College of Commerce Distance Learning Program

advertisement

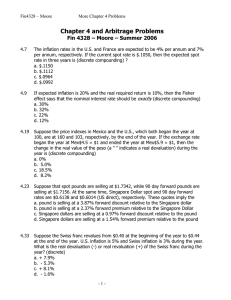

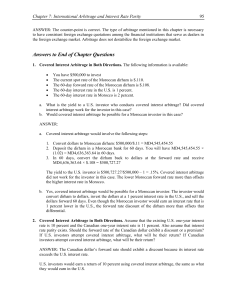

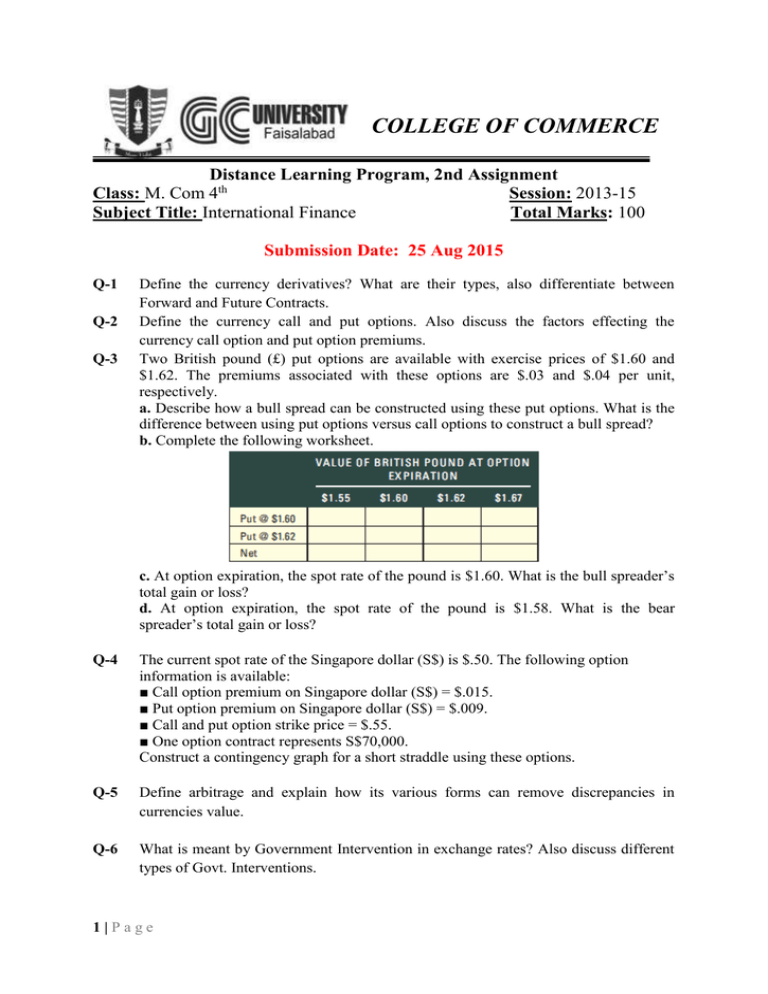

COLLEGE OF COMMERCE Distance Learning Program, 2nd Assignment Class: M. Com 4th Session: 2013-15 Subject Title: International Finance Total Marks: 100 Submission Date: 25 Aug 2015 Q-1 Q-2 Q-3 Define the currency derivatives? What are their types, also differentiate between Forward and Future Contracts. Define the currency call and put options. Also discuss the factors effecting the currency call option and put option premiums. Two British pound (£) put options are available with exercise prices of $1.60 and $1.62. The premiums associated with these options are $.03 and $.04 per unit, respectively. a. Describe how a bull spread can be constructed using these put options. What is the difference between using put options versus call options to construct a bull spread? b. Complete the following worksheet. c. At option expiration, the spot rate of the pound is $1.60. What is the bull spreader’s total gain or loss? d. At option expiration, the spot rate of the pound is $1.58. What is the bear spreader’s total gain or loss? Q-4 The current spot rate of the Singapore dollar (S$) is $.50. The following option information is available: ■ Call option premium on Singapore dollar (S$) = $.015. ■ Put option premium on Singapore dollar (S$) = $.009. ■ Call and put option strike price = $.55. ■ One option contract represents S$70,000. Construct a contingency graph for a short straddle using these options. Q-5 Define arbitrage and explain how its various forms can remove discrepancies in currencies value. Q-6 What is meant by Government Intervention in exchange rates? Also discuss different types of Govt. Interventions. 1|Page Q-7 Define the term International Arbitrage? Explain different types of international arbitrageurs Q-8 The following information is available: ■ You have $500,000 to invest. ■ The current spot rate of the Moroccan dirham is $.110. ■ The 60-day forward rate of the Moroccan dirham is $.108. ■ The 60-day interest rate in the United States is 1 percent. ■ The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? Q-9 (Part A) You just came back from Canada, where the Canadian dollar was worth $.70. You still have C$200 from your trip and could exchange them for dollars at the airport, but the airport foreign exchange desk will only buy them for $.60. Next week, you will be going to Mexico and will need pesos. The airport foreign exchange desk will sell you pesos for $.10 per peso. You met a tourist at the airport who is from Mexico and is on his way to Canada. He is willing to buy your C$200 for 1,300 pesos. Should you accept the offer or cash the Canadian dollars in at the airport? Explain. (Part B) Assume you have $1,000 and plan to travel from the United States to the United Kingdom. Assume further that the bank’s bid rate for the British pound is $1.52 and its asked rate is $1.60. Before leaving on your trip, you go to this bank to exchanged dollars for pounds. Now suppose that because of an emergency you cannot take the trip, and reconvert the pounds back to U.S. dollars, if the exchange rate has not changed what number of dollars you will lose? Q-10 The following exchange rates and one-year interest rates exist. Bid Quote Ask Quote Euro Spot $1.12 $1.13 Euro one-year forward 1.12 1.13 Deposit Rate Loan Rate Interest rate on dollars 6.0% 9.0% Interest rate on euros 6.5% 9.5% You have $100,000 to invest for one year. Would you benefit from engaging in covered interest arbitrage? 2|Page