FINAN303Principles of FinanceSpring 2016 Financial Statements

FINAN303 Principles of Finance Spring 2016

Financial Statements – Part A

1.

How do Businesses Keep Score? a.

______________________ i.

An information system that provides reports to users about the economic activities and condition of a business. b.

Who are Some Users of Accounting Info? i.

_______________ ii.

_______________ iii.

_______________ iv.

_______________ v.

Etc. c.

There are internal users (____________________________) and external users

(____________________________).

2.

Before we get Started…Some Definitions a.

GAAP - _____________________________________________ b.

FASB - _____________________________________________ c.

IASB - _____________________________________________ d.

SEC - _____________________________________________ e.

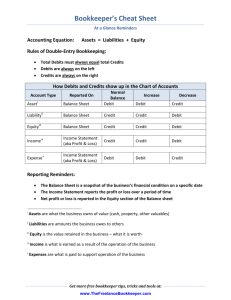

Double Entry Bookkeeping - ___________________________ (we’ll get to this in a few slides.) f.

Accrual Accounting - _____________________________________________ g.

Public Corporation - _____________________________________________

3.

The Accounting Cycle: a.

Recording Transactions b.

Recording Adjusted Entries c.

Preparing the Financial Statements

4.

The Accounting Identity: __________________________ (our version of E=mc 2 a.

The balance sheet always ____________________

) b.

If the left side of the balance sheet increases (decreases), then the right side must increase (decrease) by the exact same amount c.

Owners (also called residual claimants) get whatever is left over after creditors have been paid: Equity = _____________________________ d.

Can equity ever be negative?

Office: MBEB 2210 1 garrettmcbrayer@boisestate.edu

FINAN303 Principles of Finance Spring 2016

5.

Accounting System Components

Account Types

Permanent (Stock) Temporary (Flow)

Balances

6.

Recording Transactions a.

Internal or external event that causes a change in a company’s assets, liabilities, or stockholders’ equity b.

Recorded in a journal (journal entry) c.

Posted to general ledger accounts d.

Double-entry system i.

Debit: __________________________________________ ii.

Credit: __________________________________________ iii.

Debits = Credits

7.

Debits and Credits a.

A debit _____________ an asset or _____________a liability b.

A credit _____________a liability or _____________an asset c.

Since the balance sheet must always balance, every debit has to have an offsetting credit d.

Some examples…what happens on each? i.

A bank loan is repaid ii.

A credit sale is collected iii.

New inventory is purchased with cash iv.

New inventory is purchased with credit

8.

Debits and Credits – Redux

Assets Liabilities

Office: MBEB 2210 2 garrettmcbrayer@boisestate.edu

FINAN303 Principles of Finance Spring 2016

9.

Recording Adjusted Entries a.

Required by the accrual basis of accounting b.

Prepared at the end of the fiscal period (quarter or year) c.

Records (recognizes) for the current period i.

Expenses incurred ii.

Revenues earned d.

Recorded in the general journal e.

Posted to the general ledger

10.

Financial Statements – The Annual Report (Example: Home Depot ) a.

Income Statement i.

Temporary or permanent? ___________________ ii.

Lists income and expenses ________ a fiscal period (quarter or year) iii.

Directly from the general ledger iv.

Note: Amounts shown do not necessarily represent cash flows…huh? b.

Balance Sheet i.

Temporary or permanent? ___________________ ii.

Represents what a firm owns (_____________) and owes (_____________) at the end of a fiscal period iii.

Assets are listed on the ________ side and claims to assets (liabilities and equity) are listed on the ________ side iv.

Assets are listed in order of liquidity v.

Claims are listed in order due vi.

Assets represent uses of funds; claims represent sources of funds *Sources must always equal uses* vii.

Note: Values generally represent book or historical amounts, not necessarily current market values…huh? c.

Statement of Cash Flows i.

Required due to the widespread use of accrual accounting ii.

Attempts to reconcile balance sheet and income statement entries to actual cash flows iii.

Divided into three parts

1.

Cash flows from ____________________________

2.

Cash flows from ____________________________

3.

Cash flows from ____________________________ iv.

The three parts are added up to equal the change in cash from the end of one fiscal period to the end of the next d.

Statement of Shareholders’ Equity i.

Details the change in shareholders’ equity from the end of one fiscal period to the end of the next fiscal period

Office: MBEB 2210 3 garrettmcbrayer@boisestate.edu

FINAN303 Principles of Finance ii.

General formula: iii.

Other items may also affect shareholders’ equity (two examples)

1.

Cumulative impact of accounting changes

2.

Cumulative impact of changes in exchange rates

Spring 2016

Office: MBEB 2210 4 garrettmcbrayer@boisestate.edu