ABC 42 School Financial Services Update

advertisement

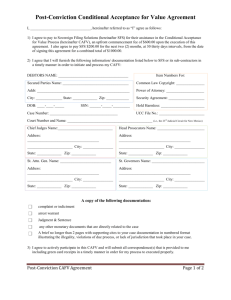

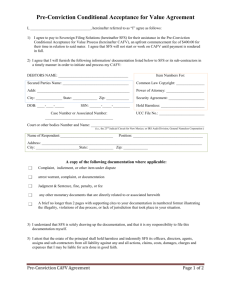

2011–12 Accounting Manual 2011–12 F-195 Budget 2010–11 Budget Extensions 2010–11 F-196 Financial Reporting SFS Update - WASBO 2011 1 daniel.lunghofer@k12.wa.us SFS Update - WASBO 2011 2 FY 2011–12 Accounting Manual Updates • • • • The Accounting Manual is published cooperatively by OSPI and SAO. The School District Accounting Advisory Committee (SDAAC) makes recommendations for updates to the manual in their role of advising on accounting, budgeting, financial reporting, and related matters. SDAAC meetings are scheduled now through December 2011 for the 2012–2013 Accounting Manual updates. The SDAAC web page: – http://www.k12.wa.us/safs/PUB/COM/SDAAC.asp. – Has the complete description of changes to the 2011–12 manual. – Has meeting agendas, materials, list of committee members, etc. SFS Update - WASBO 2011 3 FY 2011–12 Accounting Manual Updates Throughout the entire publication: • Updated GASB Codification Section references. • Corrected a myriad of typos. • Where appropriate, changed references from “Saul Haas Funds” to “InvestED Funds.” SFS Update - WASBO 2011 4 FY 2011–12 Accounting Manual Updates Chapter 4 – General Ledger Codes • Changed the text under GL 650 Deposits to read: “This account is used to record deposits received by the district that may be refunded at a later date (e.g. damage deposits). Direct deposits for payroll should be recorded in GL 605 Accrued Salaries and not in this account.” SFS Update - WASBO 2011 5 FY 2011–12 Accounting Manual Updates Chapter 5 – Revenue Codes • Deleted Revenue 4163 and 7163 Promoting Academic Success. • Deleted Revenue 4175 Professional Development. • Changed the statutory reference under Revenue 4159 Institutions—Juveniles in Adult Jails to the proper RCW/WAC references. SFS Update - WASBO 2011 6 FY 2011–12 Accounting Manual Updates Chapter 6 – Expenditure Accounts • Deleted Program 63 Promoting Academic Success. • Changed the TVF account code structure to a Type Code system similar to the CPF. – – – Type Code 33 Transportation Equipment Purchase. Type Code 34 Transportation Equipment Major Repair. Type Codes 61, 91, 92, and 93 are the same as CPF. SFS Update - WASBO 2011 7 FY 2011–12 Accounting Manual Updates Chapter 6 – Expenditure Accounts • New Activity Code 31 Instructional Professional Development. – – – – Used for recording additional costs related to instructional professional development. Substitutes, travel costs, registration fees, etc. Not open in Programs 97, 98, or 99 Intent is to capture costs related to certificated instructional staff and classified classroom aide professional development. SFS Update - WASBO 2011 8 FY 2011–12 Accounting Manual Updates Activity Code 31 • Salaries. – – – Only code extra time to the activity code, not base pay. Dedicated instructional coaches or other Professional Development staff should have their base salaries coded here. Any extra contract days that are for the express purpose of Professional Development (e.g. TRI contracts) should be charged here. SFS Update - WASBO 2011 9 FY 2011–12 Accounting Manual Updates Chapter 6 – Expenditure Accounts • New Activity Code 32 Instructional Technology. – – – Intent is to capture General Fund costs related to purchase and maintenance of instructional technology (technology in schools and classrooms). Not open in Programs 97, 98, and 99. Only Objects 0, 3, 4, 5, 7, 8, and 9 will be open (this is a change from the Accounting Manual and will be in a formal addendum). SFS Update - WASBO 2011 10 FY 2011–12 Accounting Manual Updates Activity Code 32 • Salaries. – – – – Only salaries for staff whose job duties pertain to keeping instructional technology equipment running should be coded here. Salaries for staff who teach others how to use the equipment should not be coded here. Only classified duty codes are open; only Object 3 for salaries. We are working on a Q&A/Implementation document for release this summer. SFS Update - WASBO 2011 11 FY 2011–12 Accounting Manual Updates Chapters 7 and 8 – no changes! Chapter 9 – Information Unique to Each Fund • Clarified the sources of money in the TVF (old wording was confusing). • Clarified the language about transferring state forest land revenue from DSF to CPF. SFS Update - WASBO 2011 12 FY 2011–12 Accounting Manual Updates Appendix