec Page) for the typical WC and

EL policy has three important fields listed as 3A, 3B, and

3C

48

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Item 3A: States with Active Operations

List all states where insured has known operations

Activates WC laws for those states

Cannot list Monopolistic States. Must separately purchase the Monopolistic Fund policies in those states (add Stop

Gap Coverage)

Note that there are no occurrence or aggregate limits for

WC

49

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Item 3B: Employers Liability Limits

This is the EL limits, which apply to all states listed under

3A

Consider limits carefully, especially if an Umbrella is purchased. $1M/$1M/$1M is recommended

There is no policy aggregate for BI by accident, only per accident limit

BI by disease has a per employee and policy limit

50

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

Item 3C: Other States Coverage

Activates WC laws for listed states in which work begins in those states after the effective date

Insured must notify the company when work begins in any state listed in 3C. Activated states must be moved to 3A at renewal

51

TWFG Commercial Business School

Commercial 104

Workers Compensation Coverage Overview

Underwriting Workers Compensation

What determines which States WC laws apply? (Any may apply)

State in which the employee was hired

State of the employee’s residency

State where the Primary Employer is located

State in which the employee is paid

State where the injury occurred

52

TWFG Commercial Business School

Commercial 104

Endorsements Common to Most Policies

There are three classes of endorsements that are common to most

Commercial Lines policies

Additional Insureds

Loss Payee

Waiver of Subrogation

53

TWFG Commercial Business School

Commercial 104

Endorsements Common to Most Policies

Additional Insured

Usually requested when a business operates on property owned by others, or is doing work at another’s property

Purpose of endorsement is to protect the property owner

Numerous types of Additional Insured endorsements

Included automatically on Commercial Auto.

Not used on property or WC

54

TWFG Commercial Business School

Commercial 104

Endorsements Common to Most Policies

Loss Payee

Can be either lenders of lessors

Have a financial interest in specifically described property

Protects interest by requiring that the Loss Payee be named on any loss check

Usually combined with an Additional Insured endorsement

Can be used on any policy that insures property

55

TWFG Commercial Business School

Commercial 104

Endorsements Common to Most Policies

Waiver of Subrogation

Commonly requested in conjunction with the Additional Insured endorsement

Transfers all responsibility to the insured for losses, even if the

Additional Insured contributed to loss

Waives insured’s right to subrogate (go after portion of the loss that was Additional Insured’s fault)

Common on Auto, GL, and WC

56

TWFG Commercial Business School

Commercial 104

57

TWFG Commercial Business School

Commercial 104

58

TWFG Commercial Business School

Commercial 104

QUIZ

59

TWFG Commercial Business School

Commercial 104

You are presented the opportunity to write auto coverage for an industrial electrical contractor. They have a fleet of 15 pick-ups driven by their employees to job sites. They also have 7 heavy trucks used to carry supplies and 6 utility trailers pulled by the pick-ups.

9 of the pick-ups are over 7 years old, and the insured does not want to carry comp and collision on these units. The same applies to 5 of the 7 heavy trucks.

The pick-up trucks are used for local jobs, but 5 of the heavy trucks are used for jobs within 200 miles of the insured’s shop.

The insured wants PIP and UM/UIM

60

TWFG Commercial Business School

Commercial 104

What symbols would you use for the following Coverages?

Liability PIP UM UIM

Comp Coll Trailers

61

TWFG Commercial Business School

Commercial 104

What symbols would you use for the following Coverages?

Liability

(1)

PIP

(2)

UM

(2)

UIM

(2)

Comp

(7)

Coll

(7,8)

Trailers

(none needed)

62

TWFG Commercial Business School

Commercial 104

What radius of operations apply to:

The Pick-ups The Heavy Trucks

The Trailers

63

TWFG Commercial Business School

Commercial 104

What radius of operations apply to:

The Pick-ups

(local)

The Heavy Trucks

(intermediate)

The Trailers

(local)

64

TWFG Commercial Business School

Commercial 104

What use and weight classifications are applied to:

The Heavy Trucks The Pick-ups

The Trailers

65

TWFG Commercial Business School

Commercial 104

What use and weight classifications are applied to:

The Heavy Trucks

(service, heavy)

The Pick-ups

(service, light)

The Trailers

(service, utility)

66

TWFG Commercial Business School

Commercial 104

What are two main types of combination policies issued to businesses?

67

TWFG Commercial Business School

Commercial 104

What are two main types of combination policies issued to businesses?

BOP and Commercial Package Policies

68

TWFG Commercial Business School

Commercial 104

What are two coverages provided in a Workers Compensation

Policy?

69

TWFG Commercial Business School

Commercial 104

What are two coverages provided in a Workers Compensation

Policy?

Workers Compensation and Employer’s Liability

70

TWFG Commercial Business School

Commercial 104

If an employee sustains a routine injury on the job, can he/she sue the employer?

Why or why not?

71

TWFG Commercial Business School

Commercial 104

If an employee sustains a routine injury on the job, can he/she sue the employer?

Why or why not?

1. No

2. WC is the sole remedy unless gross negligence is present

72

TWFG Commercial Business School

Commercial 104

If an employee sustains an injury on the job and believes the employer’s gross negligence caused the injury, can the employee sue the employer?

If so, would the employer’s WC policy respond?

If so, in what manner?

73

TWFG Commercial Business School

Commercial 104

If an employee sustains an injury on the job and believes the employer’s gross negligence caused the injury, can the employee sue the employer?

If so, would the employer’s WC policy respond?

If so, in what manner?

1. Yes

2. Yes

3. The EL coverage would respond

74

TWFG Commercial Business School

Commercial 104

Is Workers Compensation mandatory in Texas?

75

TWFG Commercial Business School

Commercial 104

Is Workers Compensation mandatory in Texas?

No

76

TWFG Commercial Business School

Commercial 104

What two types of rating plans can be applied to a large workers compensation risk?

77

TWFG Commercial Business School

Commercial 104

What two types of rating plans can be applied to a large workers compensation risk?

Experience rating and Schedule rating

78

TWFG Commercial Business School

Commercial 104

Future Classes

February 28 th

March 6 th

March 13 th

March 20 th

Commercial 101

Commercial 102

Commercial 103

Commercial 104

79

TWFG Commercial Business School

Commercial 104

Industry Segment Classes (Beginning in March)

Retail & Service

Artisan Contractor

Commercial Auto

Workers Compensation

Commercial Real Estate

Restaurant

Manufacturing

Agriculture

Farm/Ranch

Excess & Surplus

Professional Liability

Umbrella

Bonds

Financial Institutions

Hotels/Motels

Medical Technology

80

TWFG Commercial Business School

Commercial 104

Questions???

81