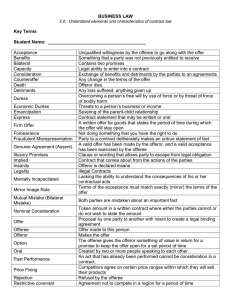

RFP # 14-9623-6EF

advertisement