B – Notes to the Financial Statements • Added a note about Encumbrances to all bases of accounting (GASB 54 implementation). • Added information about any existing minimum fund balance policy to the language pertaining to Committed Fund Balances. SFS Update - WASBO 2011 13 FY 2011–12 Accounting Manual Updates Appendix B – Notes to the Financial Statements • More changes will be coming this summer! – – Statement for Cash/F-196 districts (i.e. non-CAFR districts) about not reporting OPEB liabilities under GASB 45 for retiree carve-out. Other clarifications that are deemed necessary within the notes. SFS Update - WASBO 2011 14 FY 2011–12 Accounting Manual Updates Appendix F – Federal Stimulus Account Codes • Information relating to ARRA and EduJobs coding is contained in Appendix F. • Program 13 and Revenues 6X13 renamed to “Federal Stimulus—State Fiscal Stabilization Fund/Education Jobs Fund.” • Activity 44 Food Service Operations opened in Program 13. • ARRA funds must be obligated by September 30, 2011. SFS Update - WASBO 2011 15 FY 2011–12 Budget Update Mike Dooley, CSBO Supervisor, School District/ESD Budgeting (360) 725-6305 mike.dooley@k12.wa.us SFS Update - WASBO 2011 16 FY 2011–12 Budget Update • • • New items. Removed: – Revenue Account 2299. – Program 63. Closed: – Revenue Accounts 4163, 4175, and 7163. SFS Update - WASBO 2011 17 FY 2011–12 Budget Update • New items: – Program 13 title changed to “Federal Stimulus – Fiscal Stabilization and Education Jobs” and “Activity 44 – Operations” with Objects 0, 3, 4, 5, 7, 8, and 9 open; and the following duty codes allowed: • • Object 3 Classified Duty Code(s): – 90y, 91y, 94y, 95y, 96y, 97y, 98y, and 99y. – The third digit shown as “y” may be either 0 or 3. F-195 budgeting [wildcard] duty codes 001, 002, 003, 004, and 005 may be used for classified staff. SFS Update - WASBO 2011 18 FY 2011–12 Budget Update • New items: – – – – “Activity 31 Instructional Professional Development” allowed in all program matrices except for Programs 97, 98, and 99 with Objects 0, 2, 3, 4, 5, 7, 8, and 9 open; and the following duty codes allowed: Object 2 Certificated Duty Code(s): • 21x, 22x, 23x, 24x, 25x, 31x, 32x, 33x, 40x, 41x, 42x, 43x, 44x, 45x, 46x, 47x, 48x, 49x, 51x, 52x, 61z, 630, and 640. • The third digit shown as “x” may be 0, 1, or 2. • The third digit shown as “z” may be either 0 or 1. Object 3 Classified Duty Code(s): • 91y. • The third digit shown as “y” may be either 0 or 3. F-195 budgeting [wildcard] duty codes 001, 002, 003, 004, and 005 may be used for both certificated and classified staff. SFS Update - WASBO 2011 19 FY 2011–12 Budget Update • New items: – “Activity 32 Instructional Technology” allowed in all program matrices except for Programs 97, 98, and 99 with Objects 0, 3, 4, 5, 7, 8, and 9 open; and the following duty codes allowed: • Object 3 Classified Duty Code(s): – 96y, 97y, 98y, and 99y. – The third digit shown as “y” may be either 0 or 3. • F-195 budgeting [wildcard] duty codes 001, 002, 003, 004, and 005 may be used for classified staff. SFS Update - WASBO 2011 20 FY 2011–12 Budget Update • New items: – In Transportation Vehicle Fund Expenditures section: • Removed both description lines “Program 97 Districtwide Support” and “Program 99 Pupil Transportation.” • Replaced description line with “33 Transportation Equipment Purchases – formerly Act.57 Cash Purchases/Rebuilding of Transportation Equipment.” • Replaced description line with “34 Transportation Equipment Major Repair – formerly Act.58 Contract Purchases/Rebuilding of Transportation Equipment.” • Added description line “61 Bond/Levy Issuance and/or Election.” • Replaced description line with “91 Principal – formerly Act.84.” • Replaced description line with “92 Interest – formerly Act.83.” • Added description line “93 Arbitrage Rebate.” SFS Update - WASBO 2011 21 FY 2011–12 Budget Update • Budgeted Beginning Fund Balance Review: – – – – OSPI will review each school district’s budgeted beginning fund balance once the F-196 information is received. The budgeted ending fund balance will be recalculated based upon the actual ending fund balance from the F-196. If the result is a negative fund balance, your school district can expect a request from OSPI to revise its budget. Your school board will have 30 days of receiving notice to submit a revised budget to OSPI. SFS Update - WASBO 2011 22 FY 2011–12 Budget Update • Budgeting Receivables: – – – If your school district is unable to submit a budget extension (or budget for that matter) when revenues and fund balance do not exceed expenditures, it must request in writing to include receivables, collectible in future periods, to balance the budget or budget extension. When a school district budgets receivables, OSPI places it under binding conditions which is intended to have it recover from its deficit budget situation and move to a stable financial position. This usually places your ESD in an oversight position of your school district’s financial operations. SFS Update - WASBO 2011 23 FY 2010–11 Budget Extensions • Budget Extension Reminder: – We know all of you are busy preparing your new year budgets, but don't forget any remaining current year budget extensions. August is the final month to file your F-200 budget extensions with OSPI. Depending on when you submitted your current year F-200 for approval and when you printed your new year F-195 budget document, you may need to reprint your new year budget to allow your current year budget extension to be accurately displayed in the middle column of your new year F-195. SFS Update - WASBO 2011 24 FY 2010–11 Budget Extensions • Budget Extension Reminder: – Review budget monthly to determine necessity of an extension. • • Must complete a budget extension prior to incurring expenditures in excess of the total appropriations as required by RCW 28A.505.150. – For 1st class school districts, adopted and filed prior to incurring expenditures that exceed the appropriation in each fund. – For 2nd class school districts, adopted and approved by both the ESD and OSPI prior to incurring expenditures that exceed the appropriation in each fund. – The ESD and OSPI will adjust budget extensions that do not meet this requirement. WAC 392-138-110 requires that the Associated Student Body initially review revisions to the Associated Student Body (ASB) budget. Therefore, an extension of the ASB Fund budget should occur prior to the closing of school to secure the necessary student involvement. SFS Update - WASBO 2011 25 F-197 County Treasurers’ Report • Cash File Reminder: – – – – F-197 application in EDS is available to school districts for (recommended) monthly reconciliation to the County Treasurer. Reconciliation Excel template is in Chapter 5 of the Administrative, Budgeting, and Financial Reporting (ABFR) Handbook. SAO will review the reconciliation based on the ABFR instructions and template. Make the audit process faster and more efficient. SFS Update - WASBO 2011 26 FY 2011–12 ABFR • ABFR Status: – – – – We are in the process of posting completed sections of the 2011–12 ABFR Handbook on our website at: http://www.k12.wa.us/safs/INS/ABF/1112/hb.asp. Hardcopies will no longer be made available. We will let everyone know the availability of sections as soon as they are completed. An RSS feed will also be included.( ) Refer to the SAFS main website for 2011–2012 Bud Prep information. SFS Update - WASBO 2011 27 FY 2010–11 F-196 Update Ramona Garner Supervisor, School District/ESD Financial Reporting (360) 725-6304 ramona.garner@k12.wa.us SFS Update - WASBO 2011 28 FY 2010–11 F-196 Update The dates below have not changed. Please make a note of these dates now. It is never too early to start gathering data needed and balancing system items for year end closing. Starting now will make meeting the below listed dates easier for you. These dates all fall on a Tuesday in 2011. Final Action Date October 25 Action School Districts - Final date for submission of completed F-196 data from the school district to the local ESD. The data will be submitted electronically and/or on an F-196 manual form. Districts not able to submit by the October 25 due date may request a waiver by e-mail or written notice to the ESD. November 1 ESDs - Final date for the ESD to review and forward the certification page back to the school district for signature. November 8 School Districts - The signed certification page is due from the school district to the ESD. November 15 ESDs - Final date the signed certification page by the ESD is due at OSPI, School Financial Services. SFS Update - WASBO 2011 29 FY 2010–11 F-196 Update In accordance with Chapter WAC 392-117-035, districts and ESDs that fail to adhere to the due dates could have a delay of apportionment payments. The final date for filing or forwarding will