Basic Compliance Education Overview and Case Study

advertisement

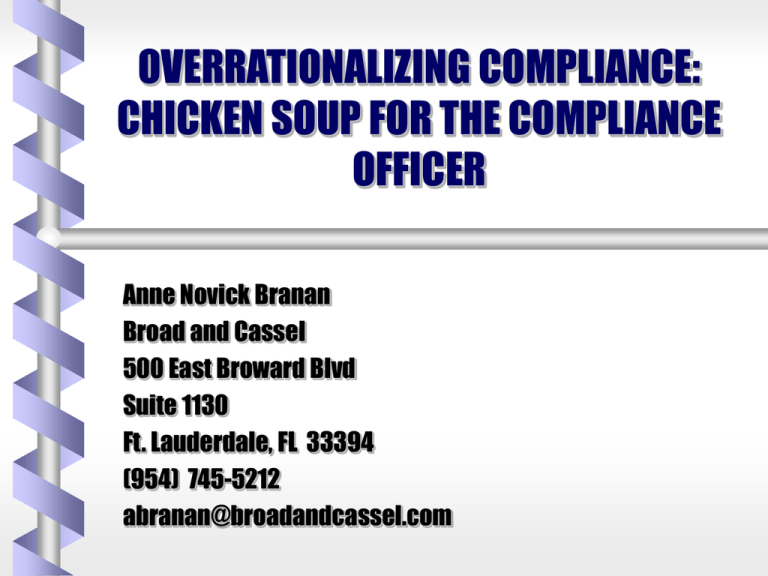

OVERRATIONALIZING COMPLIANCE: CHICKEN SOUP FOR THE COMPLIANCE OFFICER Anne Novick Branan Broad and Cassel 500 East Broward Blvd Suite 1130 Ft. Lauderdale, FL 33394 (954) 745-5212 abranan@broadandcassel.com OVERRATIONALIZING COMPLIANCE: CHICKEN SOUP FOR THE OFFICER Anne Novick Branan Broad and Cassel © 2000 Compliance Officers’ Concern for Personal Liability Scapegoat for corporate violations To some extent, concern as valid Purpose of government enforcement is to instill fear of personal liability to deter violations Compliance Officer The nature of the job entails inherent conflicts and risks. These conflicts and risks can and must be managed by those assuming the responsibilities of Compliance Officers. Liabilities Corporate vs. individual Criminal vs. civil Diverging interests of corporation and employee • Defendants • Cooperation with government • Consider option of resignation Employee-Employer Liabilities Respondeat Superior Doctrine • “Let the master answer” Employer accepts responsibility for • Actions of Employee • Acting within scope of employment Defense Issues Joint defense Multiple representation Corporate policy on providing defense for employees • Exception: Refusal to finance defense of employee who did not act in good faith or had reason to believe his/her conduct was unlawful. Compliance Officers: Managing the Risks Investigate before accepting the job Understand Job Functions Set ground rules Be knowledgeable Understand the intangibles Use outside consultants Be proactive Develop strong, clear compliance policies Investigate before accepting the job Learn about the company • Past history • Current mission/corporate culture • Organizational structure - management - parent-subsidiary Investigate before accepting the job • • • • Reputation in community Recent/anticipated business deals Meet with Board of Directors Corporate culture Understand Job Functions To whom will you report • Financial/legal officer vs. operations • Direct access to governing body and CEO • Assess commitment of “supervisor” to compliance Understand Job Functions Study job description • • • • Duties consistent with compliance objectives Realistic scope of duties Degree of independence Level of empowerment Understand Job Functions Is compliance program in place or will you develop it • Existing: get “feel” for existing program and policies • New program: dual role during development Understanding Job Functions What staff/support will you have • OIG recognizes need for sufficient funding and staff • Size and type of organization • Staffing needs – clerical, compliance assistants • Funding – education, hotline expenses, office, consultants Understanding Job Functions Full time/Part time • Job Functions consistent • Realistic time expectations Set Ground Rules with Employer Written Contract To whom will you report Authority to hire outside counsel in matters Confidentiality Objectivity and independence respected Authority to delegate Obtain indemnification/insurance coverage Be Knowledgeable Learn about company’s operations, “politics” Know compliance program documents Study the applicable law Obtain publications Connect with other compliance officers Follow trends in government enforcement Understand the Intangibles A compliance officer’s most valuable tools • • • • • Sense of what’s right Ability to “listen to your gut” Common sense Tenacity Objectivity Use outside consultants Experts in specific areas of law or business • Establish list of reliable contacts Outside counsel for investigations • • • • Attorney-client privilege issues Objectivity Expertise Get legal opinions “Sticky” internal political issues Be Proactive vs. reactive Avoid complacency Justify company’s interpretation of new or murky regulations/rules Document compliance efforts Develop Strong, Clear Compliance Policies Essential to avoid being put between “a rock and a hard place” by senior executives Policies on investigations, reporting, confidentiality are especially crucial Follow policies to avoid liability Balance between flexibility and detail Tricky Compliance Issues Confidentiality of Reports and Investigations • Breaches of trust breed suspicion • Be sure employees know of limits on promises of confidentiality • Resist pressure from senior executives to breach confidentiality Tricky Compliance Issues Handling of internal whistleblowers • Keep identity confidential –Anonymous reports • Assure Report will be taken seriously • Recognize the difficulty of “coming forward” –Fear of retaliation, isolation, losing job • Take quick action Tricky Compliance Issues Senior Executives Refusal to Cooperate with Compliance Objectives • Go to governing body • Document your efforts DISCUSSION SCENARIOS Joy is the compliance officer for a home health agency. An audit reveals that a large volume of services were billed, but not performed. She learns that a group of nurses meets regularly to “fix patient records.” She advises the administrator that an internal investigation should be conducted, but is told to “ forget about it.” DISCUSSION SCENARIOS John is the compliance officer at a large medical practice. He receives a report that one of the physicians has been accepting kickbacks from a DME company when he refers patients for equipment. The physician involved is the chairman of the board and the well-established and respected physician who hired John. DISCUSSION SCENARIOS As the compliance officer for a hospital, Bill receives a report that the compensation formula used by the hospital to compensate Dr. Jones is illegal. He looks at the independent contractor agreement between the hospital and Dr. Jones and believes there is a problem also. However, Bill becomes uncomfortable when he realizes that Ed in the hospital’s legal department drafted and approved the agreement for signing. Risk Management for Corporate Compliance Officers You can manage the risks to avoid personal liability and still protect your company!