Cost Estimating

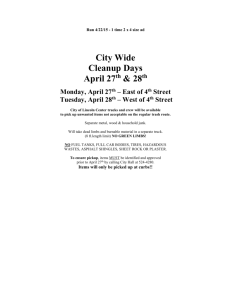

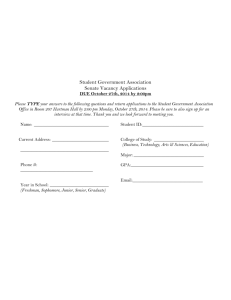

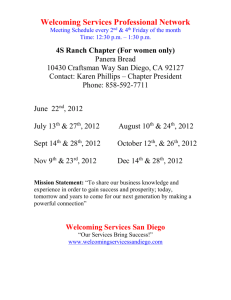

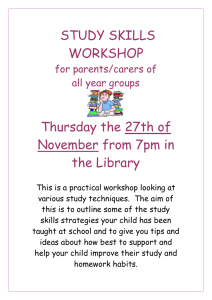

advertisement