be considered as having been met if the postmark or other evidence indicates shipment prior to the due date or the next workday if the due date falls on a weekend. SFS Update - WASBO 2011 30 FY 2010–11 F-196 Update New Items/Changes: • • • • • • There are no changes to the Certification Page; however, make sure to review this page and verify the information is correct. Several districts misstated their basis of accounting and number of days school was conducted in 2009–10. Program 02 Basic Education—Alternative Learning Experience (ALE) was added. For 2010–11, districts will need to identify the amounts in Program 13 that are: ― State Fiscal Stabilization Funds (SFSF); or ― Education Jobs Funds (EduJobs). ― More information will be forthcoming about this requirement. Program 59 Institutions—Juveniles in Adult Jails was added. Revenue Code 4159 Institutions—Juveniles in Adult Jails was added. SFS Update - WASBO 2011 31 FY 2010–11 F-196 Update • • • • Renamed Fund Balance GLs in accordance with GASB 54. Added the following GLs: ― 821 Restricted for Carryover of Restricted Revenues ― 845 Restricted for Self Insurance ― 866 Restricted from Impact Fee Proceeds ― 867 Restricted from Mitigation Fee Proceeds ― 872 Committed to Minimum Fund Balance Policy ― 884 Assigned to Other Capital Projects ― 888 Assigned to Other Purposes ― 889 Assigned to Fund Purposes Several changes were made to titles and headings as described in Bulletin No. 017-10. The State’s funding for Learning Improvement Days (LID) has been eliminated for FY year 2010–11. SFS Update - WASBO 2011 32 FY 2010–11 F-196 Update • There are no changes to the manual inputs for fire district payment, Teacher Assistance Program (TAP), and the state revenue recovery rate calculation on The Data Requirements for End of Year Reporting to Apportionment and State Recovery Rate Report. • There are no changes to the manually entered distorting items such as election expenses, flow-through grants, alterations/renovations, and fines /penalties. This data is used in the Federal Restricted and Unrestricted Indirect Rate. SFS Update - WASBO 2011 33 FY 2010–11 F-196 Update • There are no changes to the manually entered Indirect Expenditures. The district should enter audit costs, legal costs, public relations expenditures, termination leave for federally supported staff, Information System expenditures, Pupil Management and Safety costs, and space and occupancy costs, if a cost plan has been established. ― Remember that legal costs are very restrictive. Only enter costs associated with the interpretation of laws and regulations. ― Also remember that no student record costs can be entered for Information Systems. Only enter costs associated with fiscal systems (i.e., WSIPC fees, districtwide IT support). • The Restricted and Unrestricted Federal Indirect Rate Calculations have not changed. The data on the left side at the bottom will display data from the 2008–09 F-196. This data is used in the calculation on the 2010–11 F-196 for rates you will use in 2012–13. SFS Update - WASBO 2011 34 Maintenance of Effort and Recovery and Carryover Templates • The Federal Cross-Cutting and Special Education MOE tests are complete. The MOE templates have been updated and posted to our website under Training/Tools at http://www.k12.wa.us/safs/TT/tt.asp. • Districts are encouraged to access these templates to run the MOE tests for mid-year and budget purposes and the 2010–11 recovery and carryover information. • This summer Steve Shish will update the 2010–11 Recovery and Carryover Spreadsheet on our website at http://www.k12.wa.us/safs/TT/tt.asp. SFS Update - WASBO 2011 35 Other Notes of Interest • After your ESD approves your F-196, and you feel that your financial statements are correct, you can proceed with your year-end close. Any review of the district’s F-196 by OSPI does not affect the districts year-end close process. • If your district requires that an F-196 revision be made, please contact Ramona Garner via email (ramona.garner@k12.wa.us) to request an MS Word document. Upon receipt of your email she will send the district’s F-196 and instructions for making revisions. • Thank you for emailing your questions to OSPI. Emailing your questions is beneficial in assuring that OSPI understands your question and allows a “paper trail” for OSPI and the district if the question should arise again. SFS Update - WASBO 2011 36