normal balance - Teacher Pages

advertisement

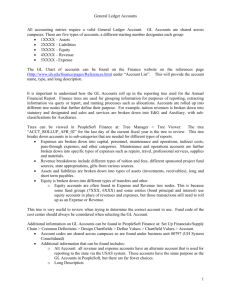

Unit 3 The Expanded Ledger and the Income Statement The recording process continued! NORMAL BALANCE Every account classification has a normal balance, whether it is a debit or credit. Assets Liabilities Assets Dr. BAL Cr. = Liabilities Dr. Cr. BAL Equity + Owner’s Equity Dr. Cr. BAL NORMAL BALANCE — OWNER’S EQITY Owner’s Equity Decrease Debit Increase Credit Normal Balance EXPANDING THE LEDGER Owner’s Equity: Expands into 4 Separate accounts Owner’s Capital Revenues Dr. Dr. Cr. Cr. Cr. Balance Owner’s Equity Dr. Balance Owner’s Drawings Expenses Dr. Dr. Cr. Cr. THE EXPANDED LEDGER Assets Assets Dr. + Cr. Owner’s Equity Liabilities Liabilities Dr. Cr. + Owner’s Capital Dr. Cr. + Owner’s Drawings Dr. + Cr. Revenues Dr. Cr. + Expenses Dr. Cr. + Equity Section Summary There are four types of accounts in the equity section: 1. 2. 3. 4. Capital Revenue Expenses Drawings Show the changes in owner's equity from one period to the next. The new accounts in the equity section of the ledger have one main purpose: to provide essential information about the progress of the business. this information is needed by managers and owners to see if the business is being run profitably and to help them make sound decisions NORMAL BALANCE — OWNER’S CAPITAL Owner’s Capital Decrease Debit Increase Credit Normal Balance 1. Capital: This account will now contain only the equity figure at the beginning of the fiscal period, plus new capital from the owner, if any. NORMAL BALANCE — OWNER’S DRAWINGS Owner’s Drawings Increase Debit Decrease Credit Normal Balance 2. Drawings: Decreases in equity resulting from the owner's personal withdrawals. A drawings account normally has a debit balance. Drawings are not a factor when calculating net income or loss. NORMAL BALANCES —REVENUES Revenues Decrease Increase Debit Credit Normal Balance 3. Revenues: Increases in equity resulting from the sale of goods or services. A revenue account normally has a credit balance. NORMAL BALANCES — EXPENSES Expenses Increase Debit Normal Balance Decrease Credit 4. Expenses: A decrease in equity resulting from the costs of producing the revenue. An expense account normally has a debit balance. Rules of Debit and Credit for Revenue and Expense Accounts Owner's Equity Debit Decrease Credit Increase Expenses Debit Increase Revenue Credit Expenses Accounts Debit Increase Credit Expenses are recorded as debits Because expenses decrease equity Debit Credit Increase Revenue Accounts Debit Credit Increase Revenue is recorded as a credit because revenue increases equity THE EXPANDED LEDGER The General Ledger Type of Account Use Asset Liability Owner’s Equity - Capital Preparation of balance sheet Drawings Revenue Expenses Preparation of Income Statement New GAAP Rules 1. Revenue Recognition 2. The Time Period Concept 3. The Matching Principle G.A.A.P To help guide the organization of these accounts and how they are used accountants/bookkeepers turn to New GAAP policies mentioned earlier GAAP-The Revenue Recognition Convention The revenue recognition convention states that revenue must be recorded in the accounts (recognized) at the time the transaction is completed. It is important to take revenue into the accounts correctly. If this is not done, the income statements of the company will be incorrect, and the readers of the financial statements will be misinformed. GAAP-The Time Period Concept The time period concept provides that accounting will take place over specific time periods known as fiscal periods. Net income is measured over a specific length of time, called the fiscal period. The fiscal period (also called the accounting period) is the period of time over which earnings are measured. These fiscal periods are of equal length and are used when measuring the financial progress of a business. GAAP-The Matching Principle The matching principle states that each expense item related to revenue earned must be recorded in the same period as the revenue it helped to earn. Separating revenues and expenses into specific fiscal periods challenges accountants to follow two important steps. In step one, they must be careful to record the proper amount of revenue in the proper period. In step two, they must subtract only those expenses that helped earn the revenue they recorded in step one. Income Statement Accounts Revenue and Expenses: are Income Statement accounts because they are BOTH need in order to determine if there has been an increase or decrease in the Owners Equity the income statement shows in a detailed way whether the business is profitable or not. new equity accounts are organized to show the net income (or net loss) of the business for a given period of time. THE INCOME STATEMENT INCOME STATEMENT PREPARATION The four steps followed in preparing an income statement are described on the following pages. The three-line heading is centred at the top of the page and is designed to provide information in this sequence: The income statement provides data for a given time period (a week a month, a year), The balance sheet provides data on a specific date. The income statement loses its usefulness if the accounting period is not specified. The revenue received from the business operations is listed under the subheading Revenue. The largest revenue item is usually listed first. The revenue is totalled and the total is placed in the right column as follows: The expense items are listed in the order in which they appear in the ledger. Net Income is not cash. It is the difference between total revenues and total expenses, if the revenues are greater than the expenses. In this case a net income is the result. A net loss occurs if the expenses are greater than the revenues. Facts to Remember For the income statement, dollar signs should be placed: • beside the first figure in each column; and • beside the net income or net loss figure at the bottom of the statement. Cash Land Accounts Payable Advertising Expense Accounts Receivable Supplies Building Equipment Bank Loan Mortgage Payable Owner’s Capital Owner’s Drawing Sales Fees Earned Delivery Expense The General Ledger Assets Liabilities Owner’s Equity Revenue Income Statement Hydro Expense Expense Miscellaneous Expense Rent Expense Salaries Expense Balance Sheet Equity Accounts on the Balance Sheet There are 3 scenarios for the Equity section on the Balance Sheet 1. Capital increases when withdrawals are less than net income Owner’s Equity Owner’s, Capital October 1 Add: Net Income for October Less: Owner’s Drawings Increase in Capital Owner’s, Capital October 31 $20 000 $3 000 1 000 2 000 $22 000 2. Capital decreases when withdrawals are greater than net income Owner’s Equity Owner’s, Capital October 1 Add: Net Income for October Less: Owner’s Drawings Decrease in Capital Owner’s, Capital October 31 $22 000 $1 000 1 500 500 $21 500 3. Capital decreases when there is a loss and the owner has withdrawn assets Owner’s Equity Owner’s, Capital October 1 Add: Net Loss for October Less: Owner’s Drawings Decrease in Capital Owner’s, Capital October 31 $21 500 $ 500 800 1 300 $20 200